In the age of digital, in which screens are the norm but the value of tangible printed objects hasn't waned. Be it for educational use or creative projects, or simply to add an individual touch to the space, Is A 401k Withdrawal Considered Taxable Income have become a valuable source. With this guide, you'll dive into the world "Is A 401k Withdrawal Considered Taxable Income," exploring the benefits of them, where you can find them, and how they can be used to enhance different aspects of your life.

Get Latest Is A 401k Withdrawal Considered Taxable Income Below

Is A 401k Withdrawal Considered Taxable Income

Is A 401k Withdrawal Considered Taxable Income - Is A 401k Withdrawal Considered Taxable Income, Is 401k Distribution Considered Taxable Income, Is A 401k Withdrawal Taxable Income, Is 401k Considered Non Taxable Income, Is 401k Withdrawal Considered Earned Income, Do You Have To Include 401k Withdrawal On Taxes, Does 401k Withdrawal Count As Income

If you withdraw 5 000 per month from your traditional 401 k and you don t have other sources of income your income will be 60 000 which puts you in the 12 tax bracket if you re married filing jointly

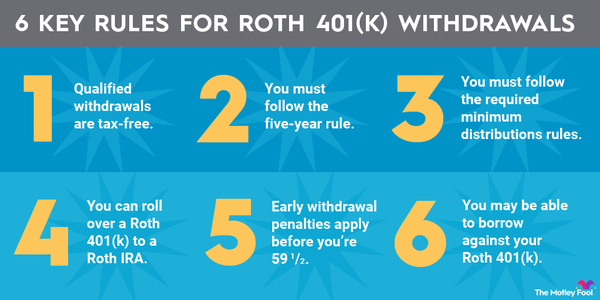

Traditional 401 k withdrawals are taxed at the account owner s current income tax rate In general Roth 401 k withdrawals are not taxable provided the account was opened at

Printables for free cover a broad range of downloadable, printable material that is available online at no cost. They are available in a variety of types, such as worksheets coloring pages, templates and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Is A 401k Withdrawal Considered Taxable Income

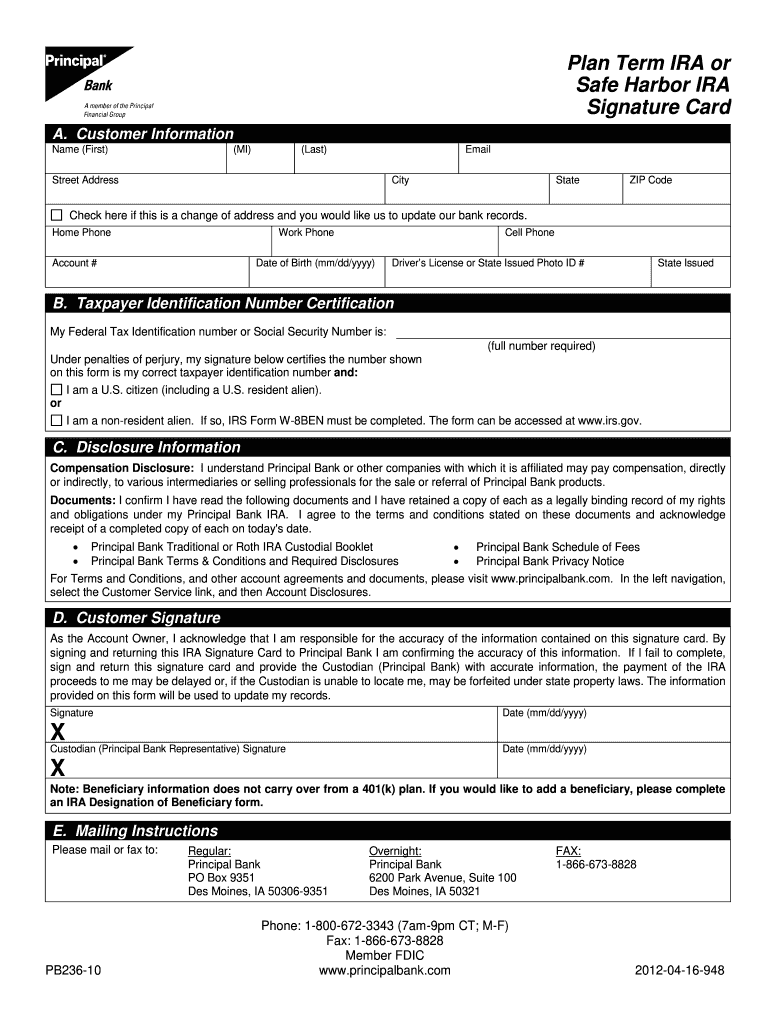

Principal 401k Withdrawal Fill Out Sign Online DocHub

Principal 401k Withdrawal Fill Out Sign Online DocHub

You won t pay income tax on 401 k money until you withdraw it Since your employer considers your contributions when calculating your taxable income on your W 2 you don t need to deduct your 401 k contributions on your tax return

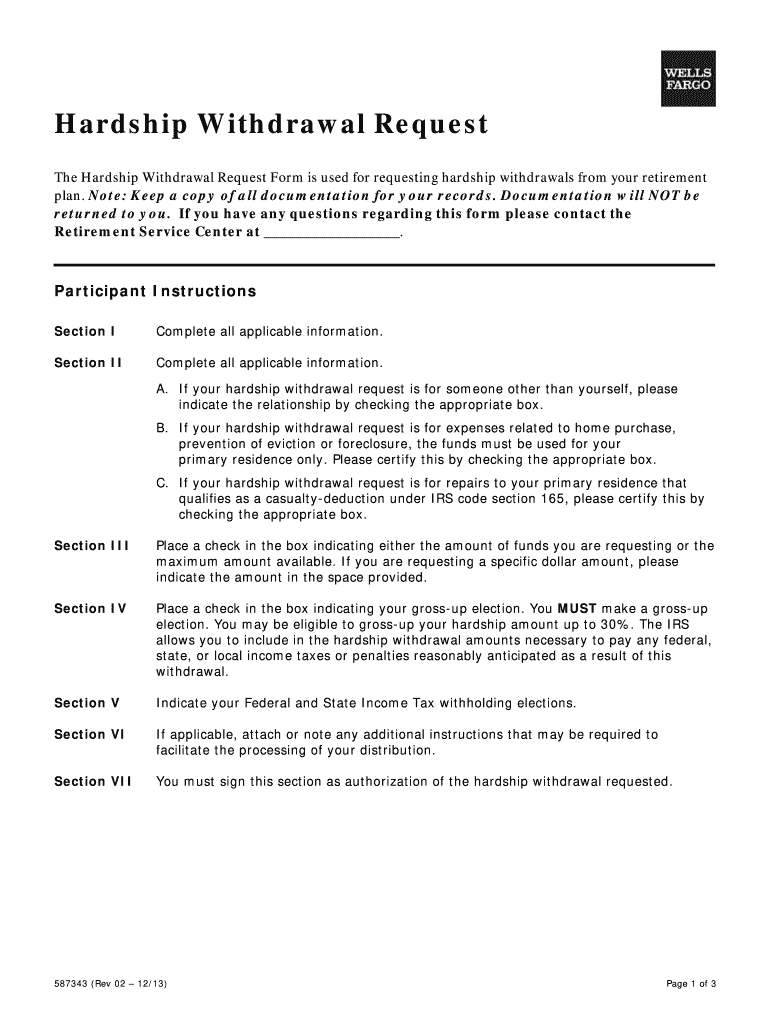

401 k loans don t create taxable income So you won t pay taxes on the amount you borrow The interest you pay on a 401 k loan is added to your own retirement account balance An early withdrawal from a 401 k

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Personalization They can make printing templates to your own specific requirements when it comes to designing invitations planning your schedule or even decorating your home.

-

Educational Value Downloads of educational content for free cater to learners from all ages, making these printables a powerful aid for parents as well as educators.

-

Affordability: Instant access to a variety of designs and templates reduces time and effort.

Where to Find more Is A 401k Withdrawal Considered Taxable Income

Pin On Retirement

Pin On Retirement

There is no set tax applied to 401 k withdrawals 401 k withdrawals are taxed the same way the income from your job is taxed Single filers who earn at least 37 650 per year are in the 25 tax bracket If you earn at least 190 150 The 33 tax bracket starts at an annual income of 190 150

If you have a traditional 401 k you will generally have to pay taxes on withdrawals after age 59 This is because the money you contributed to the 401 k was not taxed when you earned it so it s considered income when you withdraw it in retirement

We hope we've stimulated your interest in Is A 401k Withdrawal Considered Taxable Income Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Is A 401k Withdrawal Considered Taxable Income for various needs.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free with flashcards and other teaching materials.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs covered cover a wide range of interests, everything from DIY projects to planning a party.

Maximizing Is A 401k Withdrawal Considered Taxable Income

Here are some fresh ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home and in class.

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Is A 401k Withdrawal Considered Taxable Income are an abundance of creative and practical resources catering to different needs and passions. Their accessibility and flexibility make they a beneficial addition to both personal and professional life. Explore the plethora of Is A 401k Withdrawal Considered Taxable Income right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes, they are! You can print and download these free resources for no cost.

-

Do I have the right to use free printables in commercial projects?

- It's all dependent on the terms of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may contain restrictions on their use. Be sure to review the terms and conditions set forth by the creator.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in the local print shops for higher quality prints.

-

What program is required to open printables that are free?

- Most printables come in the format of PDF, which is open with no cost software such as Adobe Reader.

401k Withdrawal Calculator 401k Plan 401k Login 401 K

Provident Fund New Rule PF Withdrawal Will Be Taxable If Money

Check more sample of Is A 401k Withdrawal Considered Taxable Income below

When Is It OK To Withdraw Money Early From Your 401K

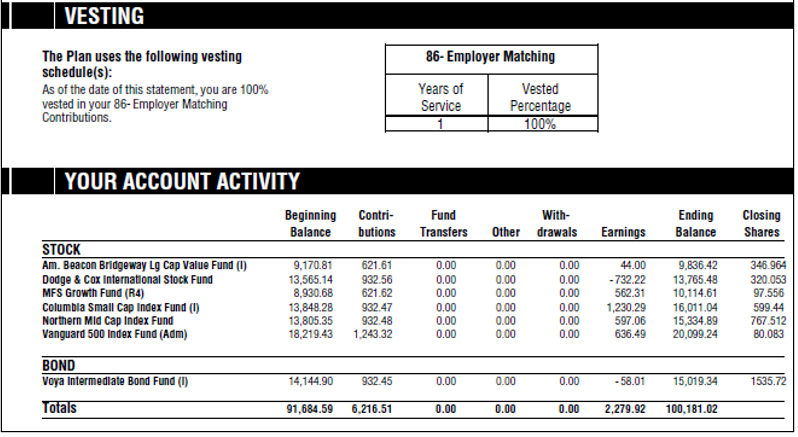

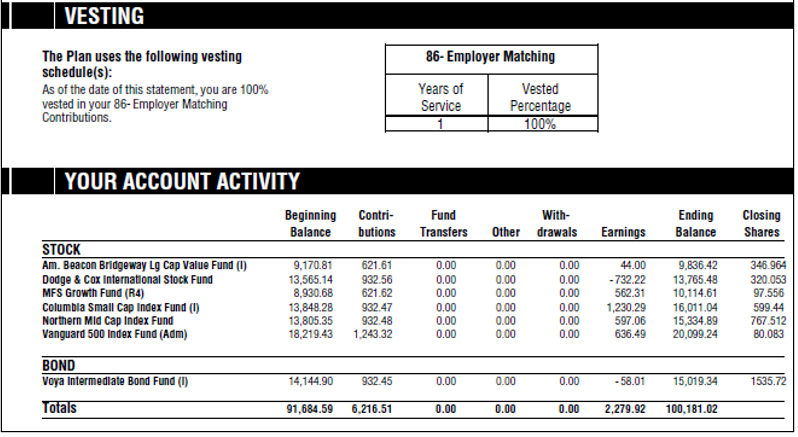

Understanding Your Quarterly 401 k Statement Education CenterBankers

401k Withdrawal Penalty 401k Plan 401k Login Www 401k

401k Withdrawal Strategy For Early Retirement Early Retirement

/what-age-can-funds-be-withdrawn-from-401k-2388807_FINAL-5b632ba64cedfd0050ac345a.png)

Avoid Losing 30 Of Your Money With THIS 401k Withdrawal Penalty

Penalty Free 401k Withdrawal

https://www.investopedia.com/articles/personal...

Traditional 401 k withdrawals are taxed at the account owner s current income tax rate In general Roth 401 k withdrawals are not taxable provided the account was opened at

https://www.nerdwallet.com/article/taxes/401k-taxes

The money you withdraw also called a distribution from a traditional 401 k is taxable as regular income in the year you take the money out

Traditional 401 k withdrawals are taxed at the account owner s current income tax rate In general Roth 401 k withdrawals are not taxable provided the account was opened at

The money you withdraw also called a distribution from a traditional 401 k is taxable as regular income in the year you take the money out

/what-age-can-funds-be-withdrawn-from-401k-2388807_FINAL-5b632ba64cedfd0050ac345a.png)

401k Withdrawal Strategy For Early Retirement Early Retirement

Understanding Your Quarterly 401 k Statement Education CenterBankers

Avoid Losing 30 Of Your Money With THIS 401k Withdrawal Penalty

Penalty Free 401k Withdrawal

The Ultimate Roth 401 k Guide 2023

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money From My 401 k Before I Retire

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money From My 401 k Before I Retire

/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

How Much Is 401K Taxed On Early Withdrawal BERITA EKONOMI