In this digital age, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses or creative projects, or simply to add the personal touch to your space, Income Tax Rebate On Fixed Deposit are a great source. Through this post, we'll take a dive through the vast world of "Income Tax Rebate On Fixed Deposit," exploring their purpose, where they are, and ways they can help you improve many aspects of your lives.

Get Latest Income Tax Rebate On Fixed Deposit Below

Income Tax Rebate On Fixed Deposit

Income Tax Rebate On Fixed Deposit - Income Tax Rebate On Fixed Deposit Interest, Income Tax Rebate On Fixed Deposit, Income Tax Rebate On Fixed Deposit Interest For Senior Citizens, Income Tax Return On Fixed Deposit Interest, Income Tax Benefit On Fixed Deposit Sbi, Income Tax Exemption On Fixed Deposit Interest For Senior Citizens, Tax Rebate For Fixed Deposit, Tax Exemption On Fixed Deposit Interest, Tax Deduction On Fixed Deposit, Is There Income Tax On Fixed Deposit

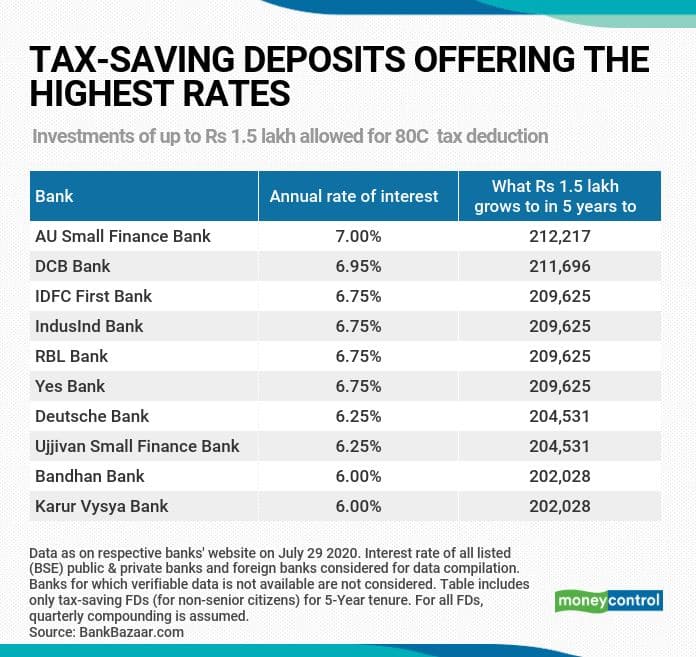

Web Individuals with fixed deposit accounts can claim deductions of up to Rs 1 5 lakh on the amount invested by them in fixed deposits This TDS on fixed deposits can be avoided

Web 9 nov 2020 nbsp 0183 32 What is a Tax Saving FD A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income

Income Tax Rebate On Fixed Deposit include a broad range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in a variety of types, such as worksheets templates, coloring pages, and many more. One of the advantages of Income Tax Rebate On Fixed Deposit lies in their versatility and accessibility.

More of Income Tax Rebate On Fixed Deposit

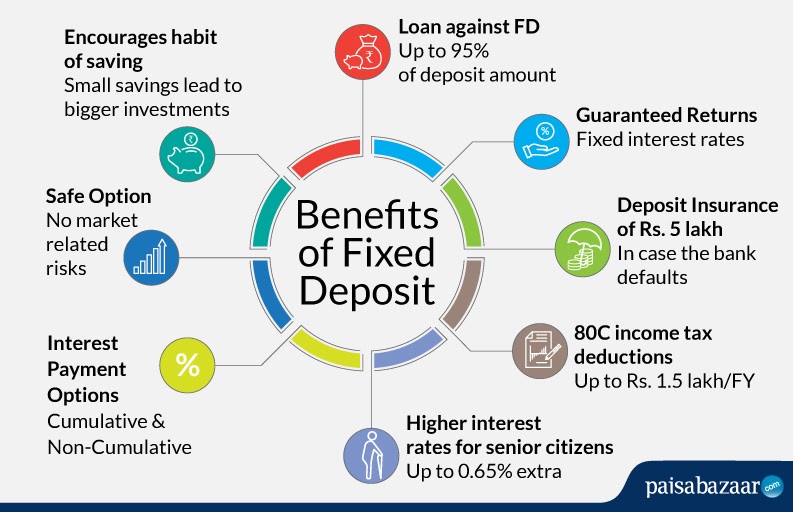

Benefits Of Fixed Deposits FDs In India

Benefits Of Fixed Deposits FDs In India

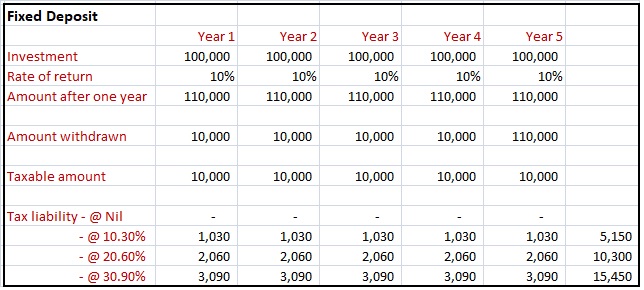

Web 18 janv 2022 nbsp 0183 32 The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable To calculate income tax on

Web 29 juin 2022 nbsp 0183 32 Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can

The Income Tax Rebate On Fixed Deposit have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: It is possible to tailor the design to meet your needs whether you're designing invitations making your schedule, or decorating your home.

-

Educational Use: Printables for education that are free cater to learners from all ages, making these printables a powerful tool for teachers and parents.

-

Simple: Quick access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Income Tax Rebate On Fixed Deposit

57 Tax Cut On Debt Mutual Funds Vs Fixed Deposits The Wealth Architects

57 Tax Cut On Debt Mutual Funds Vs Fixed Deposits The Wealth Architects

Web The interest earned from FDs is added to the income and is taxable However if your tax liability on total income amounts to Nil you can claim for non deduction of TDS on fixed deposit by submitting form 15G or

Web 9 janv 2018 nbsp 0183 32 According to current income tax laws if an individual opts for old existing tax regime then under Section 80C of the Income tax Act you can claim deduction for investments up to Rs 1 5 lakh in a financial year

In the event that we've stirred your interest in Income Tax Rebate On Fixed Deposit Let's find out where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Income Tax Rebate On Fixed Deposit to suit a variety of reasons.

- Explore categories such as home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a broad spectrum of interests, that includes DIY projects to planning a party.

Maximizing Income Tax Rebate On Fixed Deposit

Here are some inventive ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to reinforce learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate On Fixed Deposit are an abundance of innovative and useful resources which cater to a wide range of needs and desires. Their accessibility and versatility make they a beneficial addition to each day life. Explore the vast world of Income Tax Rebate On Fixed Deposit right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes, they are! You can print and download these materials for free.

-

Do I have the right to use free printables in commercial projects?

- It is contingent on the specific conditions of use. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues with Income Tax Rebate On Fixed Deposit?

- Some printables may have restrictions concerning their use. Be sure to review the terms and conditions offered by the author.

-

How can I print Income Tax Rebate On Fixed Deposit?

- You can print them at home using any printer or head to the local print shops for better quality prints.

-

What software do I require to view Income Tax Rebate On Fixed Deposit?

- The majority of PDF documents are provided in PDF format. These is open with no cost software like Adobe Reader.

How To Compute And File The 2nd Quarter Income Tax Return TRAIN

10 Tax saving Fixed Deposits That Offer The Best Interest Rates 10 Tax

Check more sample of Income Tax Rebate On Fixed Deposit below

Best FD Rates In India In March 2019

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax On Interest On Fixed Deposit By NRI

Carbon Tax Rebate 2022 Printable Rebate Form

https://cleartax.in/s/tax-saving-fd-fixed-deposits

Web 9 nov 2020 nbsp 0183 32 What is a Tax Saving FD A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income

https://www.valueresearchonline.com/stories/50686/fixed-deposits...

Web 6 avr 2022 nbsp 0183 32 To be eligible for a deduction from taxable income a fixed deposit must have a lock in period of five years In other words only specific five year tax saving fixed

Web 9 nov 2020 nbsp 0183 32 What is a Tax Saving FD A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income

Web 6 avr 2022 nbsp 0183 32 To be eligible for a deduction from taxable income a fixed deposit must have a lock in period of five years In other words only specific five year tax saving fixed

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Income Tax On Interest On Fixed Deposit By NRI

Carbon Tax Rebate 2022 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Deductions List FY 2019 20

Income Tax Deductions List FY 2019 20

Income Tax Rebate Under Section 87A