In the age of digital, in which screens are the norm but the value of tangible printed objects isn't diminished. Whether it's for educational purposes in creative or artistic projects, or simply adding personal touches to your area, What Happens With Nondeductible Ira Contributions are now a useful source. In this article, we'll take a dive to the depths of "What Happens With Nondeductible Ira Contributions," exploring the different types of printables, where they are, and how they can enhance various aspects of your life.

Get Latest What Happens With Nondeductible Ira Contributions Below

What Happens With Nondeductible Ira Contributions

What Happens With Nondeductible Ira Contributions - What Happens With Nondeductible Ira Contributions, What To Do With Non Deductible Ira Contributions, Is There An Income Limit For Nondeductible Ira Contributions, What Are Non-deductible Ira Contributions

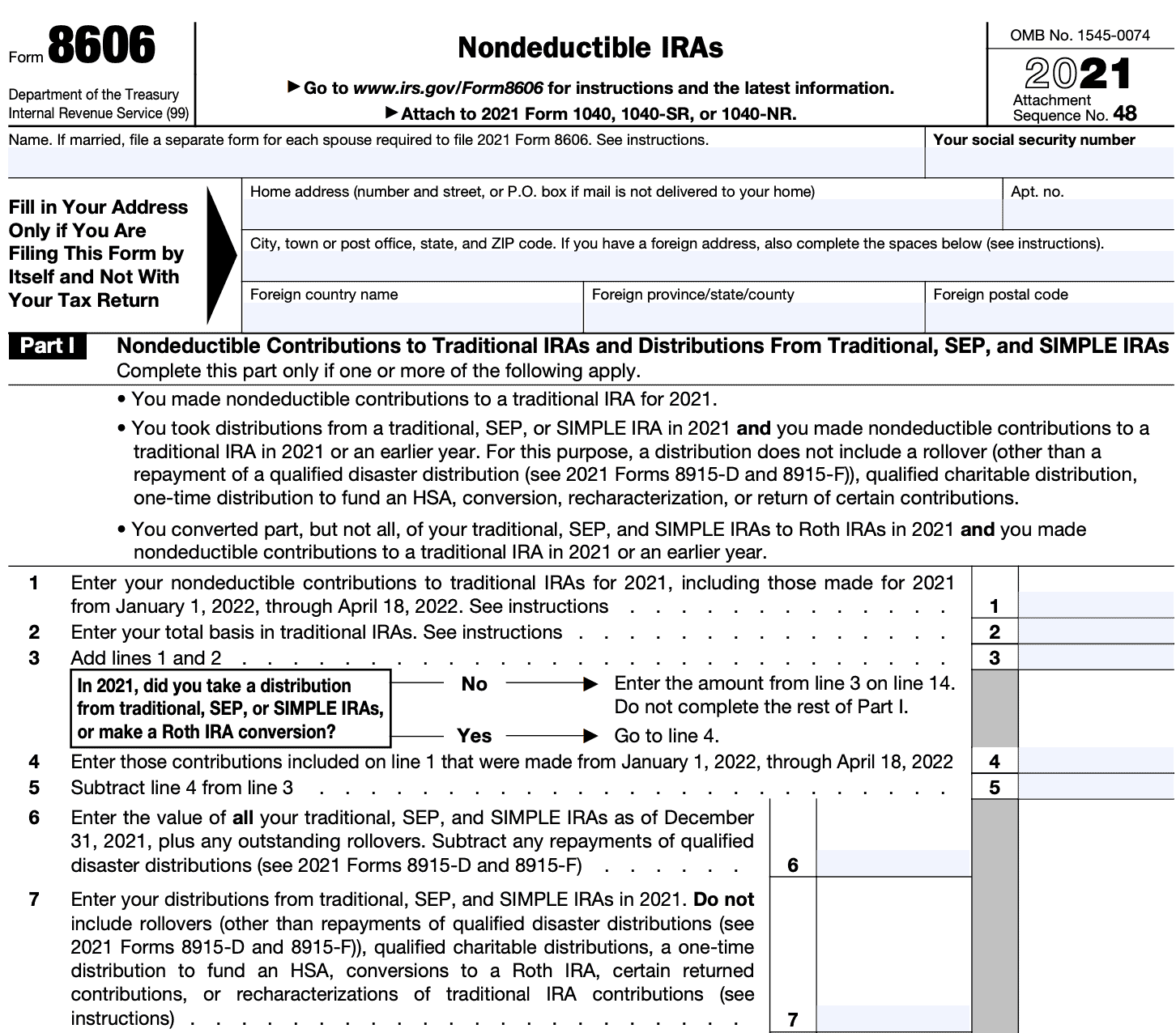

To assist you in complying with the tax rules for IRAs this publication contains worksheets and sample forms which can be found throughout the publication and in the appendices at the end

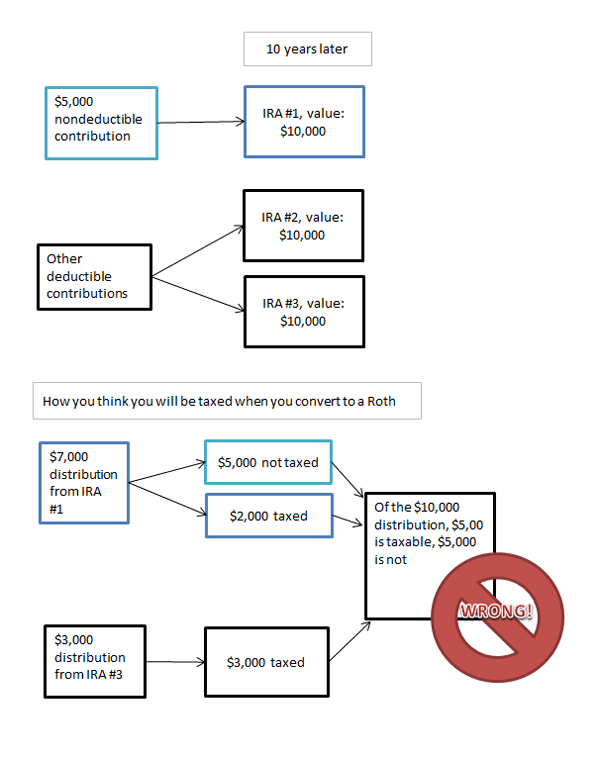

A non deductible IRA is a retirement account that behaves like a traditional IRA except that it is funded with after tax dollars

What Happens With Nondeductible Ira Contributions cover a large array of printable content that can be downloaded from the internet at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and more. The appeal of printables for free is their flexibility and accessibility.

More of What Happens With Nondeductible Ira Contributions

Additional Nondeductible IRA Contribution Source

Additional Nondeductible IRA Contribution Source

An individual who fails to file Form 8606 to report a nondeductible contribution will owe the IRS a 50 penalty

It s generally used by people who earn more than the IRA income limit

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Personalization You can tailor designs to suit your personal needs when it comes to designing invitations, organizing your schedule, or decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free offer a wide range of educational content for learners from all ages, making these printables a powerful tool for parents and teachers.

-

Accessibility: You have instant access various designs and templates cuts down on time and efforts.

Where to Find more What Happens With Nondeductible Ira Contributions

Simple Ira Contribution Rules Choosing Your Gold IRA

Simple Ira Contribution Rules Choosing Your Gold IRA

When you open a nondeductible IRA you won t need to specify a special type of IRA it s simply a traditional IRA funded with nondeductible contributions You don t need

A Non Deductible IRA is a special type of Individual Retirement Arrangement in which when an IRA is opened or started the contributions that are made into it are not deductible from the investor s federal income taxes

Now that we've ignited your interest in What Happens With Nondeductible Ira Contributions Let's take a look at where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of What Happens With Nondeductible Ira Contributions suitable for many reasons.

- Explore categories like decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- This is a great resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs covered cover a wide variety of topics, from DIY projects to party planning.

Maximizing What Happens With Nondeductible Ira Contributions

Here are some creative ways how you could make the most use of What Happens With Nondeductible Ira Contributions:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets from the internet to build your knowledge at home and in class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What Happens With Nondeductible Ira Contributions are a treasure trove with useful and creative ideas that cater to various needs and needs and. Their accessibility and flexibility make them a wonderful addition to any professional or personal life. Explore the endless world of What Happens With Nondeductible Ira Contributions today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can print and download these resources at no cost.

-

Can I make use of free printables in commercial projects?

- It is contingent on the specific conditions of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright concerns with What Happens With Nondeductible Ira Contributions?

- Some printables may have restrictions on usage. Check these terms and conditions as set out by the author.

-

How can I print What Happens With Nondeductible Ira Contributions?

- Print them at home with either a printer at home or in the local print shops for higher quality prints.

-

What program must I use to open printables for free?

- The majority are printed in PDF format, which is open with no cost software like Adobe Reader.

IRS Form 8606 A Comprehensive Guide To Nondeductible IRAs

How Are Non Deductible IRA Contributions Taxed When Withdrawn

Check more sample of What Happens With Nondeductible Ira Contributions below

SEP IRA Vs Roth IRA Definition How To Set Up Major Differences

Nondeductible IRA Contributions Require Careful Tracking Ryan

Taxes On Non Deductible IRA Contributions Page 66 Marotta On Money

What Is A Nondeductible IRA Rebalance

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

The Ins And Outs Of Reporting Nondeductible IRA Contributions Seiler

https://smartasset.com › retirement › what-i…

A non deductible IRA is a retirement account that behaves like a traditional IRA except that it is funded with after tax dollars

https://www.investopedia.com › retire…

Non deductible IRAs are particularly attractive for people who are restricted by income limits in how much money they can put away for retirement

A non deductible IRA is a retirement account that behaves like a traditional IRA except that it is funded with after tax dollars

Non deductible IRAs are particularly attractive for people who are restricted by income limits in how much money they can put away for retirement

What Is A Nondeductible IRA Rebalance

Nondeductible IRA Contributions Require Careful Tracking Ryan

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

The Ins And Outs Of Reporting Nondeductible IRA Contributions Seiler

Business Concept About Nondeductible Ira Phrase Stock Photo 1973323016

Nondeductible IRA Distributions Fishman Block Diamond LLP

Nondeductible IRA Distributions Fishman Block Diamond LLP

Roth Ira Growth Calculator GarveenIndia