In this age of electronic devices, where screens rule our lives however, the attraction of tangible printed materials isn't diminishing. Be it for educational use or creative projects, or simply adding personal touches to your area, Why Would You Make A Non Deductible Ira Contribution are a great source. Here, we'll take a dive through the vast world of "Why Would You Make A Non Deductible Ira Contribution," exploring the different types of printables, where they are available, and ways they can help you improve many aspects of your daily life.

Get Latest Why Would You Make A Non Deductible Ira Contribution Below

Why Would You Make A Non Deductible Ira Contribution

Why Would You Make A Non Deductible Ira Contribution - Why Would You Make A Non Deductible Ira Contribution, Can You Make A Non Deductible Ira Contribution Without Earned Income, Can You Make A Non Deductible Sep-ira Contribution, Can You Make A Non Deductible Roth Ira Contribution, Why Make A Non Deductible Ira Contribution, Should You Make Non Deductible Ira Contributions, Can I Make A Non Deductible Ira Contribution, What Are Non-deductible Ira Contributions

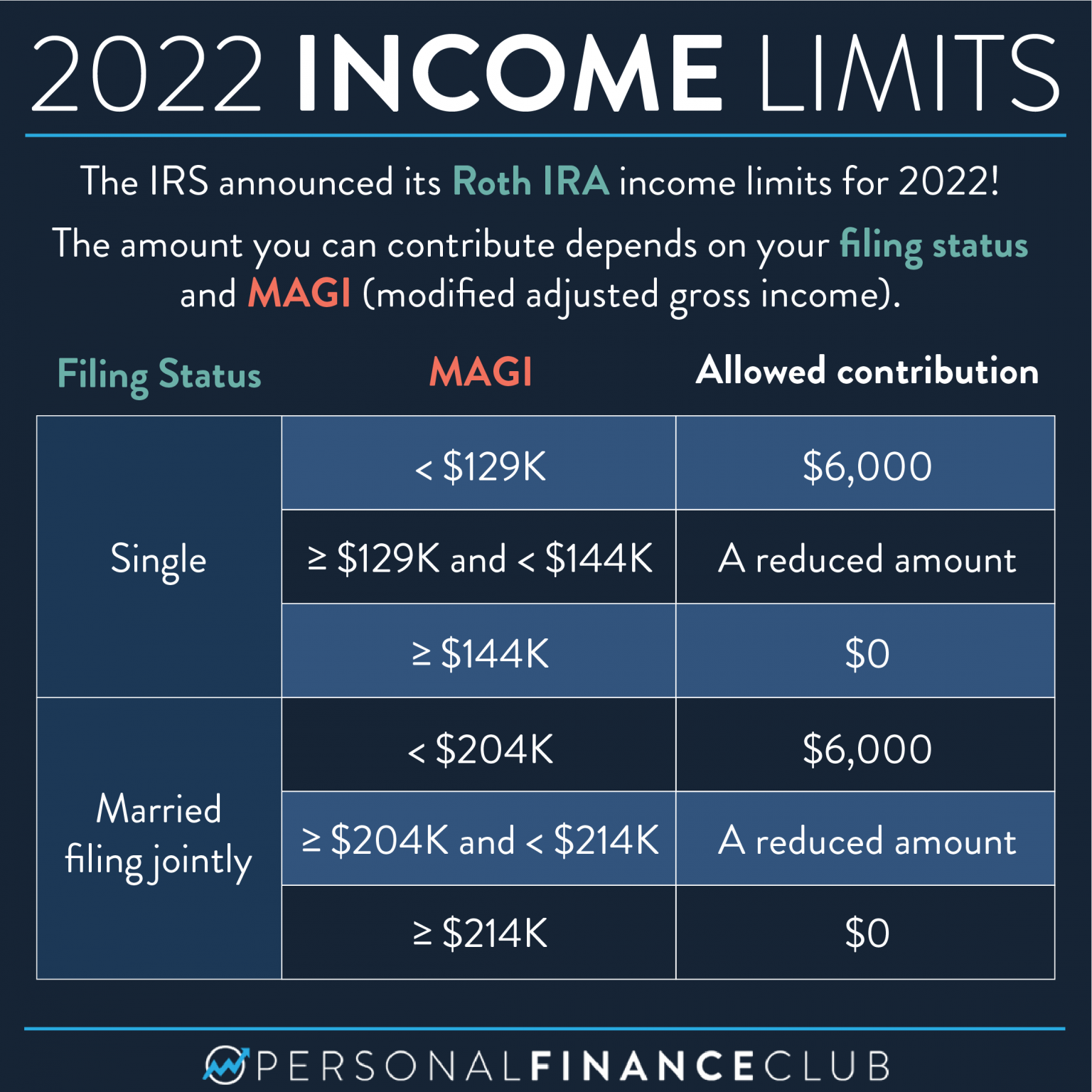

A nondeductible IRA is a retirement savings account to which you contribute after tax dollars but that allows you to grow your money for retirement without paying taxes until gains are

A nondeductible contribution to your IRA may pay off in the future Learn about the income limits that may allow you to make tax free contributions

Why Would You Make A Non Deductible Ira Contribution encompass a wide collection of printable materials available online at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and more. The great thing about Why Would You Make A Non Deductible Ira Contribution lies in their versatility and accessibility.

More of Why Would You Make A Non Deductible Ira Contribution

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

With a nondeductible IRA as you may have gathered by the nondeductible part the IRS does not allow you to deduct your contribution from your income taxes So there

A nondeductible IRA contribution is typically made by high earners looking for a way to save additional funds Here s how to make a nondeductible IRA contribution

Why Would You Make A Non Deductible Ira Contribution have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Personalization There is the possibility of tailoring printables to your specific needs be it designing invitations, organizing your schedule, or even decorating your house.

-

Educational Benefits: Free educational printables offer a wide range of educational content for learners from all ages, making them a vital tool for parents and educators.

-

Easy to use: Access to an array of designs and templates can save you time and energy.

Where to Find more Why Would You Make A Non Deductible Ira Contribution

What Is A Non deductible IRA Finance Strategists

What Is A Non deductible IRA Finance Strategists

Why would you open a non deductible IRA If you meet certain criteria such as your income is too high to allow you to contribute to a traditional IRA or Roth IRA a non deductible IRA might help you increase your

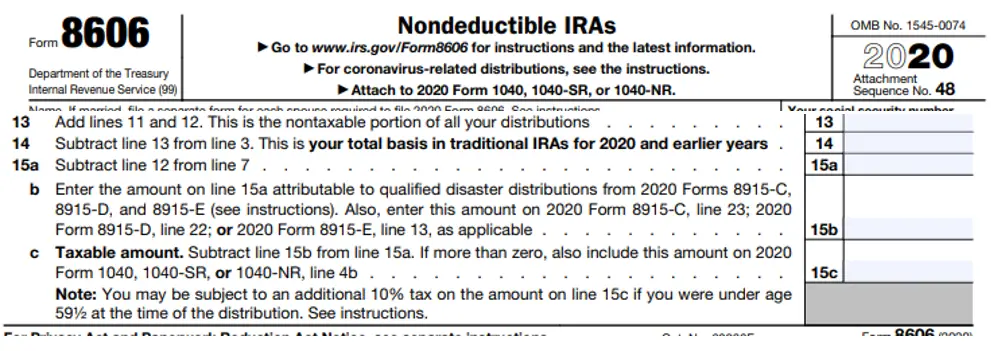

Filers who make nondeductible contributions to an IRA use IRS Form 8606 Any taxpayer with a cost basis above zero for IRA assets should use Form 8606 to prorate the taxable vs nontaxable

Since we've got your curiosity about Why Would You Make A Non Deductible Ira Contribution Let's take a look at where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Why Would You Make A Non Deductible Ira Contribution for various purposes.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs are a vast range of interests, that range from DIY projects to planning a party.

Maximizing Why Would You Make A Non Deductible Ira Contribution

Here are some ways ensure you get the very most use of Why Would You Make A Non Deductible Ira Contribution:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Why Would You Make A Non Deductible Ira Contribution are an abundance of practical and imaginative resources that meet a variety of needs and pursuits. Their accessibility and versatility make them a great addition to each day life. Explore the endless world of Why Would You Make A Non Deductible Ira Contribution and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Why Would You Make A Non Deductible Ira Contribution really available for download?

- Yes they are! You can download and print these tools for free.

-

Can I use free printables for commercial uses?

- It's contingent upon the specific usage guidelines. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright rights issues with Why Would You Make A Non Deductible Ira Contribution?

- Some printables may contain restrictions regarding usage. Make sure to read the terms and conditions set forth by the designer.

-

How can I print Why Would You Make A Non Deductible Ira Contribution?

- Print them at home with printing equipment or visit any local print store for top quality prints.

-

What program is required to open printables free of charge?

- Many printables are offered in the format of PDF, which can be opened using free software like Adobe Reader.

Simple Ira Contribution Rules Choosing Your Gold IRA

What Is A Non deductible IRA Empower

Check more sample of Why Would You Make A Non Deductible Ira Contribution below

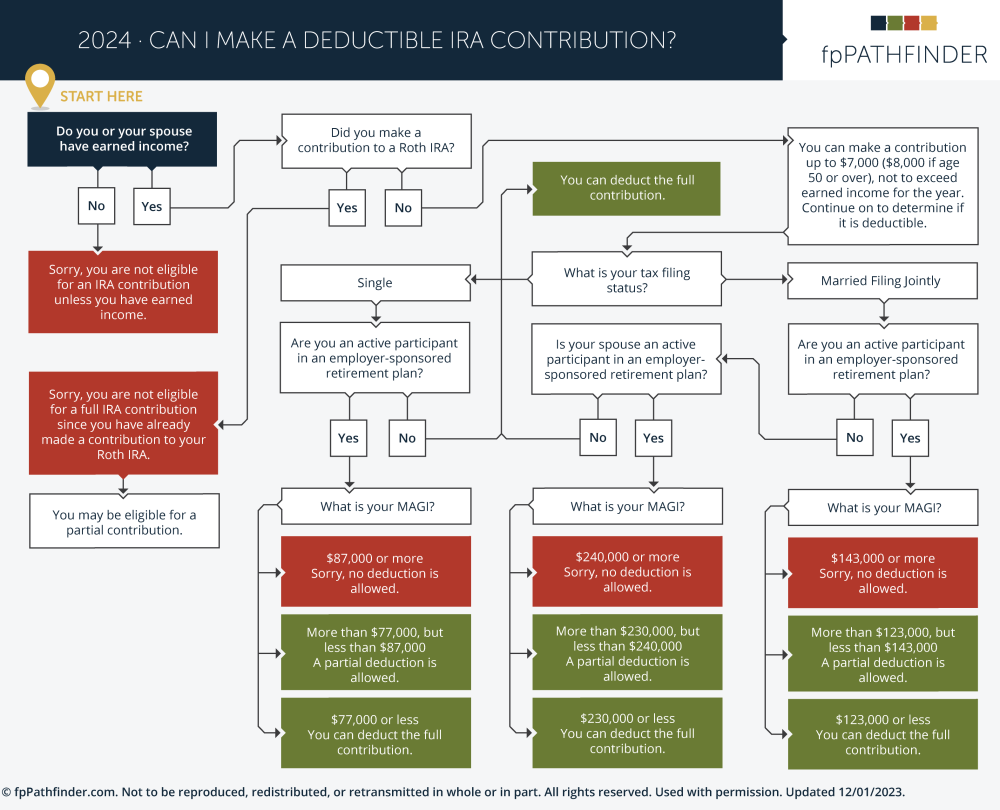

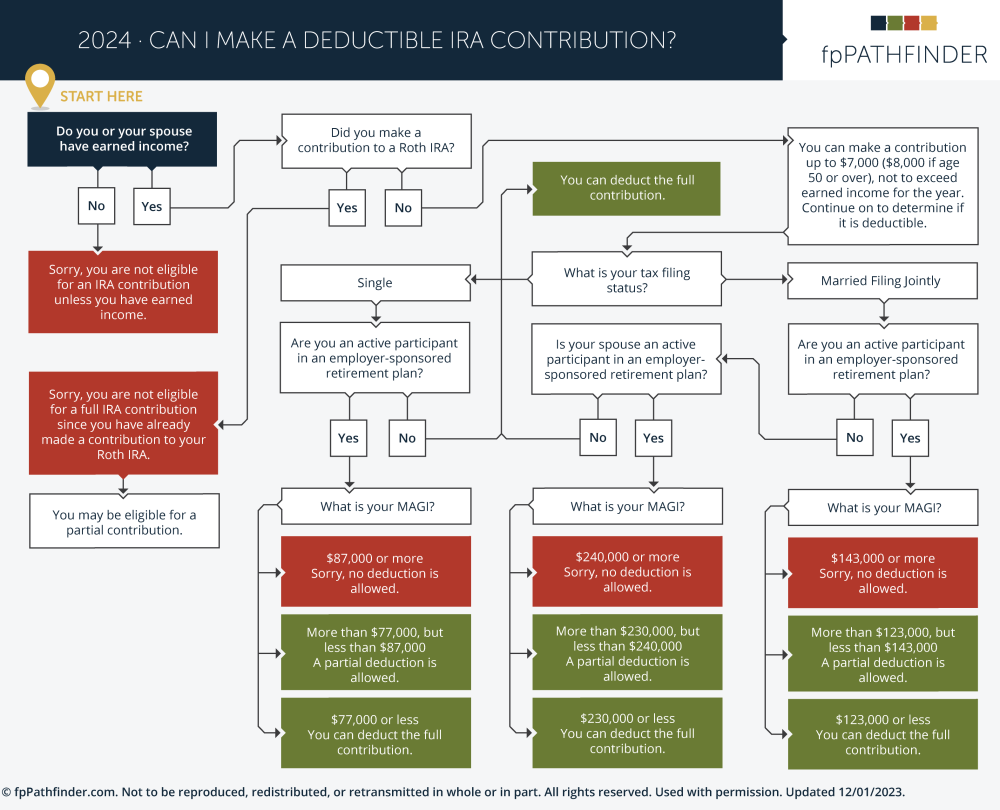

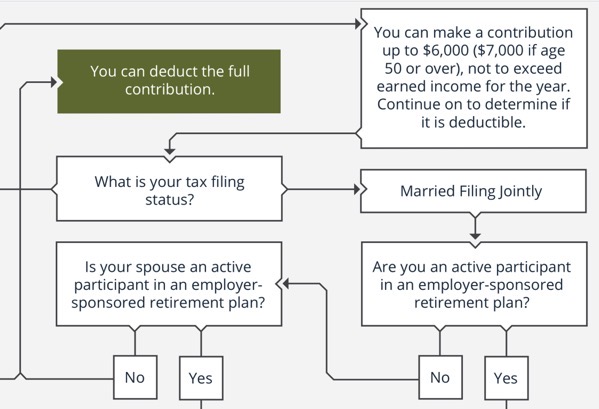

Can I Make A Deductible IRA Contribution Echo45 Advisors

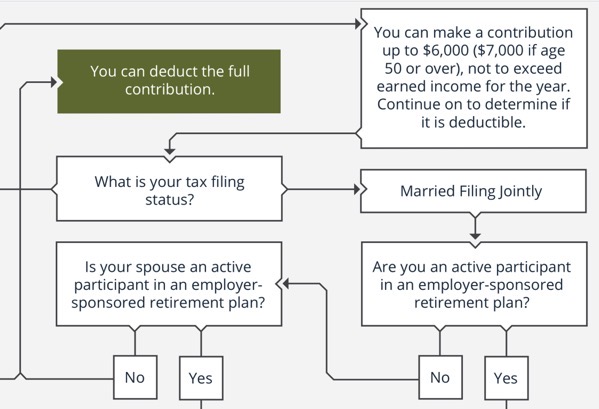

Can I Make A Deductible IRA Contribution FpPathfinder Guides

Non Deductible IRA Definition How It Works Seeking Alpha

Can A Non Working Spouse Make A Non Deductible IRA Contribution

Deductible IRA Contribution Independent Fiduciary Advisor

Non Deductible IRA Contribution Vs Taxable Brokerage Account Savings

https://www.thebalancemoney.com/non …

A nondeductible contribution to your IRA may pay off in the future Learn about the income limits that may allow you to make tax free contributions

https://www.forbes.com/sites/kristinmckenna/2021/...

Anyone with earned income can make a non deductible after tax contribution to an IRA and benefit from tax deferred growth But it may not be worth it due in part to often

A nondeductible contribution to your IRA may pay off in the future Learn about the income limits that may allow you to make tax free contributions

Anyone with earned income can make a non deductible after tax contribution to an IRA and benefit from tax deferred growth But it may not be worth it due in part to often

Can A Non Working Spouse Make A Non Deductible IRA Contribution

Can I Make A Deductible IRA Contribution FpPathfinder Guides

Deductible IRA Contribution Independent Fiduciary Advisor

Non Deductible IRA Contribution Vs Taxable Brokerage Account Savings

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

What Is A Non Deductible IRA SoFi

What Is A Non Deductible IRA SoFi

Must Know Roth Ira Max Contribution 2023 Ideas 2023 GDS