In this age of electronic devices, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes project ideas, artistic or simply adding an individual touch to the area, How Much Does Wisconsin Tax Social Security are now a useful resource. For this piece, we'll dive into the world "How Much Does Wisconsin Tax Social Security," exploring what they are, where to locate them, and how they can enhance various aspects of your lives.

What Are How Much Does Wisconsin Tax Social Security?

How Much Does Wisconsin Tax Social Security cover a large assortment of printable documents that can be downloaded online at no cost. These printables come in different types, like worksheets, templates, coloring pages, and more. The appeal of printables for free is their flexibility and accessibility.

How Much Does Wisconsin Tax Social Security

How Much Does Wisconsin Tax Social Security

How Much Does Wisconsin Tax Social Security -

[desc-5]

[desc-1]

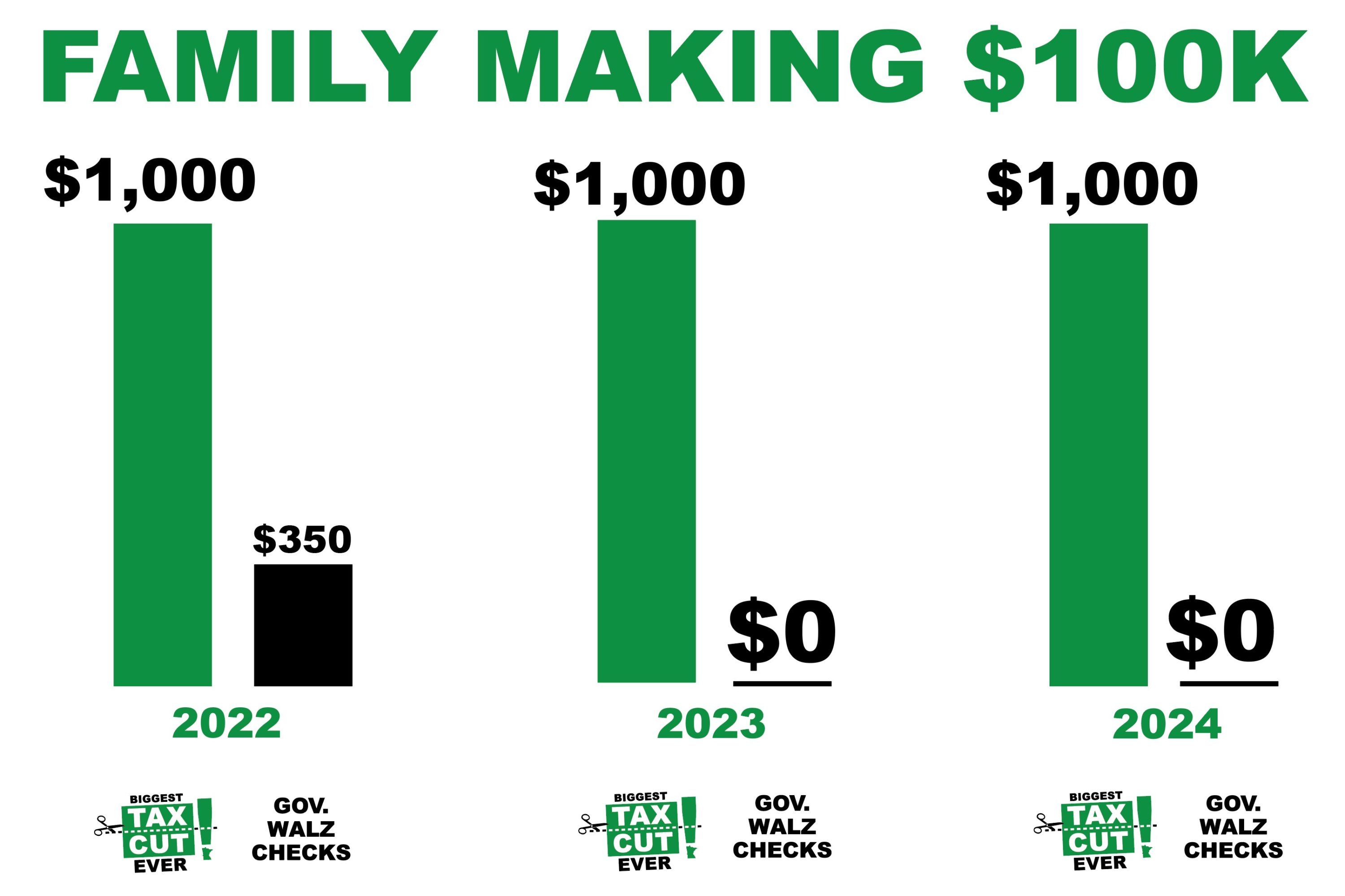

The Biggest Tax Cut Ever Minnesota Senate Republicans

The Biggest Tax Cut Ever Minnesota Senate Republicans

[desc-4]

[desc-6]

Meet The 38 States That Do Not Tax Social Security Do You Live In One

Meet The 38 States That Do Not Tax Social Security Do You Live In One

[desc-9]

[desc-7]

Taxes On Social Security Benefits Inflation Protection

7 States That Do NOT Tax Retirement Income Easy Seniors Club

Can I Pay My Taxes With A Credit Card

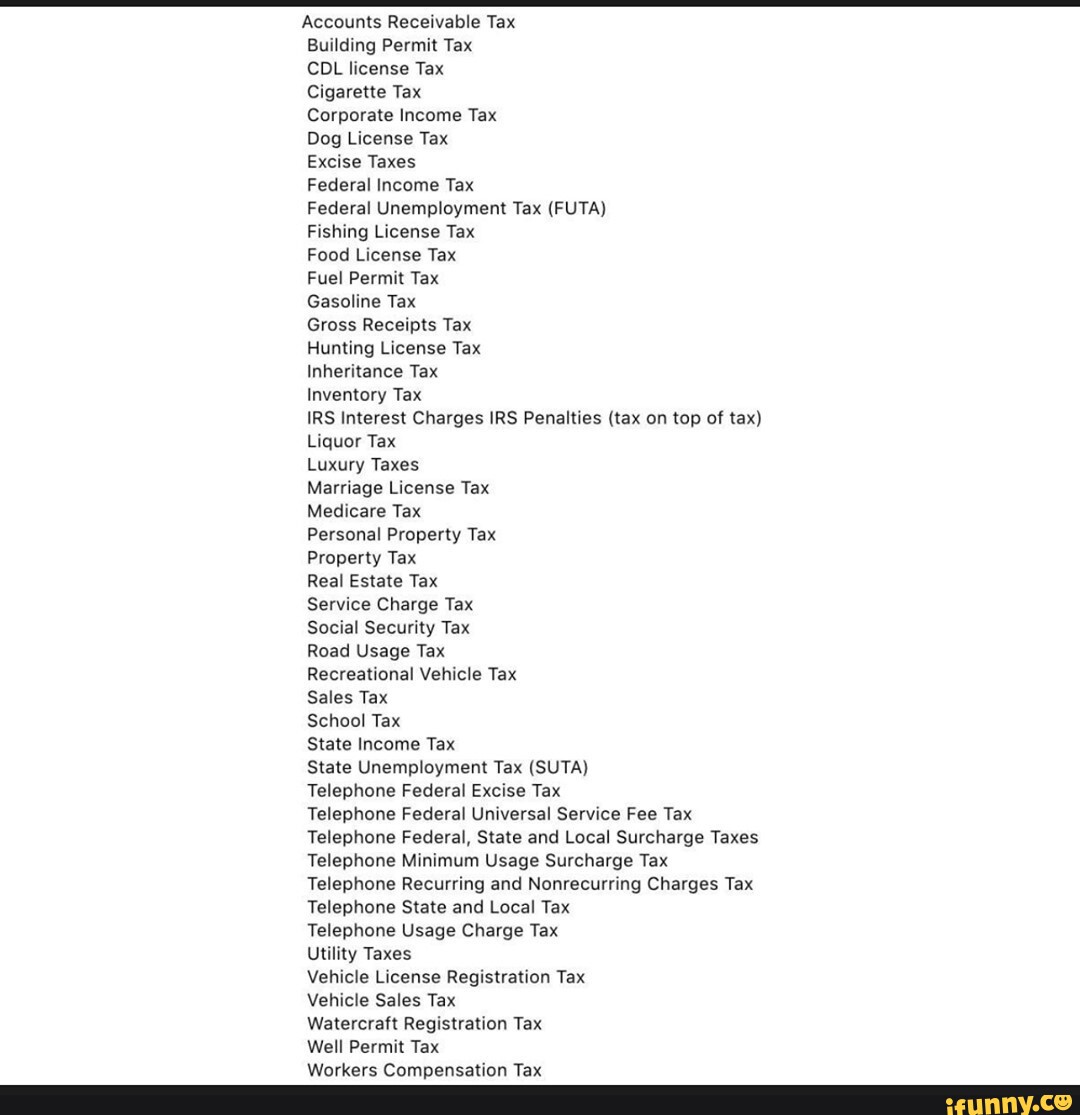

Receivable Memes Best Collection Of Funny Receivable Pictures On

Irs Social Security Tax Worksheet Irs Tax Rules Federal Income Tax

Solved 1 Sue Earned 56 000 Working For An Employer In The Current

Solved 1 Sue Earned 56 000 Working For An Employer In The Current

States That Tax Social Security Benefits Tax Foundation