In this age of electronic devices, where screens dominate our lives and the appeal of physical printed materials isn't diminishing. Whether it's for educational purposes such as creative projects or just adding a personal touch to your area, How Are Lump Sum Vacation Payments Taxed In Canada are now a vital source. Here, we'll dive into the world of "How Are Lump Sum Vacation Payments Taxed In Canada," exploring the different types of printables, where they are, and how they can improve various aspects of your lives.

Get Latest How Are Lump Sum Vacation Payments Taxed In Canada Below

How Are Lump Sum Vacation Payments Taxed In Canada

How Are Lump Sum Vacation Payments Taxed In Canada -

Having a larger than normal cheque can result when you add a bonus or other lump sum payment onto your employee s weekly salary To avoid withholding

You have to deduct income tax from lump sum payments that are from a registered retirement savings plan RRSP or a plan referred to in subsection 146 12 of the

How Are Lump Sum Vacation Payments Taxed In Canada provide a diverse selection of printable and downloadable materials that are accessible online for free cost. These resources come in many forms, including worksheets, templates, coloring pages, and more. The beauty of How Are Lump Sum Vacation Payments Taxed In Canada lies in their versatility and accessibility.

More of How Are Lump Sum Vacation Payments Taxed In Canada

Lump Sum Tax What Is It Formula Calculation Example

Lump Sum Tax What Is It Formula Calculation Example

Find the latest income tax rates on lump sum payments in Canada Nethris simplifies payroll management for small and medium businesses

The best way to answer this question is by contrasting it with the normal rules for calculating Canada Revenue Agency CRA income tax source deductions termed the periodic method There are other CRA

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization It is possible to tailor printables to your specific needs be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Benefits: The free educational worksheets cater to learners from all ages, making them a great tool for parents and educators.

-

An easy way to access HTML0: instant access a plethora of designs and templates is time-saving and saves effort.

Where to Find more How Are Lump Sum Vacation Payments Taxed In Canada

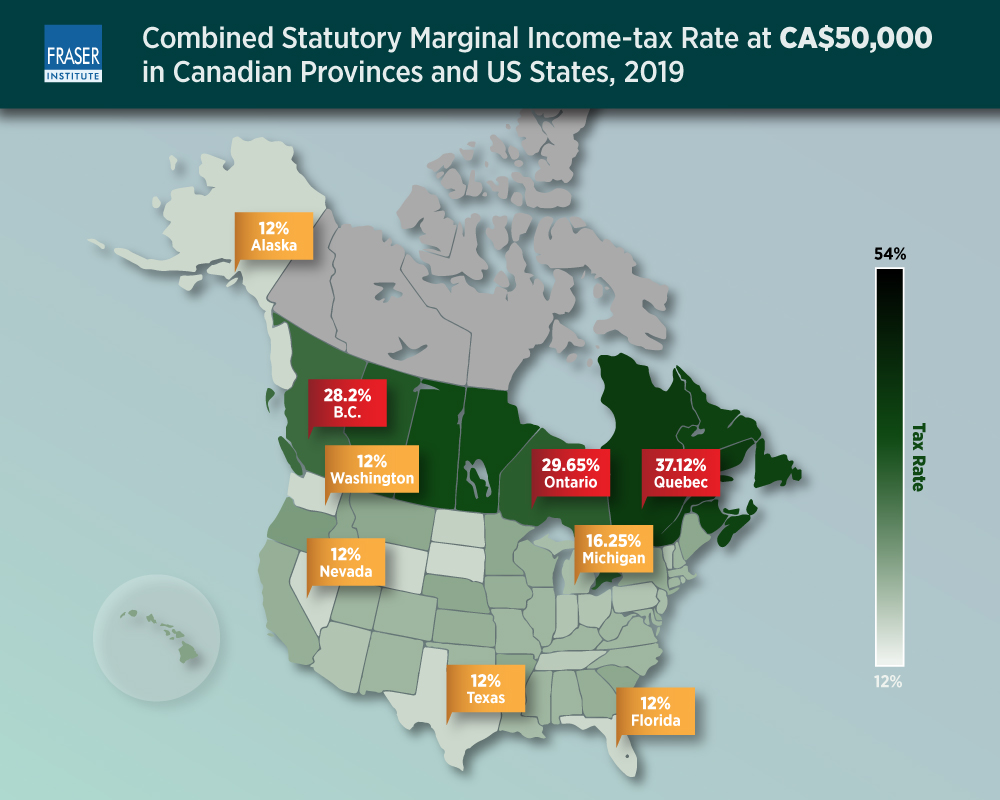

Canadas rising personal tax rates failing tax competitiveness 2020

Canadas rising personal tax rates failing tax competitiveness 2020

Income tax When you calculate the amount of income tax to deduct use the tax table that applies to the period of vacation For example for one week of paid vacation use the

Getting a bonus is exciting but you should make sure you add that extra lump sum of money to your taxable income for the year Bonus are taxed the same

In the event that we've stirred your interest in printables for free, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with How Are Lump Sum Vacation Payments Taxed In Canada for all reasons.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free, flashcards, and learning materials.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs covered cover a wide range of interests, starting from DIY projects to party planning.

Maximizing How Are Lump Sum Vacation Payments Taxed In Canada

Here are some creative ways how you could make the most of How Are Lump Sum Vacation Payments Taxed In Canada:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

How Are Lump Sum Vacation Payments Taxed In Canada are a treasure trove of creative and practical resources which cater to a wide range of needs and hobbies. Their accessibility and flexibility make them an invaluable addition to both personal and professional life. Explore the vast array of How Are Lump Sum Vacation Payments Taxed In Canada right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Are Lump Sum Vacation Payments Taxed In Canada truly absolutely free?

- Yes, they are! You can download and print the resources for free.

-

Can I make use of free printables for commercial uses?

- It's contingent upon the specific conditions of use. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may have restrictions on their use. Be sure to read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- Print them at home using your printer or visit an area print shop for superior prints.

-

What program will I need to access printables that are free?

- The majority of printables are as PDF files, which can be opened using free programs like Adobe Reader.

Lump Sum Payment Definition Finance Strategists

Como Os Dividendos S o Tributados No Canad O B sico 2024

Check more sample of How Are Lump Sum Vacation Payments Taxed In Canada below

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Income Tax What Does It Mean To Reduce Tax On Lump Sum Payments

Lump Sum DCF Payments DCF Annuities

How Dividends Are Taxed In Canada YouTube

Pros And Cons Of Workers Compensation Lump Sum Payments

Would You Rather Spread Out Your Property Tax bill Payments Or Make One

https://www.canada.ca/.../special-payments/lump-payments.html

You have to deduct income tax from lump sum payments that are from a registered retirement savings plan RRSP or a plan referred to in subsection 146 12 of the

https://turbotax.intuit.ca/tips/lump-sum-payments-6363

Taxes On Lump Sum Payments All of these lump sum payments are taxable and your employer plan administrator or whoever drafts the cheque should

You have to deduct income tax from lump sum payments that are from a registered retirement savings plan RRSP or a plan referred to in subsection 146 12 of the

Taxes On Lump Sum Payments All of these lump sum payments are taxable and your employer plan administrator or whoever drafts the cheque should

How Dividends Are Taxed In Canada YouTube

Income Tax What Does It Mean To Reduce Tax On Lump Sum Payments

Pros And Cons Of Workers Compensation Lump Sum Payments

Would You Rather Spread Out Your Property Tax bill Payments Or Make One

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money

Lump Sum Vs Payments Providence Financial 2019

Lump Sum Vs Payments Providence Financial 2019

Lump Sum Versus Payments Which Option Is Better Personal Finance