In the age of digital, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. In the case of educational materials such as creative projects or simply adding the personal touch to your area, Maximum Tax Deduction For Church Donations are now a useful source. Through this post, we'll dive through the vast world of "Maximum Tax Deduction For Church Donations," exploring what they are, how they are available, and what they can do to improve different aspects of your daily life.

Get Latest Maximum Tax Deduction For Church Donations Below

Maximum Tax Deduction For Church Donations

Maximum Tax Deduction For Church Donations -

Church donations are tax deductible only to churches that meet the requirements of section 501 c 3 of the Internal Revenue Code If your church meets these requirements you receive tax exempt status

In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the

Maximum Tax Deduction For Church Donations include a broad array of printable materials available online at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages, and many more. The beauty of Maximum Tax Deduction For Church Donations is their versatility and accessibility.

More of Maximum Tax Deduction For Church Donations

Exemptions Allowances And Deductions Under Old New Tax Regime

Exemptions Allowances And Deductions Under Old New Tax Regime

The short answer is that yes donations to a church are generally tax deductible as are charitable gifts made to mosques synagogues and other houses of worship that are registered as 501 c 3 charitable organizations

Donating to a Church Donating to your place of worship like to any other qualified charity can be tax deductible if the requirements are met The most common deduction here is for cash

Maximum Tax Deduction For Church Donations have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Individualization This allows you to modify designs to suit your personal needs such as designing invitations as well as organizing your calendar, or decorating your home.

-

Educational value: These Maximum Tax Deduction For Church Donations are designed to appeal to students of all ages. This makes them an invaluable tool for teachers and parents.

-

Simple: You have instant access a variety of designs and templates can save you time and energy.

Where to Find more Maximum Tax Deduction For Church Donations

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

In 2020 and 2021 a temporary tax law allowed non itemizers to deduct up to 600 married filing jointly and 300 all other filers of qualified charitable cash contributions on

Religious organizations churches Abbys Convents Monistaries etc are exempt from the requirement to file for 501 c 3 status and tax payers can donate to them and take the donation as a charitable deduction on their

Now that we've ignited your interest in printables for free Let's see where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and Maximum Tax Deduction For Church Donations for a variety reasons.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets with flashcards and other teaching materials.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing Maximum Tax Deduction For Church Donations

Here are some unique ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets for free for reinforcement of learning at home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Maximum Tax Deduction For Church Donations are an abundance of creative and practical resources for a variety of needs and preferences. Their availability and versatility make them a great addition to your professional and personal life. Explore the plethora of Maximum Tax Deduction For Church Donations to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Maximum Tax Deduction For Church Donations really gratis?

- Yes they are! You can download and print these documents for free.

-

Does it allow me to use free printouts for commercial usage?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Are there any copyright violations with Maximum Tax Deduction For Church Donations?

- Certain printables might have limitations in use. Be sure to review the terms and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home with an printer, or go to any local print store for superior prints.

-

What program must I use to open printables that are free?

- The majority of printables are in the PDF format, and is open with no cost software, such as Adobe Reader.

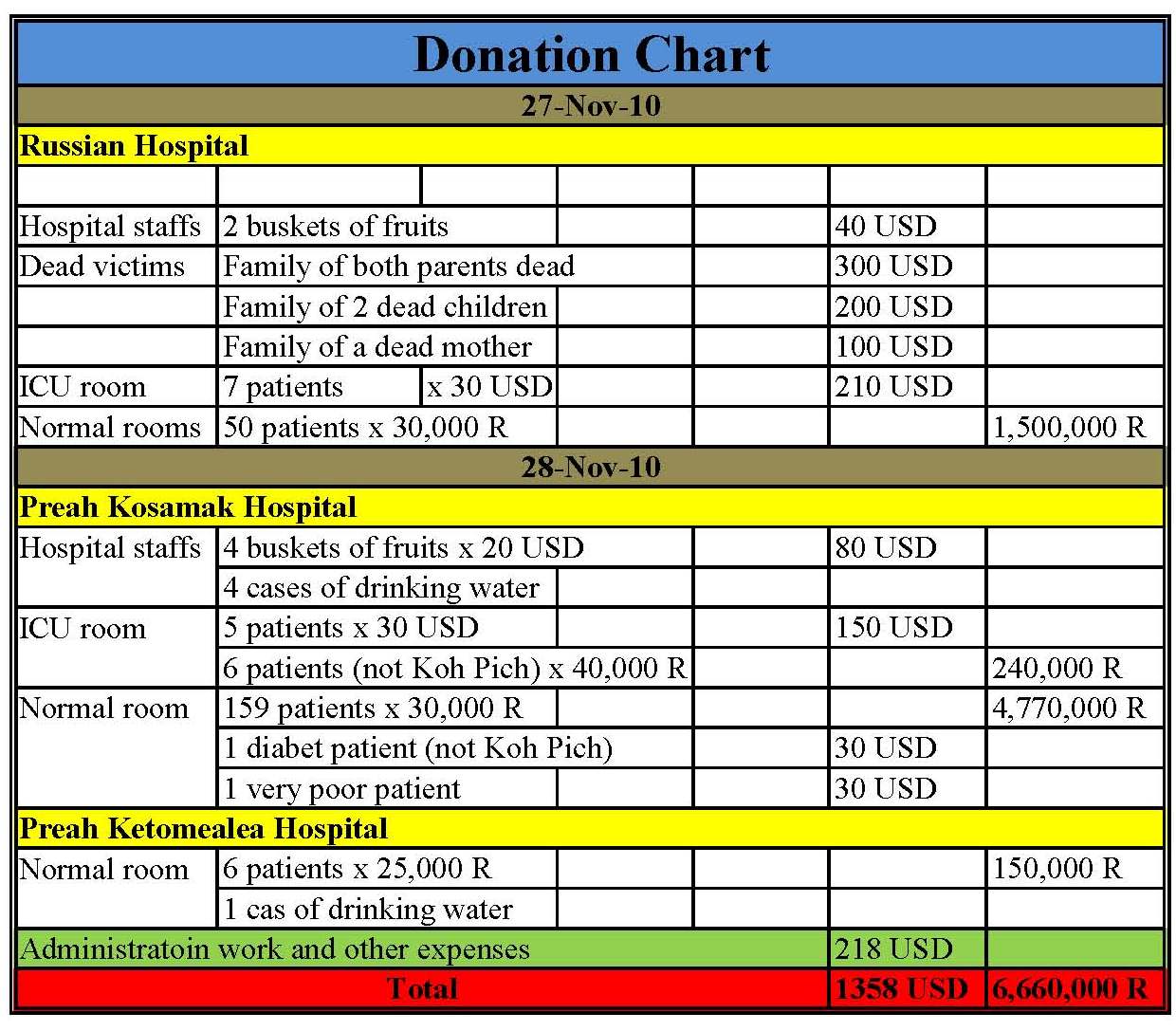

Donation Chart Template

By Giving Greater Relief To The Highest Earners The Charitable

Check more sample of Maximum Tax Deduction For Church Donations below

About That Property Tax Deduction For Vets NJMoneyHelp

How To Donate Real estate And Get A Tax Deduction By I Believe World

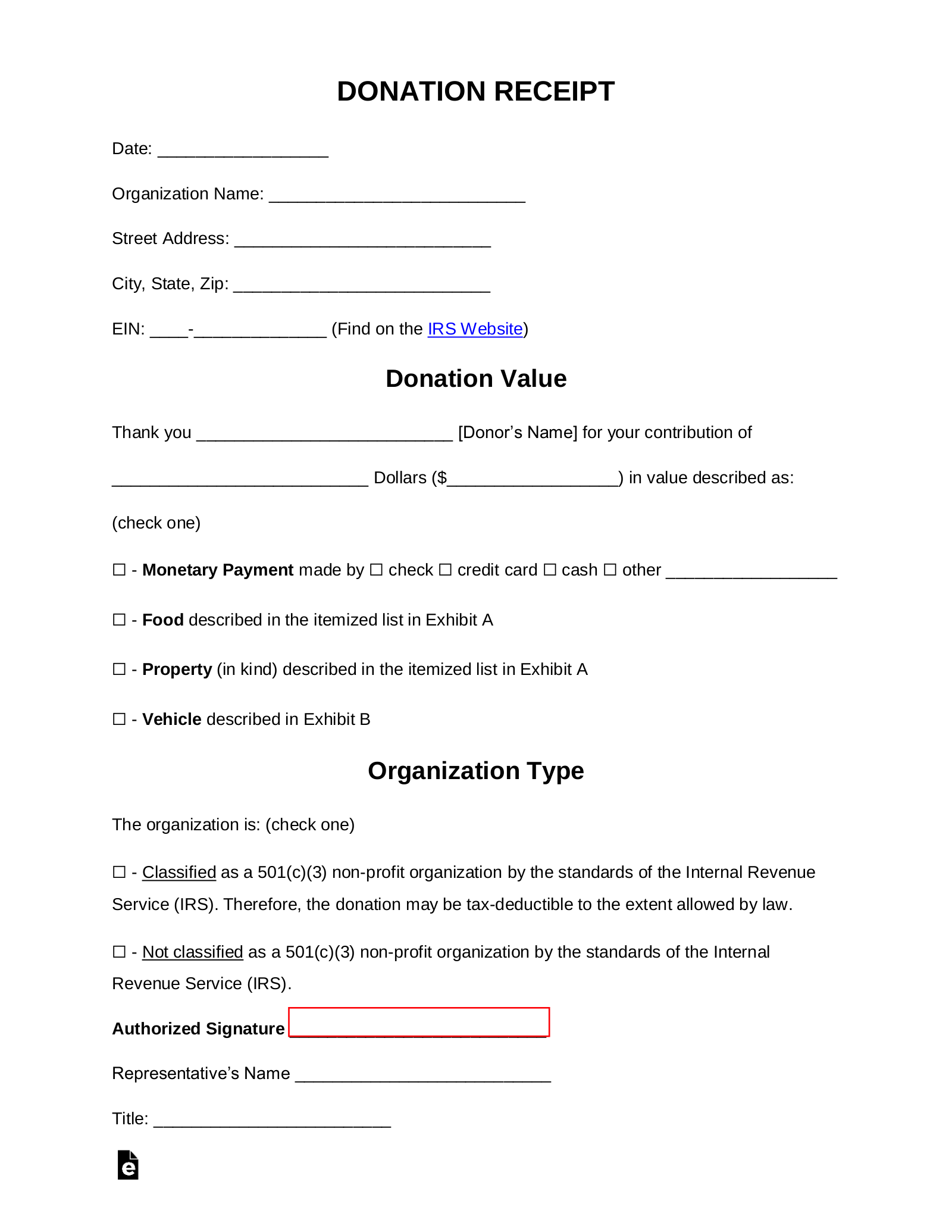

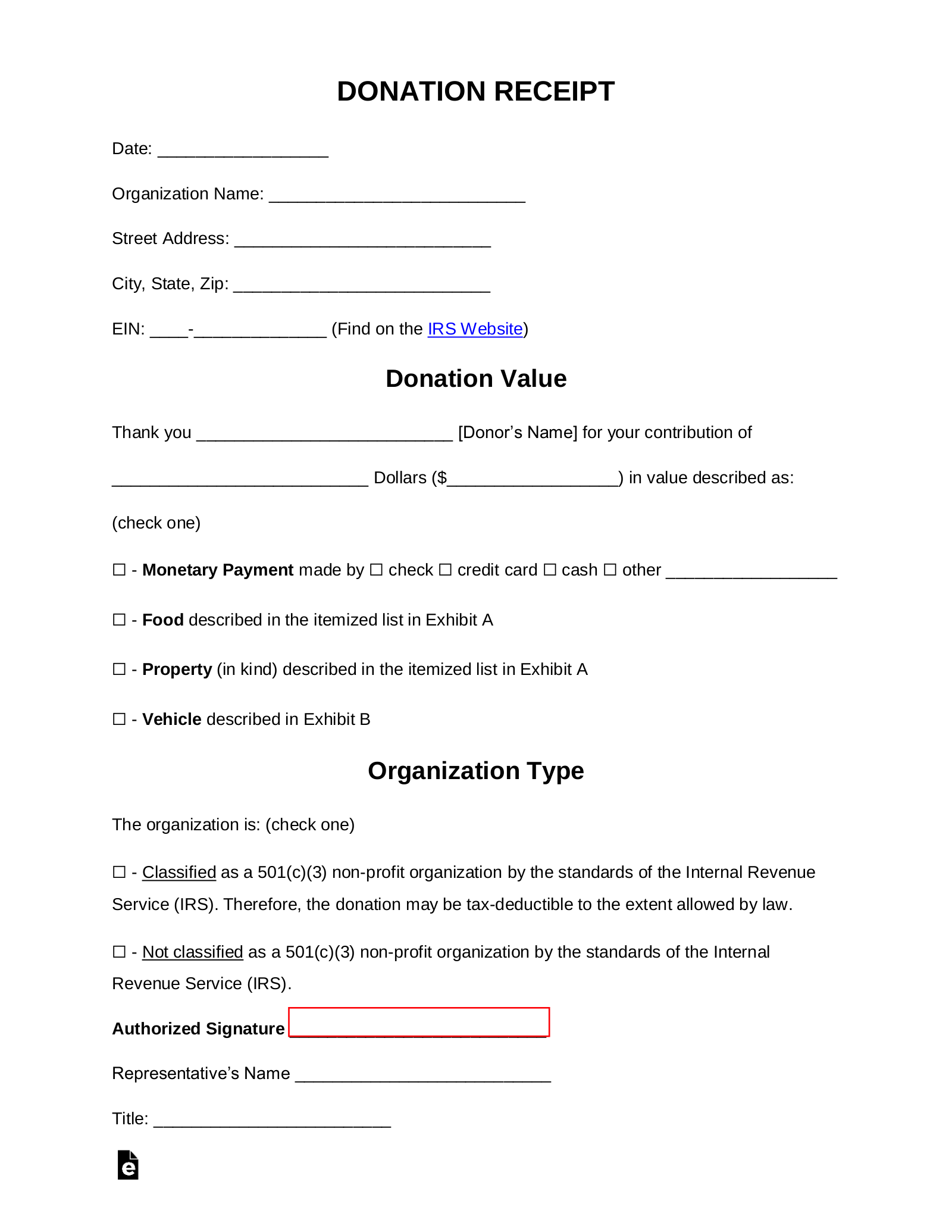

Image Result For Nonprofit Donation Letter For Tax Receipt Donation

How To Maximize Your Charity Tax Deductible Donation WealthFit

Non Profit Letter For Donations Database Letter Template Collection

Printable Donation Receipt Letter Template Printable Templates

https://www.irs.gov/charities-non-profits/...

In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the

https://www.nolo.com/legal-encyclopedia/are-church...

You can only deduct a donation to a church if you itemize your personal tax deductions on IRS Schedule A This greatly limits the actual number of people who can take

In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the

You can only deduct a donation to a church if you itemize your personal tax deductions on IRS Schedule A This greatly limits the actual number of people who can take

How To Maximize Your Charity Tax Deductible Donation WealthFit

How To Donate Real estate And Get A Tax Deduction By I Believe World

Non Profit Letter For Donations Database Letter Template Collection

Printable Donation Receipt Letter Template Printable Templates

Chapter VI A 80G Deduction For Donation To Charitable Institution

Explore Our Free Church Tithing Receipt Template Receipt Template

Explore Our Free Church Tithing Receipt Template Receipt Template

GOP Plan To Scrap Tax Deduction Would Hurt New York Lawmakers Say