Today, with screens dominating our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education or creative projects, or just adding an extra personal touch to your space, What To Do With Non Deductible Ira Contributions have become a valuable source. With this guide, you'll dive into the sphere of "What To Do With Non Deductible Ira Contributions," exploring what they are, how they are, and how they can add value to various aspects of your daily life.

Get Latest What To Do With Non Deductible Ira Contributions Below

What To Do With Non Deductible Ira Contributions

What To Do With Non Deductible Ira Contributions -

Here is a step by step guide for converting a nondeductible IRA to a Roth IRA and calculating how much you will have to pay in taxes

This is how you prevent non deductible IRA contributions from being taxed twice Additional tax traps to consider before making non deductible IRA contributions State tax laws

Printables for free include a vast collection of printable items that are available online at no cost. These resources come in various types, such as worksheets templates, coloring pages, and many more. The appeal of printables for free is in their variety and accessibility.

More of What To Do With Non Deductible Ira Contributions

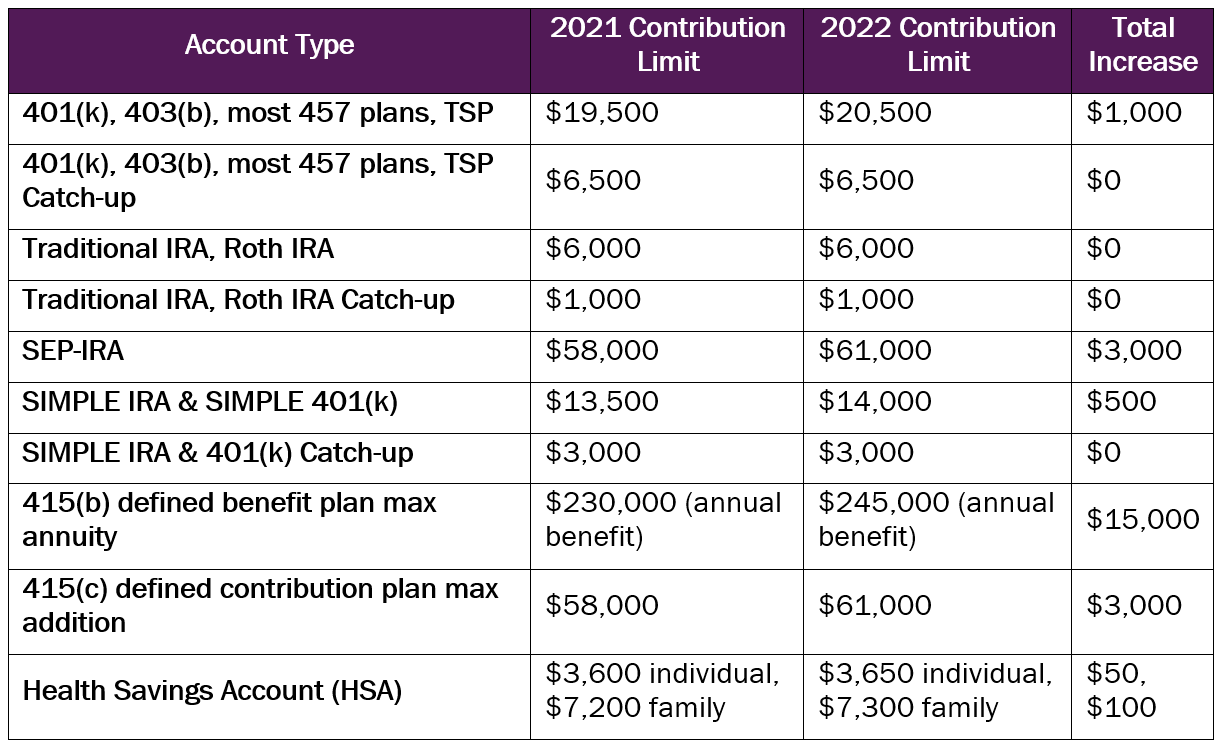

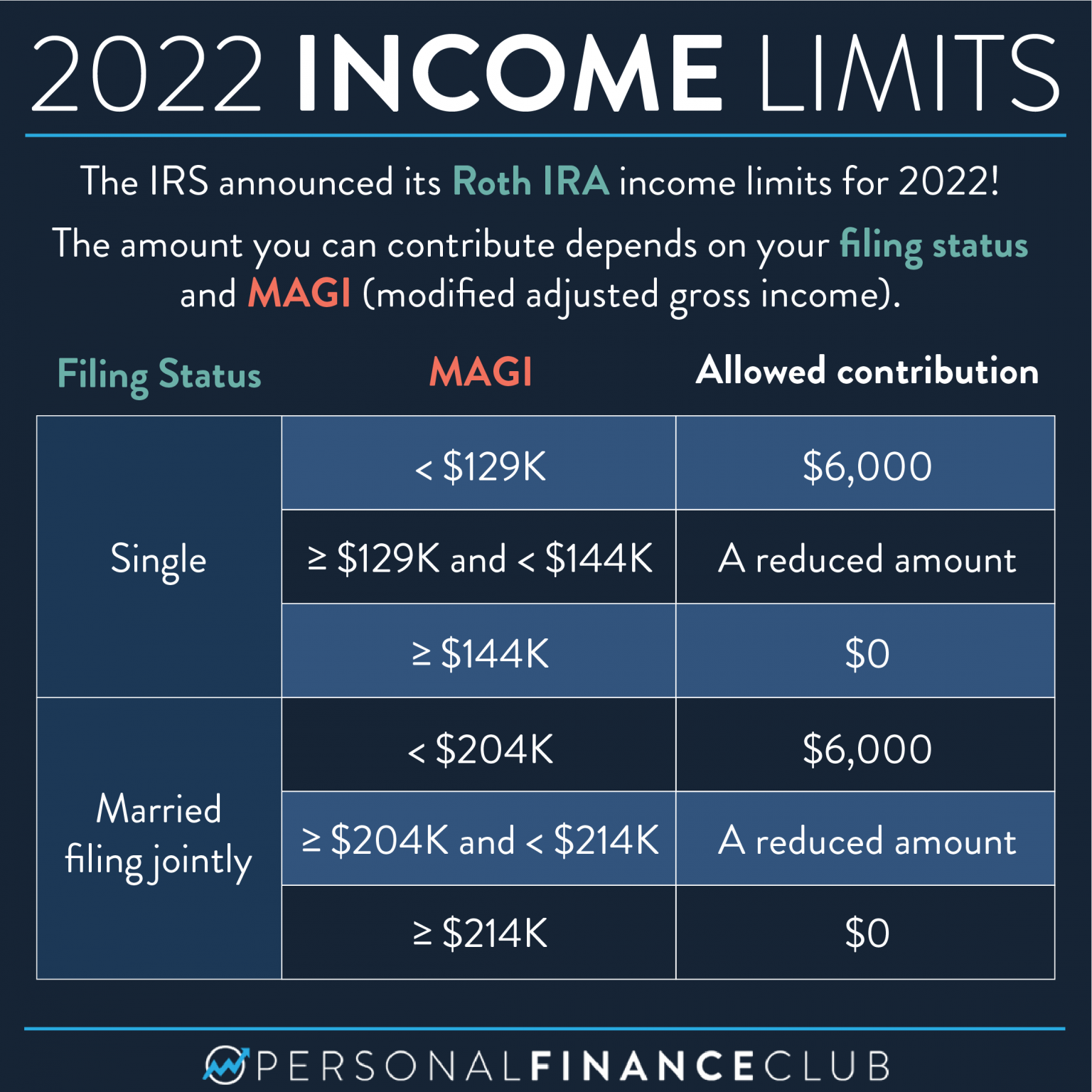

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Taxes can get complicated with nondeductible IRAs but here s what you need to know Most people use traditional IRAs to make deductible contributions that result in

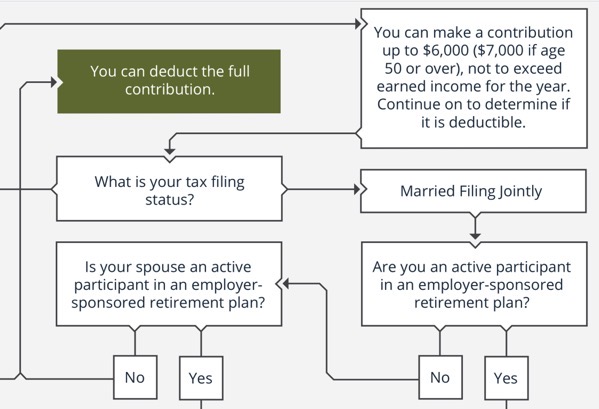

Nondeductible IRA contributions provide a way around the Roth IRA income limits You can contribute to a nondeductible IRA then do a Roth IRA conversion to put money into the

What To Do With Non Deductible Ira Contributions have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Modifications: This allows you to modify print-ready templates to your specific requirements such as designing invitations to organize your schedule or decorating your home.

-

Educational Value Educational printables that can be downloaded for free can be used by students from all ages, making them an invaluable aid for parents as well as educators.

-

Convenience: instant access a variety of designs and templates, which saves time as well as effort.

Where to Find more What To Do With Non Deductible Ira Contributions

Understanding Nondeductible Expenses For Business Owners

Understanding Nondeductible Expenses For Business Owners

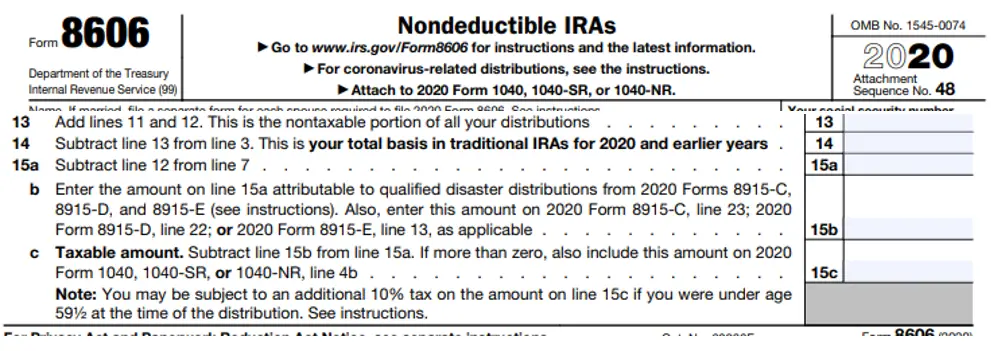

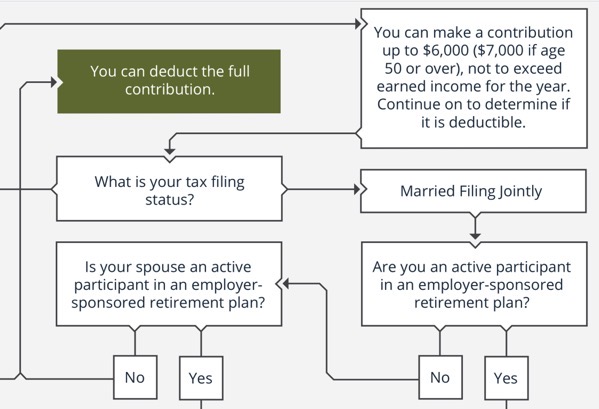

Any money you contribute to a traditional IRA that you do not deduct on your tax return is a nondeductible contribution You still must report these contributions on your return and you use Form 8606 to do so

If you re not eligible to deduct traditional IRA contributions you can still contribute to that workplace plan especially if your employer offers matching dollars and the nondeductible

Now that we've piqued your interest in What To Do With Non Deductible Ira Contributions Let's find out where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in What To Do With Non Deductible Ira Contributions for different objectives.

- Explore categories like decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets with flashcards and other teaching materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide array of topics, ranging all the way from DIY projects to party planning.

Maximizing What To Do With Non Deductible Ira Contributions

Here are some inventive ways of making the most use of What To Do With Non Deductible Ira Contributions:

1. Home Decor

- Print and frame gorgeous images, quotes, or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home and in class.

3. Event Planning

- Invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

What To Do With Non Deductible Ira Contributions are a treasure trove with useful and creative ideas that cater to various needs and interests. Their accessibility and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the wide world that is What To Do With Non Deductible Ira Contributions today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are What To Do With Non Deductible Ira Contributions truly absolutely free?

- Yes you can! You can print and download the resources for free.

-

Can I utilize free templates for commercial use?

- It's dependent on the particular conditions of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright issues when you download What To Do With Non Deductible Ira Contributions?

- Certain printables might have limitations in use. Make sure to read the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home using any printer or head to the local print shops for the highest quality prints.

-

What software will I need to access What To Do With Non Deductible Ira Contributions?

- Many printables are offered in PDF format. They can be opened using free software, such as Adobe Reader.

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

IRS Form 8606 Nondeductible IRAs Walkthrough For 2022 YouTube

Check more sample of What To Do With Non Deductible Ira Contributions below

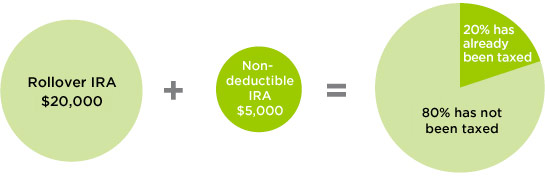

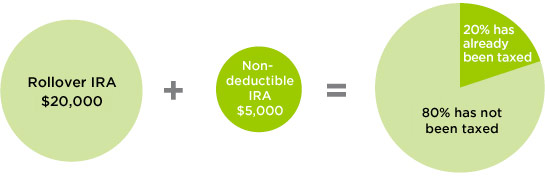

How Are Non Deductible IRA Contributions Taxed When Withdrawn

Deductible IRA Contribution Independent Fiduciary Advisor

What Is A Non deductible IRA Empower

How Are Non Deductible IRA Contributions Taxed When Withdrawn

Non deductible IRA Contributions And Roth Conversions Putnam Wealth

Non Deductible IRA Contributions Could Tax You Twice NerdWallet

https://www.forbes.com › sites › kristinmckenna › ...

This is how you prevent non deductible IRA contributions from being taxed twice Additional tax traps to consider before making non deductible IRA contributions State tax laws

https://www.financestrategists.com › retir…

To be eligible for Non Deductible IRA accounts the individual must meet the following eligibility requirements Be under 70 years of age Not be covered by an employer s retirement plan Cannot be a Non Spouse

This is how you prevent non deductible IRA contributions from being taxed twice Additional tax traps to consider before making non deductible IRA contributions State tax laws

To be eligible for Non Deductible IRA accounts the individual must meet the following eligibility requirements Be under 70 years of age Not be covered by an employer s retirement plan Cannot be a Non Spouse

How Are Non Deductible IRA Contributions Taxed When Withdrawn

Deductible IRA Contribution Independent Fiduciary Advisor

Non deductible IRA Contributions And Roth Conversions Putnam Wealth

Non Deductible IRA Contributions Could Tax You Twice NerdWallet

Why I Am Against Non Deductible IRA Contributions YouTube

Investment Expenses What s Tax Deductible Charles Schwab

Investment Expenses What s Tax Deductible Charles Schwab

Traditional IRA Vs Roth IRA Which One Is Right For You Capstone