In a world where screens have become the dominant feature of our lives The appeal of tangible printed materials isn't diminishing. If it's to aid in education or creative projects, or simply to add personal touches to your area, Maximum Tax Deduction For Donated Goods are now a vital resource. Here, we'll dive deeper into "Maximum Tax Deduction For Donated Goods," exploring the benefits of them, where to find them and how they can be used to enhance different aspects of your life.

Get Latest Maximum Tax Deduction For Donated Goods Below

Maximum Tax Deduction For Donated Goods

Maximum Tax Deduction For Donated Goods -

Religious and charitable organizations typically fall under section 501 c 3 and can receive tax deductible donations Not every section allows these deductions For instance social welfare and civic organizations registered under section

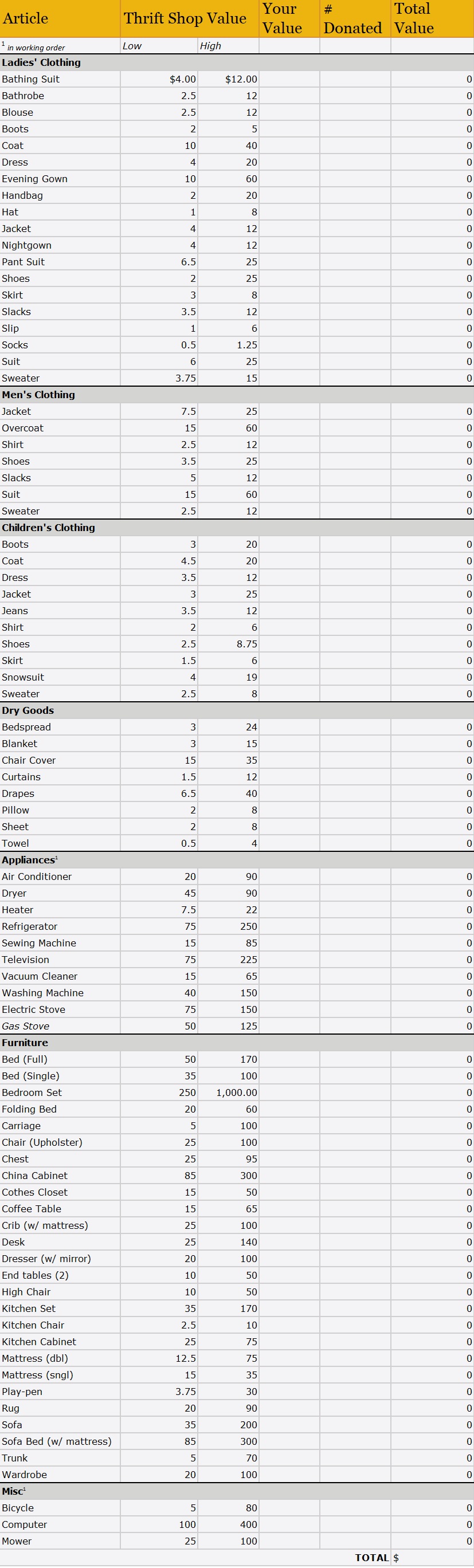

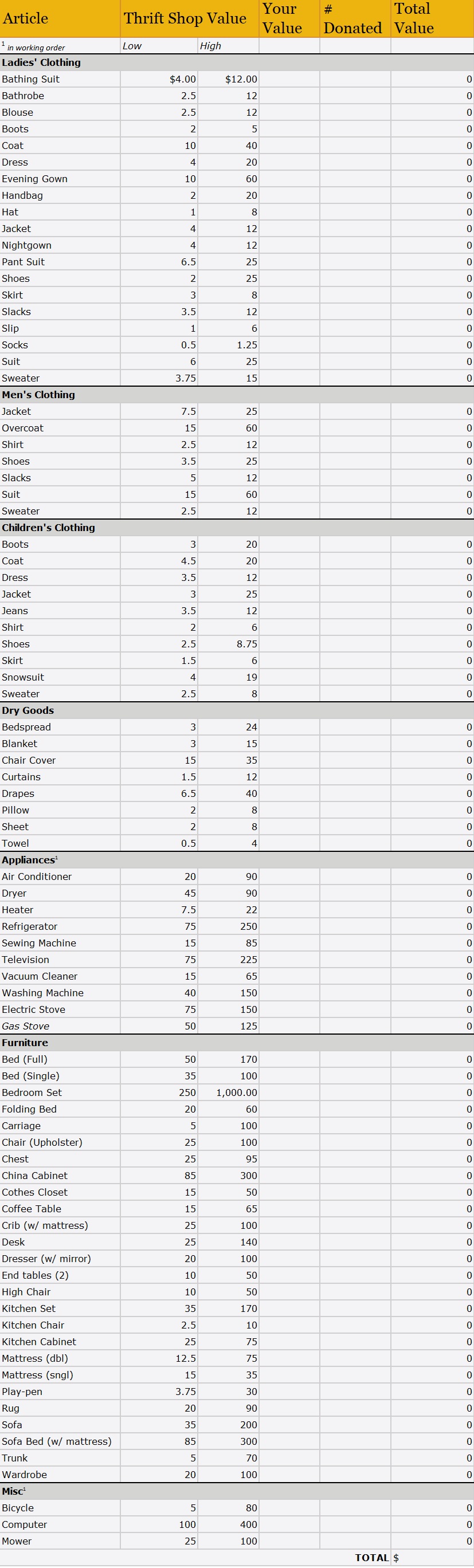

LUATION GUIDE FOR GOODWILL DONORS The U S Internal Revenue Service IRS r quires donors to value their items To help guide you Goodwill Industries International has

Printables for free include a vast assortment of printable materials online, at no cost. They come in many types, such as worksheets templates, coloring pages, and many more. The value of Maximum Tax Deduction For Donated Goods is their versatility and accessibility.

More of Maximum Tax Deduction For Donated Goods

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

One of the most appealing benefits of a corporate DAF is that you can take an immediate tax deduction up to the maximum allowed by law for the amount you ve

November 4 2021 TOPICS This article discusses donor advised funds which have become increasingly popular because they offer a workaround for a complication that a recent

Maximum Tax Deduction For Donated Goods have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Flexible: This allows you to modify printing templates to your own specific requirements for invitations, whether that's creating them and schedules, or even decorating your home.

-

Educational Benefits: The free educational worksheets are designed to appeal to students of all ages, making these printables a powerful aid for parents as well as educators.

-

Simple: Instant access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Maximum Tax Deduction For Donated Goods

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

Tax on ordinary income is 65 485 plus 28 000 tax on the sale of the art for a total tax of 93 485 Comparing the two scenarios the marginal tax rate on the collectible gain is 37 6 calculated as 93 485 55 885

Additionally the lifetime estate and gift tax exemption will increase to 13 99 million per individual for 2025 up from 13 61 million in 2024 This allows a married couple to potentially shield

We've now piqued your interest in printables for free Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Maximum Tax Deduction For Donated Goods to suit a variety of reasons.

- Explore categories such as home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- The blogs are a vast spectrum of interests, everything from DIY projects to planning a party.

Maximizing Maximum Tax Deduction For Donated Goods

Here are some innovative ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Maximum Tax Deduction For Donated Goods are a treasure trove with useful and creative ideas that meet a variety of needs and pursuits. Their access and versatility makes them an invaluable addition to every aspect of your life, both professional and personal. Explore the plethora of Maximum Tax Deduction For Donated Goods to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes, they are! You can print and download these documents for free.

-

Can I use free printables for commercial uses?

- It's contingent upon the specific terms of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright violations with Maximum Tax Deduction For Donated Goods?

- Certain printables might have limitations on usage. Always read the terms and conditions offered by the designer.

-

How do I print Maximum Tax Deduction For Donated Goods?

- You can print them at home using either a printer or go to a local print shop for high-quality prints.

-

What software must I use to open Maximum Tax Deduction For Donated Goods?

- Most printables come in PDF format. These can be opened using free software like Adobe Reader.

Exemptions Allowances And Deductions Under Old New Tax Regime

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Check more sample of Maximum Tax Deduction For Donated Goods below

Section 194Q Deduction Of Tax At Source On Payment Of Doc Template

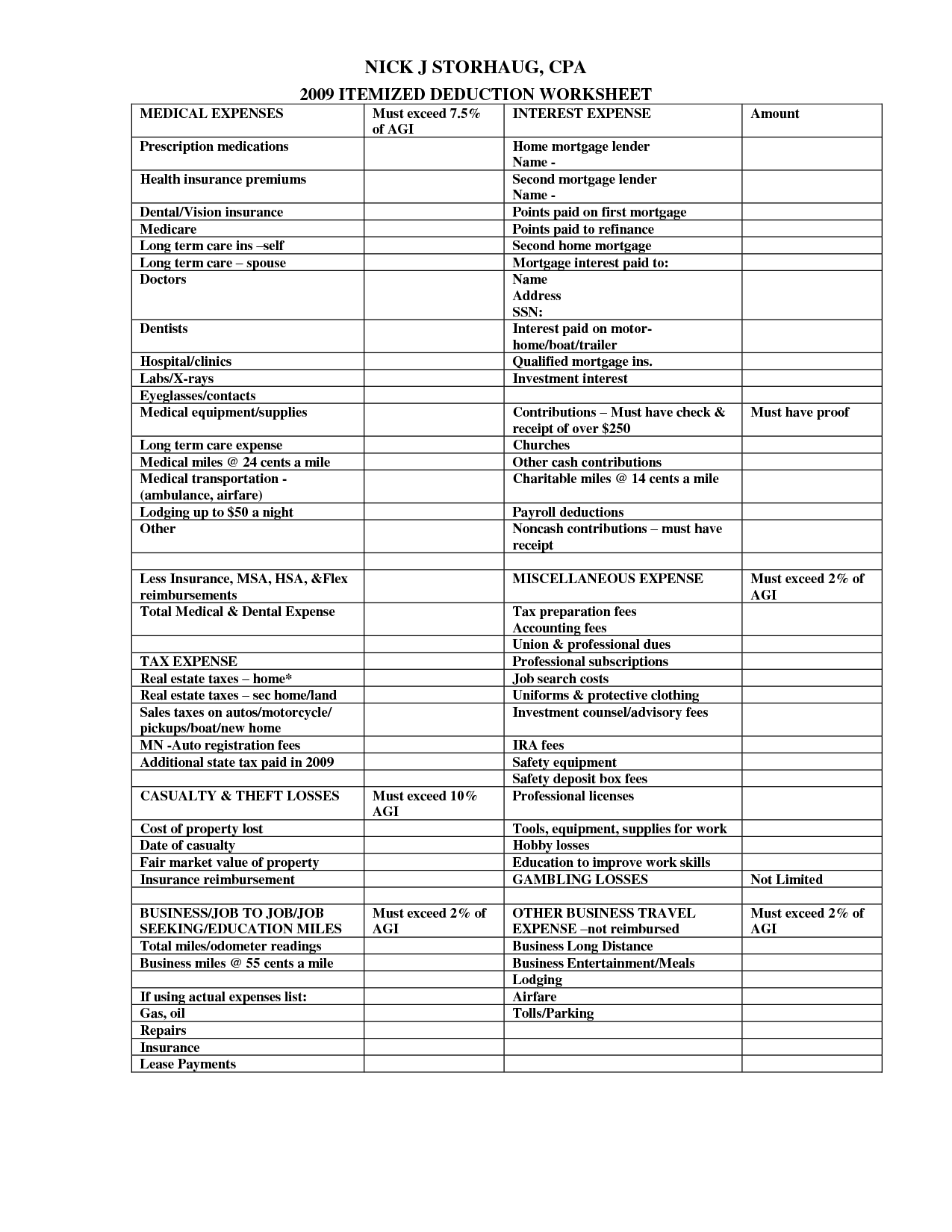

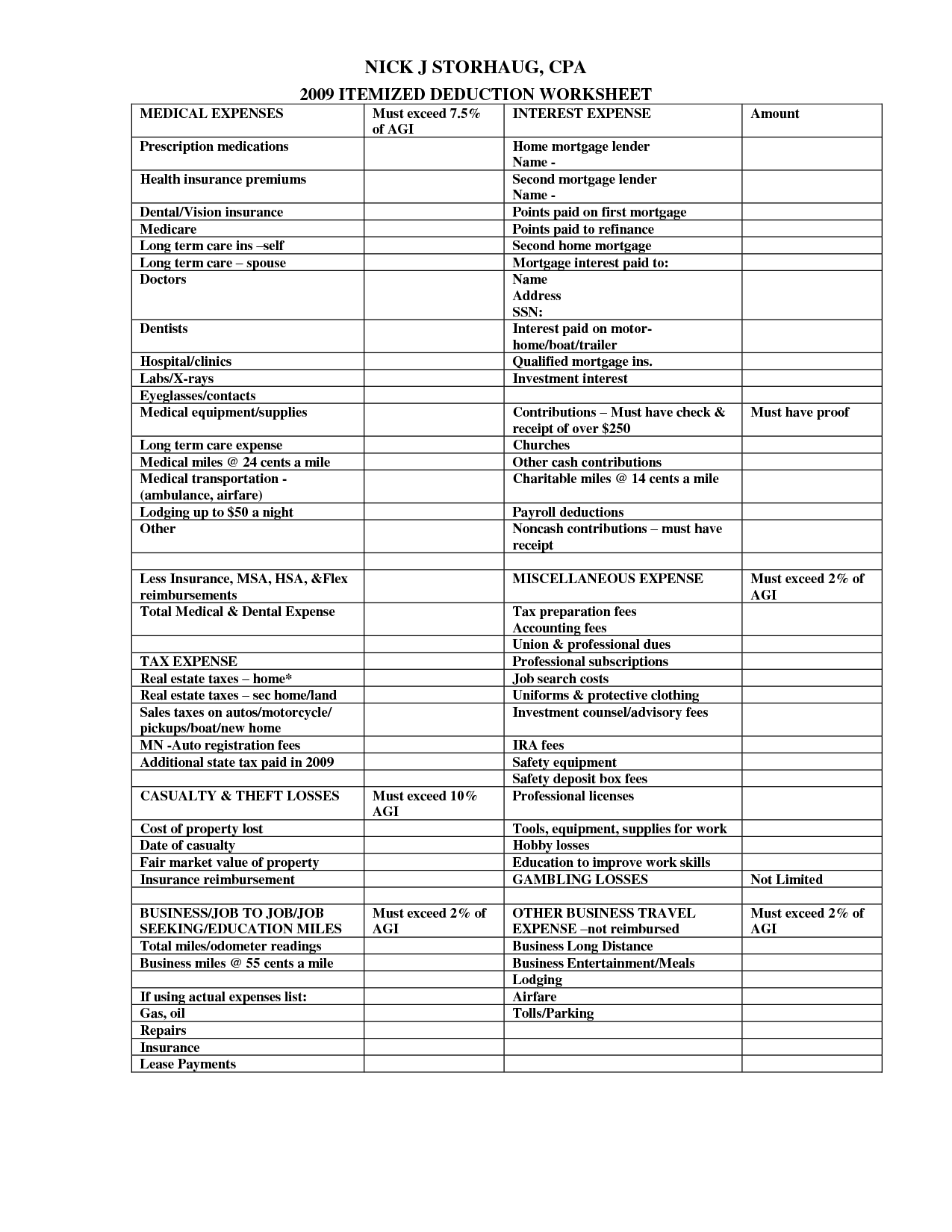

13 Tax Deduction Worksheet 2014 Worksheeto

Tips To Get The Best Tax Deduction On Donated Items Tax Deductions

About That Property Tax Deduction For Vets NJMoneyHelp

10 2014 Itemized Deductions Worksheet Worksheeto

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

https://www.goodwill.org/wp-content/uploads/2020/...

LUATION GUIDE FOR GOODWILL DONORS The U S Internal Revenue Service IRS r quires donors to value their items To help guide you Goodwill Industries International has

https://www.charitynavigator.org/dono…

IRA charitable rollover offers tax The IRA Charitable Rollover allows individuals who are 70 1 2 years old to donate up to 100 000 to charitable organizations directly from their IRA without that donation being counted as taxable income

LUATION GUIDE FOR GOODWILL DONORS The U S Internal Revenue Service IRS r quires donors to value their items To help guide you Goodwill Industries International has

IRA charitable rollover offers tax The IRA Charitable Rollover allows individuals who are 70 1 2 years old to donate up to 100 000 to charitable organizations directly from their IRA without that donation being counted as taxable income

About That Property Tax Deduction For Vets NJMoneyHelp

13 Tax Deduction Worksheet 2014 Worksheeto

10 2014 Itemized Deductions Worksheet Worksheeto

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

How Do Tax Deductions For Donating A Car Actually Work

A Guide To Valuing Donated Goods Gordon Advisors

A Guide To Valuing Donated Goods Gordon Advisors

Tax Deductions You Can Deduct What Napkin Finance