In this age of technology, where screens dominate our lives but the value of tangible printed items hasn't gone away. Whatever the reason, whether for education and creative work, or simply to add a personal touch to your home, printables for free are now a vital resource. For this piece, we'll dive into the world of "Are 401 K Distributions Taxable In Pa," exploring the different types of printables, where you can find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Are 401 K Distributions Taxable In Pa Below

Are 401 K Distributions Taxable In Pa

Are 401 K Distributions Taxable In Pa - Are 401 K Distributions Taxable In Pa, Are 401 K Distributions Taxable In Pennsylvania, Are 401 K Withdrawals Taxable In Pennsylvania, Are 401 K Contributions Taxable In Pennsylvania, Are 401k Distributions Taxed In Pa, Are Early 401k Distributions Taxable In Pa, Are 401k Contributions Taxable In Pa, Are 401k Withdrawals Taxable In Pa, Are 401k Withdrawals Taxed In Pa, Are 401k Contributions Taxed In Pa

PA Tax on 401 k Distributions Similar to IRAs 401 k distributions are generally not taxable in Pennsylvania at the state level However exceptions apply and federal taxation is a consideration If

Based on the cost recovery method the first 16 000 of the distribution was your own money leaving only 4 000 as taxable If you recover all your contributions

Printables for free cover a broad range of downloadable, printable items that are available online at no cost. These printables come in different types, such as worksheets coloring pages, templates and many more. The appealingness of Are 401 K Distributions Taxable In Pa is in their variety and accessibility.

More of Are 401 K Distributions Taxable In Pa

401 k Distributions FAQs For Employers

401 k Distributions FAQs For Employers

The Federal provisions are not applicable to PA PA doesn t tax distributions from old age or retirement benefit plans if the distribution is made after

Traditionally 401 k distributions are taxed as ordinary income However the tax burden you ll incur varies by the type of account you have a traditional 401 k or a Roth 401 k and by

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Modifications: This allows you to modify print-ready templates to your specific requirements, whether it's designing invitations planning your schedule or even decorating your house.

-

Educational Value These Are 401 K Distributions Taxable In Pa are designed to appeal to students of all ages, making the perfect source for educators and parents.

-

Easy to use: Access to an array of designs and templates cuts down on time and efforts.

Where to Find more Are 401 K Distributions Taxable In Pa

The Complete Guide To 401 k Corrective Distributions

The Complete Guide To 401 k Corrective Distributions

Distributions from your 401 k plan are taxable unless the amounts are rolled over as described below in the section titled Rollovers from your 401 k plan If you receive a

Pennsylvania fully exempts all income from Social Security as well as payments from retirement accounts like 401 k s and IRAs It also exempts pension income for seniors age 60 or older While its property tax rates

We've now piqued your interest in Are 401 K Distributions Taxable In Pa Let's look into where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Are 401 K Distributions Taxable In Pa for various uses.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning tools.

- This is a great resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs covered cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing Are 401 K Distributions Taxable In Pa

Here are some ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets to reinforce learning at home also in the classes.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Are 401 K Distributions Taxable In Pa are an abundance filled with creative and practical information that can meet the needs of a variety of people and needs and. Their availability and versatility make they a beneficial addition to any professional or personal life. Explore the many options of Are 401 K Distributions Taxable In Pa today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes, they are! You can print and download these resources at no cost.

-

Are there any free printables for commercial use?

- It is contingent on the specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may come with restrictions on usage. Always read the terms and conditions set forth by the designer.

-

How can I print Are 401 K Distributions Taxable In Pa?

- You can print them at home using an printer, or go to any local print store for high-quality prints.

-

What program do I need to run printables at no cost?

- A majority of printed materials are in the format PDF. This is open with no cost programs like Adobe Reader.

What Are The Benefits Of Having 401 k Plan

401k Minimum Distribution Table 2017 Www microfinanceindia

Check more sample of Are 401 K Distributions Taxable In Pa below

401 K A Smart Investment That Can Significantly Lower Your Taxes

Can I Take Two 401 k Distributions Under The CARES Act

401k Rmd Distribution Table Elcho Table

How Companies Can Improve Their 401 k Plans

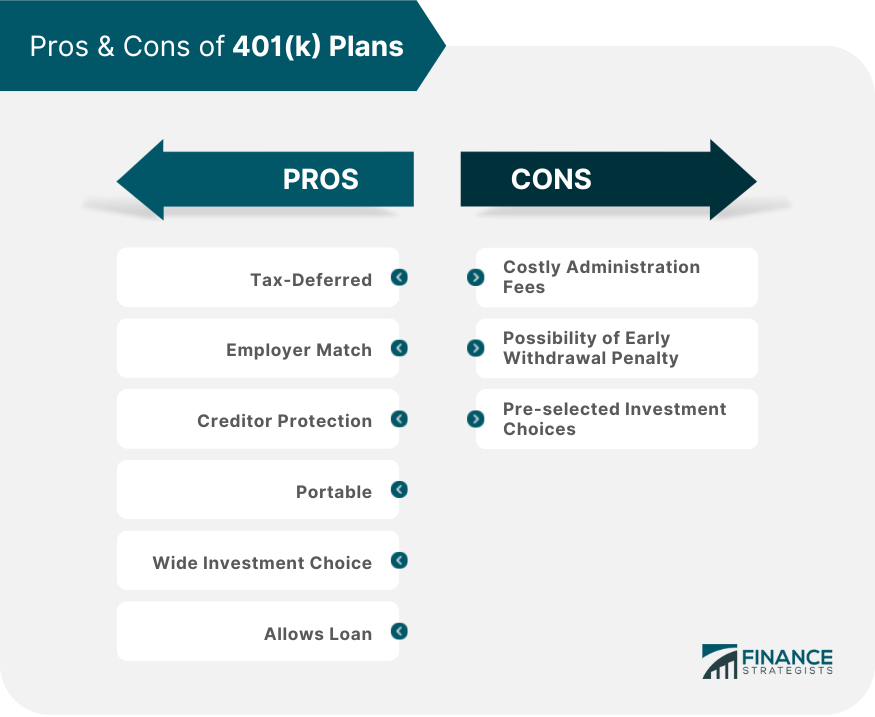

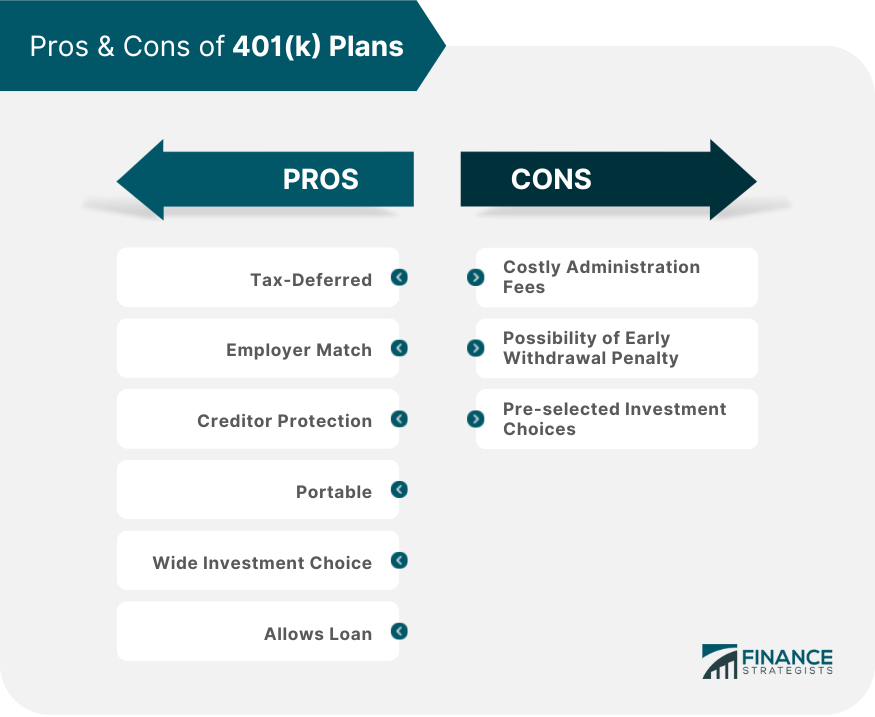

401 k Plan Pros And Cons Finance Strategists

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

https://revenue-pa.custhelp.com/app/answers/detail/a_id/1469

Based on the cost recovery method the first 16 000 of the distribution was your own money leaving only 4 000 as taxable If you recover all your contributions

https://pocketsense.com/401k-distributions-taxable...

In Pennsylvania your 401 k contributions are fully taxable in the year you make them Investment profits are still tax free Then when you reach the eligible age of

Based on the cost recovery method the first 16 000 of the distribution was your own money leaving only 4 000 as taxable If you recover all your contributions

In Pennsylvania your 401 k contributions are fully taxable in the year you make them Investment profits are still tax free Then when you reach the eligible age of

How Companies Can Improve Their 401 k Plans

Can I Take Two 401 k Distributions Under The CARES Act

401 k Plan Pros And Cons Finance Strategists

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

Drag Each Tile To The Correct Box Match Each Tax Classification To The

Golden Rule 401 k

Golden Rule 401 k

2023 K1 Form Printable Forms Free Online