In the age of digital, when screens dominate our lives but the value of tangible printed material hasn't diminished. In the case of educational materials such as creative projects or simply adding a personal touch to your space, Does The State Of Wisconsin Tax Social Security Income have proven to be a valuable resource. Through this post, we'll dive through the vast world of "Does The State Of Wisconsin Tax Social Security Income," exploring what they are, where to find them and what they can do to improve different aspects of your lives.

Get Latest Does The State Of Wisconsin Tax Social Security Income Below

Does The State Of Wisconsin Tax Social Security Income

Does The State Of Wisconsin Tax Social Security Income - Does The State Of Wisconsin Tax Social Security Income, Does The State Of Wisconsin Tax Retirement Income, Does Wisconsin Tax Social Security Income, Do You Have To Pay Taxes On Social Security In Wisconsin, Does Wisconsin Tax Ss Income, Does Wisconsin Tax Social Security

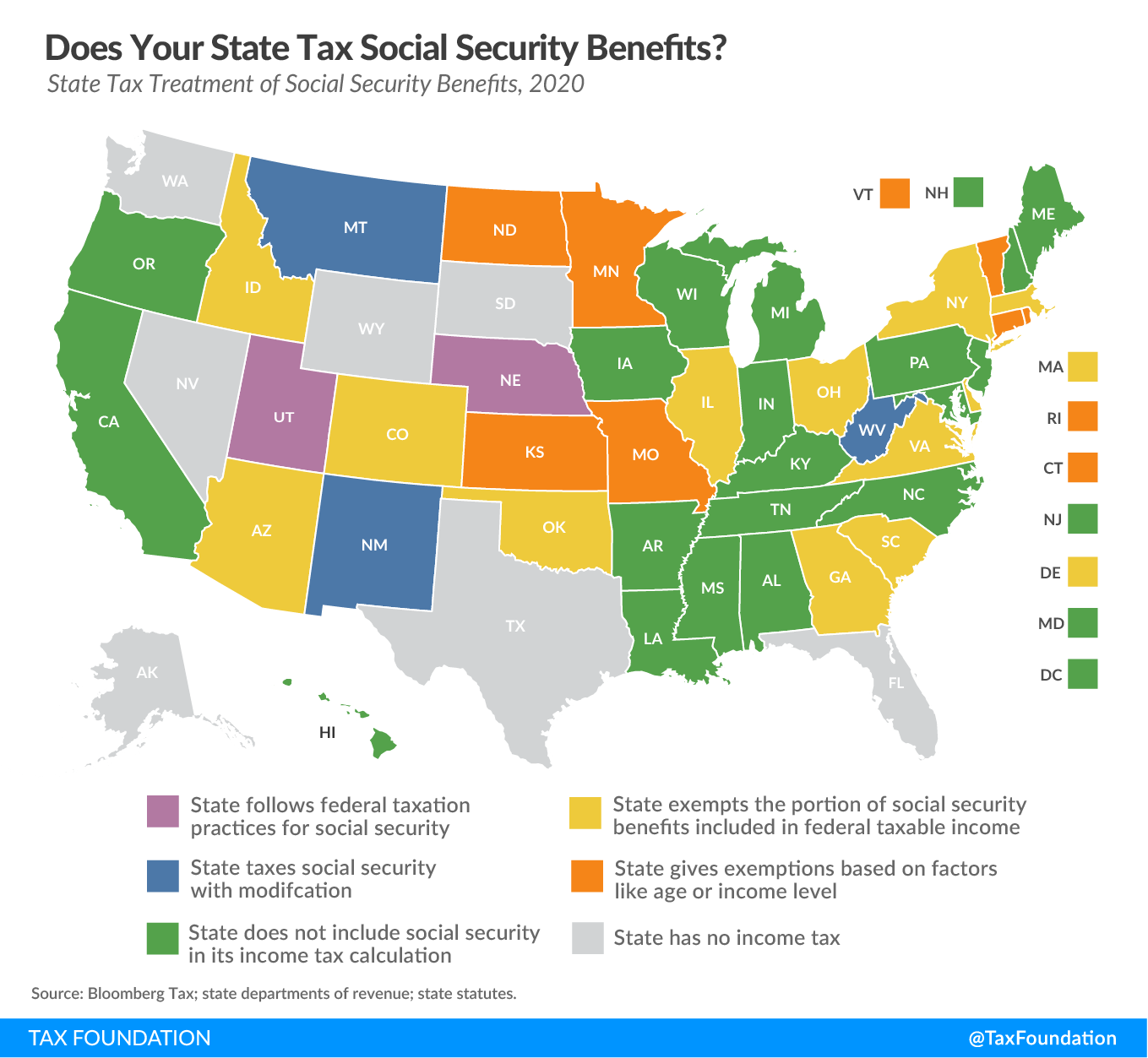

Here s what you need to know if you live in one of the nine states tax Social Security income in 2024

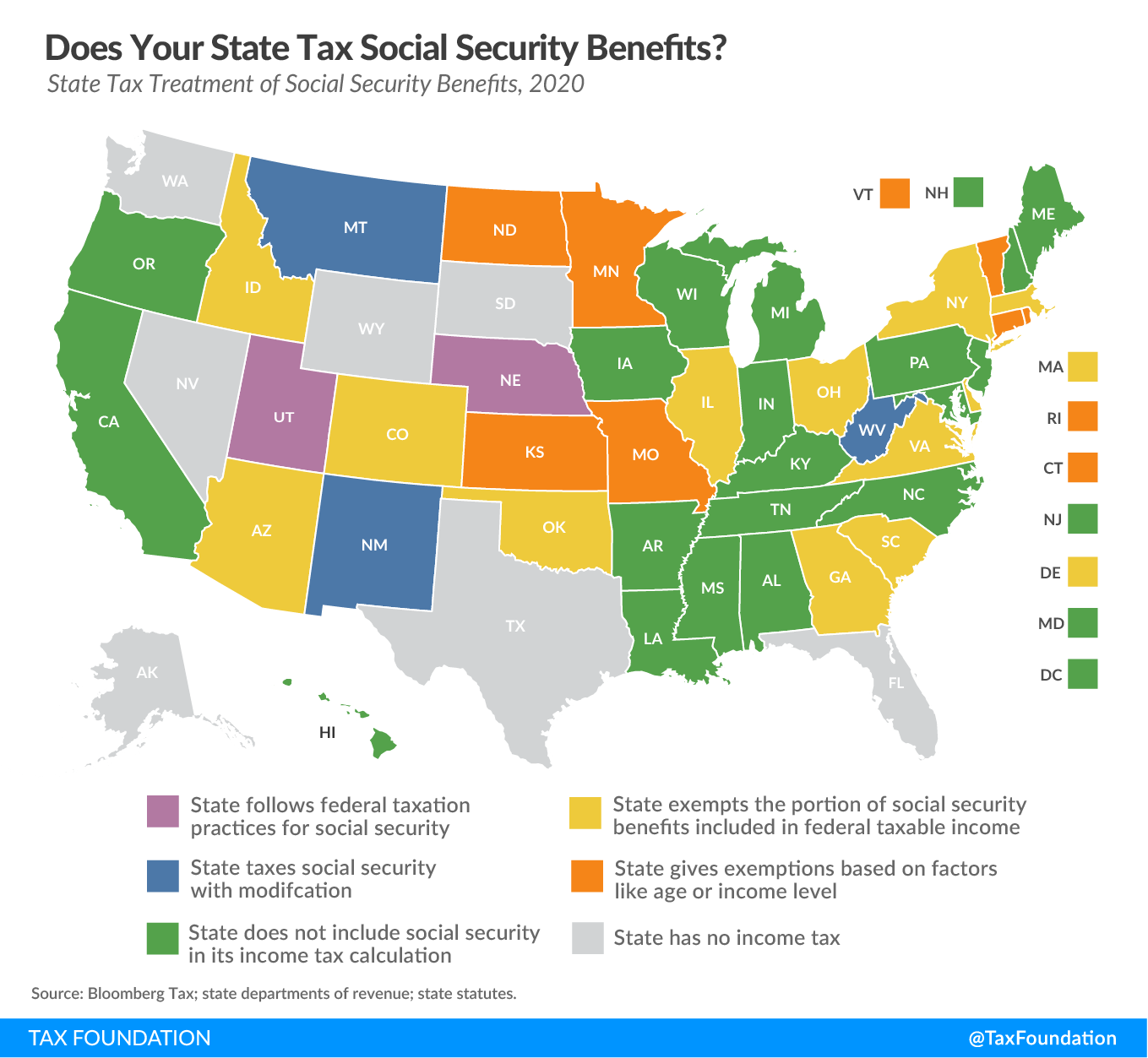

Thirteen states tax Social Security benefits a matter of significant interest to retirees Each of these states has its own approach to determining what share of

The Does The State Of Wisconsin Tax Social Security Income are a huge selection of printable and downloadable documents that can be downloaded online at no cost. These resources come in many forms, including worksheets, coloring pages, templates and many more. The value of Does The State Of Wisconsin Tax Social Security Income is their flexibility and accessibility.

More of Does The State Of Wisconsin Tax Social Security Income

13 States That Tax Social Security Income The Motley Fool

13 States That Tax Social Security Income The Motley Fool

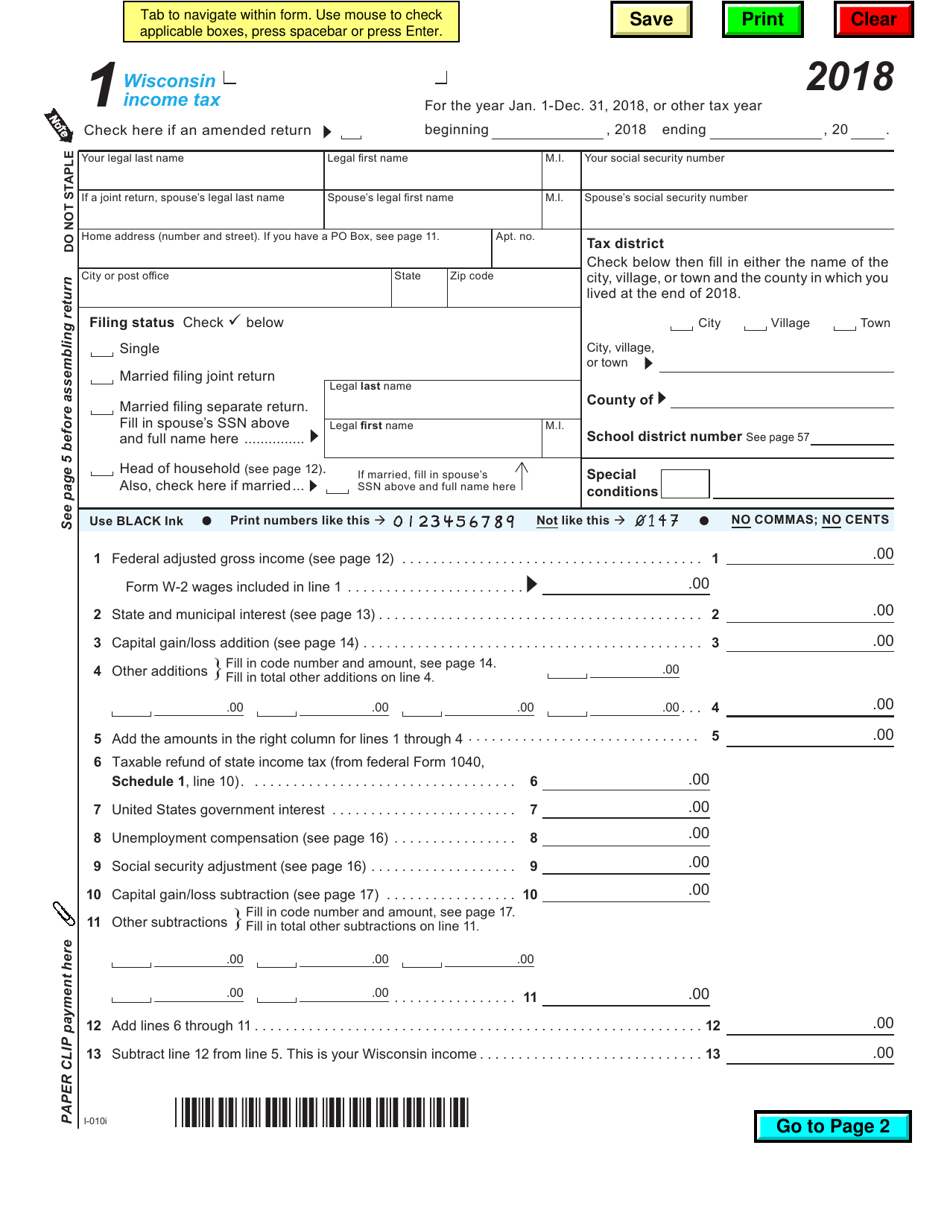

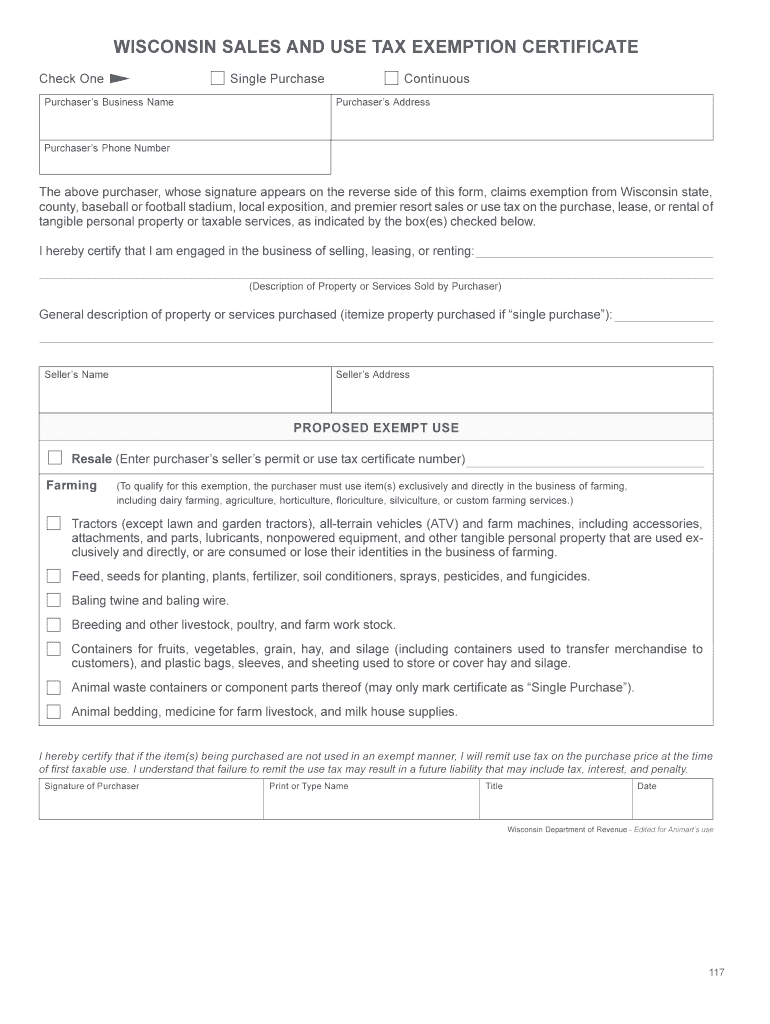

Social security benefits are not taxable by Wisconsin Payments received from the retirement systems listed below are not taxable by Wisconsin provided any of the

Wisconsin does not tax Social Security benefits and some state and local government retirees qualify for a tax exemption Military retirement payments are not taxed but out of state government

The Does The State Of Wisconsin Tax Social Security Income have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization It is possible to tailor print-ready templates to your specific requirements such as designing invitations planning your schedule or even decorating your house.

-

Educational Value: Educational printables that can be downloaded for free provide for students of all ages, which makes the perfect resource for educators and parents.

-

An easy way to access HTML0: instant access numerous designs and templates can save you time and energy.

Where to Find more Does The State Of Wisconsin Tax Social Security Income

13 States That Tax Social Security Benefits

13 States That Tax Social Security Benefits

Use our income tax calculator to find out what your take home pay will be in Wisconsin for the tax year Enter your details to estimate your salary after tax

Wisconsin tax on retirement benefits Wisconsin doesn t tax Social Security or Railroad Retirement benefits Military pay that is exempt from federal taxation is also exempt in Wisconsin

Now that we've piqued your curiosity about Does The State Of Wisconsin Tax Social Security Income we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Does The State Of Wisconsin Tax Social Security Income suitable for many applications.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a wide variety of topics, including DIY projects to party planning.

Maximizing Does The State Of Wisconsin Tax Social Security Income

Here are some unique ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Does The State Of Wisconsin Tax Social Security Income are an abundance of useful and creative resources that meet a variety of needs and hobbies. Their accessibility and versatility make them a great addition to both professional and personal lives. Explore the vast array of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes you can! You can download and print these documents for free.

-

Can I use the free printables to make commercial products?

- It depends on the specific conditions of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables could have limitations regarding their use. Make sure to read the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- You can print them at home with the printer, or go to a print shop in your area for top quality prints.

-

What software do I need in order to open printables for free?

- Many printables are offered in PDF format. These is open with no cost software, such as Adobe Reader.

States That Tax Social Security Benefits Consider Before Deciding On

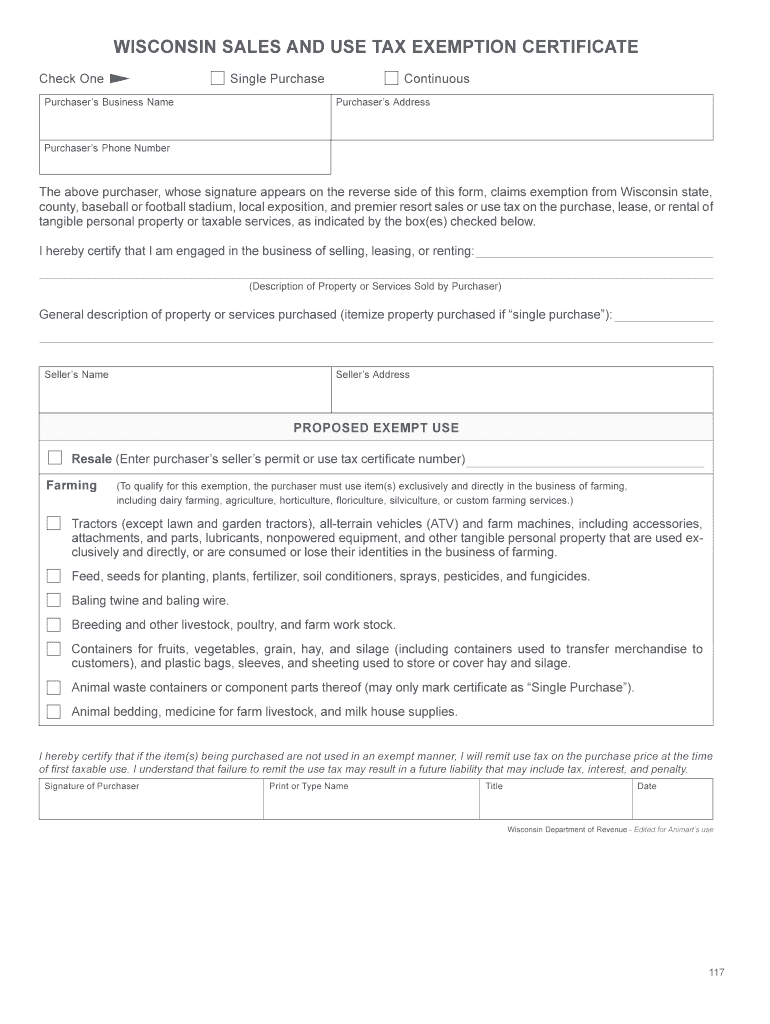

2014 Form WI WT 4 Fill Online Printable Fillable Blank PdfFiller

Check more sample of Does The State Of Wisconsin Tax Social Security Income below

Wisconsin Form 1 Fillable Printable Forms Free Online

Does Your State Tax Social Security Benefits Upstate Tax Professionals

States That Tax Social Security Benefits Tax Foundation

Are My Social Security Benefits Taxable Calculator

Wisconsin Tax Exempt Form Fillable Printable Forms Free Online

8 2023 Social Security Tax Limit Ideas 2023 GDS

https://taxfoundation.org/data/all/state/states...

Thirteen states tax Social Security benefits a matter of significant interest to retirees Each of these states has its own approach to determining what share of

https://smartasset.com/.../wisconsin-reti…

Wisconsin does not tax Social Security retirement benefits even those taxed at the federal level Income from retirement accounts including an IRA or a 401 k is taxable at rates ranging from 3 50 to 7 65

Thirteen states tax Social Security benefits a matter of significant interest to retirees Each of these states has its own approach to determining what share of

Wisconsin does not tax Social Security retirement benefits even those taxed at the federal level Income from retirement accounts including an IRA or a 401 k is taxable at rates ranging from 3 50 to 7 65

Are My Social Security Benefits Taxable Calculator

Does Your State Tax Social Security Benefits Upstate Tax Professionals

Wisconsin Tax Exempt Form Fillable Printable Forms Free Online

8 2023 Social Security Tax Limit Ideas 2023 GDS

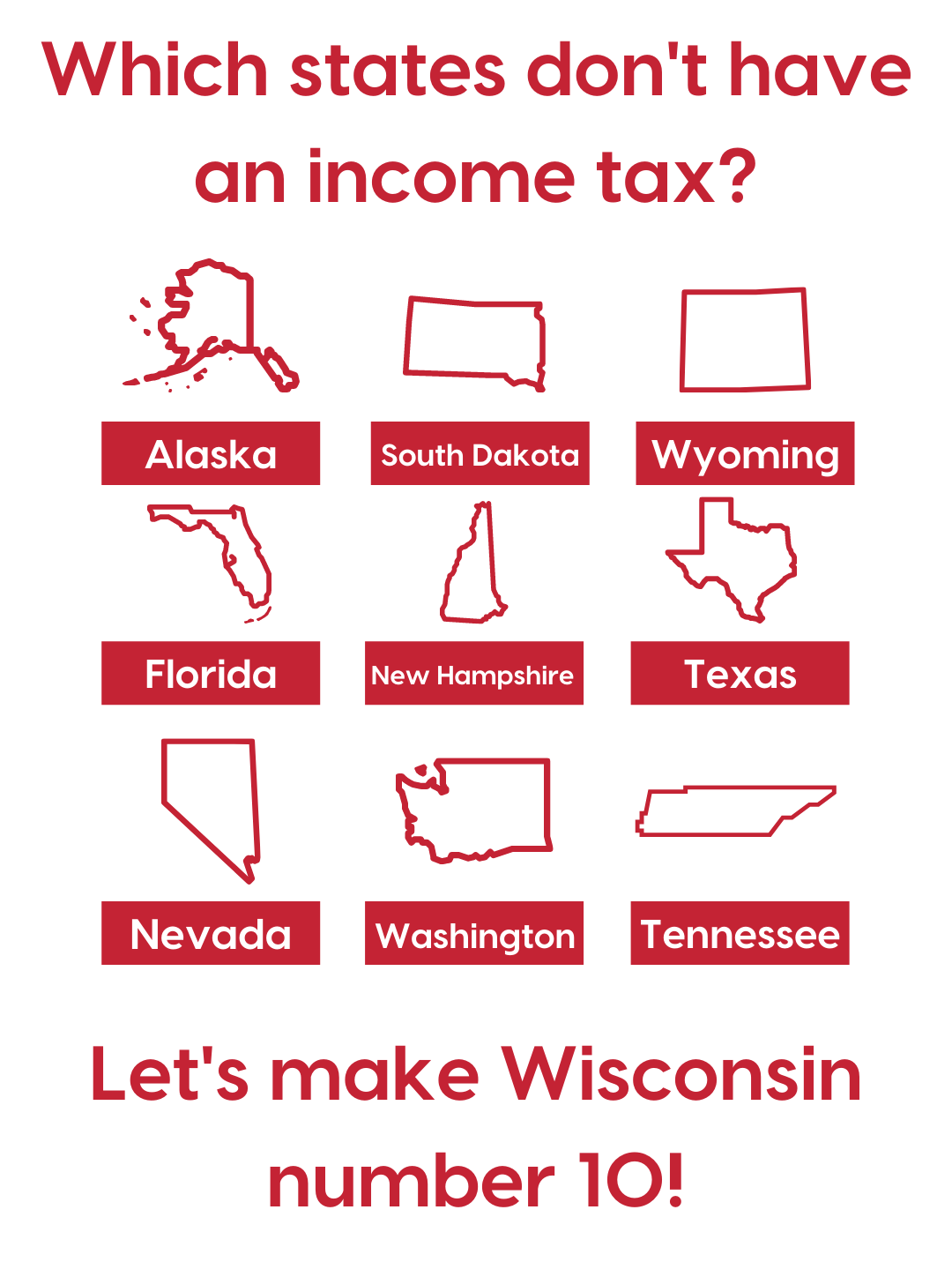

Wisconsin Should Eliminate The State Income Tax Institute For

Which States Tax My Social Security Retirement Benefits YouTube

Which States Tax My Social Security Retirement Benefits YouTube

Q A Is My Social Security Income Taxable