In this age of electronic devices, when screens dominate our lives but the value of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons as well as creative projects or simply adding an extra personal touch to your area, Maximum Tax Deduction For Donations To Goodwill are a great resource. This article will take a dive to the depths of "Maximum Tax Deduction For Donations To Goodwill," exploring what they are, how to find them and how they can improve various aspects of your lives.

Get Latest Maximum Tax Deduction For Donations To Goodwill Below

Maximum Tax Deduction For Donations To Goodwill

Maximum Tax Deduction For Donations To Goodwill -

These individuals including married individuals filing separate returns can claim a deduction of up to 300 for cash contributions made to qualifying charities during 2021 The

Goodwill donations can only get you a deduction on your Federal income taxes if you itemize them When you file your taxes you can choose to

Maximum Tax Deduction For Donations To Goodwill offer a wide collection of printable materials online, at no cost. These resources come in many forms, including worksheets, coloring pages, templates and much more. The value of Maximum Tax Deduction For Donations To Goodwill is their versatility and accessibility.

More of Maximum Tax Deduction For Donations To Goodwill

The Complete 2022 Charitable Tax Deductions Guide

The Complete 2022 Charitable Tax Deductions Guide

If you itemize deductions on your federal tax return you may be entitled to claim a charitable deduction for your Goodwill donations According to the Internal Revenue Service IRS a

Starting with tax year 2022 your deduction for cash contributions is limited to 60 of your AGI minus your deductions for all other contributions These limits are described in detail in this section

Maximum Tax Deduction For Donations To Goodwill have risen to immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor print-ready templates to your specific requirements be it designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value: Printables for education that are free offer a wide range of educational content for learners of all ages, making them a valuable resource for educators and parents.

-

Affordability: Fast access a variety of designs and templates, which saves time as well as effort.

Where to Find more Maximum Tax Deduction For Donations To Goodwill

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

Your donation may be tax deductible Browse Goodwill tax deduction resources to learn more and see if your donation qualifies

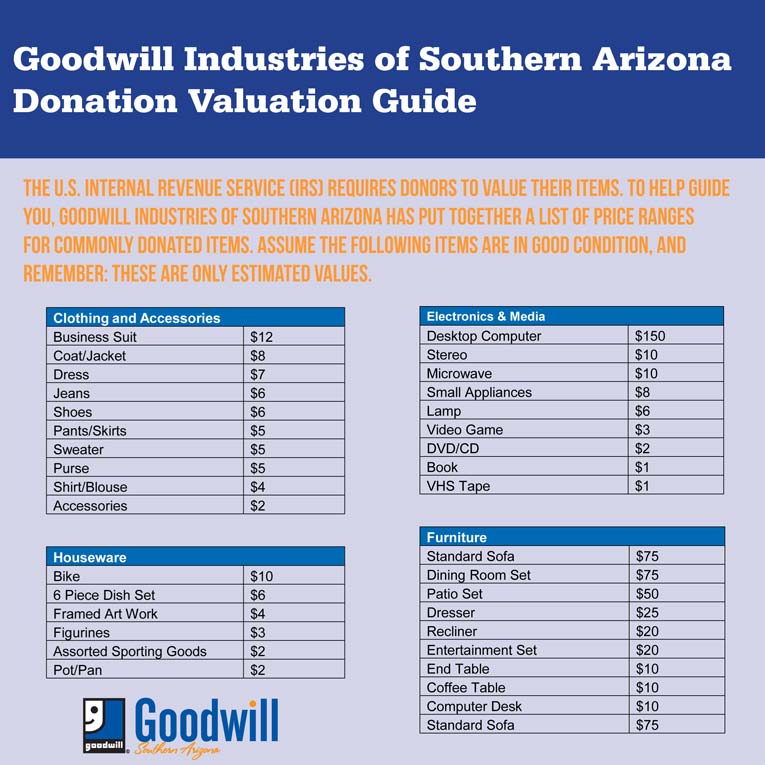

How much can you deduct for the gently used goods you donate to Goodwill The IRS allows you to deduct fair market value for gently used items The quality of the item when new and its age must be considered The IRS requires an

If we've already piqued your curiosity about Maximum Tax Deduction For Donations To Goodwill Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Maximum Tax Deduction For Donations To Goodwill suitable for many purposes.

- Explore categories like design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets including flashcards, learning tools.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- The blogs covered cover a wide range of interests, that range from DIY projects to party planning.

Maximizing Maximum Tax Deduction For Donations To Goodwill

Here are some ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Maximum Tax Deduction For Donations To Goodwill are an abundance of creative and practical resources that satisfy a wide range of requirements and interests. Their availability and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast collection of Maximum Tax Deduction For Donations To Goodwill and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes, they are! You can download and print these items for free.

-

Can I make use of free printables for commercial purposes?

- It's based on the usage guidelines. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using Maximum Tax Deduction For Donations To Goodwill?

- Certain printables might have limitations regarding usage. Be sure to check the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home using a printer or visit any local print store for more high-quality prints.

-

What software must I use to open printables that are free?

- The majority of printed documents are with PDF formats, which can be opened using free programs like Adobe Reader.

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

How To Maximize Your Charity Tax Deductible Donation WealthFit

Check more sample of Maximum Tax Deduction For Donations To Goodwill below

Free Goodwill Donation Receipt Template PDF EForms

Free Goodwill Donation Receipt Template Pdf Eforms Free Goodwill

How To Maximize Your Charity Tax Deductible Donation WealthFit

What s The Value Of Your Donated Items Out Of Debt Again

Donation Tax Calculator Giving NUS Yong Loo Lin School Of Medicine

Free Goodwill Donation Receipt Template Pdf Eforms Free Goodwill

https://www.wikihow.com › Get-Tax-De…

Goodwill donations can only get you a deduction on your Federal income taxes if you itemize them When you file your taxes you can choose to

https://sammydvintage.com › articles › h…

If you donate 5 000 worth of household goods and clothing to Goodwill here is an estimate of your tax savings 5 000 Goodwill donation deduction amount 5 000 counted as itemized deduction Reduces your

Goodwill donations can only get you a deduction on your Federal income taxes if you itemize them When you file your taxes you can choose to

If you donate 5 000 worth of household goods and clothing to Goodwill here is an estimate of your tax savings 5 000 Goodwill donation deduction amount 5 000 counted as itemized deduction Reduces your

What s The Value Of Your Donated Items Out Of Debt Again

Free Goodwill Donation Receipt Template Pdf Eforms Free Goodwill

Donation Tax Calculator Giving NUS Yong Loo Lin School Of Medicine

Free Goodwill Donation Receipt Template Pdf Eforms Free Goodwill

Section 80G 80GGA Of Income Tax Act Income Tax Deduction For

Chapter VI A 80G Deduction For Donation To Charitable Institution

Chapter VI A 80G Deduction For Donation To Charitable Institution

Goodwill Donation Estimate The Value Of Your Donation