In this age of technology, in which screens are the norm and the appeal of physical printed materials hasn't faded away. No matter whether it's for educational uses project ideas, artistic or just adding personal touches to your home, printables for free are now a vital source. We'll dive to the depths of "Are Non Deductible Ira Contributions Taxable," exploring the benefits of them, where they can be found, and what they can do to improve different aspects of your lives.

What Are Are Non Deductible Ira Contributions Taxable?

Printables for free cover a broad assortment of printable, downloadable materials online, at no cost. These printables come in different types, such as worksheets templates, coloring pages and much more. The great thing about Are Non Deductible Ira Contributions Taxable is in their variety and accessibility.

Are Non Deductible Ira Contributions Taxable

Are Non Deductible Ira Contributions Taxable

Are Non Deductible Ira Contributions Taxable - Are Non-deductible Ira Contributions Taxable, Are Non Deductible Ira Contributions Taxed When Withdrawn, Are Non Deductible Ira Contributions Taxed When Converted To Roth, Are Non-deductible Ira Contributions Taxed Twice, How Are Non Deductible Ira Contributions Taxed, How Are Non Deductible Ira Distributions Taxed, Non Deductible Ira Contribution Tax Form, What Are Non-deductible Ira Contributions, Do I Have To Report Non Deductible Ira Contributions, Can You Contribute To A Non Deductible Ira

[desc-5]

[desc-1]

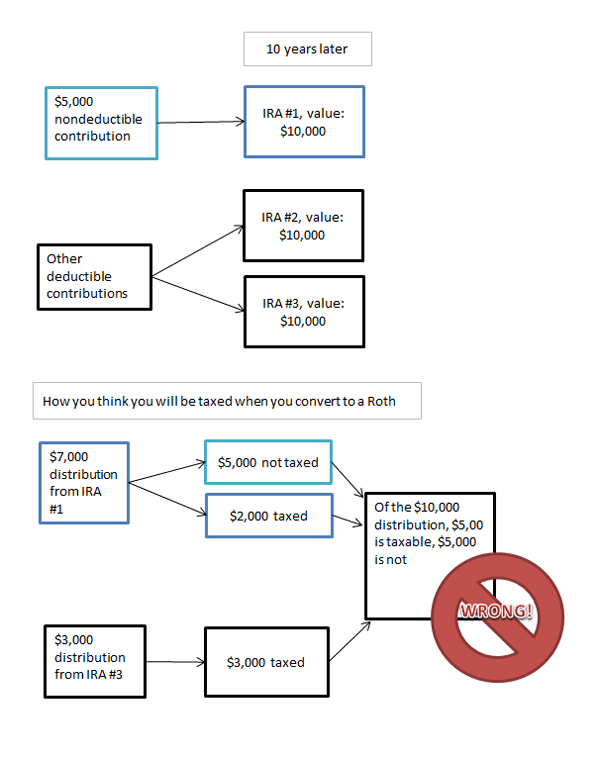

Avoid Paying Tax On Non Deductible IRA Contributions Hantzmon Wiebel

Avoid Paying Tax On Non Deductible IRA Contributions Hantzmon Wiebel

[desc-4]

[desc-6]

How Are Non Deductible IRA Contributions Taxed When Withdrawn

How Are Non Deductible IRA Contributions Taxed When Withdrawn

[desc-9]

[desc-7]

Non Deductible IRA Contributions Could Tax You Twice NerdWallet

What Are Non Deductible Expenses In Business

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Taxes On Non Deductible IRA Contributions Page 66 Marotta On Money

Non Deductible IRA Contributions Require Tracking Roger Rossmeisl CPA

Non Deductible IRA Contributions Require Tracking Roger Rossmeisl CPA

2023 Dcfsa Limits 2023 Calendar