In the age of digital, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Be it for educational use, creative projects, or simply to add an individual touch to the space, Tax Rebate On Interest On Home Loan are a great resource. With this guide, you'll take a dive into the sphere of "Tax Rebate On Interest On Home Loan," exploring their purpose, where they are, and how they can add value to various aspects of your life.

Get Latest Tax Rebate On Interest On Home Loan Below

Tax Rebate On Interest On Home Loan

Tax Rebate On Interest On Home Loan - Tax Rebate On Interest On Home Loan, Tax Deduction On Interest On Home Loan, Tax Rebate On Interest On Housing Loan, Tax Rebate On Interest Paid On Home Loan, Tax Benefit On Interest Paid On Home Loan Before Possession, Income Tax Rebate On Interest Paid On Home Loan, Section 24 Income Tax Benefit On Interest On Home Loan, Income Tax Rebate On Interest Paid On Housing Loan, Tax Exemption On Home Loan Interest 2022-23, Tax Exemption On Home Loan Interest 2023-24

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Tax Rebate On Interest On Home Loan encompass a wide selection of printable and downloadable resources available online for download at no cost. They come in many forms, including worksheets, templates, coloring pages and more. The appealingness of Tax Rebate On Interest On Home Loan lies in their versatility and accessibility.

More of Tax Rebate On Interest On Home Loan

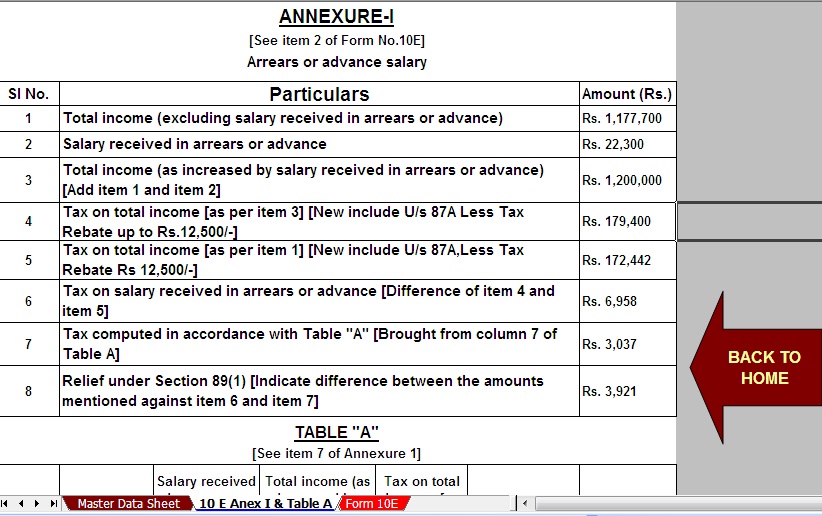

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Web 11 sept 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Individualization This allows you to modify print-ready templates to your specific requirements whether it's making invitations, organizing your schedule, or decorating your home.

-

Educational Value: Downloads of educational content for free can be used by students from all ages, making the perfect source for educators and parents.

-

Easy to use: Instant access to an array of designs and templates will save you time and effort.

Where to Find more Tax Rebate On Interest On Home Loan

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI they paid throughout the year Income

Web Tax saving on home loan increases the affordability of your home loan With the help of a home loan tax benefit calculator you can find out your exact tax exemption My Annual

We hope we've stimulated your curiosity about Tax Rebate On Interest On Home Loan Let's look into where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Tax Rebate On Interest On Home Loan to suit a variety of objectives.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free or flashcards as well as learning materials.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs are a vast range of topics, all the way from DIY projects to planning a party.

Maximizing Tax Rebate On Interest On Home Loan

Here are some new ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print free worksheets to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Rebate On Interest On Home Loan are a treasure trove of fun and practical tools which cater to a wide range of needs and needs and. Their accessibility and versatility make them a wonderful addition to the professional and personal lives of both. Explore the endless world of Tax Rebate On Interest On Home Loan right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes they are! You can download and print these free resources for no cost.

-

Can I use free printables for commercial purposes?

- It is contingent on the specific conditions of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download Tax Rebate On Interest On Home Loan?

- Certain printables might have limitations on their use. Always read these terms and conditions as set out by the author.

-

How can I print Tax Rebate On Interest On Home Loan?

- Print them at home with either a printer at home or in an area print shop for top quality prints.

-

What software do I need in order to open printables that are free?

- The majority of PDF documents are provided as PDF files, which is open with no cost software like Adobe Reader.

What Are Reuluations About Getting A Home Loan On A Forclosed Home

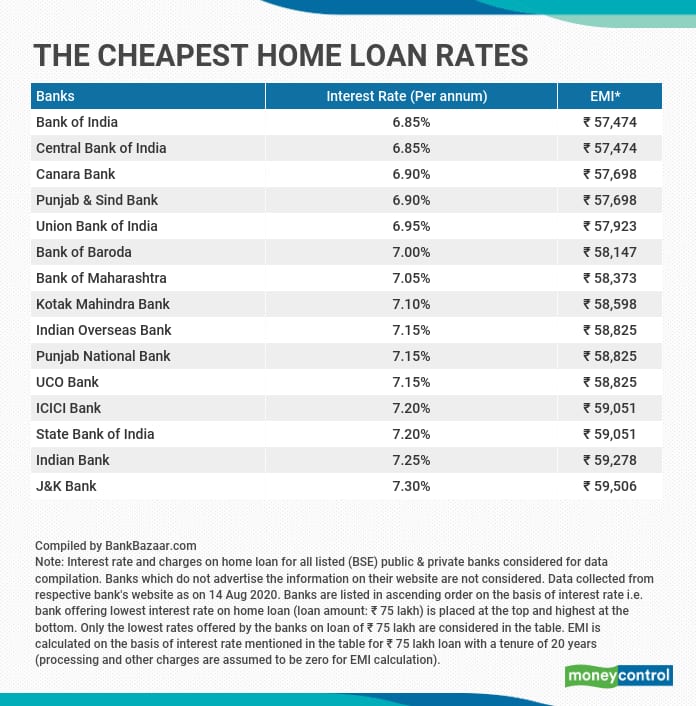

Top 15 Banks That Offer The Lowest Home Loan Interest Rates Perfect Homez

Check more sample of Tax Rebate On Interest On Home Loan below

Sbi Home Loan Interest Rate Today Sale Discount Save 49 Jlcatj gob mx

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

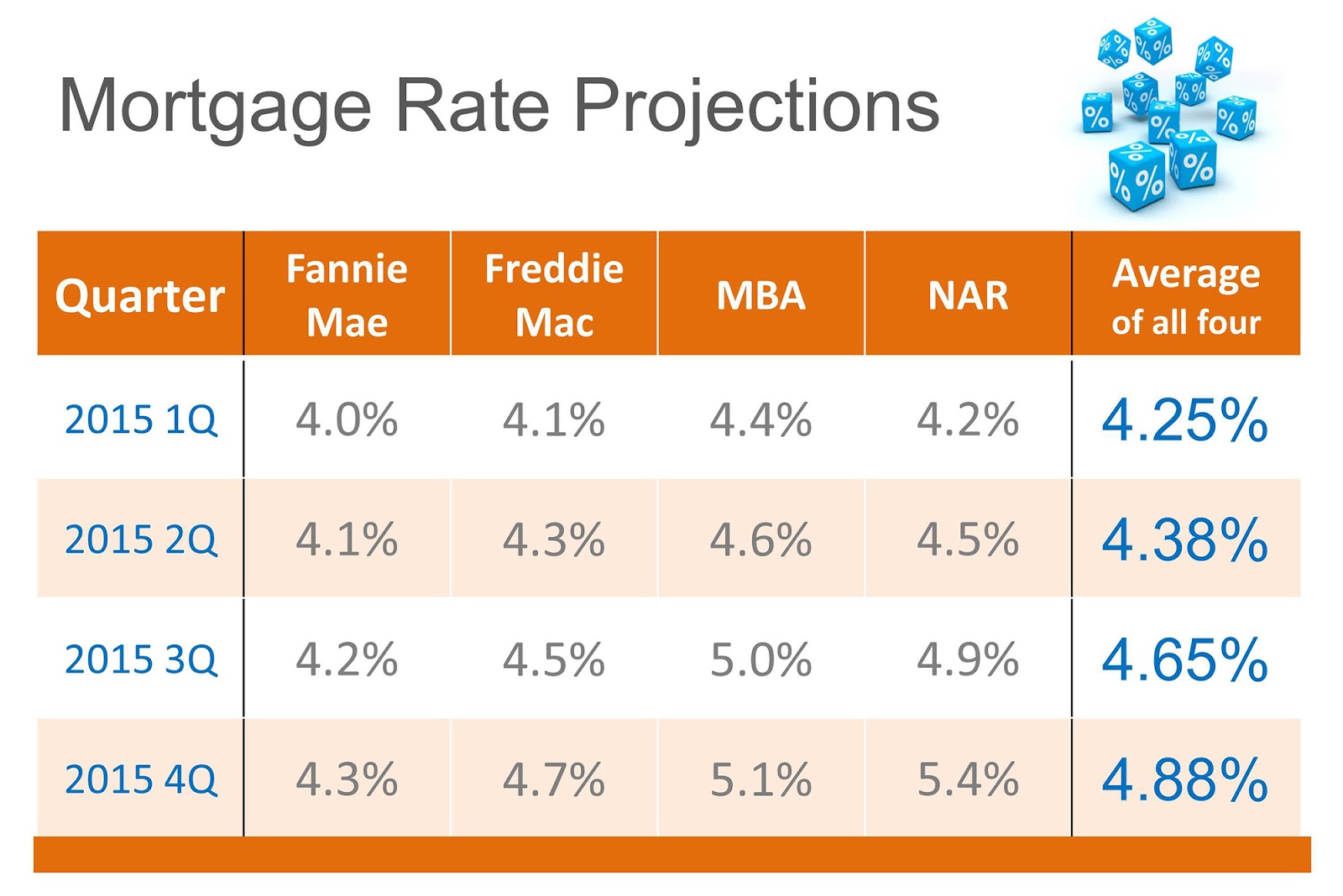

The Real Estate Word Mortgage Interest Rate Predictions For 2015

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

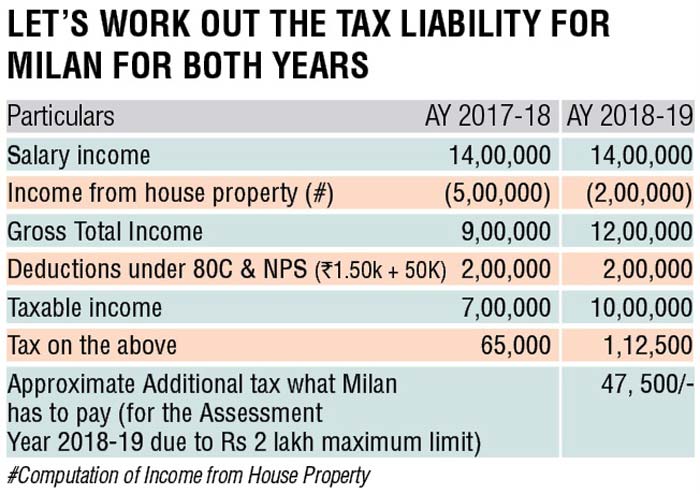

Tax Benefits On Home Loan Complete Details And Doubts

Lowest Interest Rates On Home Loans Under Rs 30 Lakh Here s What 15

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

Tax Benefits On Home Loan Complete Details And Doubts

Lowest Interest Rates On Home Loans Under Rs 30 Lakh Here s What 15

Understanding The Tax Benefit Of Home Loan Interest

Home Loan Interest Exemption In Income Tax Home Sweet Home

Home Loan Interest Exemption In Income Tax Home Sweet Home

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers