In this age of electronic devices, with screens dominating our lives, the charm of tangible, printed materials hasn't diminished. No matter whether it's for educational uses and creative work, or simply to add an individual touch to your home, printables for free are now a vital source. We'll dive into the sphere of "Is Interest Paid On A Home Mortgage Tax Deductible," exploring what they are, how to find them, and how they can enrich various aspects of your lives.

Get Latest Is Interest Paid On A Home Mortgage Tax Deductible Below

Is Interest Paid On A Home Mortgage Tax Deductible

Is Interest Paid On A Home Mortgage Tax Deductible -

You may deduct in each year only the interest that applies to that year However an exception applies to points paid on a principal residence see Topic no 504 Types of interest deductible as itemized deductions on Schedule A Form 1040 Itemized Deductions include

The name says it all The mortgage interest deduction allows you to deduct only the interest not the principal you pay on your mortgage Let s say your monthly mortgage payment is 1 500

Is Interest Paid On A Home Mortgage Tax Deductible encompass a wide variety of printable, downloadable content that can be downloaded from the internet at no cost. These resources come in many formats, such as worksheets, templates, coloring pages, and many more. The benefit of Is Interest Paid On A Home Mortgage Tax Deductible lies in their versatility and accessibility.

More of Is Interest Paid On A Home Mortgage Tax Deductible

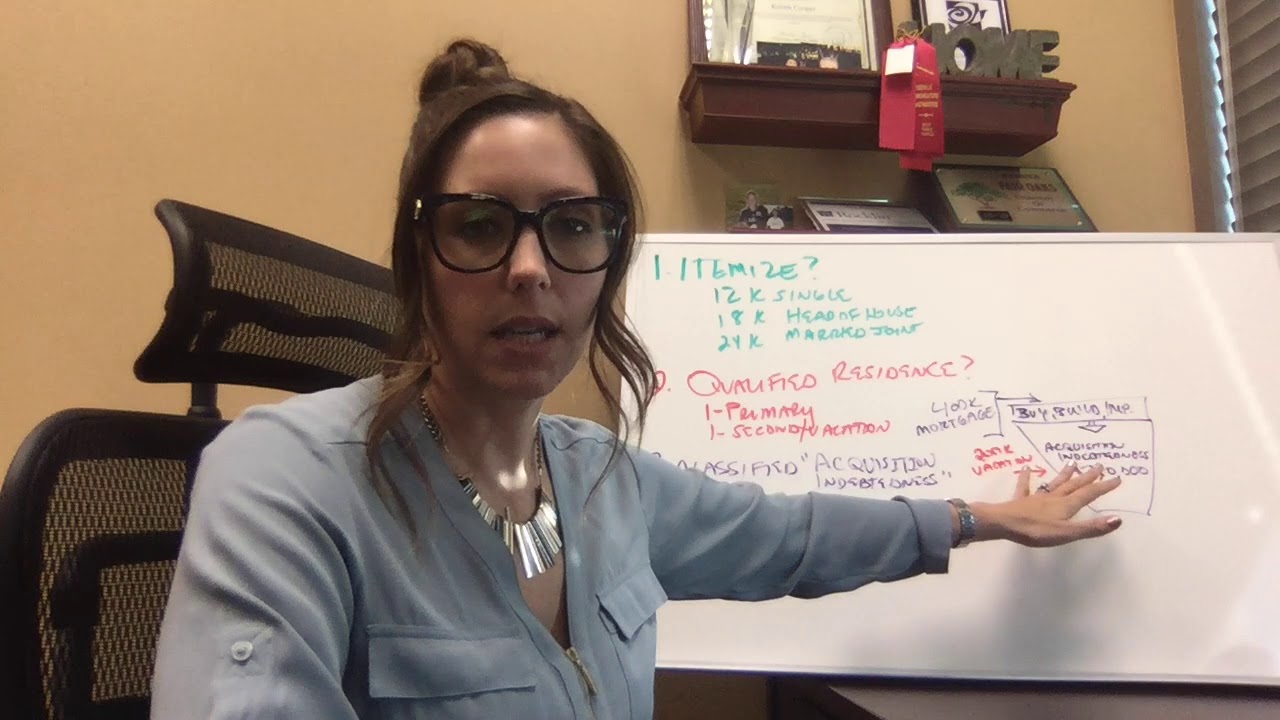

Make Your Mortgage Tax Deductible YouTube

Make Your Mortgage Tax Deductible YouTube

If you re a homeowner you probably qualify for a deduction on your home mortgage interest The tax deduction also applies if you pay interest on a condominium cooperative mobile home boat or recreational vehicle used as a residence TABLE OF CONTENTS It pays to take mortgage interest deductions

Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans

Is Interest Paid On A Home Mortgage Tax Deductible have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Customization: We can customize printables to your specific needs whether it's making invitations or arranging your schedule or decorating your home.

-

Education Value These Is Interest Paid On A Home Mortgage Tax Deductible are designed to appeal to students of all ages, which makes them a great tool for parents and educators.

-

It's easy: Access to various designs and templates reduces time and effort.

Where to Find more Is Interest Paid On A Home Mortgage Tax Deductible

Contrary To Popular Belief Mortgage Interest Is Not Always Tax

Contrary To Popular Belief Mortgage Interest Is Not Always Tax

You can fully deduct most interest paid on home mortgages if all the requirements are met First you must separate qualified mortgage interest from personal interest Mortgage interest is usually deductible but personal interest isn t The deduction for mortgage interest is allowed only for acquisition debt

Key Takeaways Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages of up to 1 million A mortgage calculator can help you determine how much interest you paid each month last year

Now that we've piqued your interest in printables for free Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection and Is Interest Paid On A Home Mortgage Tax Deductible for a variety reasons.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a broad selection of subjects, from DIY projects to planning a party.

Maximizing Is Interest Paid On A Home Mortgage Tax Deductible

Here are some innovative ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Utilize free printable worksheets for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is Interest Paid On A Home Mortgage Tax Deductible are a treasure trove of practical and imaginative resources which cater to a wide range of needs and hobbies. Their accessibility and versatility make them an invaluable addition to both professional and personal life. Explore the wide world of Is Interest Paid On A Home Mortgage Tax Deductible right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Interest Paid On A Home Mortgage Tax Deductible really for free?

- Yes they are! You can download and print these materials for free.

-

Can I make use of free printables in commercial projects?

- It's determined by the specific conditions of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables could have limitations in their usage. Be sure to review the terms and condition of use as provided by the author.

-

How do I print Is Interest Paid On A Home Mortgage Tax Deductible?

- You can print them at home using printing equipment or visit a print shop in your area for top quality prints.

-

What software do I need to open printables that are free?

- The majority of printed documents are in PDF format, which can be opened using free programs like Adobe Reader.

How To Calculate Interest Rate Per Month Formula Haiper

Is Mortgage Interest Tax Deductible In 2023 Orchard

Check more sample of Is Interest Paid On A Home Mortgage Tax Deductible below

Is Reverse Mortgage Interest Tax Deductible REVERSE MORTGAGE LOAN

Making Your Home Mortgage Tax Deductible Purtzki Johansen Associates

Are Mortgage Points Tax Deductible AZexplained

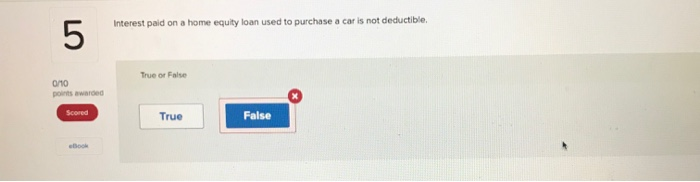

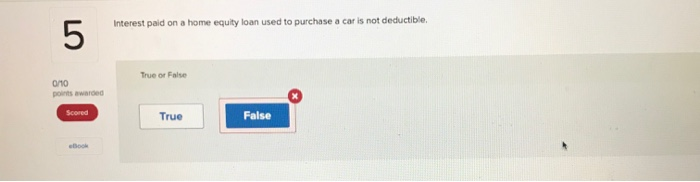

Solved 5 Interest Paid On A Home Equity Loan Used To Chegg

Mortgage Interest Tax Deductible 2023

How To Calculate Your Monthly Mortgage Payment Given The Principal

https://www.forbes.com/advisor/mortgages/mortgage-interest-

The name says it all The mortgage interest deduction allows you to deduct only the interest not the principal you pay on your mortgage Let s say your monthly mortgage payment is 1 500

https://www.irs.gov/publications/p936

You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebtedness However higher limitations 1 million 500 000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017 Future developments

The name says it all The mortgage interest deduction allows you to deduct only the interest not the principal you pay on your mortgage Let s say your monthly mortgage payment is 1 500

You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebtedness However higher limitations 1 million 500 000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017 Future developments

Solved 5 Interest Paid On A Home Equity Loan Used To Chegg

Making Your Home Mortgage Tax Deductible Purtzki Johansen Associates

Mortgage Interest Tax Deductible 2023

How To Calculate Your Monthly Mortgage Payment Given The Principal

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

32 Is Your Mortgage Tax Deductible DaanyaalFenrir

32 Is Your Mortgage Tax Deductible DaanyaalFenrir

When Is Mortgage Interest Tax Deductible YouTube