In this day and age where screens dominate our lives but the value of tangible printed items hasn't gone away. If it's to aid in education as well as creative projects or just adding a personal touch to your area, Income Tax Rebate On Interest Paid On Home Loan are now an essential resource. For this piece, we'll take a dive to the depths of "Income Tax Rebate On Interest Paid On Home Loan," exploring what they are, how they can be found, and what they can do to improve different aspects of your life.

Get Latest Income Tax Rebate On Interest Paid On Home Loan Below

Income Tax Rebate On Interest Paid On Home Loan

Income Tax Rebate On Interest Paid On Home Loan -

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

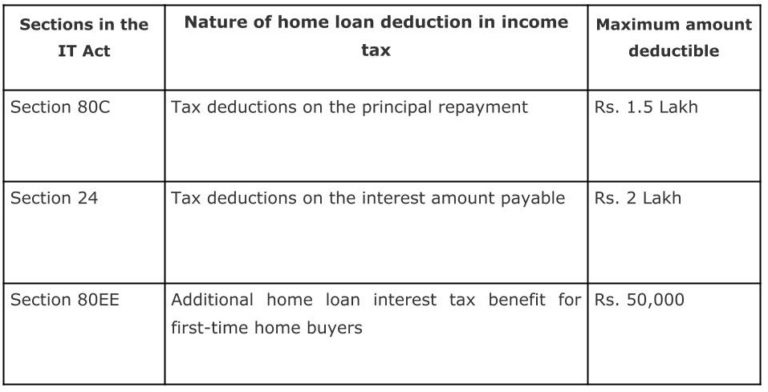

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Income Tax Rebate On Interest Paid On Home Loan include a broad assortment of printable, downloadable materials available online at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages and more. The benefit of Income Tax Rebate On Interest Paid On Home Loan is their flexibility and accessibility.

More of Income Tax Rebate On Interest Paid On Home Loan

Home Loan EMI And Tax Deduction On It EMI Calculator

Home Loan EMI And Tax Deduction On It EMI Calculator

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to

Web You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: You can tailor designs to suit your personal needs when it comes to designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: Printing educational materials for no cost are designed to appeal to students from all ages, making them a valuable device for teachers and parents.

-

Affordability: You have instant access many designs and templates reduces time and effort.

Where to Find more Income Tax Rebate On Interest Paid On Home Loan

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Income Tax Rebate On Home Loan Fy 2019 20 A design system

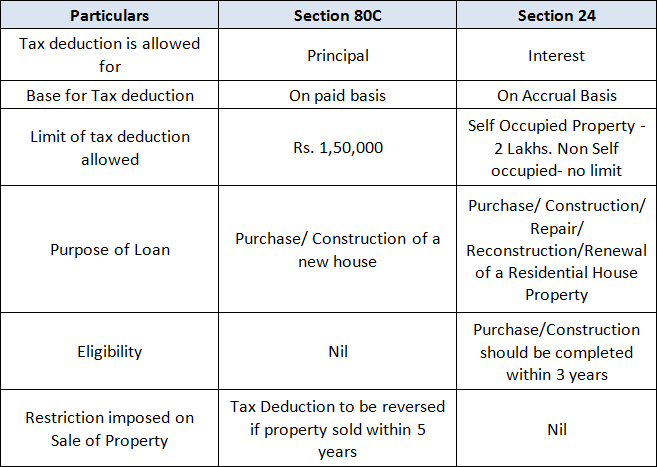

Web Under Sections 80C and 24 both the borrowers are eligible for up to Rs 2 lakh tax rebate on interest payment each and up to Rs 1 5 lakh benefit on the principal repayment each

Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial

We've now piqued your curiosity about Income Tax Rebate On Interest Paid On Home Loan and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with Income Tax Rebate On Interest Paid On Home Loan for all objectives.

- Explore categories like furniture, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- The blogs covered cover a wide variety of topics, all the way from DIY projects to planning a party.

Maximizing Income Tax Rebate On Interest Paid On Home Loan

Here are some fresh ways that you can make use use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Rebate On Interest Paid On Home Loan are an abundance with useful and creative ideas catering to different needs and interests. Their accessibility and versatility make they a beneficial addition to the professional and personal lives of both. Explore the wide world of Income Tax Rebate On Interest Paid On Home Loan now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes you can! You can download and print the resources for free.

-

Can I use free printouts for commercial usage?

- It's determined by the specific terms of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables could be restricted concerning their use. You should read the terms and conditions set forth by the creator.

-

How do I print Income Tax Rebate On Interest Paid On Home Loan?

- You can print them at home with printing equipment or visit the local print shop for superior prints.

-

What software do I need in order to open Income Tax Rebate On Interest Paid On Home Loan?

- The majority of printed documents are as PDF files, which can be opened with free software such as Adobe Reader.

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Check more sample of Income Tax Rebate On Interest Paid On Home Loan below

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

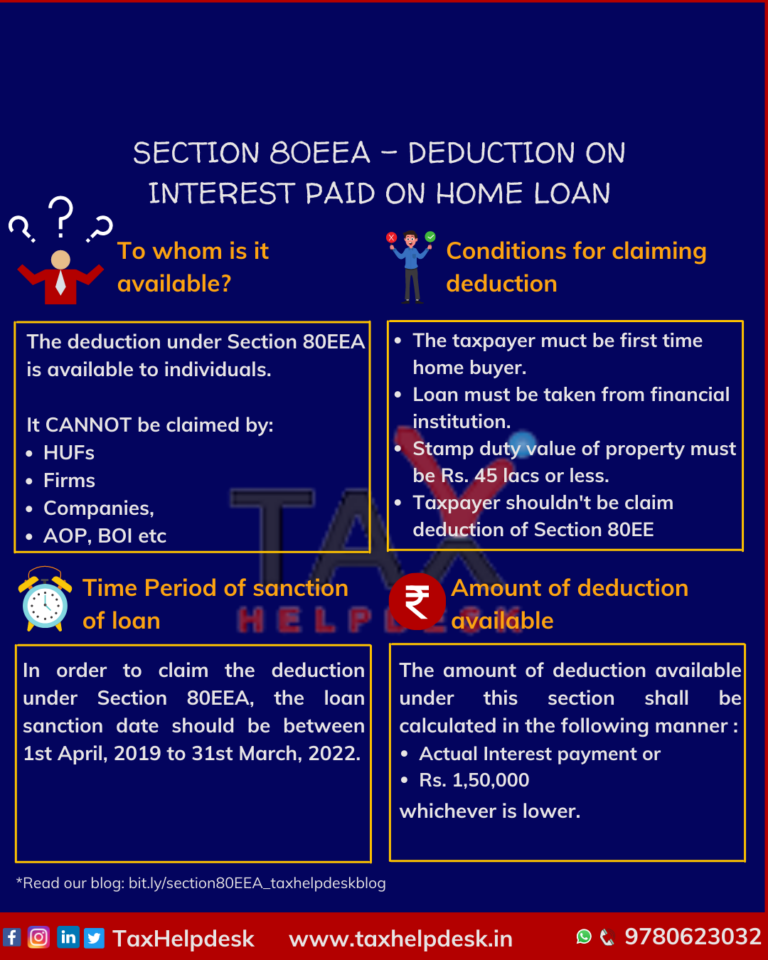

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Latest Income Tax Rebate On Home Loan 2023

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://www.thebalancemoney.com/home-mortgage-interest-tax-deductio…

Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who

Latest Income Tax Rebate On Home Loan 2023

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Form 12BB New Form To Claim Income Tax Benefits Rebate

INCOME TAX REBATE ON HOME LOAN

INCOME TAX REBATE ON HOME LOAN

Top 10 Tax Saving Tips For FY 2021 Rurash Blog