In this digital age, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. If it's to aid in education, creative projects, or simply adding an element of personalization to your home, printables for free are now a useful resource. We'll dive deep into the realm of "Are Inherited Ira Distributions Taxable In Pennsylvania," exploring the different types of printables, where you can find them, and how they can improve various aspects of your daily life.

Get Latest Are Inherited Ira Distributions Taxable In Pennsylvania Below

Are Inherited Ira Distributions Taxable In Pennsylvania

Are Inherited Ira Distributions Taxable In Pennsylvania - Are Inherited Ira Distributions Taxable In Pennsylvania, Are Inherited Ira Distributions Taxable In Pa, Are Beneficiary Ira Distributions Taxable In Pa, Are Inherited Ira Distributions Taxable, Are Ira Distributions Taxable In Pa, Do I Have To Pay Taxes On An Inherited Ira Distribution

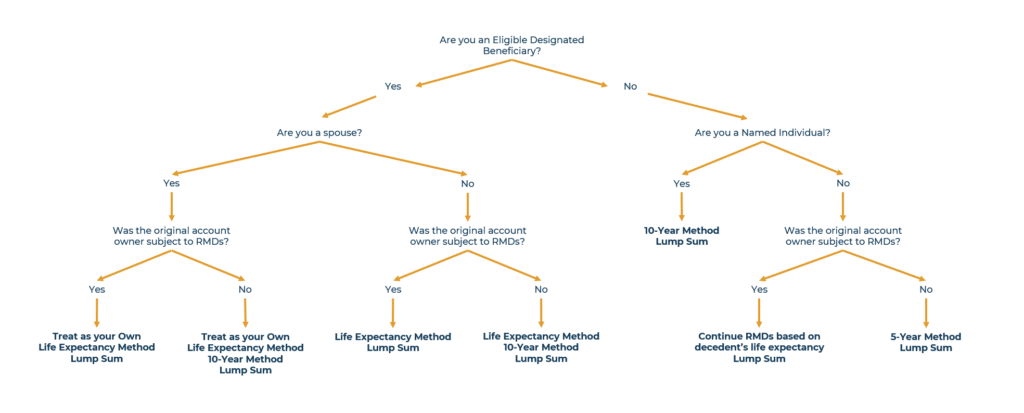

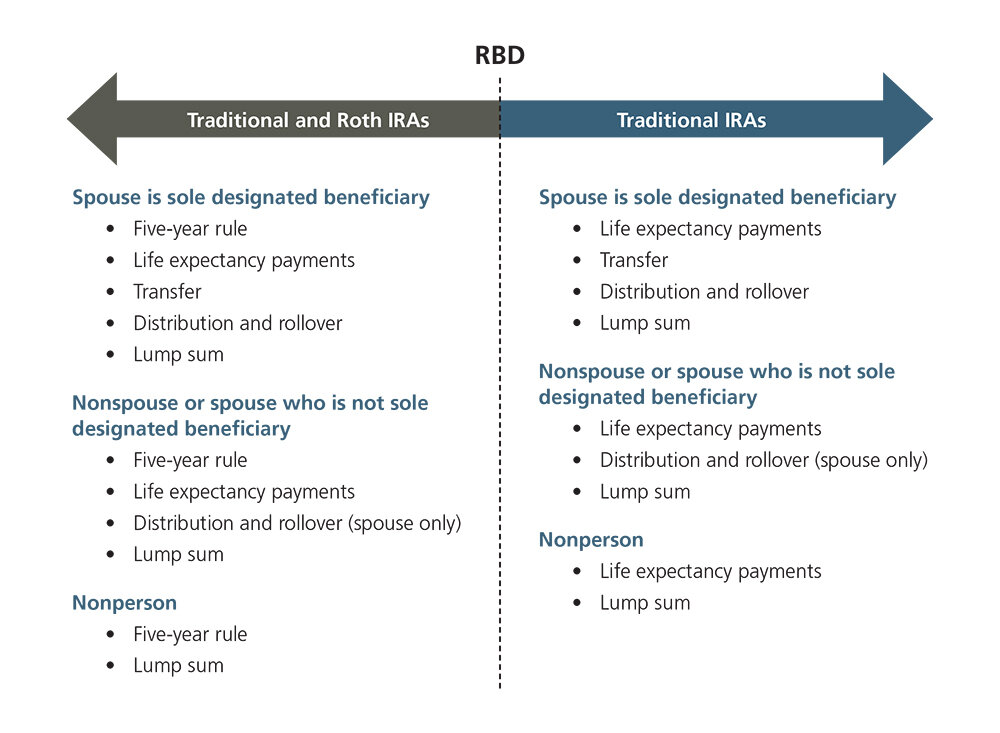

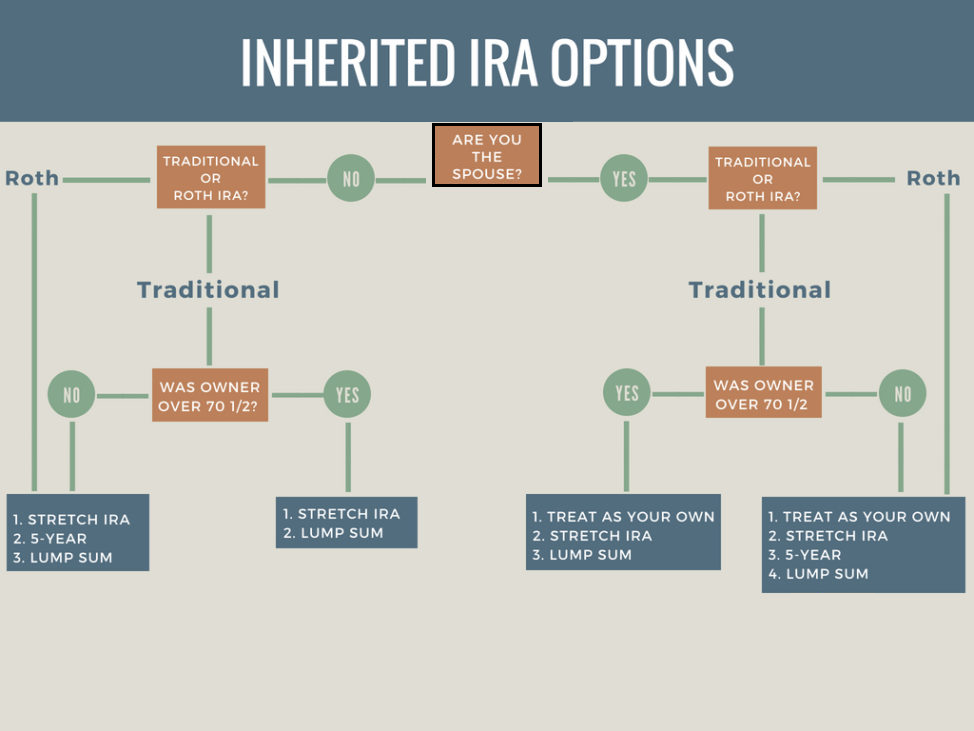

Home Resource Center Inheriting IRAs in Pennsylvania While IRAs are generally non probate assets not controlled by the decedent s Will IRAs both traditional and Roth may be subject

The IRA will be subject to inheritance tax if the decedent was over 59 1 2 years old at the time of death for traditional IRAs Roth IRAs are always

Are Inherited Ira Distributions Taxable In Pennsylvania include a broad selection of printable and downloadable items that are available online at no cost. These resources come in many designs, including worksheets coloring pages, templates and much more. The appealingness of Are Inherited Ira Distributions Taxable In Pennsylvania lies in their versatility as well as accessibility.

More of Are Inherited Ira Distributions Taxable In Pennsylvania

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

Yes All IRA distributions should be reported on PA Schedule W 2S Wage Statement Summary whether or not some or all of the distributions are taxable

Income on assets held in a Roth IRA is not taxable Distributions are includable in income to the extent that contributions were not previously included

Are Inherited Ira Distributions Taxable In Pennsylvania have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Individualization Your HTML0 customization options allow you to customize the templates to meet your individual needs such as designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Worth: Printables for education that are free cater to learners of all ages, which makes these printables a powerful resource for educators and parents.

-

Convenience: Quick access to a myriad of designs as well as templates saves time and effort.

Where to Find more Are Inherited Ira Distributions Taxable In Pennsylvania

Taxation And Investing Of Inherited IRA Distributions NJMoneyHelp

Taxation And Investing Of Inherited IRA Distributions NJMoneyHelp

Your IRA is subject to the Pennsylvania Inheritance Tax which can prove to be a tax trap For example if you leave 100 000 from your IRA to a friend that gift is subject to the 15

1 Best answer re2boys Level 9 https revenue pa custhelp app answers detail a id 988 related 1 Am I required to pay

We hope we've stimulated your interest in printables for free we'll explore the places you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Are Inherited Ira Distributions Taxable In Pennsylvania designed for a variety goals.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets or flashcards as well as learning materials.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs are a vast range of interests, that range from DIY projects to planning a party.

Maximizing Are Inherited Ira Distributions Taxable In Pennsylvania

Here are some creative ways that you can make use use of Are Inherited Ira Distributions Taxable In Pennsylvania:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to reinforce learning at home for the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Are Inherited Ira Distributions Taxable In Pennsylvania are an abundance of fun and practical tools which cater to a wide range of needs and interests. Their availability and versatility make them a great addition to any professional or personal life. Explore the endless world of Are Inherited Ira Distributions Taxable In Pennsylvania now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can download and print these files for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's based on the conditions of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright violations with Are Inherited Ira Distributions Taxable In Pennsylvania?

- Certain printables might have limitations regarding usage. Be sure to check the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home using your printer or visit a local print shop for premium prints.

-

What program do I need to run Are Inherited Ira Distributions Taxable In Pennsylvania?

- The majority are printed in the format of PDF, which can be opened using free programs like Adobe Reader.

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Schwab Inherited Ira Rmd Calculator NirvannaAnhad

Check more sample of Are Inherited Ira Distributions Taxable In Pennsylvania below

IRA Beneficiary Options For Deaths Before January 1 2020 Ascensus

+1000px.jpg)

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

Ira Required Minimum Distribution Table Ii Elcho Table

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Roth IRA Withdrawal Rules Oblivious Investor

Spousal Beneficiary Options For Inherited IRAs And Roth IRAs

https://revenue-pa.custhelp.com/app/answers/detail/a_id/988

The IRA will be subject to inheritance tax if the decedent was over 59 1 2 years old at the time of death for traditional IRAs Roth IRAs are always

https://www.spadealawfirm.com/inherited-ira

The good news is that the Traditional IRA is not subject to Pennsylvania income tax If you inherit an IRA you should consider all the options the Plan Administrator

The IRA will be subject to inheritance tax if the decedent was over 59 1 2 years old at the time of death for traditional IRAs Roth IRAs are always

The good news is that the Traditional IRA is not subject to Pennsylvania income tax If you inherit an IRA you should consider all the options the Plan Administrator

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

Roth IRA Withdrawal Rules Oblivious Investor

Spousal Beneficiary Options For Inherited IRAs And Roth IRAs

/https://blogs-images.forbes.com/baldwin/files/2014/03/rmd_own_larger.png?resize=618%2C635&ssl=1)

Ira Minimum Distribution Table Spouse 10 Years Younger Brokeasshome

Ira Required Minimum Distribution Table Ii Elcho Table

Ira Required Minimum Distribution Table Ii Elcho Table

Inheriting An IRA From Your Spouse Know Your Options New Century