In the age of digital, when screens dominate our lives however, the attraction of tangible printed objects isn't diminished. For educational purposes and creative work, or just adding the personal touch to your space, Does Wisconsin Tax Ss Income are now an essential source. The following article is a take a dive into the sphere of "Does Wisconsin Tax Ss Income," exploring what they are, where to locate them, and ways they can help you improve many aspects of your life.

Get Latest Does Wisconsin Tax Ss Income Below

Does Wisconsin Tax Ss Income

Does Wisconsin Tax Ss Income - Does Wisconsin Tax Ss Income, Does Wisconsin Tax Social Security Income, Does Wi Tax Ss Income, Does Wi Tax Ss Benefits, Does Wisconsin Tax Social Security Retirement Benefits, Does The State Of Wisconsin Tax Social Security Income, Does Wisconsin Tax Social Security, How Much Does Wisconsin Tax Social Security

Your state of residence will determine the taxes you owe on your Social Security benefits at the state level during retirement If it wasn t obvious minimizing taxes on your Social Security

Wisconsin s income tax treatment of retirement benefits received by a resident of Wisconsin is generally the same as the federal tax treatment However there are differences This publication discusses the differences between the federal and

Does Wisconsin Tax Ss Income cover a large range of downloadable, printable documents that can be downloaded online at no cost. They are available in a variety of forms, like worksheets coloring pages, templates and many more. The value of Does Wisconsin Tax Ss Income lies in their versatility as well as accessibility.

More of Does Wisconsin Tax Ss Income

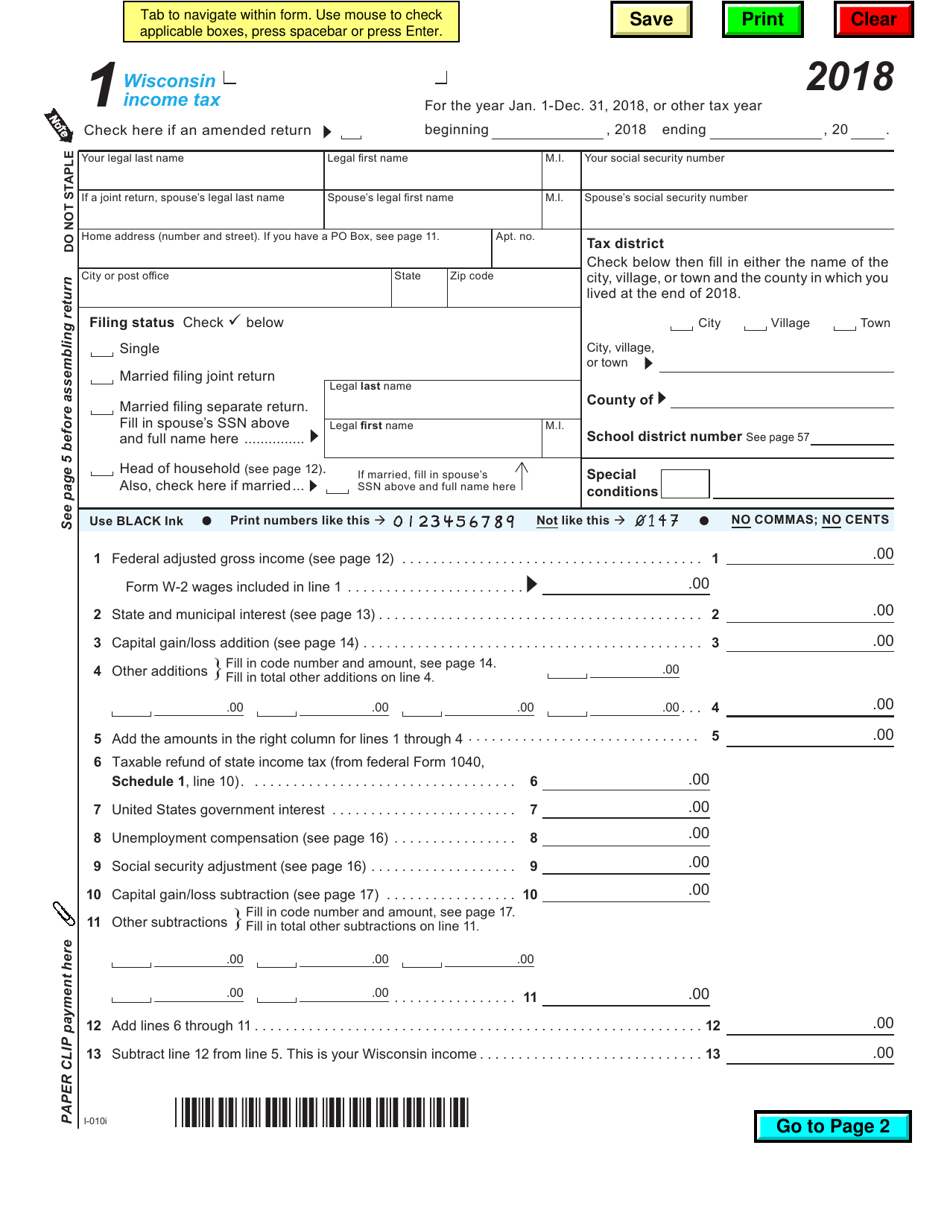

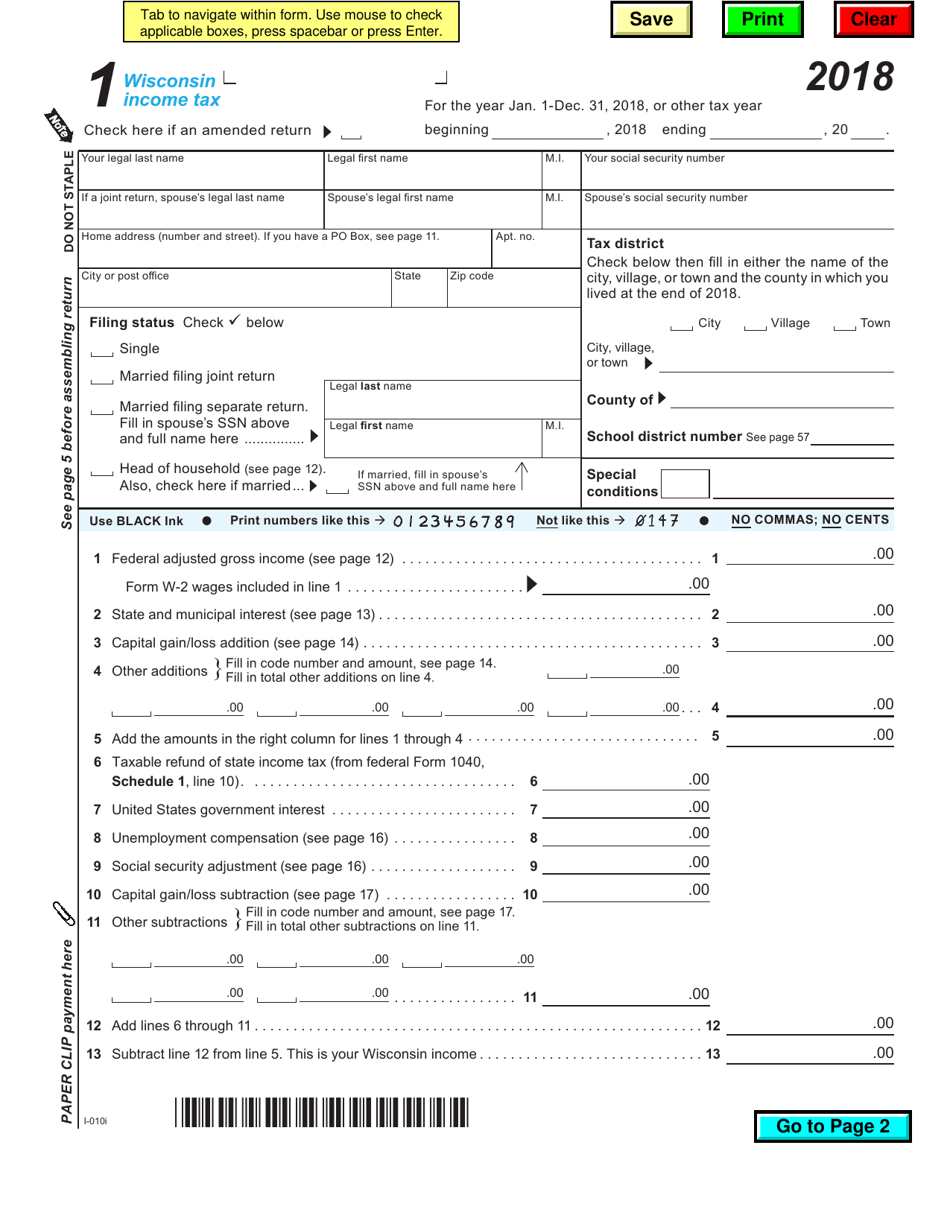

Wisconsin Form 1 Fillable Printable Forms Free Online

Wisconsin Form 1 Fillable Printable Forms Free Online

Wisconsin does not tax Social Security retirement benefits even those taxed at the federal level Are other forms of retirement income taxable in Wisconsin Income from retirement accounts including an IRA or a

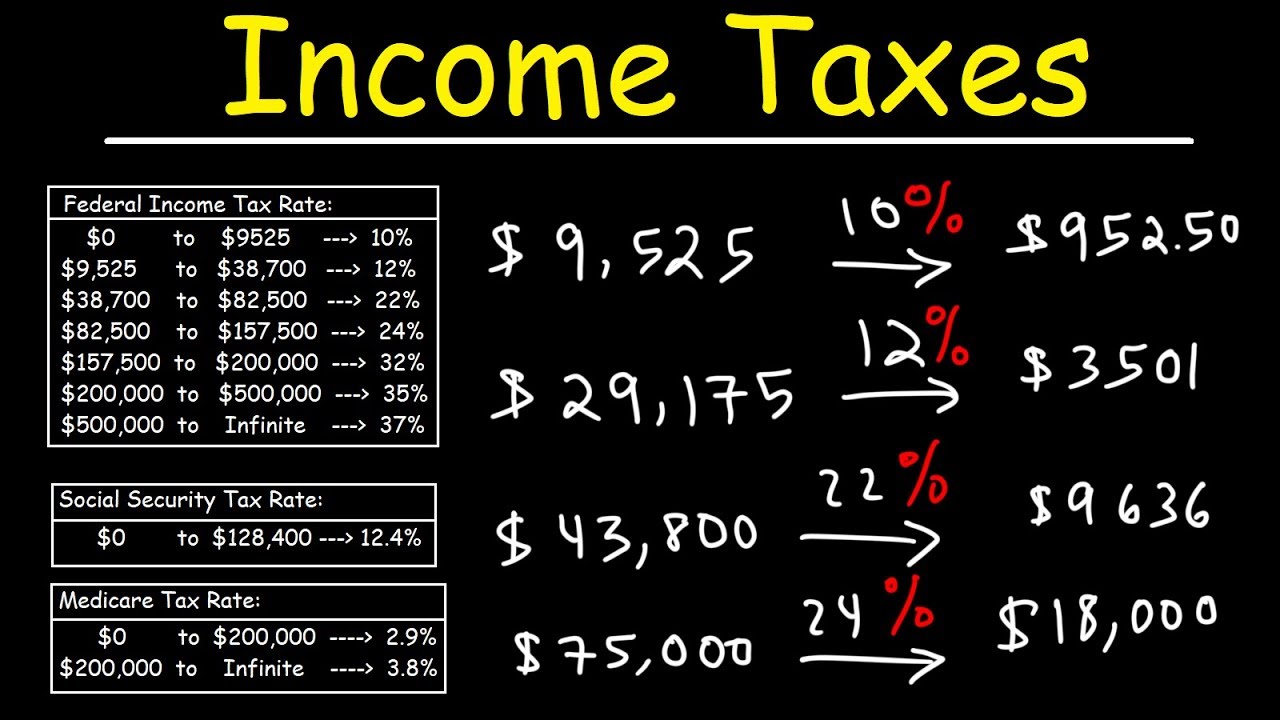

Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your depends on your income level If you have other sources of retirement income such

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: They can make printing templates to your own specific requirements when it comes to designing invitations planning your schedule or even decorating your home.

-

Educational value: Educational printables that can be downloaded for free cater to learners of all ages. This makes them an essential source for educators and parents.

-

Simple: Instant access to a variety of designs and templates helps save time and effort.

Where to Find more Does Wisconsin Tax Ss Income

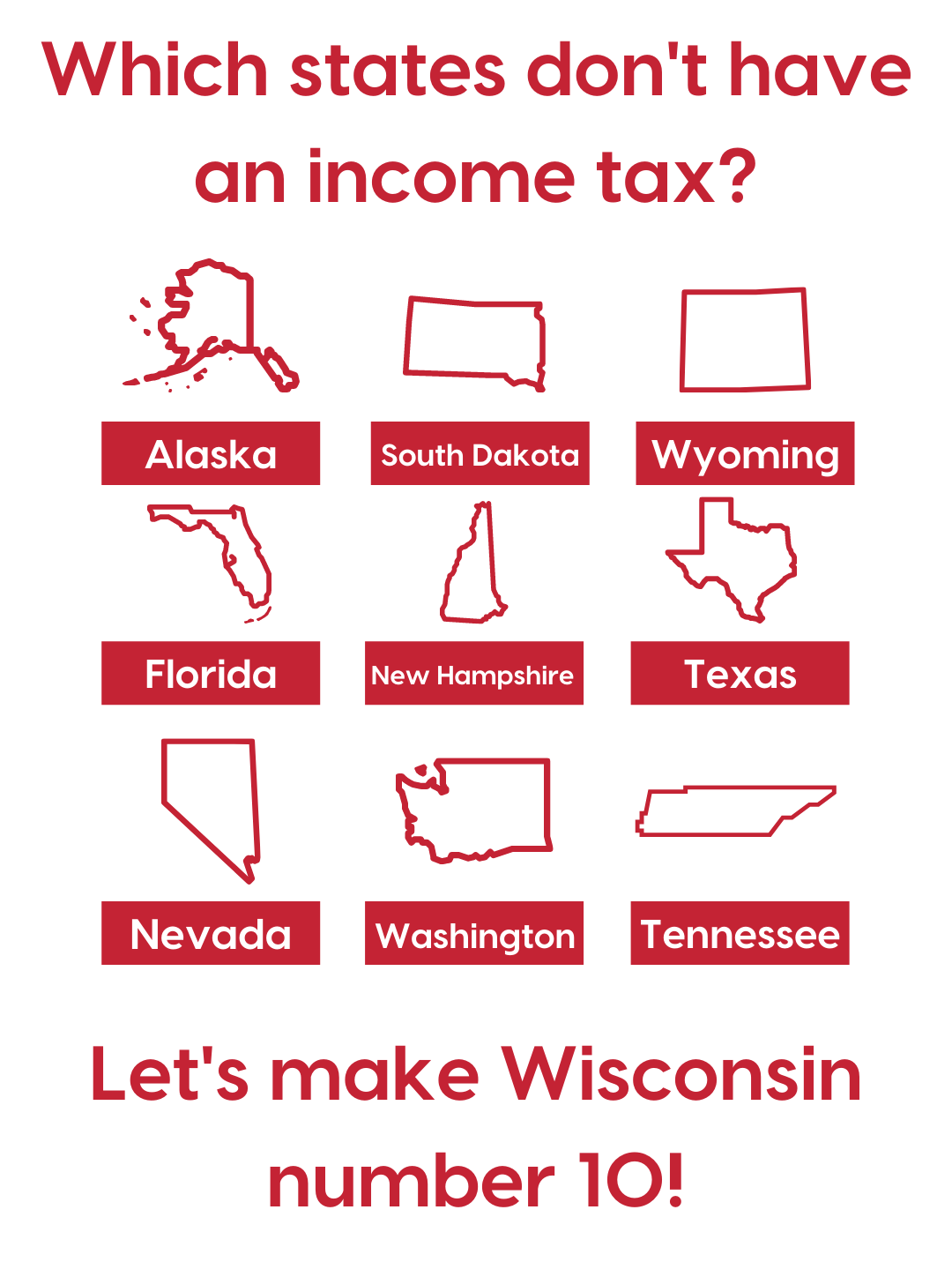

Wisconsin Should Eliminate The State Income Tax Institute For

Wisconsin Should Eliminate The State Income Tax Institute For

The statewide sales tax in Wisconsin is 5 Local taxes of 0 5 are collected in 68 Wisconsin counties The table below shows the sales taxes in all 72 Wisconsin counties New York Tax Calculator Find

Wisconsin Washington D C However thanks to recent legislation the state will phase out the state income tax on benefits by 2025 gradually It began with a reduction of 5 for 2022 20 in

Now that we've ignited your curiosity about Does Wisconsin Tax Ss Income Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection with Does Wisconsin Tax Ss Income for all motives.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free including flashcards, learning tools.

- Perfect for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- These blogs cover a broad spectrum of interests, all the way from DIY projects to party planning.

Maximizing Does Wisconsin Tax Ss Income

Here are some creative ways how you could make the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to build your knowledge at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Does Wisconsin Tax Ss Income are a treasure trove of creative and practical resources which cater to a wide range of needs and preferences. Their accessibility and versatility make them a great addition to your professional and personal life. Explore the vast world that is Does Wisconsin Tax Ss Income today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Does Wisconsin Tax Ss Income truly for free?

- Yes, they are! You can download and print these tools for free.

-

Can I make use of free printables for commercial purposes?

- It's based on specific terms of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Are there any copyright problems with Does Wisconsin Tax Ss Income?

- Certain printables could be restricted on use. Check the terms and regulations provided by the designer.

-

How can I print Does Wisconsin Tax Ss Income?

- You can print them at home with your printer or visit a print shop in your area for more high-quality prints.

-

What program do I need to run printables for free?

- The majority of printed documents are with PDF formats, which can be opened with free programs like Adobe Reader.

States That Tax Social Security Benefits Tax Foundation

Where Could Interest And Tax Rates Be Headed Mercer Advisors

Check more sample of Does Wisconsin Tax Ss Income below

Tax Reduction Company Inc

Income Tax Practitioner Dhaka

States That Tax Social Security Benefits Consider Before Deciding On

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Wisconsin Small Business Tax Rates Are High But Improving Brookfield

Tax Policy And The Family Cornerstone

https://www.revenue.wi.gov/DOR Publications/pb126.pdf

Wisconsin s income tax treatment of retirement benefits received by a resident of Wisconsin is generally the same as the federal tax treatment However there are differences This publication discusses the differences between the federal and

https://www.revenue.wi.gov/DOR Publications/pb106.pdf

Up to 5 000 of certain retirement income may be subtracted from Wisconsin income if You or your spouse if married filing a joint return were age 65 or older on December31 2022 and Your federal adjusted gross income FAGI is less than 15 000 If married

Wisconsin s income tax treatment of retirement benefits received by a resident of Wisconsin is generally the same as the federal tax treatment However there are differences This publication discusses the differences between the federal and

Up to 5 000 of certain retirement income may be subtracted from Wisconsin income if You or your spouse if married filing a joint return were age 65 or older on December31 2022 and Your federal adjusted gross income FAGI is less than 15 000 If married

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Income Tax Practitioner Dhaka

Wisconsin Small Business Tax Rates Are High But Improving Brookfield

Tax Policy And The Family Cornerstone

.jpg)

Don t Want To Pay Taxes On Your Social Security Benetfit Here s Where

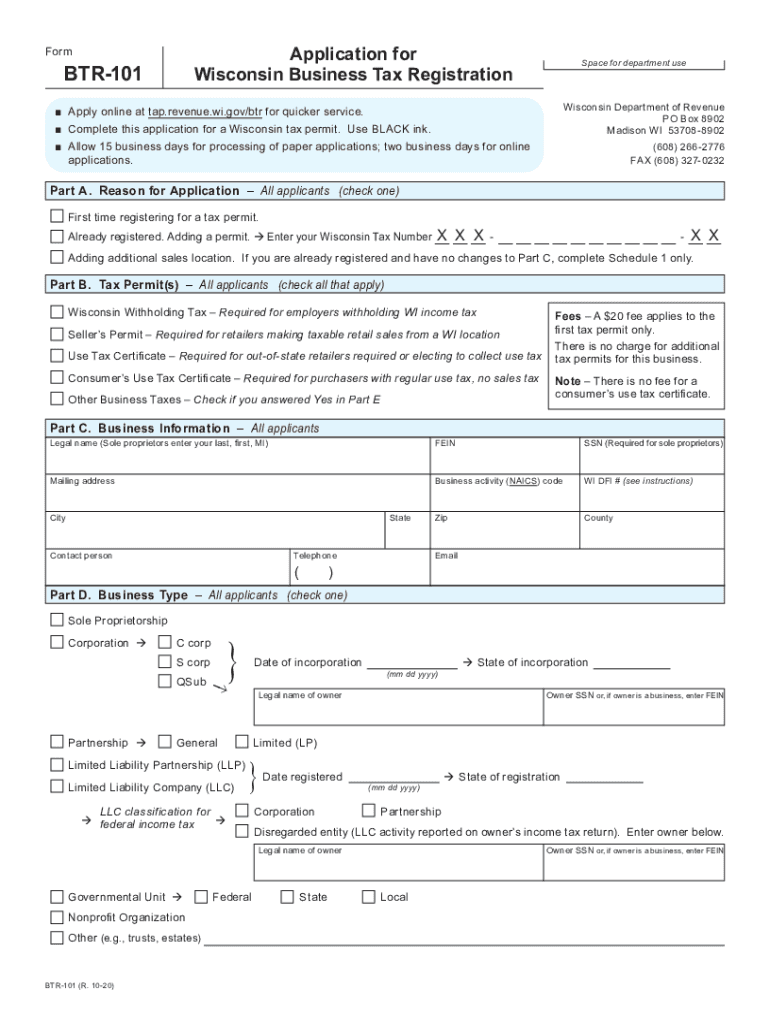

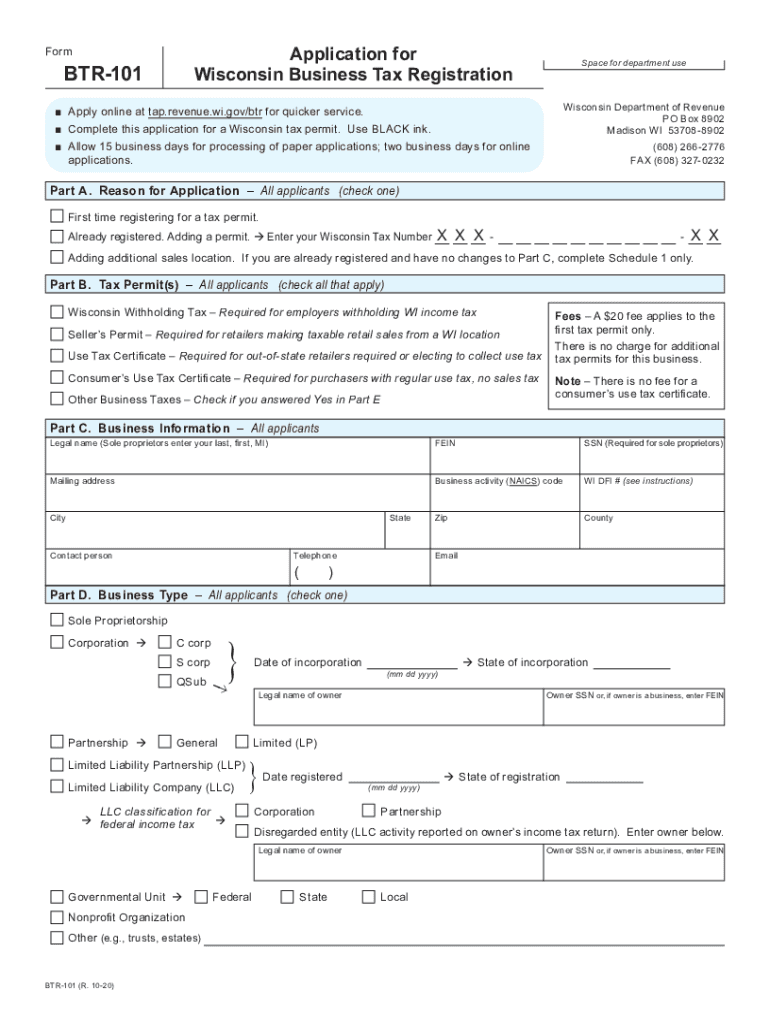

Wisconsin Btr 101 Fillable 2020 2023 Form Fill Out And Sign Printable

Wisconsin Btr 101 Fillable 2020 2023 Form Fill Out And Sign Printable

Free Tax Prep Assistance And Forms At Birmingham Public Library