In this age of electronic devices, where screens rule our lives The appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes such as creative projects or simply adding some personal flair to your home, printables for free are now a vital source. For this piece, we'll dive deep into the realm of "How Are Non Deductible Ira Contributions Taxed," exploring their purpose, where to locate them, and how they can improve various aspects of your life.

Get Latest How Are Non Deductible Ira Contributions Taxed Below

How Are Non Deductible Ira Contributions Taxed

How Are Non Deductible Ira Contributions Taxed - How Are Non-deductible Ira Contributions Taxed When Withdrawn, How Are Non Deductible Ira Contributions Taxed, How Are Non Deductible Ira Distributions Taxed, Are Non Deductible Ira Contributions Taxed When Converted To Roth, Are Non-deductible Ira Contributions Taxed Twice, Are Non-deductible Ira Contributions Taxable, What Are Non-deductible Ira Contributions, Can You Contribute To A Non Deductible Ira

A nondeductible contribution to your IRA may pay off in the future Learn about the income limits that may allow you to make tax free contributions

Nondeductible IRAs and tax basis With most traditional IRAs the tax consequences are simple All distributions are taxable That s because if you get an up

The How Are Non Deductible Ira Contributions Taxed are a huge assortment of printable resources available online for download at no cost. These resources come in various types, such as worksheets templates, coloring pages and more. One of the advantages of How Are Non Deductible Ira Contributions Taxed is in their variety and accessibility.

More of How Are Non Deductible Ira Contributions Taxed

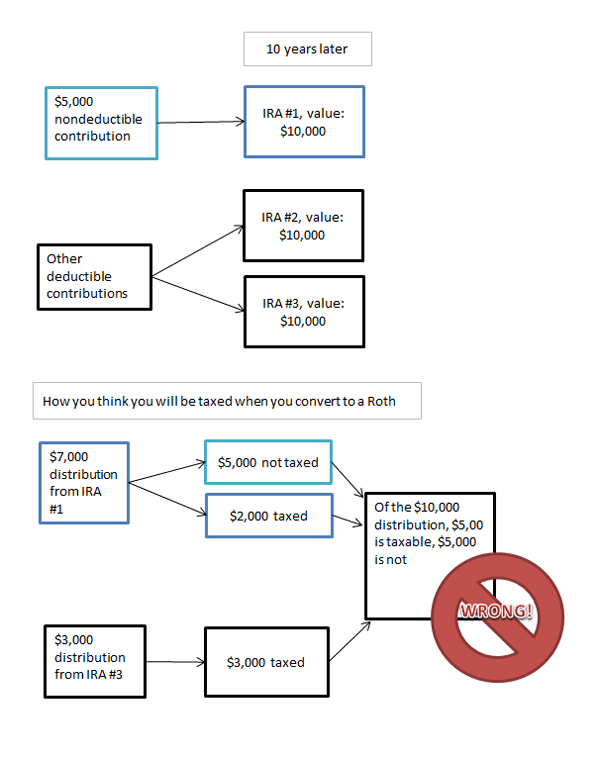

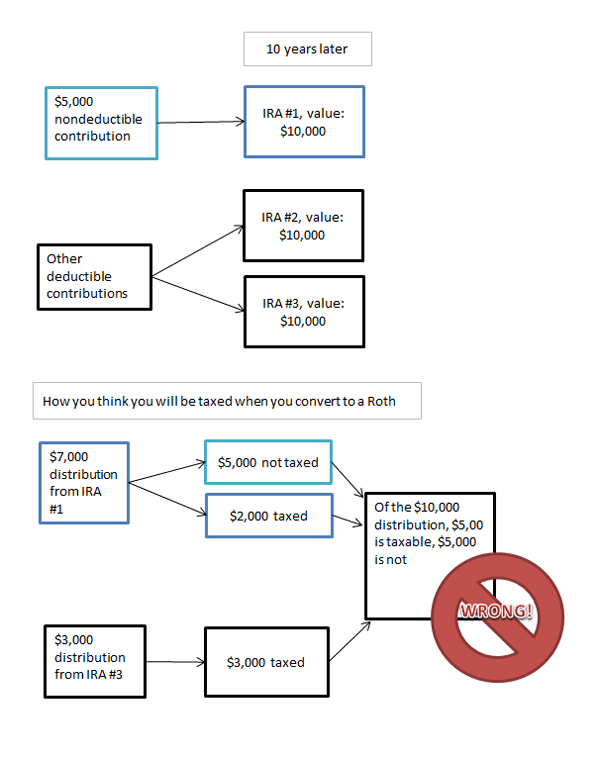

Avoid Paying Tax On Non Deductible IRA Contributions Hantzmon Wiebel

Avoid Paying Tax On Non Deductible IRA Contributions Hantzmon Wiebel

How Non Deductible IRAs Work In a given tax year as long as you or your spouse have enough earned or self employment income you can each contribute to an

The name gives it away A nondeductible IRA is a traditional IRA for which you don t get an immediate tax deduction for your contributions While there s no tax

How Are Non Deductible Ira Contributions Taxed have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: There is the possibility of tailoring designs to suit your personal needs when it comes to designing invitations making your schedule, or decorating your home.

-

Educational value: Education-related printables at no charge cater to learners of all ages. This makes them a useful instrument for parents and teachers.

-

The convenience of Access to many designs and templates saves time and effort.

Where to Find more How Are Non Deductible Ira Contributions Taxed

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

How Non Deductible IRAs Are Taxed Guide Start Conversation What is a non deductible IRA And how are distributions from non deductible IRAs

However Non Deductible IRA contributions are not tax deductible unlike Traditional IRA accounts For 2024 the Non Deductible IRA account is capped at the

Now that we've ignited your interest in printables for free, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of How Are Non Deductible Ira Contributions Taxed to suit a variety of needs.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning materials.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs covered cover a wide array of topics, ranging all the way from DIY projects to party planning.

Maximizing How Are Non Deductible Ira Contributions Taxed

Here are some inventive ways create the maximum value of How Are Non Deductible Ira Contributions Taxed:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Print free worksheets for teaching at-home or in the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

How Are Non Deductible Ira Contributions Taxed are a treasure trove of practical and imaginative resources that can meet the needs of a variety of people and desires. Their availability and versatility make them a great addition to both professional and personal lives. Explore the plethora of How Are Non Deductible Ira Contributions Taxed and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can download and print these resources at no cost.

-

Can I utilize free printouts for commercial usage?

- It is contingent on the specific usage guidelines. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may have restrictions in use. Be sure to read the terms and conditions provided by the author.

-

How can I print printables for free?

- Print them at home with any printer or head to an in-store print shop to get more high-quality prints.

-

What program do I need to open printables free of charge?

- Most PDF-based printables are available in the format PDF. This can be opened using free software such as Adobe Reader.

Simple Ira Contribution Rules Choosing Your Gold IRA

What Are Non Deductible Expenses In Business

Check more sample of How Are Non Deductible Ira Contributions Taxed below

How Are Non Deductible IRA Contributions Taxed When Withdrawn

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

What Is A Non deductible IRA Empower

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Are IRA Contributions Tax Deductible Alto

Taxes On Non Deductible IRA Contributions Page 66 Marotta On Money

https://www.fool.com/knowledge-center/tax...

Nondeductible IRAs and tax basis With most traditional IRAs the tax consequences are simple All distributions are taxable That s because if you get an up

https://www.forbes.com/sites/kristinmckenna/2021/...

This is how you prevent non deductible IRA contributions from being taxed twice Additional tax traps to consider before making non deductible IRA contributions

Nondeductible IRAs and tax basis With most traditional IRAs the tax consequences are simple All distributions are taxable That s because if you get an up

This is how you prevent non deductible IRA contributions from being taxed twice Additional tax traps to consider before making non deductible IRA contributions

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

Are IRA Contributions Tax Deductible Alto

Taxes On Non Deductible IRA Contributions Page 66 Marotta On Money

IRA Contributions Tax Deductible Mullooly Asset Management

Non Deductible IRA Contributions Could Tax You Twice NerdWallet

Non Deductible IRA Contributions Could Tax You Twice NerdWallet

Non Deductible IRA Tax Hack YouTube