In this age of technology, where screens rule our lives and the appeal of physical, printed materials hasn't diminished. No matter whether it's for educational uses or creative projects, or simply to add some personal flair to your area, How Are Non Deductible Ira Contributions Taxed When Withdrawn have proven to be a valuable source. For this piece, we'll dive into the world "How Are Non Deductible Ira Contributions Taxed When Withdrawn," exploring what they are, where they can be found, and how they can enrich various aspects of your lives.

What Are How Are Non Deductible Ira Contributions Taxed When Withdrawn?

How Are Non Deductible Ira Contributions Taxed When Withdrawn provide a diverse range of printable, free resources available online for download at no cost. They are available in numerous types, like worksheets, coloring pages, templates and many more. The appealingness of How Are Non Deductible Ira Contributions Taxed When Withdrawn is their flexibility and accessibility.

How Are Non Deductible Ira Contributions Taxed When Withdrawn

How Are Non Deductible Ira Contributions Taxed When Withdrawn

How Are Non Deductible Ira Contributions Taxed When Withdrawn -

[desc-5]

[desc-1]

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

[desc-4]

[desc-6]

Deductible IRA Contribution Independent Fiduciary Advisor

Deductible IRA Contribution Independent Fiduciary Advisor

[desc-9]

[desc-7]

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

Are Roth Contributions Right For Me

Are Roth IRA Contributions Tax Deductible Roth Ira Contributions

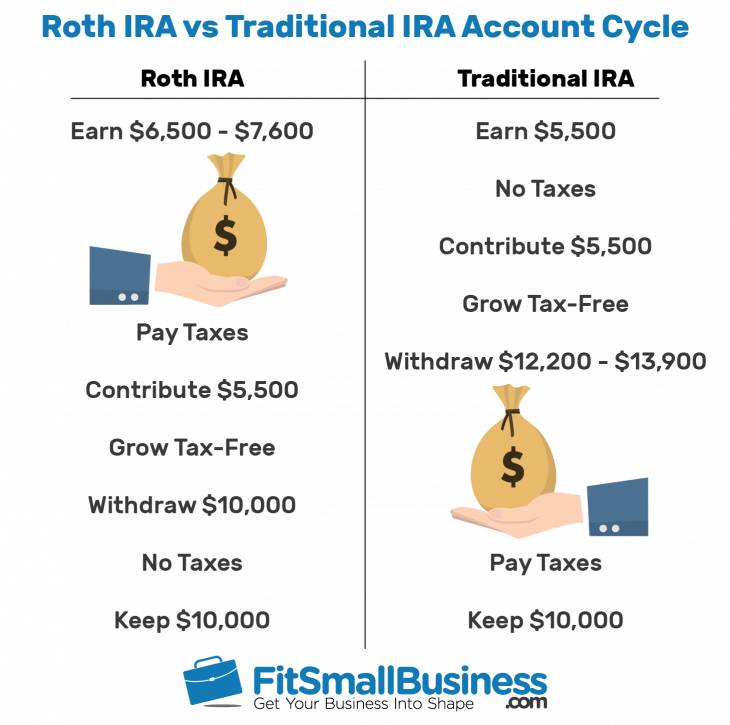

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

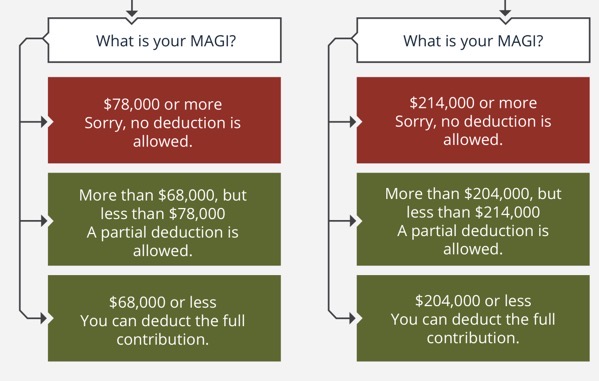

Non Deductible IRA Contributions Could Tax You Twice NerdWallet

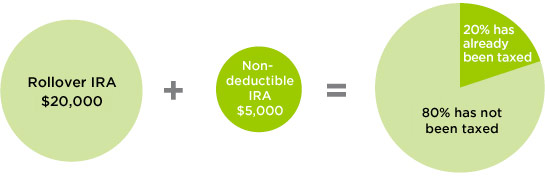

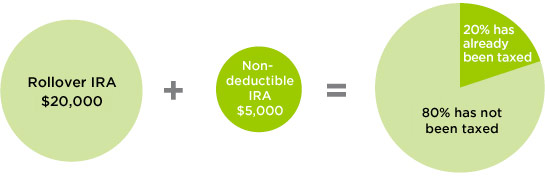

Non deductible IRA Contributions And Roth Conversions Putnam Wealth

Non deductible IRA Contributions And Roth Conversions Putnam Wealth

Roth IRA Rules Contribution Limits Deadlines Best Practice In HR