In this day and age where screens have become the dominant feature of our lives, the charm of tangible printed objects isn't diminished. In the case of educational materials and creative work, or just adding an element of personalization to your space, Is 401k Withdrawal Considered Earned Income have proven to be a valuable source. We'll take a dive deep into the realm of "Is 401k Withdrawal Considered Earned Income," exploring the different types of printables, where they are, and how they can enrich various aspects of your daily life.

Get Latest Is 401k Withdrawal Considered Earned Income Below

Is 401k Withdrawal Considered Earned Income

Is 401k Withdrawal Considered Earned Income -

Your 401 k distributions are taxed as ordinary income All that means is the government treats it the same as money you earned from a job The good news for most people is that incomes

With a traditional 401 k your entire withdrawal contributions and earnings will be taxed as income These distributions are taxed like the money you earn from a job

Is 401k Withdrawal Considered Earned Income offer a wide assortment of printable, downloadable materials that are accessible online for free cost. The resources are offered in a variety designs, including worksheets coloring pages, templates and more. One of the advantages of Is 401k Withdrawal Considered Earned Income lies in their versatility and accessibility.

More of Is 401k Withdrawal Considered Earned Income

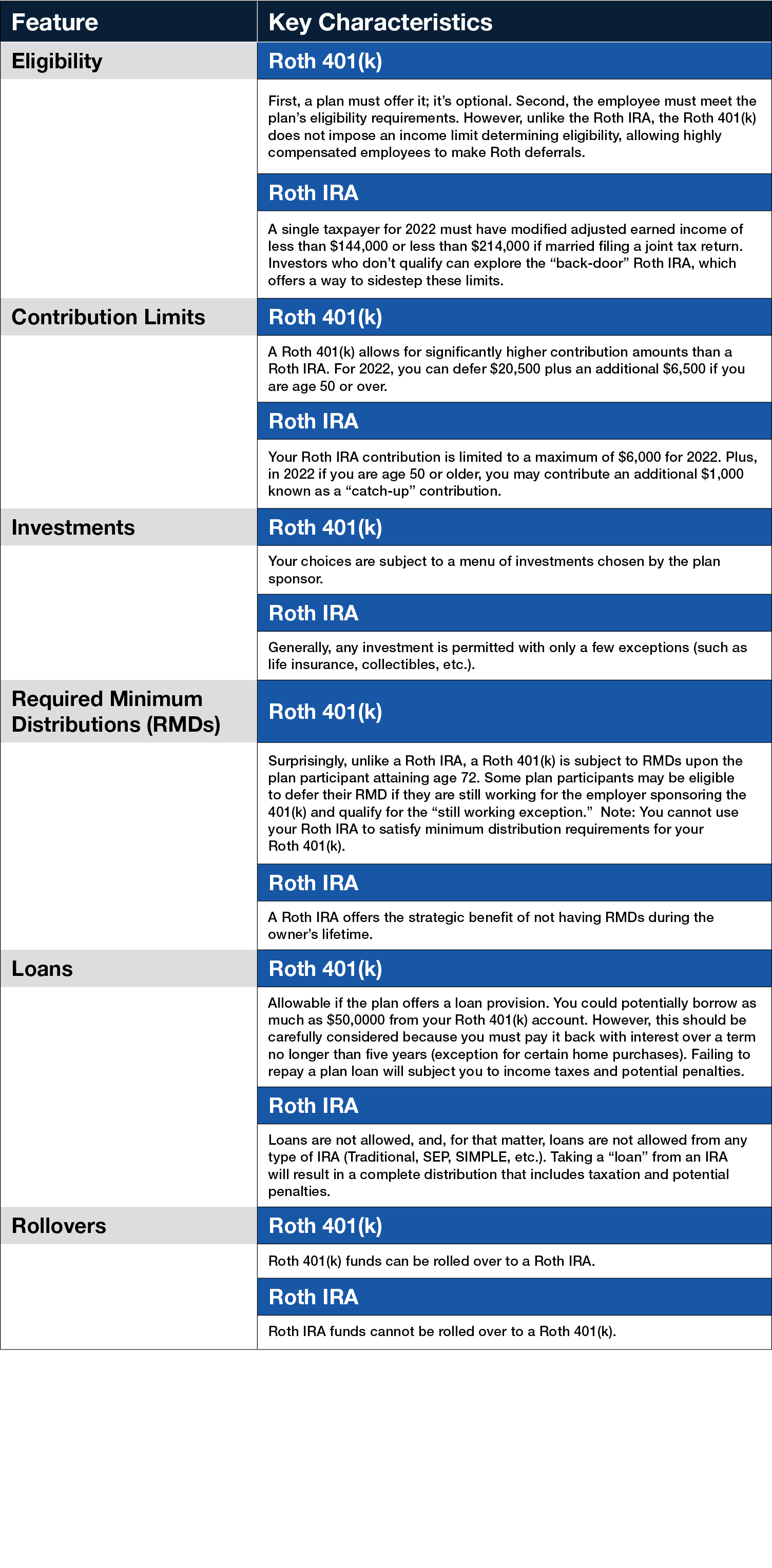

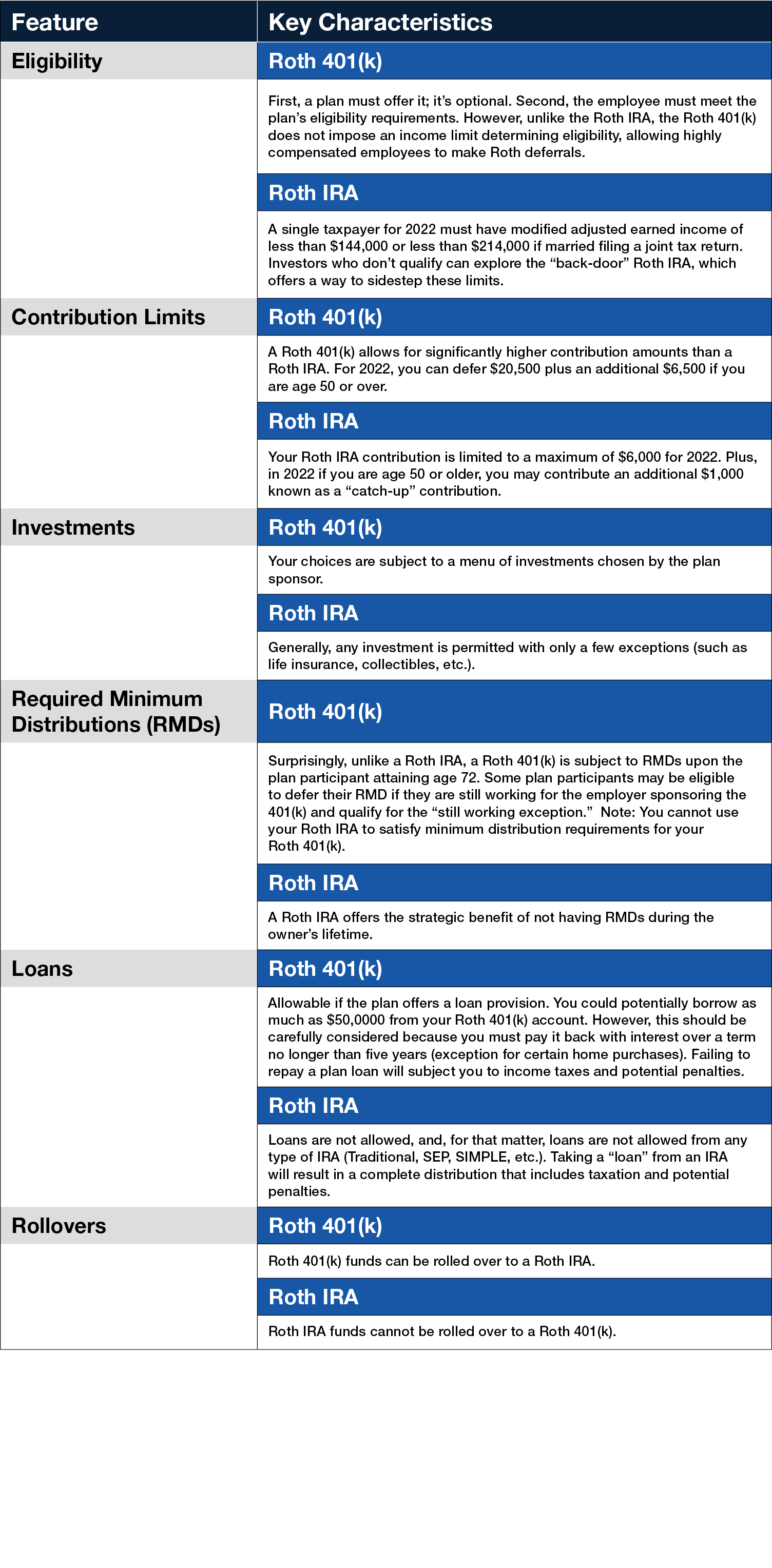

Roth 401 k Versus Roth IRA Essential Info For Retirement Investors

Roth 401 k Versus Roth IRA Essential Info For Retirement Investors

Once you start withdrawing from your traditional 401 k your withdrawals are usually taxed as ordinary taxable income That said you ll report the taxable part of your distribution directly on your Form 1040 for any tax year that you make a distribution

You won t pay income tax on 401 k money until you withdraw it Since your employer considers your contributions when calculating your taxable income on your W 2 you don t need to deduct your 401 k contributions on your tax return

The Is 401k Withdrawal Considered Earned Income have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Personalization This allows you to modify the design to meet your needs for invitations, whether that's creating them planning your schedule or decorating your home.

-

Educational Value: Printables for education that are free cater to learners of all ages, making them an essential tool for parents and teachers.

-

The convenience of instant access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Is 401k Withdrawal Considered Earned Income

401k Vs Roth Ira Calculator Choosing Your Gold IRA

401k Vs Roth Ira Calculator Choosing Your Gold IRA

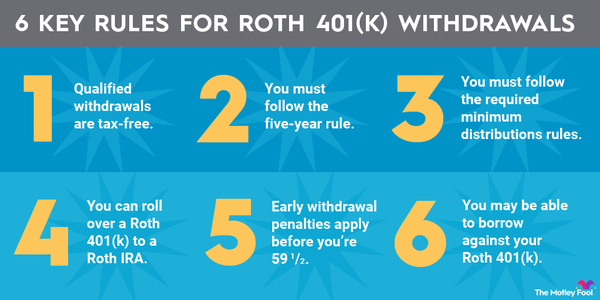

The interest you pay on a 401 k loan is added to your own retirement account balance An early withdrawal from a 401 k plan typically counts as taxable income You ll also have to pay a 10 penalty on the amount withdrawn if

You may be able to make a 401 k withdrawal before age 59 but it could trigger a 10 early distribution penalty on top of ordinary income taxes Some reasons for taking an early 401 k

In the event that we've stirred your curiosity about Is 401k Withdrawal Considered Earned Income Let's find out where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of purposes.

- Explore categories such as decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a broad spectrum of interests, all the way from DIY projects to planning a party.

Maximizing Is 401k Withdrawal Considered Earned Income

Here are some new ways in order to maximize the use of Is 401k Withdrawal Considered Earned Income:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is 401k Withdrawal Considered Earned Income are an abundance of practical and innovative resources designed to meet a range of needs and needs and. Their availability and versatility make them an invaluable addition to the professional and personal lives of both. Explore the vast collection of Is 401k Withdrawal Considered Earned Income right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes they are! You can download and print these resources at no cost.

-

Does it allow me to use free printables for commercial uses?

- It's determined by the specific rules of usage. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright concerns when using Is 401k Withdrawal Considered Earned Income?

- Certain printables may be subject to restrictions on usage. Make sure you read the terms and conditions set forth by the author.

-

How do I print printables for free?

- You can print them at home using a printer or visit an in-store print shop to get more high-quality prints.

-

What software do I need to run Is 401k Withdrawal Considered Earned Income?

- The majority of printed documents are in PDF format. These can be opened using free software, such as Adobe Reader.

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

401 k Withdrawal Rules Early No Penalty Options

Check more sample of Is 401k Withdrawal Considered Earned Income below

Pin On Retirement

401k Vs Roth 401k Decide Which One Is Better Nectar Spring

Social Security Cost Of Living Adjustments 2023

401k Withdrawal Penalty Calculator BryceJemmison

The Ultimate Roth 401 k Guide 2023

Can I Withdraw Money From My 401 k Before I Retire

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

https://www.investopedia.com/articles/personal...

With a traditional 401 k your entire withdrawal contributions and earnings will be taxed as income These distributions are taxed like the money you earn from a job

https://www.sofi.com/learn/content/401k-taxes

If you have a traditional 401 k you will generally have to pay taxes on withdrawals after age 59 This is because the money you contributed to the 401 k was not taxed when you earned it so it s considered income when you withdraw it

With a traditional 401 k your entire withdrawal contributions and earnings will be taxed as income These distributions are taxed like the money you earn from a job

If you have a traditional 401 k you will generally have to pay taxes on withdrawals after age 59 This is because the money you contributed to the 401 k was not taxed when you earned it so it s considered income when you withdraw it

401k Withdrawal Penalty Calculator BryceJemmison

401k Vs Roth 401k Decide Which One Is Better Nectar Spring

The Ultimate Roth 401 k Guide 2023

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money From My 401 k Before I Retire

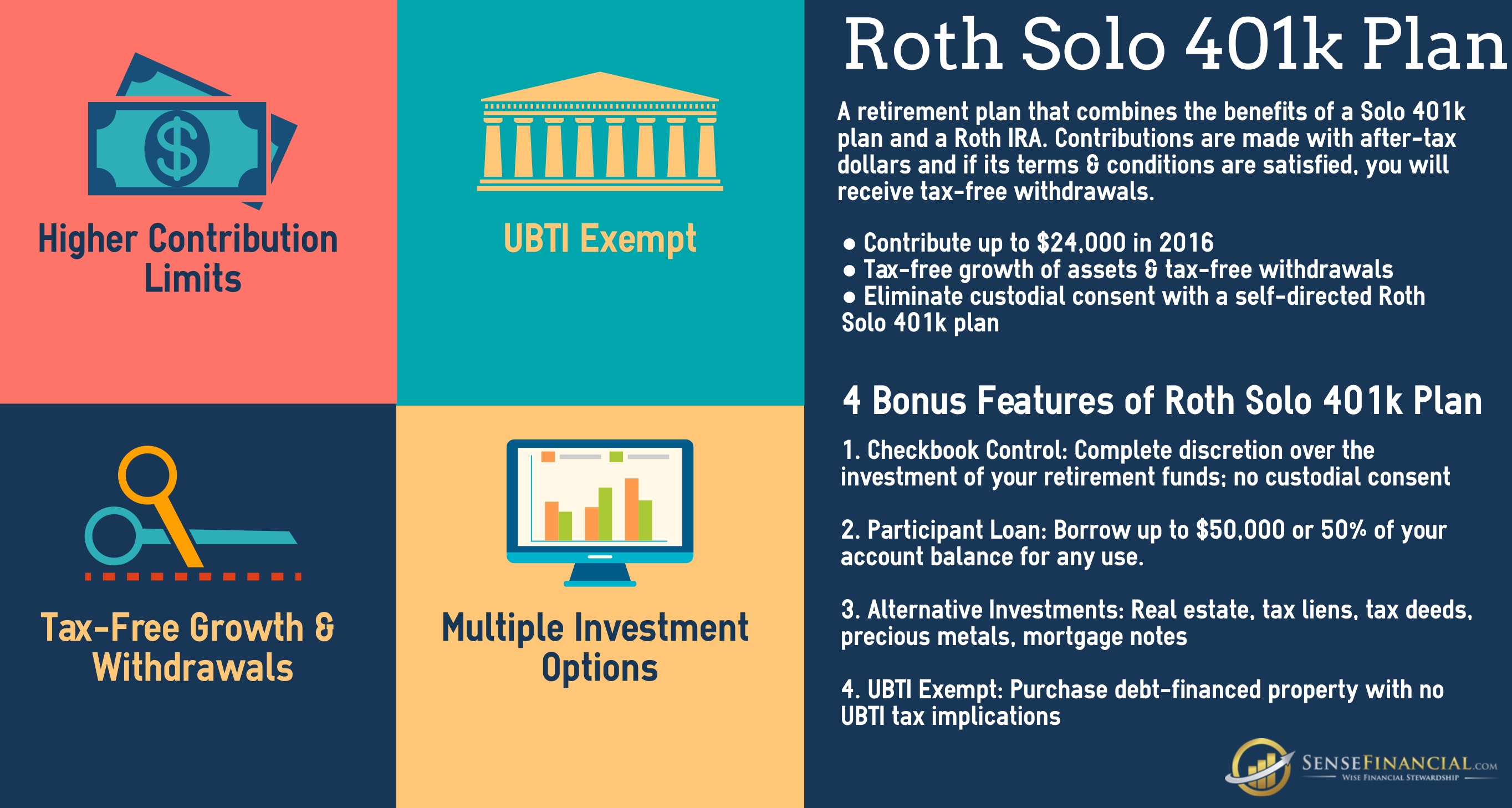

Infographics Why Choosing A Roth Solo 401 K Plan Makes Sense

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

401 k Vs Roth 401 k Which Is Best For You The Motley Fool