In this age of electronic devices, where screens rule our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. In the case of educational materials project ideas, artistic or simply adding an individual touch to the space, Maximum Tax Break For Donations can be an excellent source. Here, we'll take a dive in the world of "Maximum Tax Break For Donations," exploring the benefits of them, where to locate them, and how they can enhance various aspects of your lives.

Get Latest Maximum Tax Break For Donations Below

Maximum Tax Break For Donations

Maximum Tax Break For Donations -

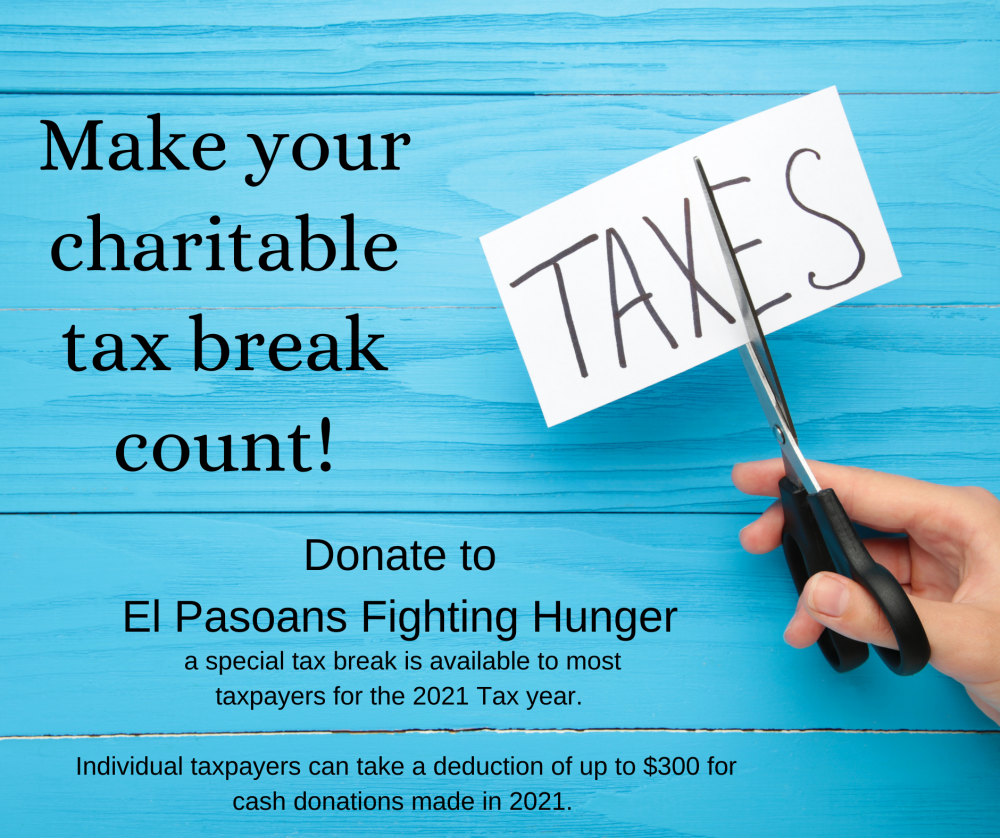

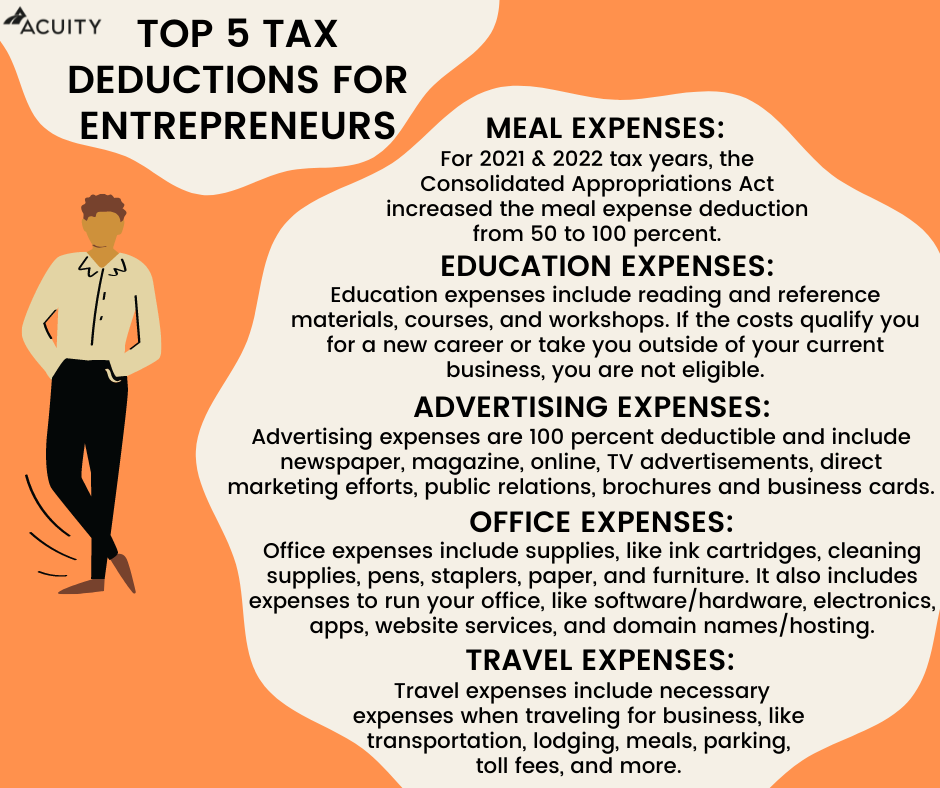

Excess contributions may be carried forward for up to five tax years The law now permits electing individuals to apply an increased limit Increased Individual Limit up to

If you aren t taking the standard deduction you will likely qualify for tax breaks for charitable donations and strategies that maximize them Many seniors can also take a tax break

The Maximum Tax Break For Donations are a huge selection of printable and downloadable resources available online for download at no cost. They are available in numerous formats, such as worksheets, templates, coloring pages, and more. The benefit of Maximum Tax Break For Donations lies in their versatility and accessibility.

More of Maximum Tax Break For Donations

How To Score A Tax Break For Your Charitable Giving

How To Score A Tax Break For Your Charitable Giving

The law now allows taxpayers to apply up to 100 of their AGI for calendar year 2021 qualified contributions Qualified contributions are cash contributions to qualifying

Deductions for charitable donations generally cannot exceed 60 of your adjusted gross income AGI though in some cases limits of 20 30 or 50 may apply In order to claim the

Maximum Tax Break For Donations have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Personalization We can customize the templates to meet your individual needs whether you're designing invitations or arranging your schedule or decorating your home.

-

Educational value: Educational printables that can be downloaded for free can be used by students of all ages. This makes them an essential device for teachers and parents.

-

Affordability: Quick access to an array of designs and templates helps save time and effort.

Where to Find more Maximum Tax Break For Donations

Net Zero Super Deduction For UK Businesses Invinity

Net Zero Super Deduction For UK Businesses Invinity

You must have documentation for cash donations of more than 250 You must have written appraisals for noncash donations of more than 5 000

For tax years 2020 and 2021 you can deduct up to 300 of qualified charitable cash contributions 600 if married filing a joint tax return from your adjusted gross income without itemizing deductions

We've now piqued your interest in Maximum Tax Break For Donations We'll take a look around to see where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection in Maximum Tax Break For Donations for different reasons.

- Explore categories like decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets including flashcards, learning materials.

- The perfect resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- The blogs are a vast array of topics, ranging ranging from DIY projects to party planning.

Maximizing Maximum Tax Break For Donations

Here are some creative ways of making the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home also in the classes.

3. Event Planning

- Create invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Maximum Tax Break For Donations are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and desires. Their accessibility and flexibility make them an invaluable addition to both professional and personal lives. Explore the vast collection of Maximum Tax Break For Donations right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I make use of free printables for commercial purposes?

- It's based on the usage guidelines. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright rights issues with Maximum Tax Break For Donations?

- Some printables could have limitations in their usage. Be sure to read these terms and conditions as set out by the author.

-

How can I print Maximum Tax Break For Donations?

- You can print them at home with a printer or visit a local print shop for high-quality prints.

-

What software do I need to run printables for free?

- Most printables come in the format of PDF, which can be opened using free programs like Adobe Reader.

529 Plans Are A Tax Break For The Rich YouTube

Getting A Tax Break For Donating To Charity YouTube

Check more sample of Maximum Tax Break For Donations below

New Tax Break For Seniors Charitable Gift Annuity From IRA Macro

Ada Nya Begini Entertainers Working In Multiple States Run Into Tax

Exemptions Allowances And Deductions Under Old New Tax Regime

Make Charitable Donation Get Tax Break

A Broken Pathway To A Promised Tax Break The Boston Globe

Federal Tax Breaks For Graduate School Other Tax Benefits Graduate

https://www.wsj.com › personal-finance › ta…

If you aren t taking the standard deduction you will likely qualify for tax breaks for charitable donations and strategies that maximize them Many seniors can also take a tax break

https://www.investopedia.com › article…

The limit on charitable cash contributions is 60 of the taxpayer s adjusted gross income for tax years 2023 and 2024 The IRS allows deductions for cash and noncash donations based on annual

If you aren t taking the standard deduction you will likely qualify for tax breaks for charitable donations and strategies that maximize them Many seniors can also take a tax break

The limit on charitable cash contributions is 60 of the taxpayer s adjusted gross income for tax years 2023 and 2024 The IRS allows deductions for cash and noncash donations based on annual

Make Charitable Donation Get Tax Break

Ada Nya Begini Entertainers Working In Multiple States Run Into Tax

A Broken Pathway To A Promised Tax Break The Boston Globe

Federal Tax Breaks For Graduate School Other Tax Benefits Graduate

Startup Tax Credits Deductions You Might Be Missing

Tax Breaks That Are Going Away So Use These Deductions Now

Tax Breaks That Are Going Away So Use These Deductions Now

Non Refundable Portion Of Employee Retention Credit