In this age of electronic devices, where screens have become the dominant feature of our lives but the value of tangible printed materials isn't diminishing. In the case of educational materials and creative work, or simply adding an individual touch to the home, printables for free have become an invaluable resource. The following article is a take a dive deep into the realm of "Are 401 K Distributions Taxable In Pennsylvania," exploring the different types of printables, where to get them, as well as how they can enhance various aspects of your daily life.

Get Latest Are 401 K Distributions Taxable In Pennsylvania Below

Are 401 K Distributions Taxable In Pennsylvania

Are 401 K Distributions Taxable In Pennsylvania - Are 401 K Distributions Taxable In Pennsylvania, Are 401 K Withdrawals Taxable In Pennsylvania, Are 401 K Contributions Taxable In Pennsylvania, Are 401 K Distributions Taxable In Pa, Are 401k Withdrawals Taxed In Pennsylvania, Are 401k Distributions Taxed In Pa, Are 401k Distributions Taxable, Does Pa Tax 401k Distributions, Are 401k Distributions Subject To State Tax

For example if you contributed 200 a month for 80 months to a qualifying pension plan you contributed 16 000 to the plan If you took a lump sum distribution of

Pennsylvania generally does not levy state income tax on distributions from a 401 k plan as long as you receive those distributions after age 59 1 2 This

Are 401 K Distributions Taxable In Pennsylvania encompass a wide collection of printable materials available online at no cost. They are available in a variety of formats, such as worksheets, coloring pages, templates and more. The value of Are 401 K Distributions Taxable In Pennsylvania is their flexibility and accessibility.

More of Are 401 K Distributions Taxable In Pennsylvania

401 k Distributions FAQs For Employers

401 k Distributions FAQs For Employers

Federal law allows for 401 k distributions as early as age 55 under certain circumstances but it s unclear whether Pennsylvania s rules allowing distributions when

Similar to IRAs 401 k distributions are generally not taxable in Pennsylvania at the state level However exceptions apply and federal taxation is a consideration If you re uncertain about your

Are 401 K Distributions Taxable In Pennsylvania have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Customization: You can tailor printables to your specific needs in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Use: Free educational printables provide for students from all ages, making them a great tool for parents and educators.

-

Easy to use: The instant accessibility to various designs and templates will save you time and effort.

Where to Find more Are 401 K Distributions Taxable In Pennsylvania

The Complete Guide To 401 k Corrective Distributions

The Complete Guide To 401 k Corrective Distributions

Employer contributions to qualified retirement plans like matching contributions to a 401 k are not subject to Pennsylvania income tax or withholding

Pennsylvania is very tax friendly towards retirees Some of the retirement tax benefits of Pennsylvania include Retirement income is not taxable Payments from retirement

We've now piqued your interest in Are 401 K Distributions Taxable In Pennsylvania Let's find out where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Are 401 K Distributions Taxable In Pennsylvania for various needs.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs covered cover a wide selection of subjects, all the way from DIY projects to party planning.

Maximizing Are 401 K Distributions Taxable In Pennsylvania

Here are some inventive ways ensure you get the very most use of Are 401 K Distributions Taxable In Pennsylvania:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Are 401 K Distributions Taxable In Pennsylvania are an abundance of creative and practical resources designed to meet a range of needs and passions. Their accessibility and flexibility make them a valuable addition to each day life. Explore the endless world of Are 401 K Distributions Taxable In Pennsylvania and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I use the free printables for commercial use?

- It's based on specific conditions of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables may be subject to restrictions in use. Make sure you read the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- You can print them at home with an printer, or go to a local print shop to purchase superior prints.

-

What software must I use to open printables that are free?

- The majority of printables are in the format of PDF, which can be opened using free software such as Adobe Reader.

What Are The Benefits Of Having 401 k Plan

401 K A Smart Investment That Can Significantly Lower Your Taxes

Check more sample of Are 401 K Distributions Taxable In Pennsylvania below

Can I Take Two 401 k Distributions Under The CARES Act

401k Rmd Distribution Table Elcho Table

How Companies Can Improve Their 401 k Plans

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

401k Minimum Distribution Table 2017 Www microfinanceindia

Drag Each Tile To The Correct Box Match Each Tax Classification To The

https://pocketsense.com/401k-distributions-taxable...

Pennsylvania generally does not levy state income tax on distributions from a 401 k plan as long as you receive those distributions after age 59 1 2 This

https://www.revenue.pa.gov/FormsandPublications/PA...

To determine if the amount you received is taxable in Pennsylvania review Boxes 1 through 3 the amount you received or your distributions and the Pennsylvania tax

Pennsylvania generally does not levy state income tax on distributions from a 401 k plan as long as you receive those distributions after age 59 1 2 This

To determine if the amount you received is taxable in Pennsylvania review Boxes 1 through 3 the amount you received or your distributions and the Pennsylvania tax

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

401k Rmd Distribution Table Elcho Table

401k Minimum Distribution Table 2017 Www microfinanceindia

Drag Each Tile To The Correct Box Match Each Tax Classification To The

Golden Rule 401 k

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

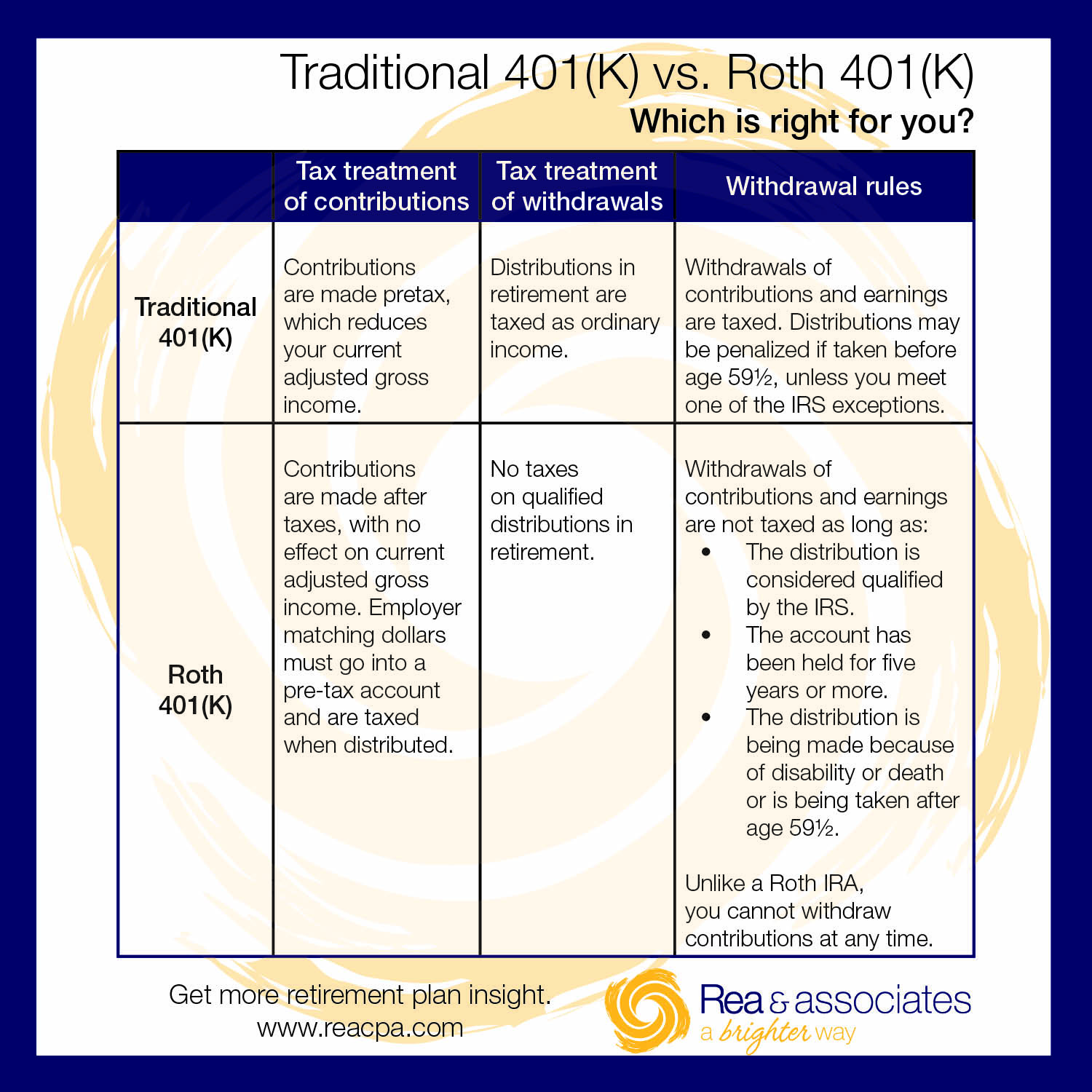

Roth Vs Traditional 401 K Retirement Ohio CPA Firm Rea CPA