In this age of electronic devices, when screens dominate our lives however, the attraction of tangible printed objects isn't diminished. Be it for educational use such as creative projects or simply to add an individual touch to the space, How Are Lump Sum Vacation Payments Taxed are now a vital resource. We'll dive through the vast world of "How Are Lump Sum Vacation Payments Taxed," exploring what they are, how they are, and the ways that they can benefit different aspects of your life.

Get Latest How Are Lump Sum Vacation Payments Taxed Below

How Are Lump Sum Vacation Payments Taxed

How Are Lump Sum Vacation Payments Taxed - How Are Lump Sum Vacation Payments Taxed, How Are Lump Sum Vacation Payments Taxed In Canada, How Much Is Lump-sum Vacation Pay Taxed In Canada, How Are Lump Sum Payments Taxed, Are Lump Sum Payments Taxed Differently, Do You Get Taxed More On Lump Sum Payments, How Do Lump Sum Payments Get Taxed, Are Lump Sum Payments Taxable

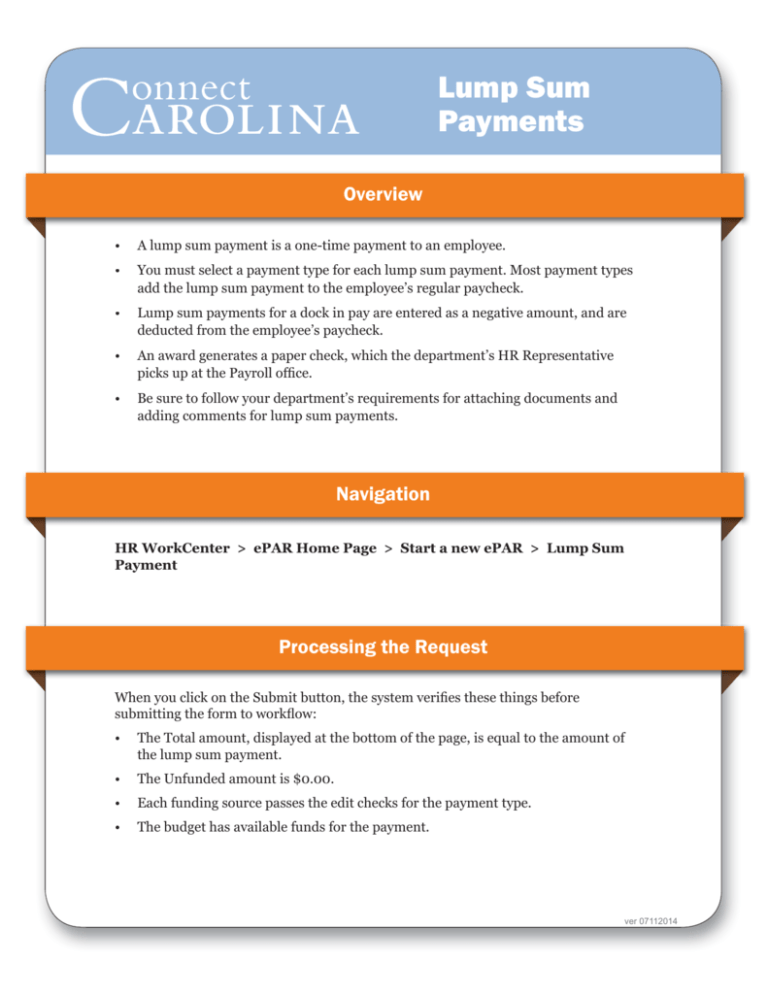

The IRS treats the lump sum payout of unused vacation as supplemental wages for tax purposes As supplemental wages a lump sum payout of unused

For instance if vacation pay is issued as a lump sum when an employee takes time off it may be taxed at a different rate compared to regular pay periods Some

How Are Lump Sum Vacation Payments Taxed include a broad collection of printable content that can be downloaded from the internet at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and many more. The value of How Are Lump Sum Vacation Payments Taxed lies in their versatility and accessibility.

More of How Are Lump Sum Vacation Payments Taxed

How Is My UK Pension Lump Sum Taxed In Spain Ask Michael Series

How Is My UK Pension Lump Sum Taxed In Spain Ask Michael Series

Vacation pay is subject to withholding as if it were a regular wage payment If it is paid in addition to regular wages and separately for the vacation period treat it as

So if a severance package bumps you from the 22 to 24 bracket it doesn t mean all your income is taxed at 24 just the last block is taxed at that rate With more income you may also be phased out of or

How Are Lump Sum Vacation Payments Taxed have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization We can customize the design to meet your needs when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Worth: These How Are Lump Sum Vacation Payments Taxed provide for students of all ages, making them a vital tool for teachers and parents.

-

Simple: The instant accessibility to numerous designs and templates, which saves time as well as effort.

Where to Find more How Are Lump Sum Vacation Payments Taxed

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money

Severance pay is taxable in the year of payment along with any unemployment compensation you receive and payments for accumulated vacation and sick time Employers usually simplify the tax

The Internal Revenue Service IRS recognizes that the loss of a job may create new tax issues The IRS provides the following information to assist displaced workers

Now that we've ignited your curiosity about How Are Lump Sum Vacation Payments Taxed, let's explore where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of How Are Lump Sum Vacation Payments Taxed for various motives.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets with flashcards and other teaching materials.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- The blogs covered cover a wide range of interests, that includes DIY projects to party planning.

Maximizing How Are Lump Sum Vacation Payments Taxed

Here are some inventive ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to enhance learning at home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

How Are Lump Sum Vacation Payments Taxed are an abundance of innovative and useful resources for a variety of needs and interest. Their accessibility and flexibility make them a great addition to every aspect of your life, both professional and personal. Explore the plethora of How Are Lump Sum Vacation Payments Taxed today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes, they are! You can print and download these free resources for no cost.

-

Are there any free printouts for commercial usage?

- It's based on specific usage guidelines. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright problems with How Are Lump Sum Vacation Payments Taxed?

- Certain printables may be subject to restrictions regarding their use. You should read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home with an printer, or go to a local print shop to purchase better quality prints.

-

What program do I need to open printables at no cost?

- The majority of printed documents are in PDF format, which can be opened using free programs like Adobe Reader.

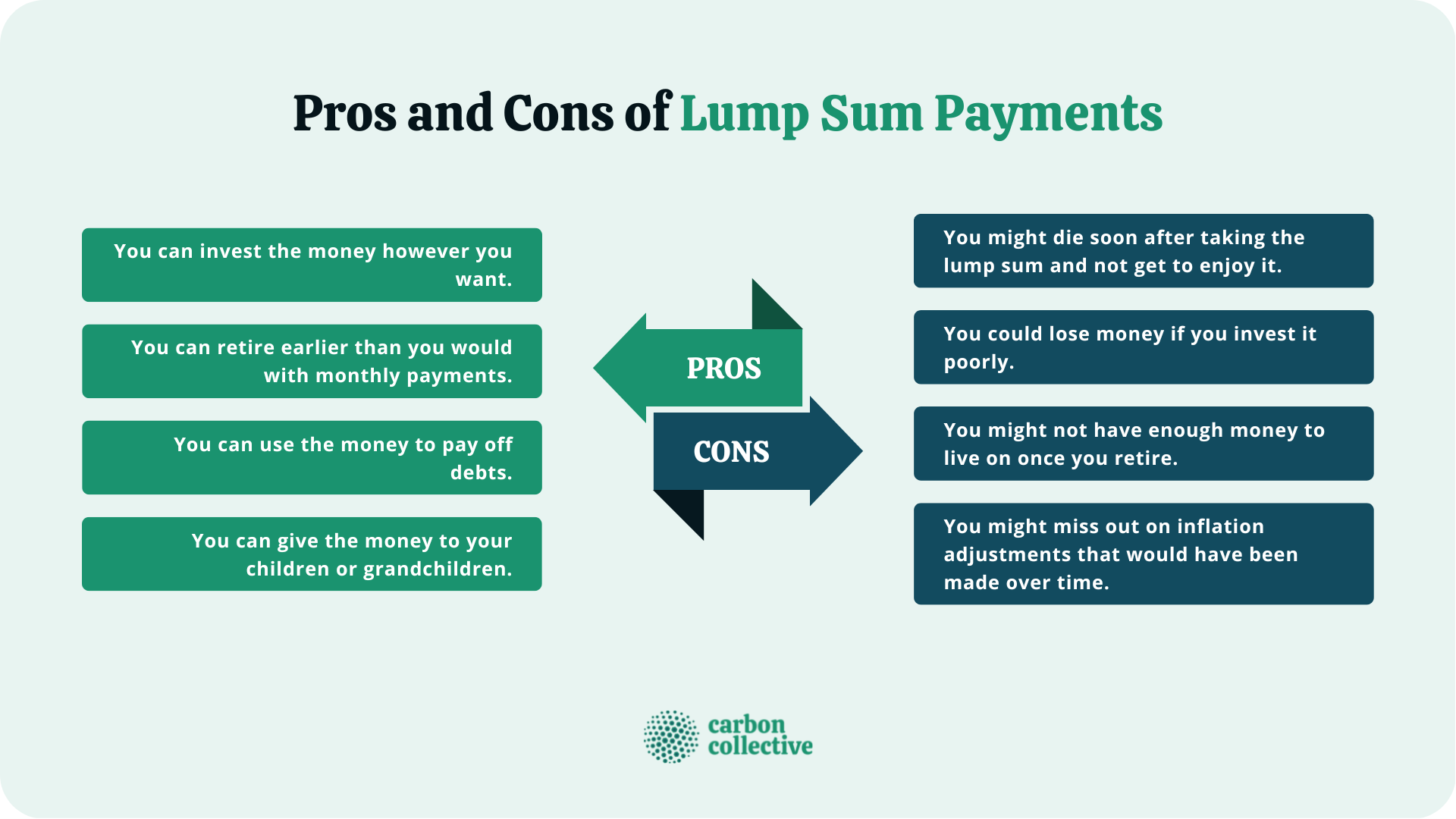

Lump Sum Payment What It Is How It Works Pros Cons

Lump Sum Vs Payments Providence Financial 2019

Check more sample of How Are Lump Sum Vacation Payments Taxed below

Lump Sum Tax What Is It Formula Calculation Example

Lump Sum Versus Payments Which Option Is Better Personal Finance

Are Lump Sum Termination Payments Subject To EI Withholdings HR Insider

Smart Tax Strategies For Lottery Winners Tax Insider

Lump Sum Versus Payments Personal Finance Advice For Real People

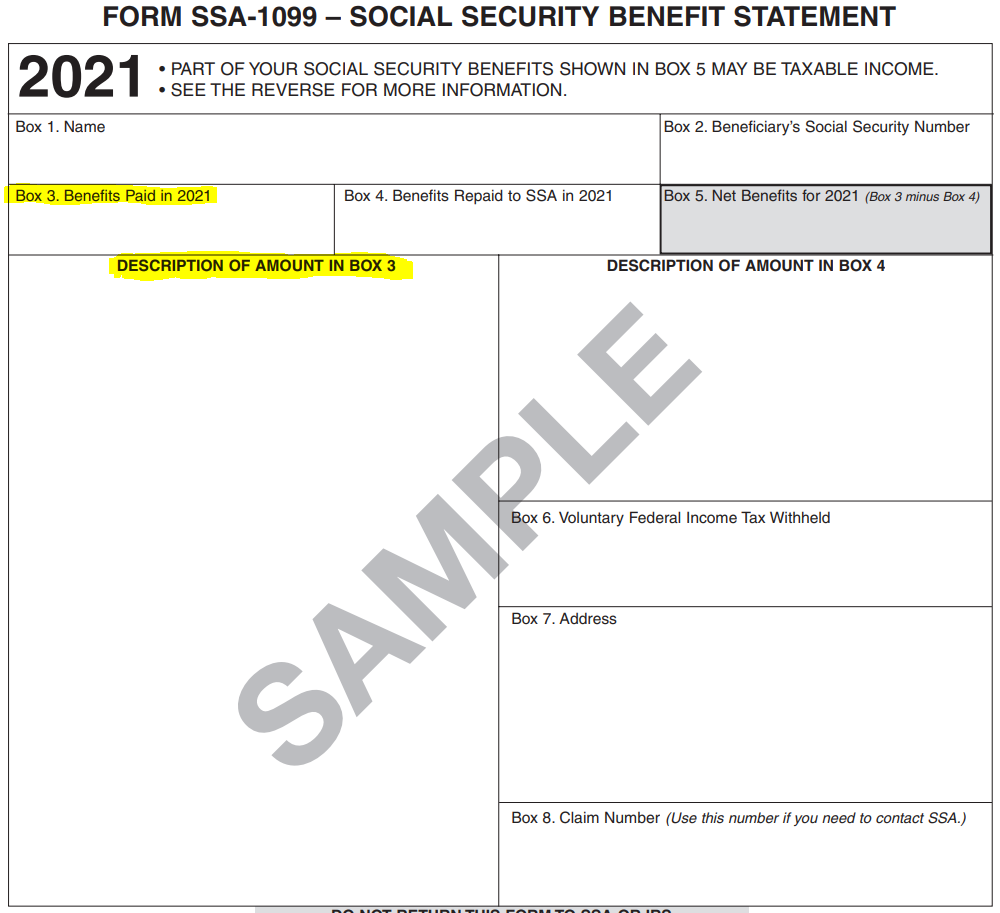

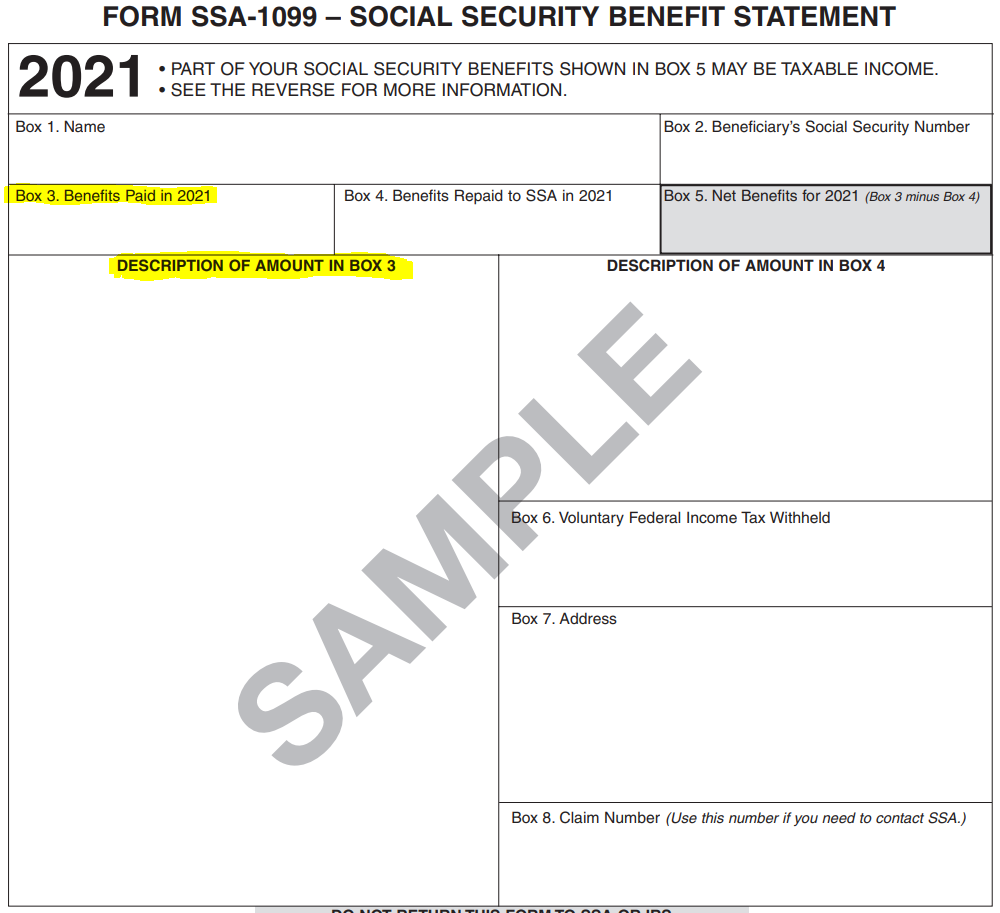

What Is A Lump Sum Payment SSA 1099 Support

https://accountinginsights.org/vacation-pay...

For instance if vacation pay is issued as a lump sum when an employee takes time off it may be taxed at a different rate compared to regular pay periods Some

https://www.ptogenius.com/resources/bl…

Taxation of PTO Payout In most states earned PTO vacation sick time or both is considered to be a form of wages The IRS taxes payout of accrued vacation and other PTO at the supplemental income tax rate of

For instance if vacation pay is issued as a lump sum when an employee takes time off it may be taxed at a different rate compared to regular pay periods Some

Taxation of PTO Payout In most states earned PTO vacation sick time or both is considered to be a form of wages The IRS taxes payout of accrued vacation and other PTO at the supplemental income tax rate of

Smart Tax Strategies For Lottery Winners Tax Insider

Lump Sum Versus Payments Which Option Is Better Personal Finance

Lump Sum Versus Payments Personal Finance Advice For Real People

What Is A Lump Sum Payment SSA 1099 Support

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Lump Sum DCF Payments DCF Annuities

Lump Sum DCF Payments DCF Annuities

Lump Sum Payments