In a world where screens have become the dominant feature of our lives yet the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses or creative projects, or just adding personal touches to your area, Income Tax Rebate On Interest Paid On Housing Loan are now a vital source. Here, we'll take a dive into the world "Income Tax Rebate On Interest Paid On Housing Loan," exploring what they are, how they are, and what they can do to improve different aspects of your daily life.

Get Latest Income Tax Rebate On Interest Paid On Housing Loan Below

Income Tax Rebate On Interest Paid On Housing Loan

Income Tax Rebate On Interest Paid On Housing Loan -

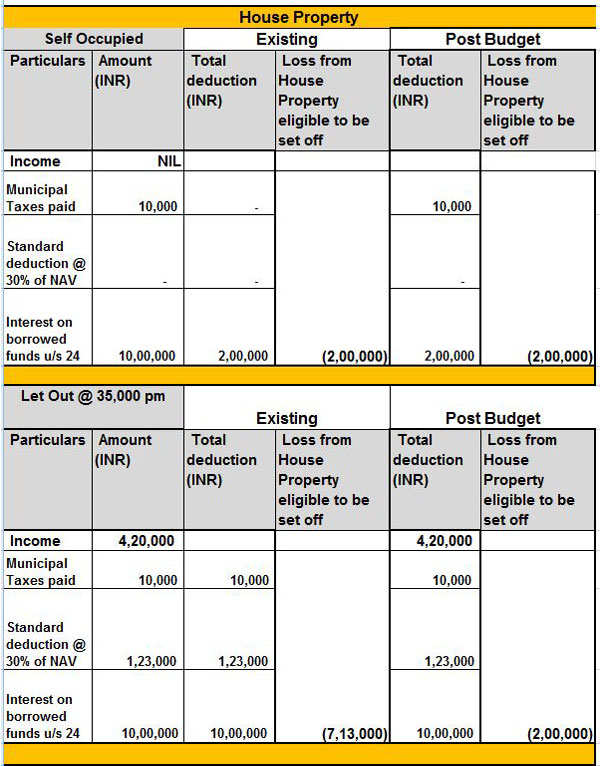

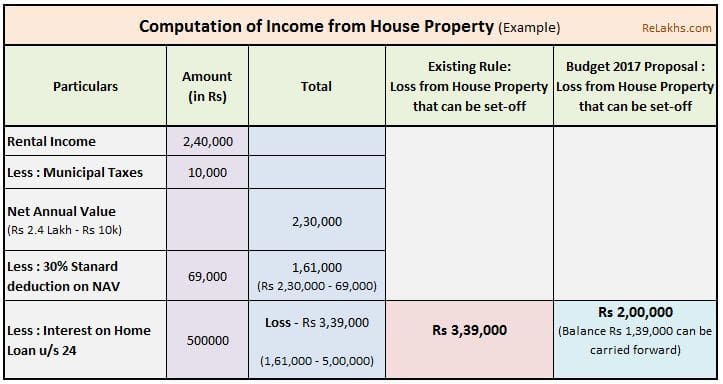

Web 24 ao 251 t 2023 nbsp 0183 32 Tax Deduction on Home Loan Interest Payment under Section 24 b As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Income Tax Rebate On Interest Paid On Housing Loan cover a large array of printable documents that can be downloaded online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages, and many more. The attraction of printables that are free is their versatility and accessibility.

More of Income Tax Rebate On Interest Paid On Housing Loan

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web 31 mai 2022 nbsp 0183 32 2 Section 24 b Tax Deduction On Interest Paid You can enjoy home loan tax exemptions of up to Rs 2 lakh on the interest payment component This is useful during the initial repayments of your

Web 25 mars 2016 nbsp 0183 32 20 OF TOTAL Rs 56 741 74 Principle and Interest on Home Loan paid during the current financial year in which I got the possession of the second flat is as follows Financial Year Principle on

Income Tax Rebate On Interest Paid On Housing Loan have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: It is possible to tailor the design to meet your needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Impact: Downloads of educational content for free can be used by students of all ages. This makes these printables a powerful tool for parents and teachers.

-

It's easy: immediate access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Income Tax Rebate On Interest Paid On Housing Loan

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Web 28 janv 2014 nbsp 0183 32 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that financial year can be claimed

Web 13 janv 2023 nbsp 0183 32 If you bought the house before December 16 2017 you can deduct the interest you paid during the year on the first 1 million of the mortgage 500 000 if married filing separately

We've now piqued your curiosity about Income Tax Rebate On Interest Paid On Housing Loan Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection and Income Tax Rebate On Interest Paid On Housing Loan for a variety goals.

- Explore categories such as design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning materials.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs covered cover a wide variety of topics, including DIY projects to planning a party.

Maximizing Income Tax Rebate On Interest Paid On Housing Loan

Here are some ways to make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate On Interest Paid On Housing Loan are a treasure trove of innovative and useful resources catering to different needs and interest. Their accessibility and versatility make them a wonderful addition to both professional and personal life. Explore the vast array of Income Tax Rebate On Interest Paid On Housing Loan now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can print and download these documents for free.

-

Are there any free printables to make commercial products?

- It's dependent on the particular conditions of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may have restrictions in their usage. Be sure to review the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- Print them at home using printing equipment or visit the local print shop for more high-quality prints.

-

What program do I need in order to open printables for free?

- Most printables come in the format PDF. This can be opened using free software like Adobe Reader.

Home Loan Tax Benefit Calculator FrankiSoumya

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Check more sample of Income Tax Rebate On Interest Paid On Housing Loan below

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Form 12BB New Form To Claim Income Tax Benefits Rebate

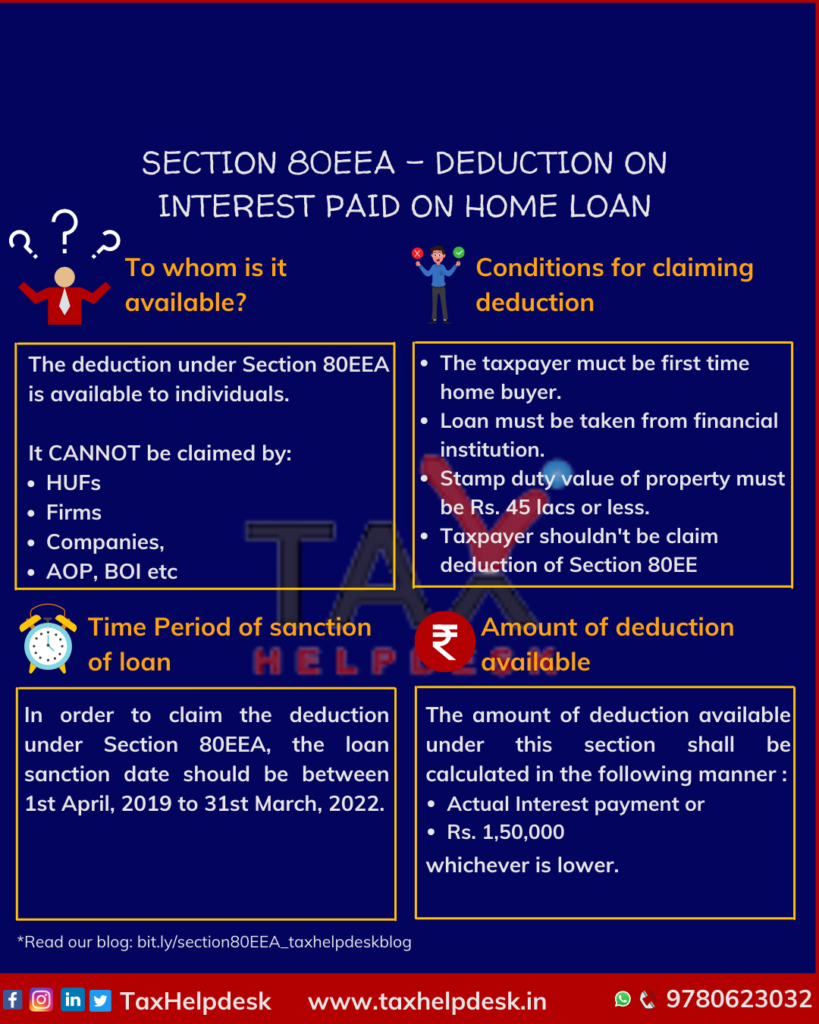

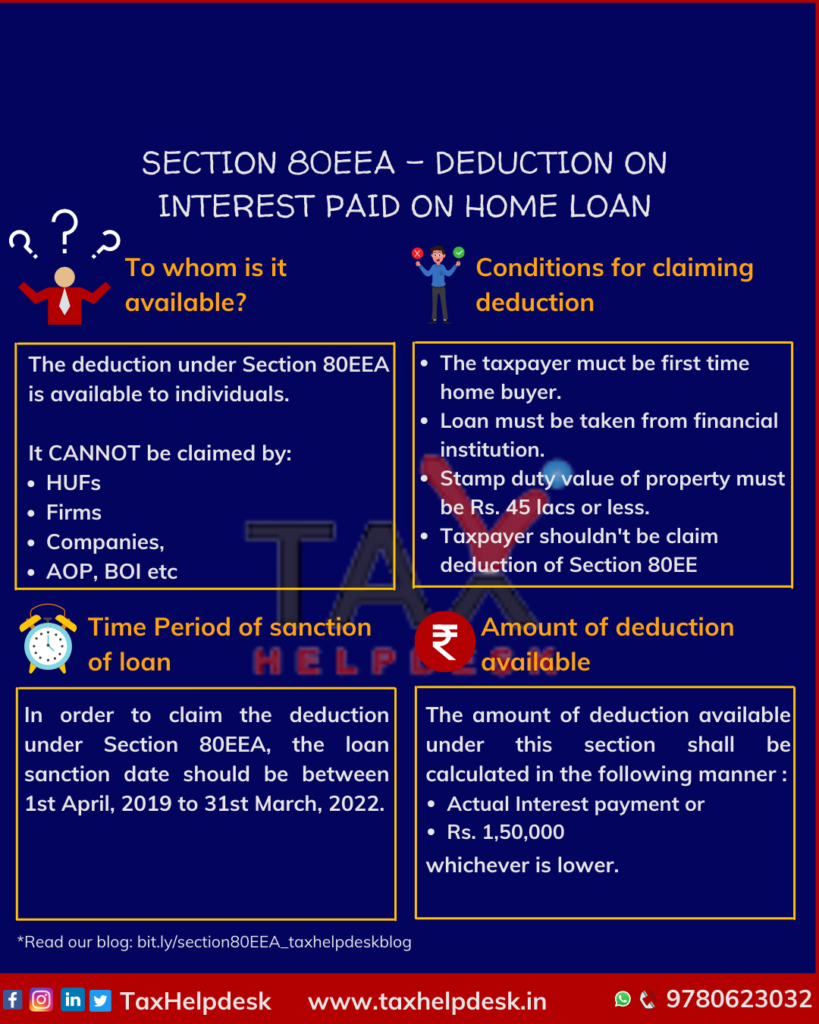

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

https://www.iifl.com/blogs/have-you-calculated-income-tax-rebate-your...

Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

How To Show Home Loan Interest For Self Occupied House In ITR 1 Tax

How To Show Home Loan Interest For Self Occupied House In ITR 1 Tax

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling