In this age of electronic devices, when screens dominate our lives however, the attraction of tangible printed items hasn't gone away. No matter whether it's for educational uses as well as creative projects or just adding some personal flair to your home, printables for free are now an essential resource. Here, we'll take a dive to the depths of "Are Ira Contributions Taxable In Pa," exploring what they are, how to get them, as well as ways they can help you improve many aspects of your lives.

Get Latest Are Ira Contributions Taxable In Pa Below

Are Ira Contributions Taxable In Pa

Are Ira Contributions Taxable In Pa - Are Ira Contributions Taxable In Pa, Are Ira Distributions Taxable In Pa, Are Inherited Ira Distributions Taxable In Pa, Are Beneficiary Ira Distributions Taxable In Pa, Are Inherited Ira Distributions Taxable In Pennsylvania, Are Ira Contributions Taxable, Are Non-deductible Ira Contributions Taxable

In Pennsylvania IRA distributions are generally not taxable at the state level Exceptions exist especially for early withdrawals If you re unsure about your specific circumstances a personalized

If a distribution from an IRA was received before age 59 and retiring and rolled the entire distribution 100 percent into a Roth IRA directly or within 60 days the distribution is

Printables for free cover a broad selection of printable and downloadable resources available online for download at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages and much more. The attraction of printables that are free is their versatility and accessibility.

More of Are Ira Contributions Taxable In Pa

401 k Contribution Limits In 2023 Meld Financial

401 k Contribution Limits In 2023 Meld Financial

In PA contributions to traditional and Roth IRAs are not taxable As for withdrawals the state usually does not tax them after the taxpayer has reached their

Overview of Pennsylvania Retirement Tax Friendliness Pennsylvania fully exempts all income from Social Security as well as payments from retirement accounts like 401 k s and IRAs It also exempts pension

Are Ira Contributions Taxable In Pa have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization This allows you to modify printed materials to meet your requirements such as designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value Free educational printables are designed to appeal to students of all ages, which makes them an essential device for teachers and parents.

-

Simple: immediate access a variety of designs and templates, which saves time as well as effort.

Where to Find more Are Ira Contributions Taxable In Pa

SEP IRA Vs Roth IRA Definition How To Set Up Major Differences

SEP IRA Vs Roth IRA Definition How To Set Up Major Differences

PA law does not permit deductions or exemptions for contributions to retirement plans investments in annuities mutual funds money market funds and other personal

IRA distributions received before turning 59 1 2 aren t eligible for the exemption and are therefore fully taxable under Pennsylvania income tax law This

Now that we've piqued your interest in printables for free Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with Are Ira Contributions Taxable In Pa for all objectives.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- The blogs are a vast range of interests, starting from DIY projects to planning a party.

Maximizing Are Ira Contributions Taxable In Pa

Here are some ideas in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Are Ira Contributions Taxable In Pa are an abundance of fun and practical tools designed to meet a range of needs and hobbies. Their access and versatility makes them a valuable addition to every aspect of your life, both professional and personal. Explore the endless world of Are Ira Contributions Taxable In Pa today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can download and print these files for free.

-

Can I make use of free printables for commercial purposes?

- It depends on the specific conditions of use. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with Are Ira Contributions Taxable In Pa?

- Some printables may contain restrictions in use. Always read the terms and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home using an printer, or go to a print shop in your area for high-quality prints.

-

What software is required to open printables at no cost?

- The majority of PDF documents are provided in PDF format. They can be opened using free programs like Adobe Reader.

How IRA Contributions Can Reduce Adjusted Gross Income AGI Dechtman

Max Ira Contribution 2022 Over 50 Choosing Your Gold IRA

Check more sample of Are Ira Contributions Taxable In Pa below

The IRS Announced Its Roth IRA Income Limits For 2022 Personal

2023 Dcfsa Limits 2023 Calendar

Roth Ira Growth Calculator GarveenIndia

Here s The Latest 401k IRA And Other Contribution Limits For 2023

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Roth IRA Rules Contribution Limits Deadlines Best Practice In HR

https://www.revenue.pa.gov/FormsandPublications/PA...

If a distribution from an IRA was received before age 59 and retiring and rolled the entire distribution 100 percent into a Roth IRA directly or within 60 days the distribution is

https://revenue-pa.custhelp.com/app/answers/detail/a_id/274

Income on assets held in a Roth IRA is not taxable Distributions are includable in income to the extent that contributions were not previously included if made

If a distribution from an IRA was received before age 59 and retiring and rolled the entire distribution 100 percent into a Roth IRA directly or within 60 days the distribution is

Income on assets held in a Roth IRA is not taxable Distributions are includable in income to the extent that contributions were not previously included if made

Here s The Latest 401k IRA And Other Contribution Limits For 2023

2023 Dcfsa Limits 2023 Calendar

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Roth IRA Rules Contribution Limits Deadlines Best Practice In HR

Entering IRA Contributions In A 1040 Return In ProSeries

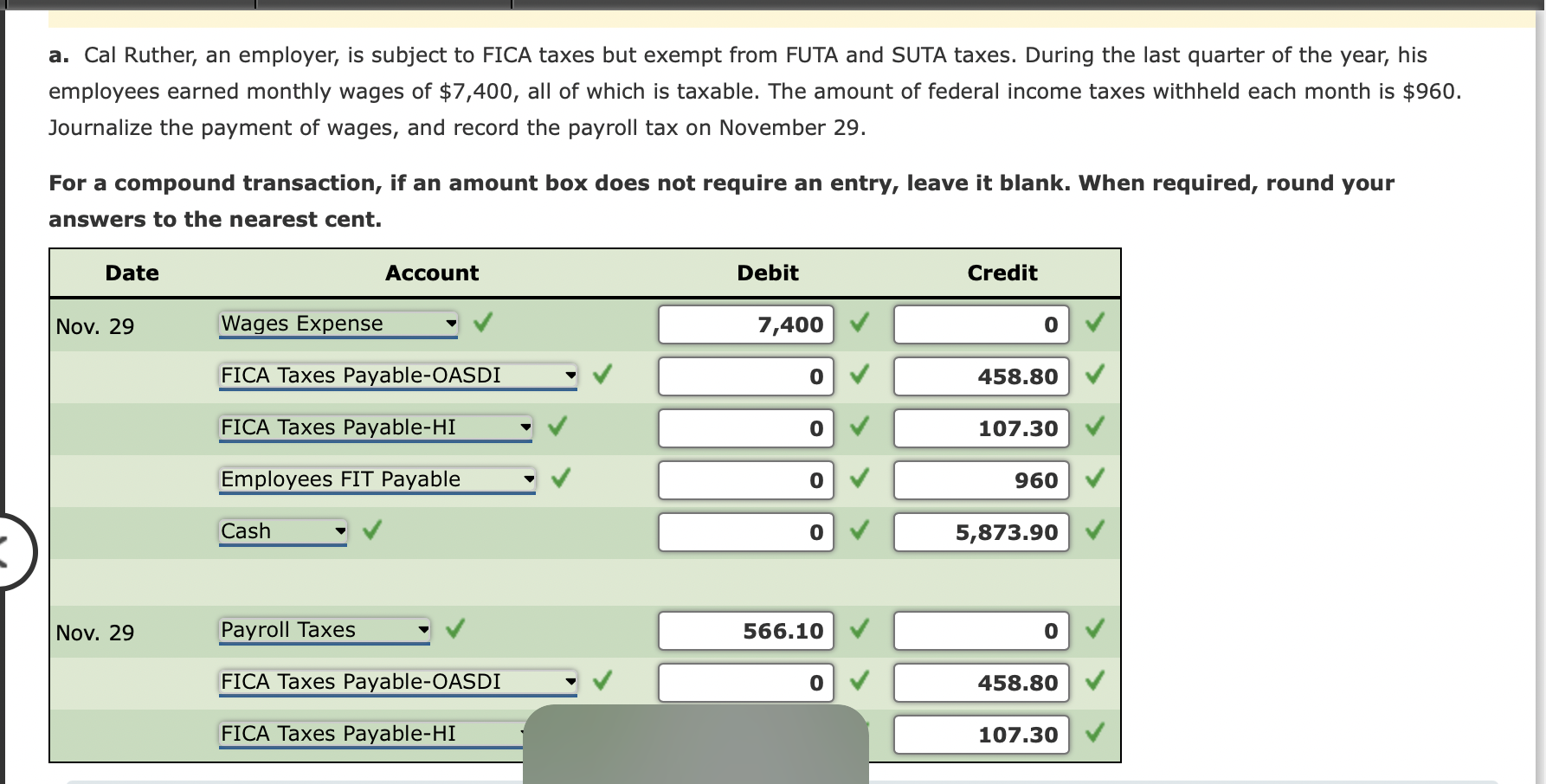

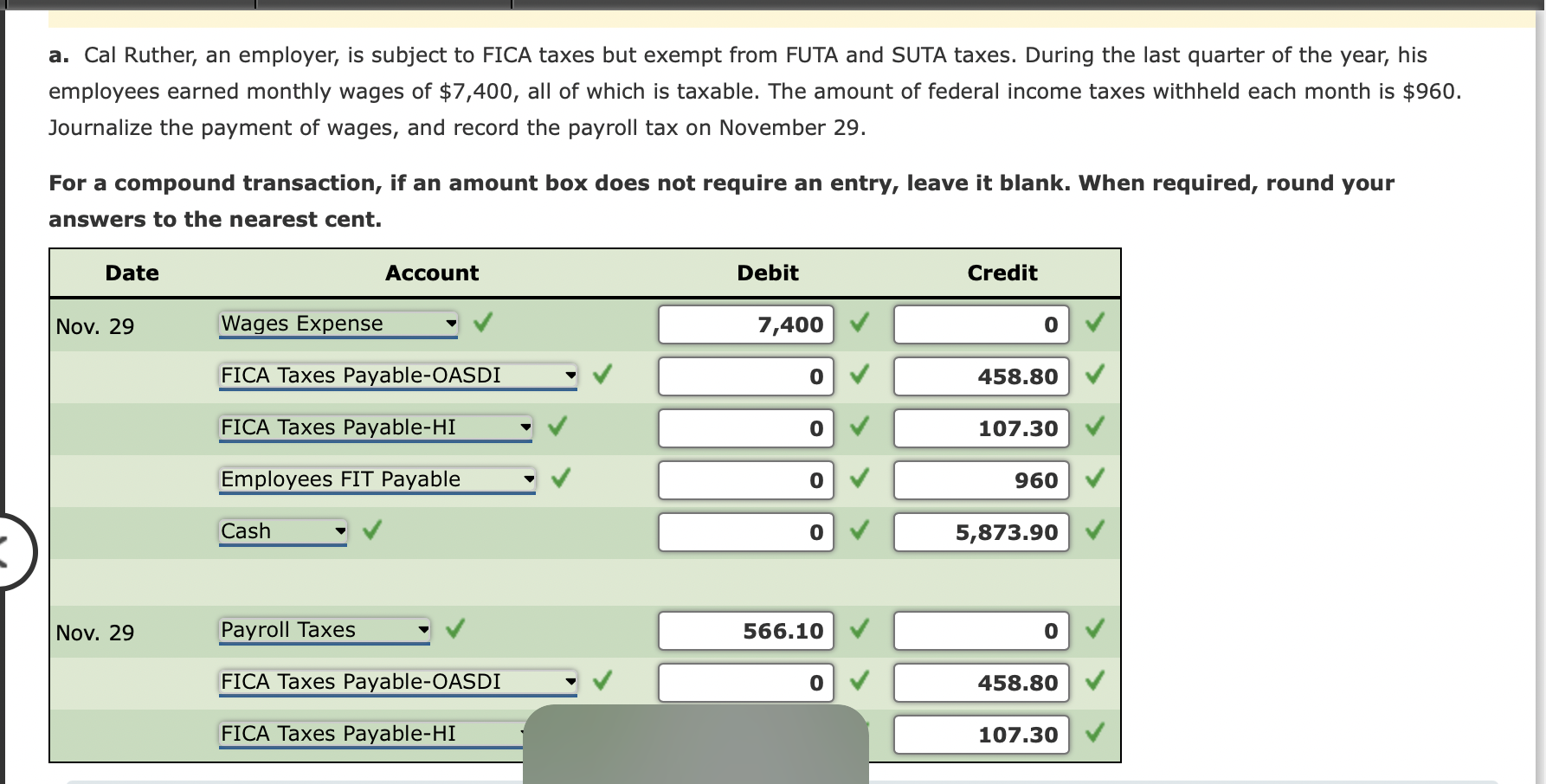

Solved Example 6 5 The Journal Entry To Record The Payroll Chegg

Solved Example 6 5 The Journal Entry To Record The Payroll Chegg

Understanding Your Tax Forms The W 2