In this day and age where screens dominate our lives, the charm of tangible printed materials isn't diminishing. Be it for educational use project ideas, artistic or simply to add an individual touch to the area, Tax Rebate On Home Loan Interest Paid have proven to be a valuable source. With this guide, you'll take a dive deep into the realm of "Tax Rebate On Home Loan Interest Paid," exploring their purpose, where they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Tax Rebate On Home Loan Interest Paid Below

Tax Rebate On Home Loan Interest Paid

Tax Rebate On Home Loan Interest Paid - Tax Rebate On Interest Paid On Home Loan, Income Tax Rebate On Interest Paid On Home Loan, Is Interest Paid On A Home Mortgage Tax Deductible, Is Home Loan Interest Tax Deductible, Is Interest On Housing Loan Exempt From Tax, How Much Of My Home Loan Interest Is Tax Deductible

Web 1 f 233 vr 2021 nbsp 0183 32 Another rule is that if the construction of your under construction house is not completed within 5 years from the year in which the home loan was taken then the tax

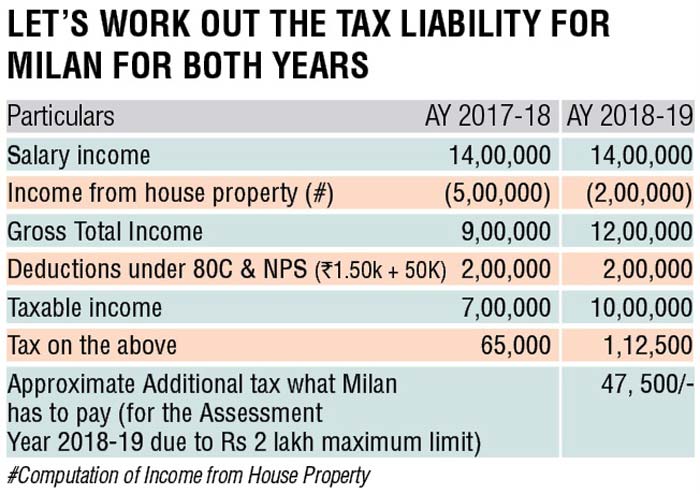

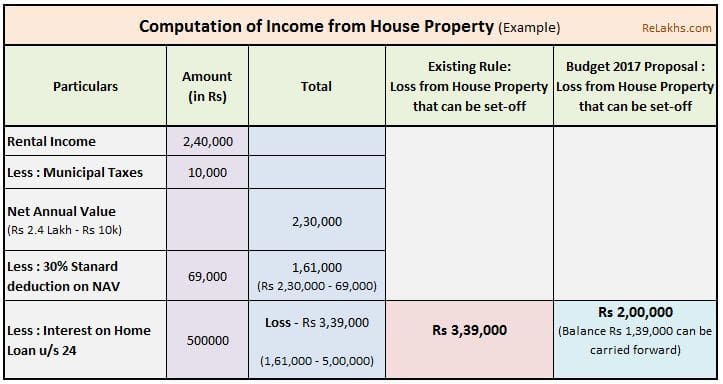

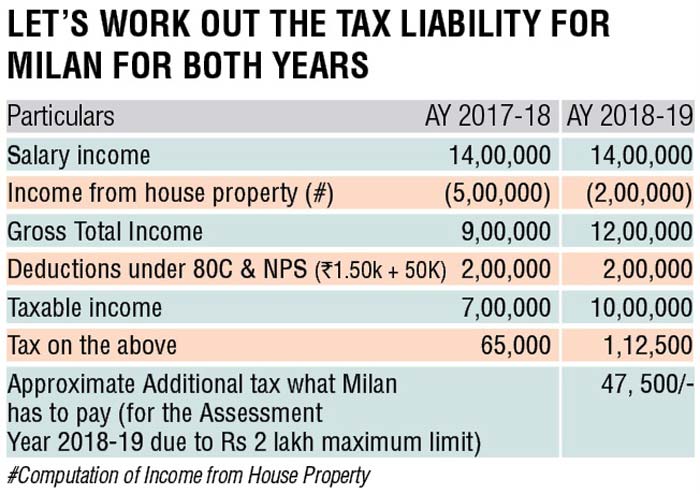

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Tax Rebate On Home Loan Interest Paid offer a wide array of printable material that is available online at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and many more. The value of Tax Rebate On Home Loan Interest Paid is in their variety and accessibility.

More of Tax Rebate On Home Loan Interest Paid

Home Loan Interest Rebate On Home Loan Interest In Income Tax

Home Loan Interest Rebate On Home Loan Interest In Income Tax

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Web 4 janv 2023 nbsp 0183 32 You can claim a tax deduction for the interest on the first 750 000 of your mortgage 375 000 if married filing separately HELOCs are no longer eligible for the

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

The ability to customize: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: Printables for education that are free are designed to appeal to students of all ages. This makes these printables a powerful tool for parents and educators.

-

Convenience: Quick access to the vast array of design and templates saves time and effort.

Where to Find more Tax Rebate On Home Loan Interest Paid

Rising Home Loan Interests Have Begun To Impact Homebuyers

Rising Home Loan Interests Have Begun To Impact Homebuyers

Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home loan

Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year So if you have a mortgage keep good records

We've now piqued your interest in Tax Rebate On Home Loan Interest Paid, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection and Tax Rebate On Home Loan Interest Paid for a variety reasons.

- Explore categories such as decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a wide spectrum of interests, from DIY projects to party planning.

Maximizing Tax Rebate On Home Loan Interest Paid

Here are some ideas ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Rebate On Home Loan Interest Paid are a treasure trove of creative and practical resources for a variety of needs and pursuits. Their access and versatility makes them a great addition to both professional and personal life. Explore the world of Tax Rebate On Home Loan Interest Paid today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Rebate On Home Loan Interest Paid truly gratis?

- Yes you can! You can download and print these resources at no cost.

-

Does it allow me to use free printables for commercial purposes?

- It's based on specific conditions of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright violations with Tax Rebate On Home Loan Interest Paid?

- Certain printables could be restricted in their usage. Be sure to review these terms and conditions as set out by the designer.

-

How do I print printables for free?

- You can print them at home using your printer or visit an in-store print shop to get more high-quality prints.

-

What software do I require to view printables for free?

- The majority of PDF documents are provided in PDF format. They can be opened using free software, such as Adobe Reader.

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers

Check more sample of Tax Rebate On Home Loan Interest Paid below

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Essential Design Smartphone Apps

Douglass Connelly

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Understanding The Tax Benefit Of Home Loan Interest

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://www.livemint.com/money/personal-fina…

Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to possession

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to possession

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Essential Design Smartphone Apps

Understanding The Tax Benefit Of Home Loan Interest

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Online Free Stuffs Free Home Mortgage Calculator For Microsoft Excel

Online Free Stuffs Free Home Mortgage Calculator For Microsoft Excel

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk