In this day and age where screens have become the dominant feature of our lives but the value of tangible printed objects isn't diminished. If it's to aid in education as well as creative projects or just adding an individual touch to the space, Do You Get Taxed More On Lump Sum Payments have become an invaluable source. We'll dive in the world of "Do You Get Taxed More On Lump Sum Payments," exploring their purpose, where they can be found, and how they can enrich various aspects of your life.

Get Latest Do You Get Taxed More On Lump Sum Payments Below

Do You Get Taxed More On Lump Sum Payments

Do You Get Taxed More On Lump Sum Payments - Do You Get Taxed More On Lump Sum Payments, Are Lump Sum Payments Taxed Differently, How Do Lump Sum Payments Get Taxed, What Is The Federal Tax Rate For Lump Sum Payments, Why Are Lump Sum Payments Taxed So High

Calculating PAYE You must deduct PAYE on lump sum payments How you calculate PAYE depends on your employee s tax code including whether they have a student loan

Monthly payments as alimony if the monthly payments are in fact alimony it will be taxed when received and deductible by your husband as ordinary income Have your lawyer

Printables for free cover a broad collection of printable materials online, at no cost. These materials come in a variety of forms, including worksheets, templates, coloring pages, and many more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Do You Get Taxed More On Lump Sum Payments

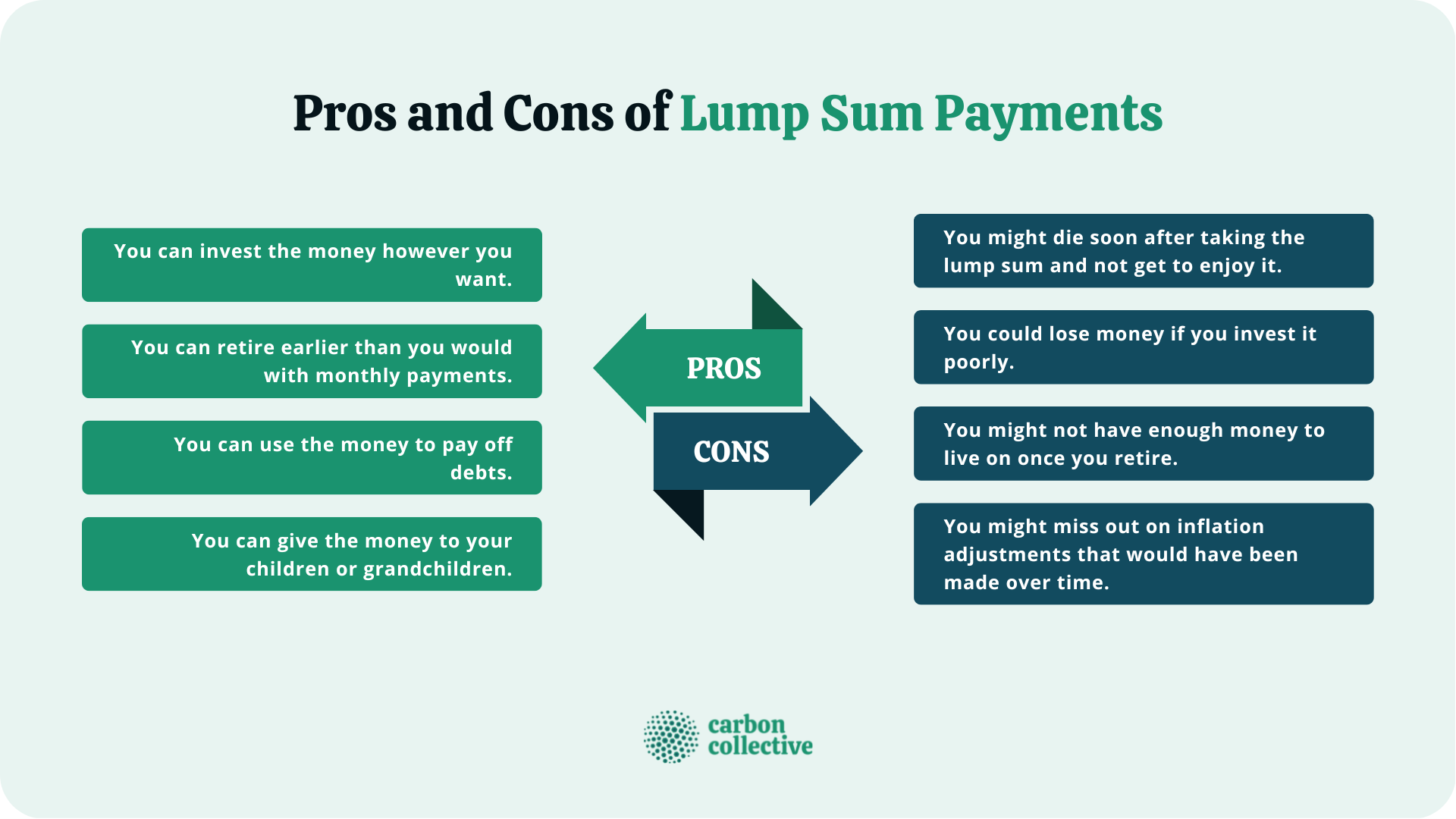

Lump Sum Payment What It Is How It Works Pros Cons

Lump Sum Payment What It Is How It Works Pros Cons

If this lump sum is paid from more than one pension you must have your savings in each scheme valued by the provider on the same day no more than 3 months before you get

Mandatory income tax withholding of 20 applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll over the

The Do You Get Taxed More On Lump Sum Payments have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization It is possible to tailor designs to suit your personal needs be it designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Use: Printing educational materials for no cost provide for students of all ages, making them an invaluable tool for teachers and parents.

-

An easy way to access HTML0: You have instant access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Do You Get Taxed More On Lump Sum Payments

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money

A mandatory income tax withholding of 20 is required on most taxable distributions received directly from an employer s retirement plan in a lump payment even if they

You don t have to pay tax on these amounts We use these amounts to work out whether you are eligible to receive certain government benefits and tax offsets

Now that we've ignited your interest in Do You Get Taxed More On Lump Sum Payments Let's see where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Do You Get Taxed More On Lump Sum Payments designed for a variety goals.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free, flashcards, and learning materials.

- This is a great resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a wide variety of topics, everything from DIY projects to party planning.

Maximizing Do You Get Taxed More On Lump Sum Payments

Here are some ways how you could make the most of Do You Get Taxed More On Lump Sum Payments:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets to enhance learning at home or in the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Do You Get Taxed More On Lump Sum Payments are an abundance of practical and imaginative resources for a variety of needs and interests. Their accessibility and versatility make them an invaluable addition to both professional and personal life. Explore the many options of Do You Get Taxed More On Lump Sum Payments to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can download and print these items for free.

-

Can I use free printables for commercial uses?

- It is contingent on the specific rules of usage. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables could be restricted concerning their use. Be sure to check the terms and condition of use as provided by the creator.

-

How do I print Do You Get Taxed More On Lump Sum Payments?

- You can print them at home with the printer, or go to a local print shop for top quality prints.

-

What program is required to open printables that are free?

- The majority are printed in the format of PDF, which is open with no cost programs like Adobe Reader.

Smart Tax Strategies For Lottery Winners Tax Insider

Lump Sum Tax What Is It Formula Calculation Example

Check more sample of Do You Get Taxed More On Lump Sum Payments below

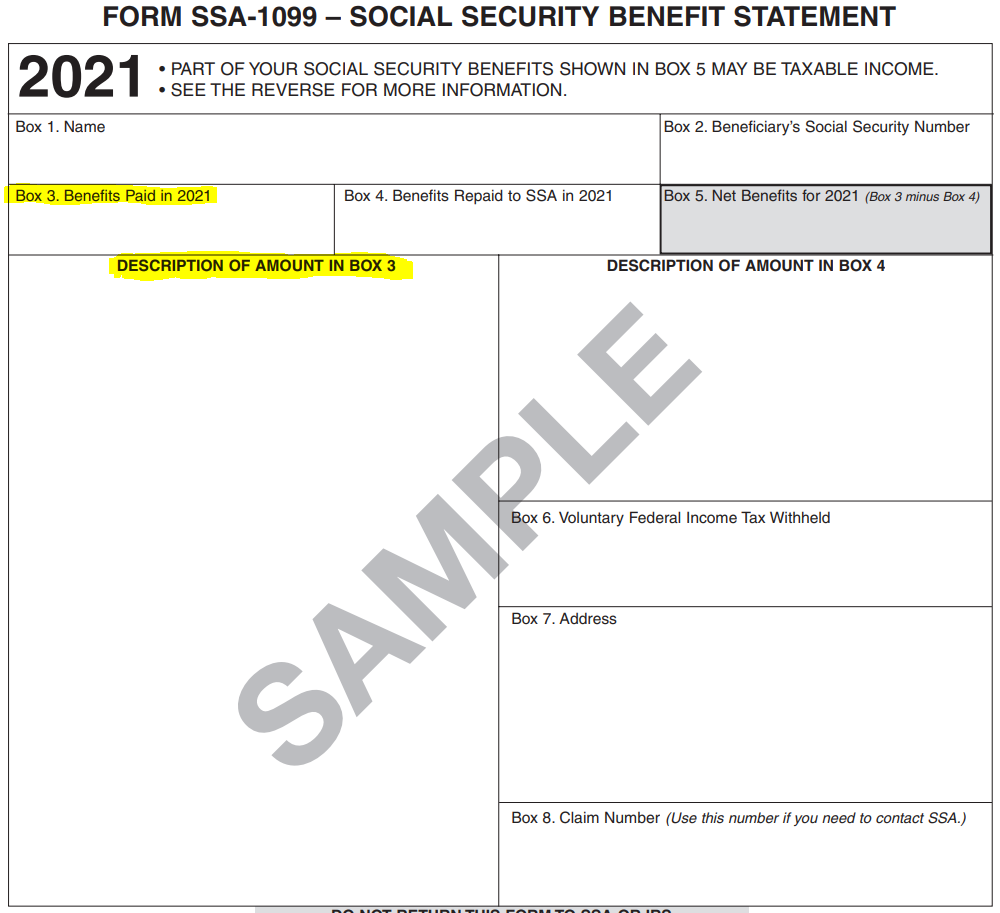

What Is A Lump Sum Payment SSA 1099 Support

Are You Taxed More If You Have 2 Jobs Lucky Transport Company

Lump Sum DCF Payments DCF Annuities

Do You Get Taxed When You Sell Your Home Tax Walls

How Your Bonus Will Be Taxed Bonus Tax Rate Explained Kiplinger

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

https://money.stackexchange.com/questions/24435

Monthly payments as alimony if the monthly payments are in fact alimony it will be taxed when received and deductible by your husband as ordinary income Have your lawyer

https://www.citizensinformation.ie/.../retirement-lump-sum-taxation

Basic Exemption Increased Exemption Increase for Standard Capital Superannuation Benefit SCSB Basic Exemption The Basic Exemption is 10 160 plus

Monthly payments as alimony if the monthly payments are in fact alimony it will be taxed when received and deductible by your husband as ordinary income Have your lawyer

Basic Exemption Increased Exemption Increase for Standard Capital Superannuation Benefit SCSB Basic Exemption The Basic Exemption is 10 160 plus

Do You Get Taxed When You Sell Your Home Tax Walls

Are You Taxed More If You Have 2 Jobs Lucky Transport Company

How Your Bonus Will Be Taxed Bonus Tax Rate Explained Kiplinger

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

The Lump Sum Retroactive Social Security Payment YouTube

Really My Bonus Is Taxed The Same As My Paycheck Human Investing

Really My Bonus Is Taxed The Same As My Paycheck Human Investing

Investment Accounts When Do I Get Taxed Personal Finance Club