In the digital age, in which screens are the norm The appeal of tangible printed objects isn't diminished. In the case of educational materials for creative projects, just adding some personal flair to your space, Are 401k Distributions Taxable are now a useful source. With this guide, you'll take a dive in the world of "Are 401k Distributions Taxable," exploring what they are, where you can find them, and how they can enrich various aspects of your lives.

Get Latest Are 401k Distributions Taxable Below

Are 401k Distributions Taxable

Are 401k Distributions Taxable - Are 401k Distributions Taxable, Are 401k Distributions Taxable In Michigan, Are 401 K Distributions Taxable In Illinois, Are 401k Distributions Taxable Income, Are 401 K Distributions Taxable In Hawaii, Are 401 K Distributions Taxable In Nj, Are 401k Distributions Taxable In Ohio, Are 401 K Distributions Taxable In New Jersey, Are 401 K Distributions Taxable In Maryland, Are 401 K Distributions Taxable In Pa

Your 401 k distributions are taxed as ordinary income All that means is the government treats it the same as money you earned from a job The good news for most people is that incomes

Once you start withdrawing from your traditional 401 k your withdrawals are usually taxed as ordinary taxable income That said you ll report the taxable part of your distribution

Printables for free cover a broad collection of printable content that can be downloaded from the internet at no cost. They are available in numerous formats, such as worksheets, templates, coloring pages, and many more. The beauty of Are 401k Distributions Taxable is in their variety and accessibility.

More of Are 401k Distributions Taxable

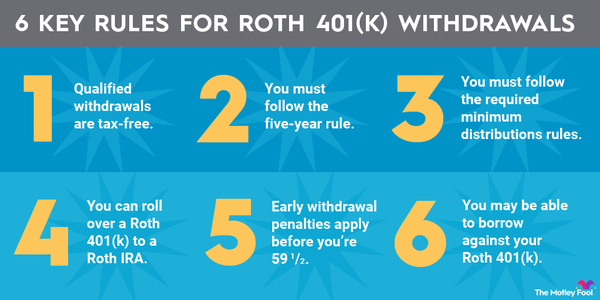

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

All traditional 401 k plan withdrawals are considered income and subject to income tax as 401 k contributions are made with pretax dollars As a result retirement savers enjoy a lower

Contributions to traditional 401 k s or other qualified retirement plans are made with pre tax dollars and aren t included in your taxable income You must pay income tax

Are 401k Distributions Taxable have gained a lot of appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Individualization This allows you to modify printables to fit your particular needs such as designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Impact: The free educational worksheets provide for students from all ages, making them a useful tool for parents and educators.

-

Affordability: You have instant access many designs and templates cuts down on time and efforts.

Where to Find more Are 401k Distributions Taxable

Brief About 401 k Plan In US Payroll Using The OpenHRMS

Brief About 401 k Plan In US Payroll Using The OpenHRMS

When you take distributions from a 401 k account the amount distributed is subject to ordinary income tax rates the same tax rates you pay on your regular wages The most common question I get is how much tax am I

Updated December 12th 2022 Key Takeaways Your 401 k contributions are put in before taxes have been paid and they grow tax free until you take them out When you take distributions the money you take each year will be taxed as ordinary income

Now that we've piqued your interest in Are 401k Distributions Taxable Let's look into where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of applications.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- The perfect resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a broad range of interests, that range from DIY projects to party planning.

Maximizing Are 401k Distributions Taxable

Here are some ideas that you can make use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Are 401k Distributions Taxable are a treasure trove of fun and practical tools which cater to a wide range of needs and interests. Their access and versatility makes them a wonderful addition to your professional and personal life. Explore the plethora of Are 401k Distributions Taxable now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can print and download these materials for free.

-

Do I have the right to use free printables for commercial purposes?

- It depends on the specific rules of usage. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Are there any copyright concerns with Are 401k Distributions Taxable?

- Some printables may come with restrictions on their use. Be sure to check these terms and conditions as set out by the creator.

-

How do I print Are 401k Distributions Taxable?

- Print them at home with the printer, or go to a print shop in your area for premium prints.

-

What software is required to open Are 401k Distributions Taxable?

- The majority of printables are in the format of PDF, which can be opened with free software like Adobe Reader.

IRA Rates Inflation Protection

401k Rmd Distribution Table Elcho Table

Check more sample of Are 401k Distributions Taxable below

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

The Complete Guide To 401 k Corrective Distributions

Golden Rule 401 k

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

https://www.hrblock.com/.../taxes-on-401k-distribution

Once you start withdrawing from your traditional 401 k your withdrawals are usually taxed as ordinary taxable income That said you ll report the taxable part of your distribution

https://www.nerdwallet.com/article/taxes/401k-taxes

What is the tax rate on 401 k withdrawals The money you withdraw also called a distribution from a traditional 401 k is taxable as regular income in the year you take the money out

Once you start withdrawing from your traditional 401 k your withdrawals are usually taxed as ordinary taxable income That said you ll report the taxable part of your distribution

What is the tax rate on 401 k withdrawals The money you withdraw also called a distribution from a traditional 401 k is taxable as regular income in the year you take the money out

The Complete Guide To 401 k Corrective Distributions

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Golden Rule 401 k

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

2012 401K IRA And Roth IRA Contribution And Income Deduction Limits

401k Reduce Taxable Income Calculator ArmaanHakeem

401k Reduce Taxable Income Calculator ArmaanHakeem

401k Early Withdrawal What To Know Before You Cash Out Community Charter