In this digital age, with screens dominating our lives yet the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses such as creative projects or simply to add some personal flair to your space, Maximum Tax Deduction For Donations 2022 can be an excellent source. This article will take a dive into the world "Maximum Tax Deduction For Donations 2022," exploring their purpose, where they are available, and what they can do to improve different aspects of your daily life.

Get Latest Maximum Tax Deduction For Donations 2022 Below

:max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif)

Maximum Tax Deduction For Donations 2022

Maximum Tax Deduction For Donations 2022 -

For the 2022 tax year meaning the taxes you ll file in 2023 the standard deduction amounts are 12 950 for single and married filing separate taxpayers 19 400 for head of household

The limit on charitable cash contributions is 60 of the taxpayer s adjusted gross income for tax years 2023 and 2024 The IRS allows deductions for cash and noncash donations based on annual

Maximum Tax Deduction For Donations 2022 offer a wide assortment of printable content that can be downloaded from the internet at no cost. They are available in numerous designs, including worksheets templates, coloring pages and more. The value of Maximum Tax Deduction For Donations 2022 is their versatility and accessibility.

More of Maximum Tax Deduction For Donations 2022

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

Starting with tax year 2022 your deduction for cash contributions is limited to 60 of your AGI minus your deductions for all other contributions These limits are described in detail in this section

If you intend to donate a large cash or high value non cash amount to a qualified 501 c 3 it is in your best interest to get the full allowable tax deduction for your generosity And if you don t itemize your taxes you may

Maximum Tax Deduction For Donations 2022 have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

The ability to customize: The Customization feature lets you tailor the design to meet your needs whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Worth: Printing educational materials for no cost can be used by students of all ages, making them a valuable device for teachers and parents.

-

An easy way to access HTML0: Instant access to a plethora of designs and templates is time-saving and saves effort.

Where to Find more Maximum Tax Deduction For Donations 2022

The Complete Charitable Deductions Tax Guide 2023 2024

The Complete Charitable Deductions Tax Guide 2023 2024

Charitable giving tax deduction limits are set by the IRS as a percentage of your income Cash contributions in 2023 and 2024 can make up 60 of your AGI The limit for

Ready to give Here s your guide to understanding how and when your charitable donations might be tax deductible Sponsored Bank Accounts Standard vs Itemized Deduction Tax deductions

Since we've got your curiosity about Maximum Tax Deduction For Donations 2022 we'll explore the places you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Maximum Tax Deduction For Donations 2022 designed for a variety applications.

- Explore categories like home decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free, flashcards, and learning materials.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs covered cover a wide range of interests, from DIY projects to party planning.

Maximizing Maximum Tax Deduction For Donations 2022

Here are some innovative ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to reinforce learning at home as well as in the class.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Maximum Tax Deduction For Donations 2022 are a treasure trove of fun and practical tools that satisfy a wide range of requirements and interest. Their accessibility and versatility make them a great addition to any professional or personal life. Explore the vast collection of Maximum Tax Deduction For Donations 2022 today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Maximum Tax Deduction For Donations 2022 truly absolutely free?

- Yes you can! You can download and print these items for free.

-

Can I use free printables for commercial uses?

- It depends on the specific usage guidelines. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may contain restrictions concerning their use. You should read the terms of service and conditions provided by the creator.

-

How do I print Maximum Tax Deduction For Donations 2022?

- You can print them at home with printing equipment or visit an area print shop for premium prints.

-

What program do I need to open Maximum Tax Deduction For Donations 2022?

- Many printables are offered as PDF files, which is open with no cost software, such as Adobe Reader.

Get 300 Tax Deduction For Cash Donations In 2020 2021

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

Check more sample of Maximum Tax Deduction For Donations 2022 below

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

How Much Do You Need To Donate For Tax Deduction

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Standard Deduction 2020 Age 65 Standard Deduction 2021

2021 Taxes For Retirees Explained Cardinal Guide

About That Property Tax Deduction For Vets NJMoneyHelp

:max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif?w=186)

https://www.investopedia.com › article…

The limit on charitable cash contributions is 60 of the taxpayer s adjusted gross income for tax years 2023 and 2024 The IRS allows deductions for cash and noncash donations based on annual

https://www.cnbc.com › how-to-maximize...

For 2022 the standard deduction is 12 950 for single filers or 25 900 for married couples filing together And if you take the standard deduction in 2022 you can t claim

The limit on charitable cash contributions is 60 of the taxpayer s adjusted gross income for tax years 2023 and 2024 The IRS allows deductions for cash and noncash donations based on annual

For 2022 the standard deduction is 12 950 for single filers or 25 900 for married couples filing together And if you take the standard deduction in 2022 you can t claim

Standard Deduction 2020 Age 65 Standard Deduction 2021

How Much Do You Need To Donate For Tax Deduction

2021 Taxes For Retirees Explained Cardinal Guide

About That Property Tax Deduction For Vets NJMoneyHelp

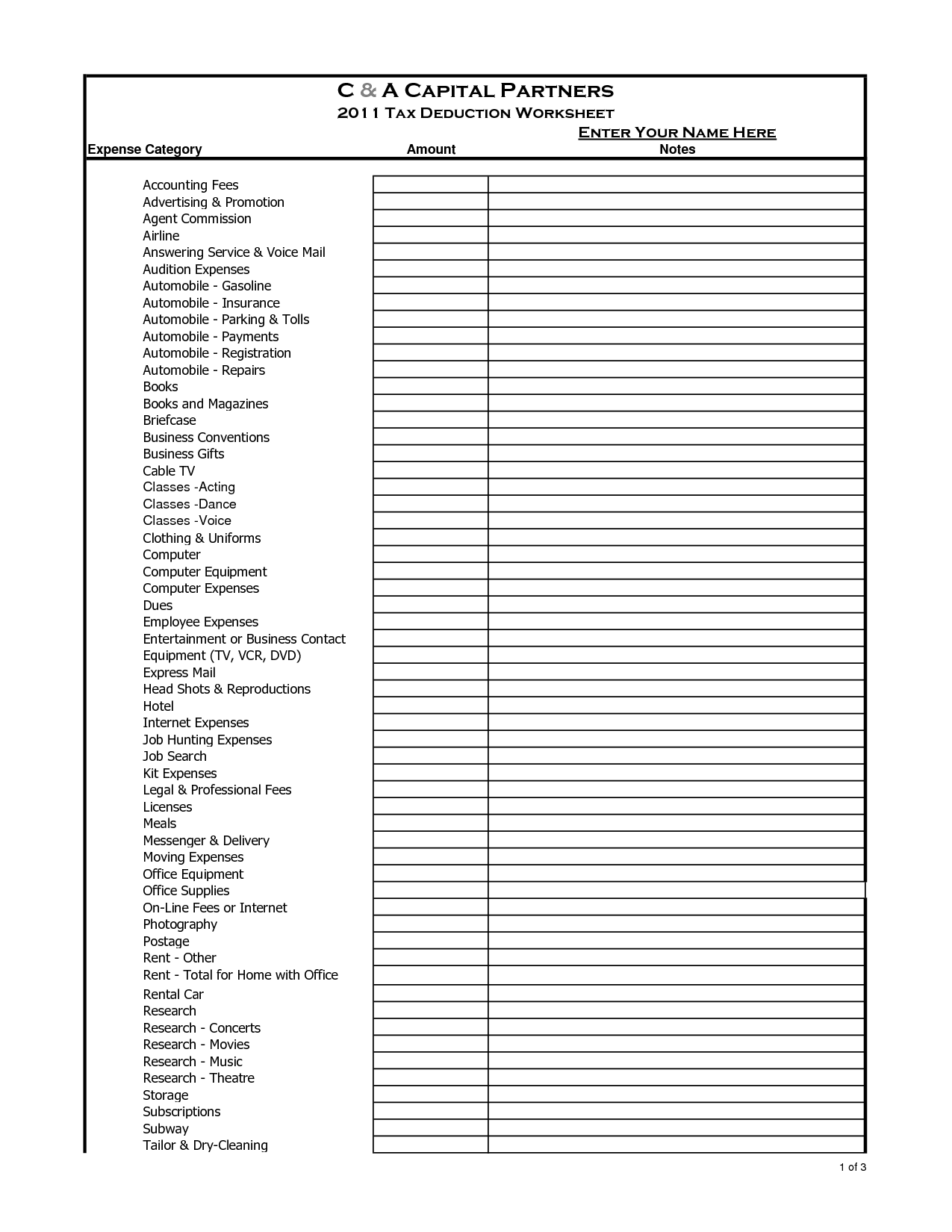

10 2014 Itemized Deductions Worksheet Worksheeto

By Giving Greater Relief To The Highest Earners The Charitable

By Giving Greater Relief To The Highest Earners The Charitable

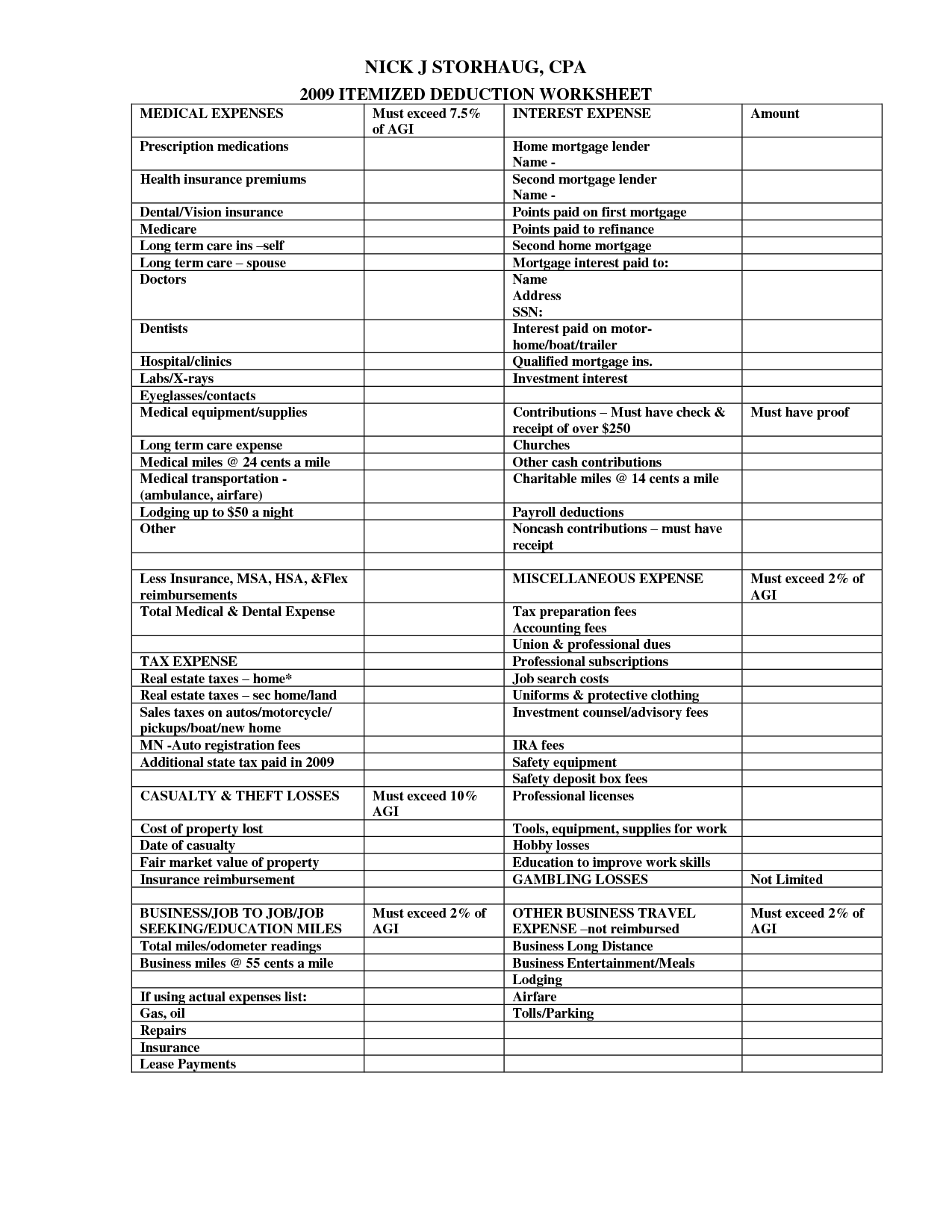

16 Insurance Comparison Worksheet Worksheeto