In the age of digital, where screens rule our lives yet the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses and creative work, or simply to add an individual touch to the area, Is A 401k Withdrawal Taxable Income have become an invaluable source. Here, we'll take a dive into the world "Is A 401k Withdrawal Taxable Income," exploring their purpose, where you can find them, and the ways that they can benefit different aspects of your lives.

Get Latest Is A 401k Withdrawal Taxable Income Below

Is A 401k Withdrawal Taxable Income

Is A 401k Withdrawal Taxable Income - Is A 401k Withdrawal Taxable Income, Is A 401k Withdrawal Considered Taxable Income, Is 401k Hardship Withdrawal Taxable Income, Is 401k Distribution Considered Taxable Income, Is 401 K Withdrawal Taxed As Ordinary Income, Do You Have To Pay Taxes On 401k Withdrawal, Do You Have To Include 401k Withdrawal On Taxes, Does 401k Withdrawal Count As Income

401 k distributions are taxed as regular taxable income in the year it is withdrawn In general any taxable distribution paid to you is subject to mandatory withholding of 20 but at tax time your tax on the

In general Roth 401 k withdrawals are not taxable provided the account was opened at least five years ago and the account owner is age 59 or older Employer matching contributions to a Roth

The Is A 401k Withdrawal Taxable Income are a huge variety of printable, downloadable materials that are accessible online for free cost. They are available in numerous formats, such as worksheets, templates, coloring pages, and much more. The beauty of Is A 401k Withdrawal Taxable Income is their versatility and accessibility.

More of Is A 401k Withdrawal Taxable Income

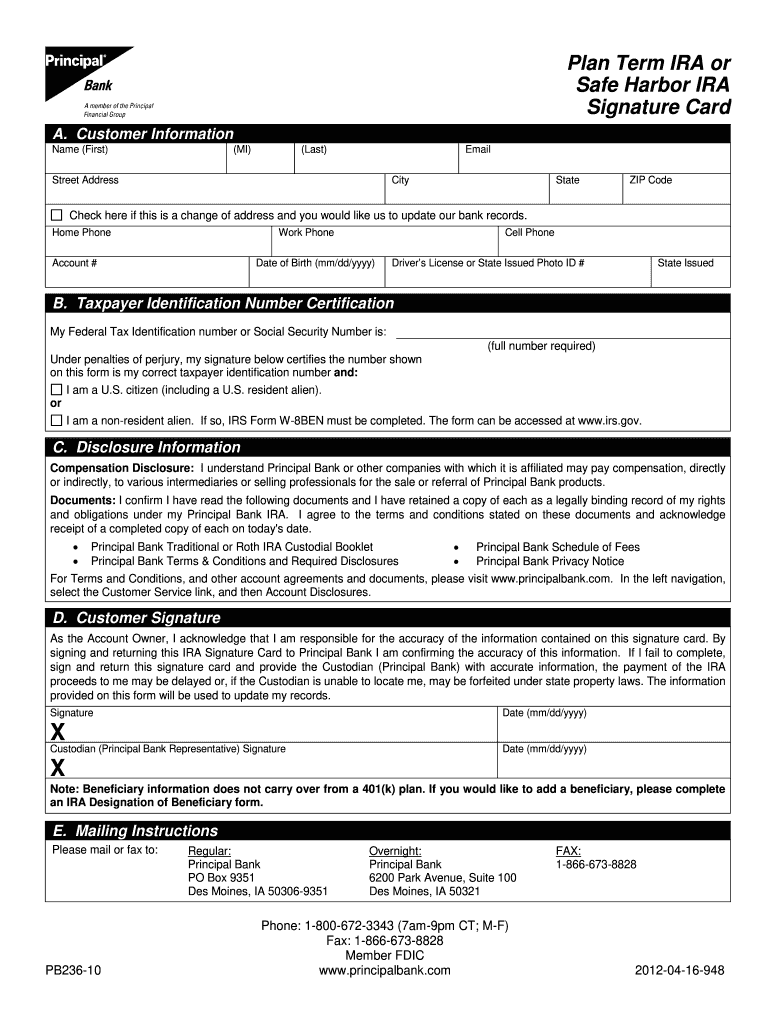

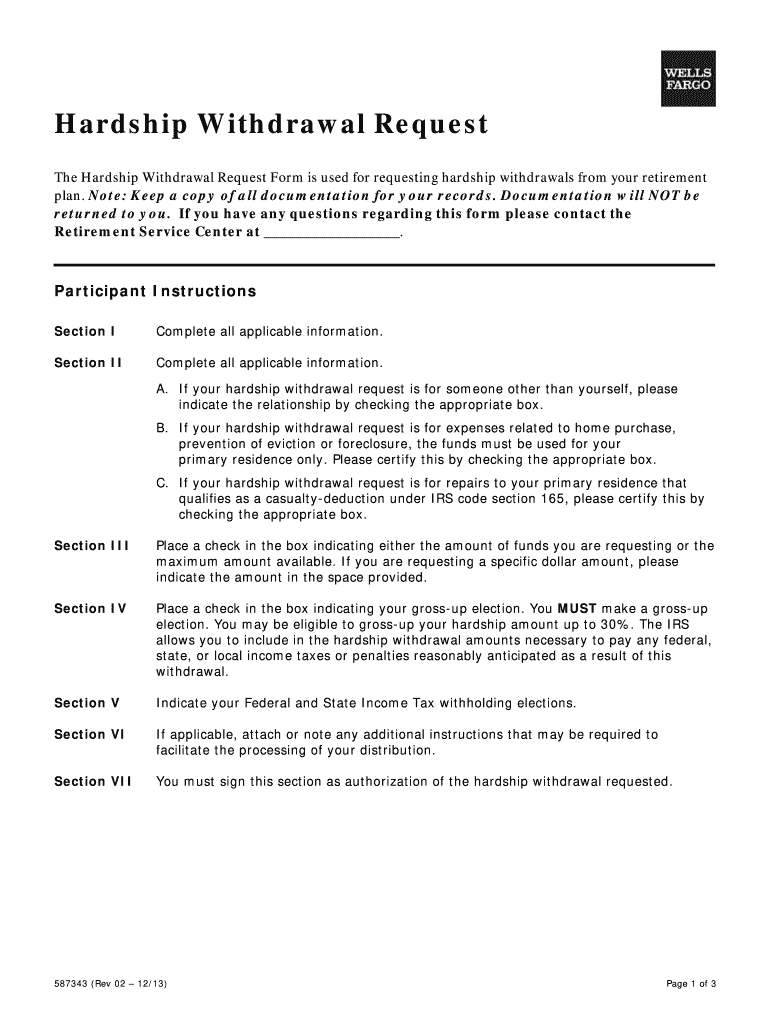

Principal 401k Withdrawal Fill Out Sign Online DocHub

Principal 401k Withdrawal Fill Out Sign Online DocHub

There is no way to take a distribution from a 401 k without owing income taxes at the rate you re paying the year you take the distribution Except in special cases you can t take a distribution from

Once you start withdrawing from your 401 k or traditional IRA your withdrawals are taxed as ordinary income You ll report the taxable part of your distribution directly on your Form 1040 Keep in mind the tax

Is A 401k Withdrawal Taxable Income have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: The Customization feature lets you tailor printed materials to meet your requirements for invitations, whether that's creating them and schedules, or even decorating your home.

-

Educational Benefits: These Is A 401k Withdrawal Taxable Income can be used by students from all ages, making them a great device for teachers and parents.

-

The convenience of immediate access a variety of designs and templates reduces time and effort.

Where to Find more Is A 401k Withdrawal Taxable Income

Roth 401k Early Withdrawal Penalty Calculator KailumTwyla

Roth 401k Early Withdrawal Penalty Calculator KailumTwyla

The Internal Revenue Service IRS allows you to begin taking distributions from your 401 k without a 10 early withdrawal penalty as soon as you are 59 years old If you retire or lose your

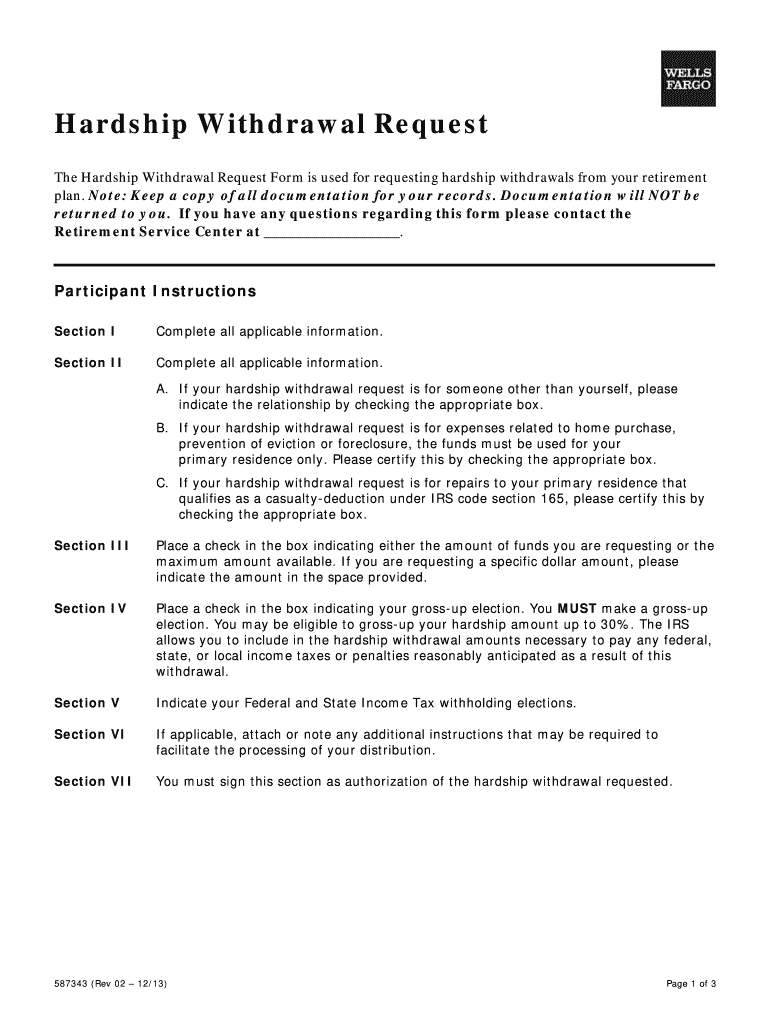

An early withdrawal from a 401 k plan typically counts as taxable income You ll also have to pay a 10 penalty on the amount withdrawn if you re under the age of

We hope we've stimulated your interest in printables for free, let's explore where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Is A 401k Withdrawal Taxable Income to suit a variety of needs.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a broad spectrum of interests, that range from DIY projects to planning a party.

Maximizing Is A 401k Withdrawal Taxable Income

Here are some ideas that you can make use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Is A 401k Withdrawal Taxable Income are an abundance of useful and creative resources that can meet the needs of a variety of people and hobbies. Their access and versatility makes them an invaluable addition to both professional and personal lives. Explore the vast collection of Is A 401k Withdrawal Taxable Income today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is A 401k Withdrawal Taxable Income really are they free?

- Yes they are! You can download and print these items for free.

-

Does it allow me to use free printables in commercial projects?

- It's determined by the specific usage guidelines. Always check the creator's guidelines before using printables for commercial projects.

-

Are there any copyright issues in Is A 401k Withdrawal Taxable Income?

- Some printables may come with restrictions on their use. Be sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home using an printer, or go to the local print shops for better quality prints.

-

What program must I use to open printables free of charge?

- Most PDF-based printables are available in the format PDF. This is open with no cost software like Adobe Reader.

Provident Fund New Rule PF Withdrawal Will Be Taxable If Money

401k Withdrawal Penalty 401k Plan 401k Login Www 401k

Check more sample of Is A 401k Withdrawal Taxable Income below

Avoid Losing 30 Of Your Money With THIS 401k Withdrawal Penalty

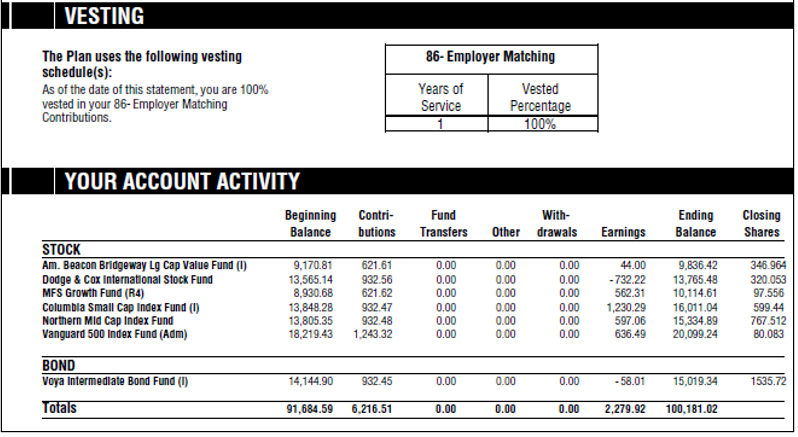

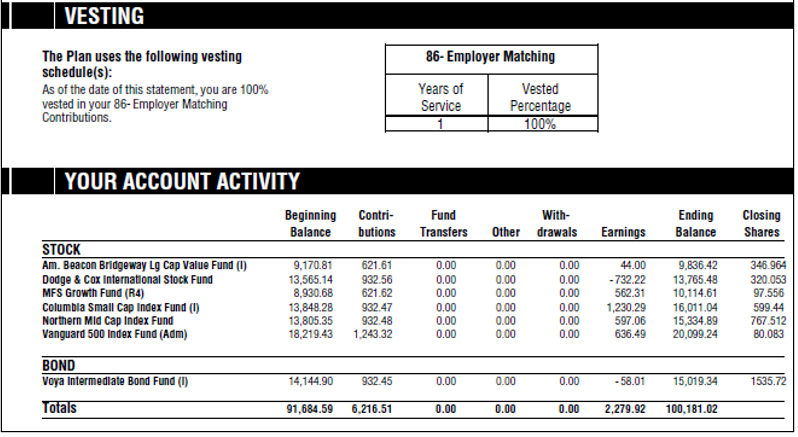

Understanding Your Quarterly 401 k Statement Education CenterBankers

401k Withdrawal Strategy For Early Retirement Early Retirement

/what-age-can-funds-be-withdrawn-from-401k-2388807_FINAL-5b632ba64cedfd0050ac345a.png)

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

Can I Withdraw Money From My 401 k Before I Retire

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Penalty Free 401k Withdrawal

https://www.investopedia.com/articles/…

In general Roth 401 k withdrawals are not taxable provided the account was opened at least five years ago and the account owner is age 59 or older Employer matching contributions to a Roth

https://smartasset.com/retirement/401k-tax

You won t pay income tax on 401 k money until you withdraw it Since your employer considers your contributions when calculating your taxable income on your W 2 you don t need to deduct

In general Roth 401 k withdrawals are not taxable provided the account was opened at least five years ago and the account owner is age 59 or older Employer matching contributions to a Roth

You won t pay income tax on 401 k money until you withdraw it Since your employer considers your contributions when calculating your taxable income on your W 2 you don t need to deduct

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

Understanding Your Quarterly 401 k Statement Education CenterBankers

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money From My 401 k Before I Retire

Penalty Free 401k Withdrawal

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

What Is A 401k Withdrawal Penalty T3 Direct Marketing

What Is A 401k Withdrawal Penalty T3 Direct Marketing

Rules For Investing Wisely In A 401k Early Withdrawal 401k Plan