In this age of electronic devices, in which screens are the norm it's no wonder that the appeal of tangible, printed materials hasn't diminished. Be it for educational use project ideas, artistic or simply adding an individual touch to your area, Should You Make Non Deductible Ira Contributions are now an essential source. Here, we'll take a dive into the world "Should You Make Non Deductible Ira Contributions," exploring what they are, where to get them, as well as how they can enrich various aspects of your lives.

Get Latest Should You Make Non Deductible Ira Contributions Below

Should You Make Non Deductible Ira Contributions

Should You Make Non Deductible Ira Contributions -

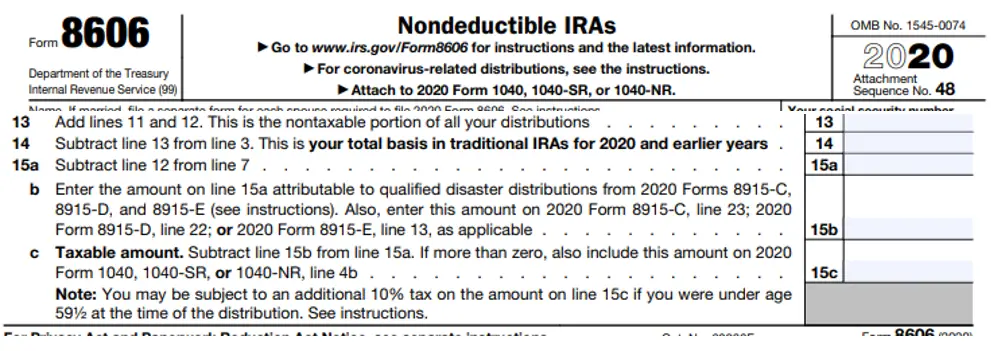

With a nondeductible IRA as you may have gathered by the nondeductible part the IRS does not allow you to deduct your contribution from your income taxes

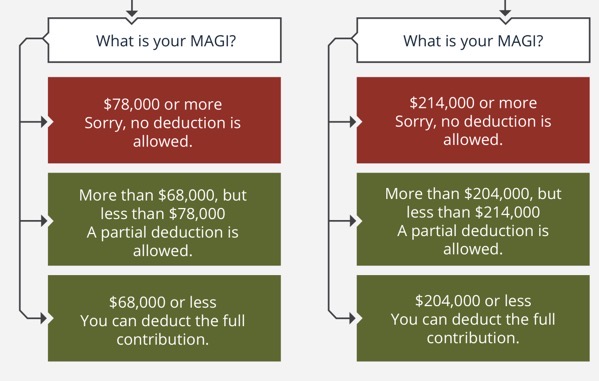

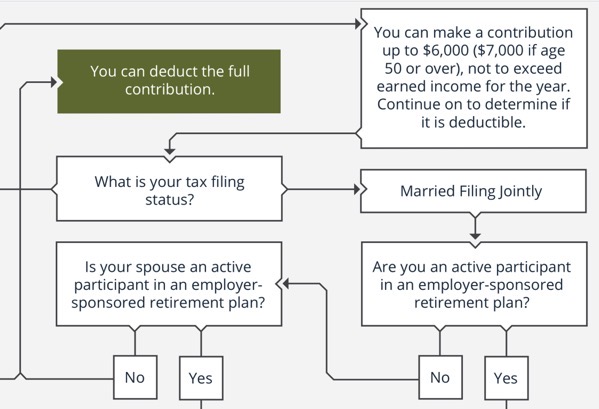

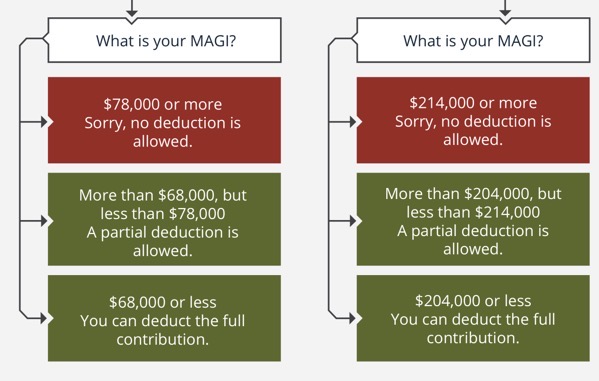

A nondeductible contribution to your IRA may pay off in the future Learn about the income limits that may allow you to make tax free contributions

Should You Make Non Deductible Ira Contributions include a broad selection of printable and downloadable materials that are accessible online for free cost. These materials come in a variety of forms, like worksheets coloring pages, templates and much more. The appealingness of Should You Make Non Deductible Ira Contributions is in their variety and accessibility.

More of Should You Make Non Deductible Ira Contributions

Deductible IRA Contribution Financial Coaching For DIY Investors

Deductible IRA Contribution Financial Coaching For DIY Investors

A nondeductible IRA is a retirement savings account to which you contribute after tax dollars but that allows you to grow your money for retirement without paying taxes until gains are

A non deductible IRA is a retirement account that behaves like a traditional IRA except that it is funded with after tax dollars Here s how it works Definition and Contribution Limits

Should You Make Non Deductible Ira Contributions have risen to immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements for invitations, whether that's creating them or arranging your schedule or even decorating your house.

-

Educational Use: The free educational worksheets can be used by students from all ages, making them a vital device for teachers and parents.

-

An easy way to access HTML0: immediate access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Should You Make Non Deductible Ira Contributions

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

With traditional IRAs you deduct contributions now and pay taxes on withdrawals later Roth IRA contributions are made with money that s been taxed so you get tax free withdrawals later Roth

If a nondeductible contribution to a traditional IRA is your only option should you go ahead One advantage is that investment earnings within any IRA are tax deferred

In the event that we've stirred your interest in printables for free, let's explore where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of motives.

- Explore categories such as decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- These blogs cover a broad array of topics, ranging including DIY projects to party planning.

Maximizing Should You Make Non Deductible Ira Contributions

Here are some creative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home and in class.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Should You Make Non Deductible Ira Contributions are an abundance of innovative and useful resources that can meet the needs of a variety of people and pursuits. Their access and versatility makes these printables a useful addition to both professional and personal life. Explore the world of Should You Make Non Deductible Ira Contributions today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes they are! You can print and download these resources at no cost.

-

Can I download free printables for commercial use?

- It's determined by the specific terms of use. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download Should You Make Non Deductible Ira Contributions?

- Some printables could have limitations in use. Be sure to check the terms and condition of use as provided by the author.

-

How do I print printables for free?

- You can print them at home with your printer or visit the local print shop for higher quality prints.

-

What program is required to open printables at no cost?

- The majority of printed documents are in the format of PDF, which can be opened using free programs like Adobe Reader.

Simple Ira Contribution Rules Choosing Your Gold IRA

What Is A Non deductible IRA Finance Strategists

Check more sample of Should You Make Non Deductible Ira Contributions below

Deductible IRA Contribution Independent Fiduciary Advisor

Can I Make A Deductible IRA Contribution Echo45 Advisors

What Is A Non deductible IRA Empower

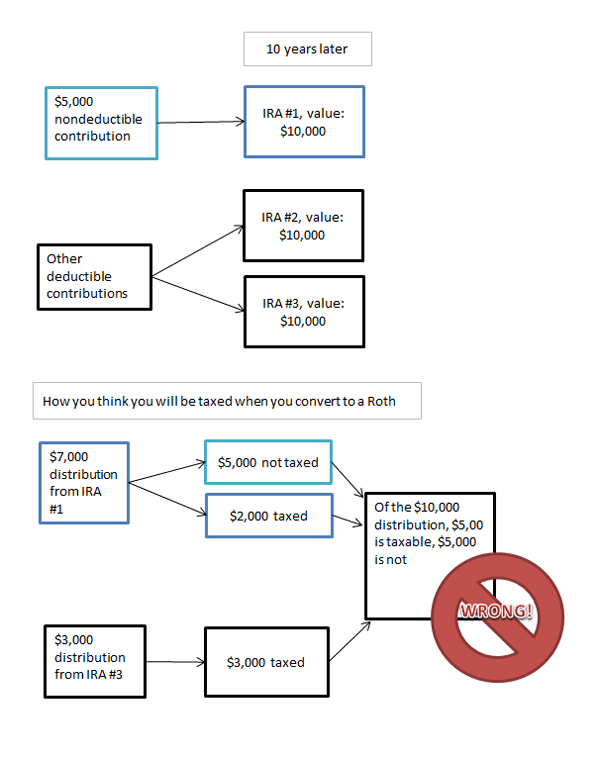

Avoid Getting Taxed Twice On Non Deductible IRA Contributions Axiom

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

How Are Non Deductible IRA Contributions Taxed When Withdrawn

https://www.thebalancemoney.com

A nondeductible contribution to your IRA may pay off in the future Learn about the income limits that may allow you to make tax free contributions

https://www.financestrategists.com › retir…

A Non Deductible IRA is a special type of Individual Retirement Arrangement in which when an IRA is opened or started the contributions that are made into it are not deductible from the investor s federal income taxes

A nondeductible contribution to your IRA may pay off in the future Learn about the income limits that may allow you to make tax free contributions

A Non Deductible IRA is a special type of Individual Retirement Arrangement in which when an IRA is opened or started the contributions that are made into it are not deductible from the investor s federal income taxes

Avoid Getting Taxed Twice On Non Deductible IRA Contributions Axiom

Can I Make A Deductible IRA Contribution Echo45 Advisors

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

How Are Non Deductible IRA Contributions Taxed When Withdrawn

Non Deductible IRA Contributions Could Tax You Twice NerdWallet

Why I Am Against Non Deductible IRA Contributions YouTube

Why I Am Against Non Deductible IRA Contributions YouTube

Taxes On Non Deductible IRA Contributions Page 66 Marotta On Money