In this age of electronic devices, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. In the case of educational materials, creative projects, or just adding an extra personal touch to your area, Max Tax Deduction For Donations are now an essential source. For this piece, we'll dive deep into the realm of "Max Tax Deduction For Donations," exploring what they are, where they are, and how they can be used to enhance different aspects of your lives.

Get Latest Max Tax Deduction For Donations Below

:max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif)

Max Tax Deduction For Donations

Max Tax Deduction For Donations - Max Tax Deduction For Donations, Max Tax Deduction For Donations 2022, Maximum Tax Deduction For Donations To Goodwill, Maximum Tax Deduction For Donations 2022, Maximum Tax Credit For Donations, Maximum Tax Break For Donations, Maximum Tax Deduction For Donated Goods, Maximum Tax Deduction For Donating A Car, Max Tax Deduction For Goodwill Donations, Maximum Tax Deduction For Church Donations

Donations to a qualified charity are deductible for taxpayers who itemize their deductions using Schedule A of IRS Form 1040 Cash donations for 2022 and later are limited to 60 of the

In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the taxpayer s adjusted gross income AGI Qualified contributions are not subject to this limitation

Max Tax Deduction For Donations encompass a wide assortment of printable, downloadable materials available online at no cost. They come in many designs, including worksheets coloring pages, templates and much more. The beauty of Max Tax Deduction For Donations lies in their versatility and accessibility.

More of Max Tax Deduction For Donations

Bunching Up Charitable Donations Could Help Tax Savings

Bunching Up Charitable Donations Could Help Tax Savings

Yes You can carry over deductions from any year in which you surpass the IRS charitable donation deduction limits up to a maximum of 5 years The same percentage limits discussed earlier apply to the year

To claim a deduction you must be the person that gives the gift or donation and it must meet the following 4 conditions It must be made to a DGR It must truly be a gift or donation that is you are voluntarily transferring money or property without receiving or expecting to receive any material benefit or advantage in return

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization: There is the possibility of tailoring print-ready templates to your specific requirements such as designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Value: Free educational printables are designed to appeal to students of all ages. This makes these printables a powerful source for educators and parents.

-

An easy way to access HTML0: Fast access an array of designs and templates saves time and effort.

Where to Find more Max Tax Deduction For Donations

How To Get A Tax Deduction For Donations To U S Charities Financial Post

How To Get A Tax Deduction For Donations To U S Charities Financial Post

When you donate money or property to a qualified nonprofit organization you can deduct the value of your donation up to IRS limits from your taxable income when filing your income tax return as long as you itemize deductions The IRS provides guidelines on which organizations qualify for tax deductible contributions

Tax deduction is given for donations made in the preceding year For example if an individual makes a donation in 2023 tax deduction will be allowed in his tax assessment for the Year of Assessment YA 2024 You do not need to declare the donation amount in your income tax return

If we've already piqued your curiosity about Max Tax Deduction For Donations and other printables, let's discover where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Max Tax Deduction For Donations for various motives.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a broad spectrum of interests, including DIY projects to party planning.

Maximizing Max Tax Deduction For Donations

Here are some inventive ways of making the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Max Tax Deduction For Donations are an abundance of useful and creative resources that cater to various needs and needs and. Their accessibility and flexibility make them a wonderful addition to both professional and personal lives. Explore the endless world of Max Tax Deduction For Donations today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes they are! You can print and download these items for free.

-

Can I use the free printables in commercial projects?

- It's based on specific usage guidelines. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright concerns when using Max Tax Deduction For Donations?

- Some printables may come with restrictions on their use. Be sure to review the terms and condition of use as provided by the author.

-

How do I print printables for free?

- You can print them at home with the printer, or go to the local print shop for superior prints.

-

What software do I require to open printables that are free?

- A majority of printed materials are as PDF files, which can be opened with free software such as Adobe Reader.

How Much Do You Need To Donate For Tax Deduction

10 Business Tax Deductions Worksheet Worksheeto

Check more sample of Max Tax Deduction For Donations below

Section 80G Deductions On Donations

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

5 Itemized Tax Deduction Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto

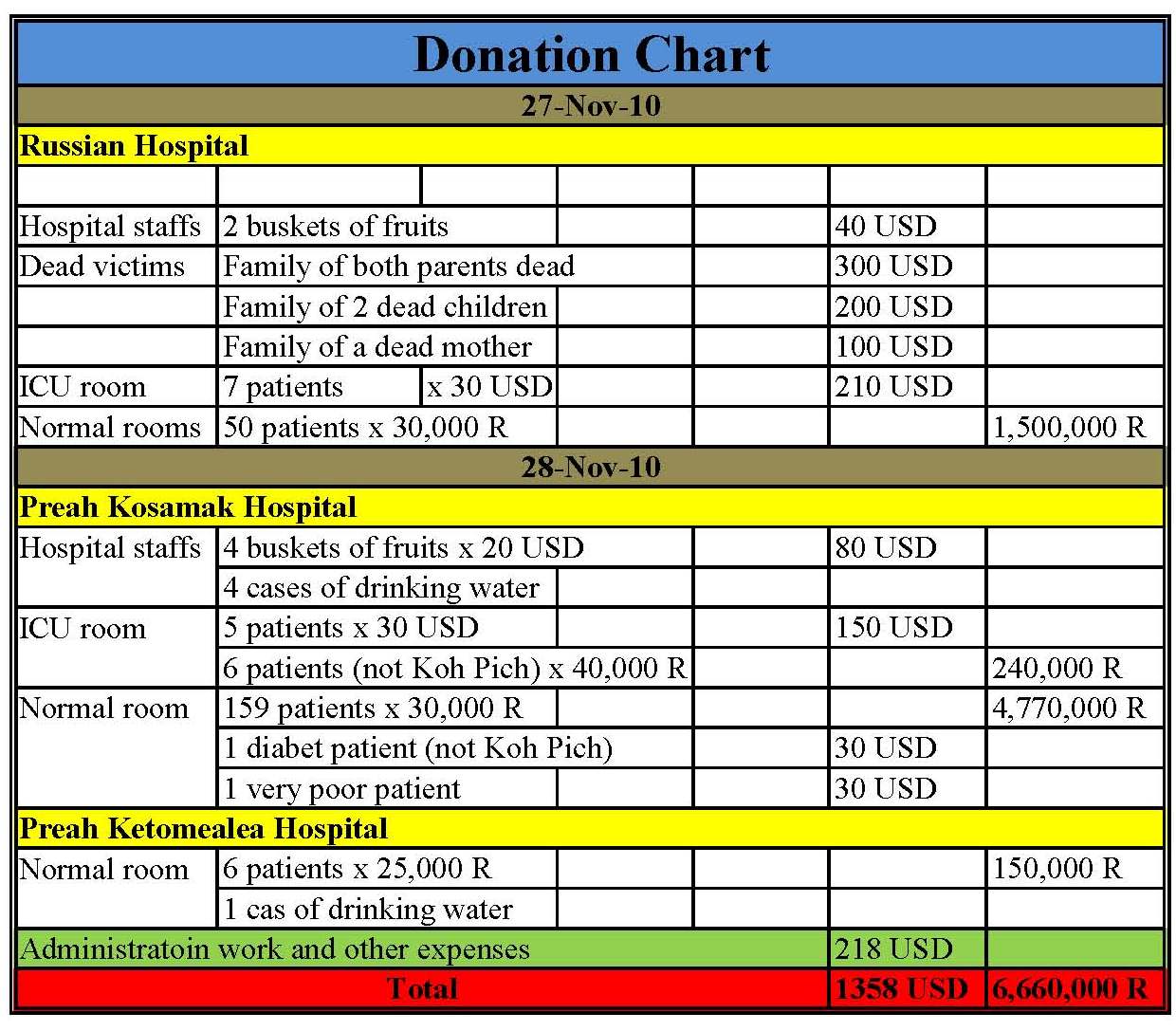

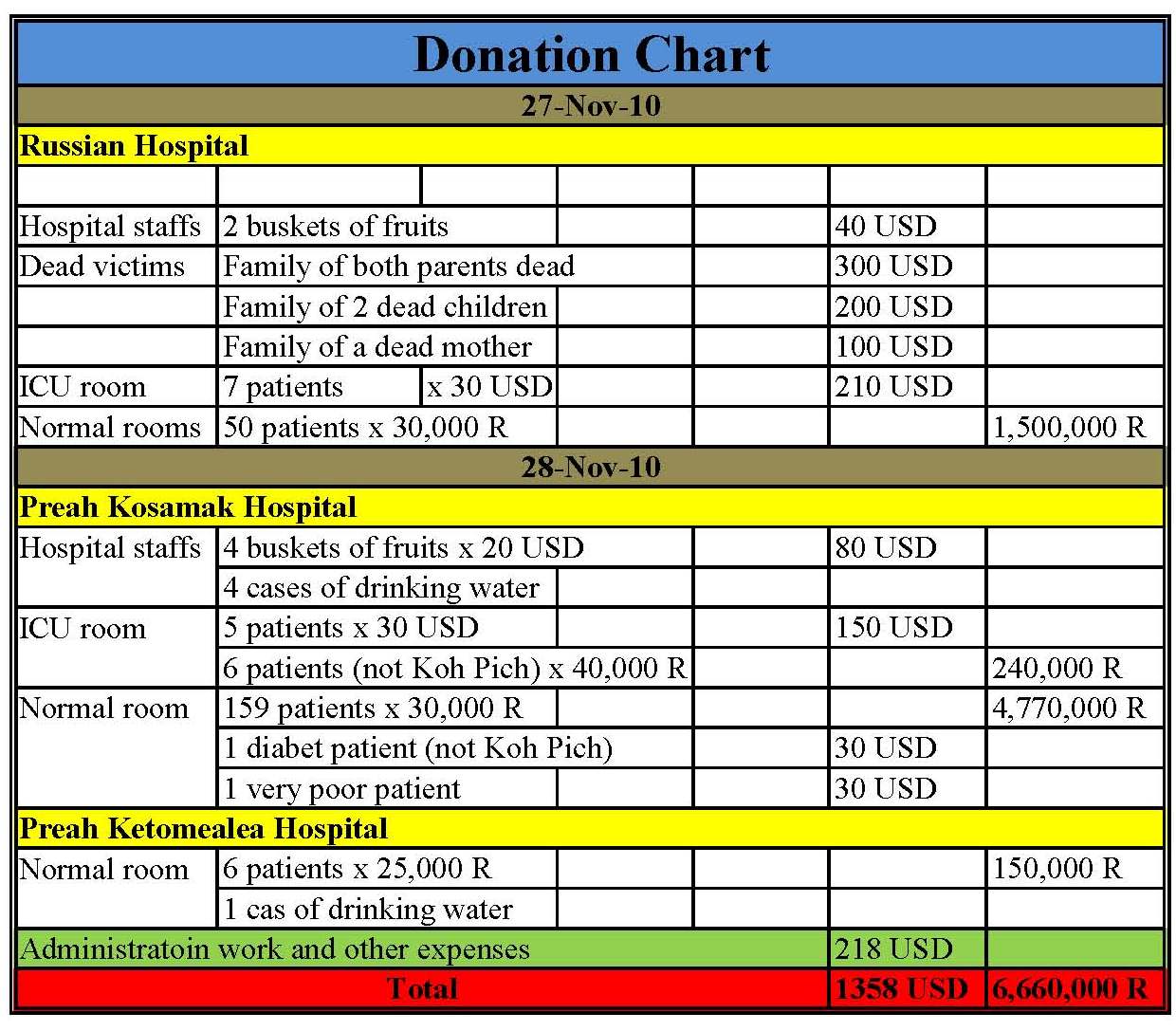

Donation Chart Template

Printable Itemized Deductions Worksheet

:max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif?w=186)

https://www.irs.gov/.../charitable-contribution-deductions

In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the taxpayer s adjusted gross income AGI Qualified contributions are not subject to this limitation

https://www.irs.gov/newsroom/expanded-tax-benefits-help...

These individuals including married individuals filing separate returns can claim a deduction of up to 300 for cash contributions made to qualifying charities during 2021 The maximum deduction is increased to 600

In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the taxpayer s adjusted gross income AGI Qualified contributions are not subject to this limitation

These individuals including married individuals filing separate returns can claim a deduction of up to 300 for cash contributions made to qualifying charities during 2021 The maximum deduction is increased to 600

5 Itemized Tax Deduction Worksheet Worksheeto

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

Donation Chart Template

Printable Itemized Deductions Worksheet

Special Tax Deduction For 2020 Allows Donations Of 300 To Charity

Real Estate Tax Deduction Worksheet

Real Estate Tax Deduction Worksheet

What Is The Standard Federal Tax Deduction Ericvisser