In the age of digital, in which screens are the norm it's no wonder that the appeal of tangible, printed materials hasn't diminished. Be it for educational use such as creative projects or simply adding some personal flair to your home, printables for free are now a vital resource. In this article, we'll dive deeper into "State Pension Lump Sum Tax Treatment," exploring the benefits of them, where they are, and how they can enrich various aspects of your life.

Get Latest State Pension Lump Sum Tax Treatment Below

State Pension Lump Sum Tax Treatment

State Pension Lump Sum Tax Treatment - State Pension Lump Sum Tax Treatment, Tax Treatment Of Deferred State Pension Lump Sum, How Is State Pension Lump Sum Taxed, Is State Pension Lump Sum Taxable, Can I Claim Back Tax On A Pension Lump Sum, Can I Take My Pension Lump Sum Tax Free

You ll pay Income Tax on any part of the lump sum that goes above either your lump sum allowance your lump sum and death benefit allowance Find out what your lump sum

Do I pay tax on deferred state pension If you decide to take an extra pension you ll simply pay income tax on the total amount of income you have from all of your pensions If you decide to take the

State Pension Lump Sum Tax Treatment encompass a wide range of downloadable, printable materials online, at no cost. They come in many designs, including worksheets templates, coloring pages and many more. The beauty of State Pension Lump Sum Tax Treatment is their versatility and accessibility.

More of State Pension Lump Sum Tax Treatment

TAX LUMP SUM

TAX LUMP SUM

The tax treatment of state pension lump sums is different from that of pensions State pension payments like other pension payments count towards taxable income so are taxed at your

If you take an uncrystallised pension fund lump tax should be automatically deducted from your lump sum by your pension company through the Pay As You Earn system or PAYE If you take a lump sum

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization The Customization feature lets you tailor printables to your specific needs be it designing invitations to organize your schedule or decorating your home.

-

Educational Use: Downloads of educational content for free offer a wide range of educational content for learners of all ages, making the perfect device for teachers and parents.

-

Affordability: You have instant access various designs and templates cuts down on time and efforts.

Where to Find more State Pension Lump Sum Tax Treatment

Lump Sum Payment What It Is How It Works Pros Cons

Lump Sum Payment What It Is How It Works Pros Cons

An OPS will also need to meet a tax recognition test FA 2017 gives special treatment to lump sums paid from an OPS A lump sum from an OPS may benefit from a reduction in the taxable amount of 25 in

Taking a one off taxable lump sum payment if you put off claiming your State Pension for at least 12 months and then getting your normal weekly State Pension for life For

We've now piqued your interest in State Pension Lump Sum Tax Treatment and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of purposes.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets as well as flashcards and other learning materials.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a broad range of interests, all the way from DIY projects to party planning.

Maximizing State Pension Lump Sum Tax Treatment

Here are some ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

State Pension Lump Sum Tax Treatment are an abundance of innovative and useful resources for a variety of needs and hobbies. Their availability and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the vast world of State Pension Lump Sum Tax Treatment now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes they are! You can print and download these materials for free.

-

Does it allow me to use free printables for commercial use?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with State Pension Lump Sum Tax Treatment?

- Some printables may have restrictions on their use. Make sure to read the terms of service and conditions provided by the author.

-

How can I print State Pension Lump Sum Tax Treatment?

- Print them at home using the printer, or go to a local print shop for superior prints.

-

What software is required to open printables that are free?

- The majority of PDF documents are provided in the PDF format, and can be opened using free software like Adobe Reader.

Lump Sum Tax What Is It Formula Calculation Example

Should You Take A Tax free Lump Sum From Your Pension Mortgage

Check more sample of State Pension Lump Sum Tax Treatment below

Should I Pay Income Tax In Installment Or Lump Sum Prudent Dreamer

Should You Take A Lump Sum Or Monthly Pension When You Retire

AT T Pension Lump Sum Interest Rates October On Vimeo

Retirement Pension Lump Sum Or Monthly Annuity Payment Pure

DB Tax Free Lump Sum T mobile

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

https://www.which.co.uk/money/pensions-…

Do I pay tax on deferred state pension If you decide to take an extra pension you ll simply pay income tax on the total amount of income you have from all of your pensions If you decide to take the

https://www.taxadvisermagazine.com/ar…

Then claim a deferred state pension lump sum of 60 000 in the 2018 19 tax year at a time when the weekly state pension received will keep them within their personal allowance and then in 2019 20

Do I pay tax on deferred state pension If you decide to take an extra pension you ll simply pay income tax on the total amount of income you have from all of your pensions If you decide to take the

Then claim a deferred state pension lump sum of 60 000 in the 2018 19 tax year at a time when the weekly state pension received will keep them within their personal allowance and then in 2019 20

Retirement Pension Lump Sum Or Monthly Annuity Payment Pure

Should You Take A Lump Sum Or Monthly Pension When You Retire

DB Tax Free Lump Sum T mobile

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Tax free Lump Sum On Death Hutt Professional Financial Planning

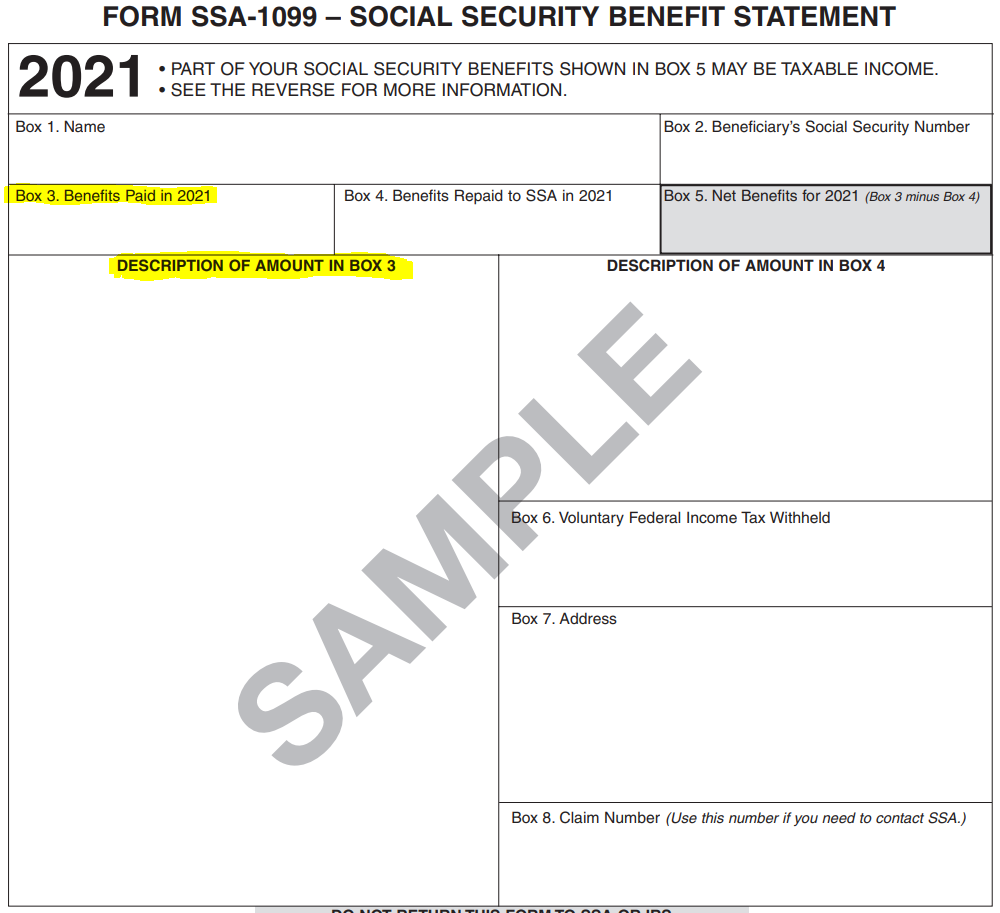

What Is A Lump Sum Payment SSA 1099 Support

What Is A Lump Sum Payment SSA 1099 Support

Lump Sum Pension Distribution Or Defined Benefit Plans Posts By