In this age of electronic devices, where screens have become the dominant feature of our lives and the appeal of physical printed objects hasn't waned. It doesn't matter if it's for educational reasons or creative projects, or simply adding a personal touch to your home, printables for free have become a valuable resource. We'll dive deep into the realm of "Tax Treatment Of Deferred State Pension Lump Sum," exploring the different types of printables, where they are, and how they can be used to enhance different aspects of your lives.

Get Latest Tax Treatment Of Deferred State Pension Lump Sum Below

Tax Treatment Of Deferred State Pension Lump Sum

Tax Treatment Of Deferred State Pension Lump Sum - Tax Treatment Of Deferred State Pension Lump Sum, How Is Deferred State Pension Lump Sum Taxed, Is Deferred State Pension Lump Sum Taxable, Is Deferred Pension Lump Sum Taxable, How Much Tax Will I Pay On My Deferred State Pension Lump Sum

The state pension lump sum is taxable in the year in which the person is entitled to it i e when the lump sum option is chosen on ceasing to defer This is irrespective of when it is actually paid

Taking a one off taxable lump sum payment if you put off claiming your State Pension for at least 12 months and then getting your normal weekly State Pension for life For

Printables for free include a vast selection of printable and downloadable materials online, at no cost. These resources come in many forms, like worksheets templates, coloring pages, and much more. The value of Tax Treatment Of Deferred State Pension Lump Sum lies in their versatility as well as accessibility.

More of Tax Treatment Of Deferred State Pension Lump Sum

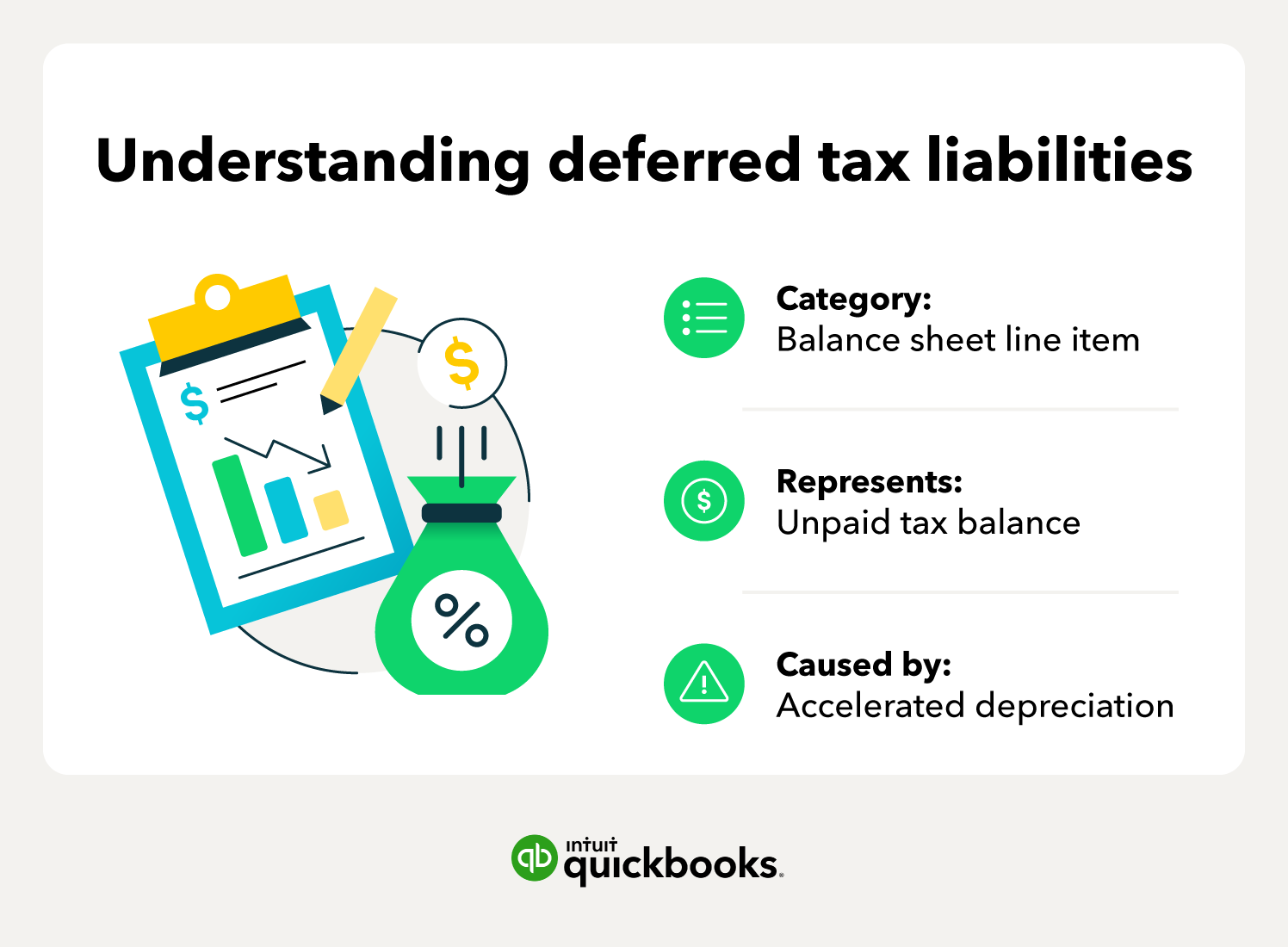

Is Deferred Revenue A Current Asset Or Liability Leia Aqui Is

Is Deferred Revenue A Current Asset Or Liability Leia Aqui Is

If you choose to have State Pension you didn t get paid as a lump sum this will be taxed at your current rate of Income Tax on your lump sum payment For

You may be able to defer tax on all or part of a lump sum distribution by requesting the payer to directly roll over the taxable portion into an individual retirement arrangement

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Flexible: It is possible to tailor printables to your specific needs be it designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value These Tax Treatment Of Deferred State Pension Lump Sum can be used by students of all ages, which makes them a valuable tool for teachers and parents.

-

An easy way to access HTML0: Fast access a variety of designs and templates helps save time and effort.

Where to Find more Tax Treatment Of Deferred State Pension Lump Sum

AT T Pension Lump Sum Interest Rates October On Vimeo

AT T Pension Lump Sum Interest Rates October On Vimeo

The tax treatment of state pension lump sums is different from that of pensions State pension payments like other pension payments count towards

State pension lump sum is taxable in the year in which it is received and will normally be charged in the tax calculation at the appropriate rate as there are specific rules about

Now that we've piqued your curiosity about Tax Treatment Of Deferred State Pension Lump Sum Let's look into where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Tax Treatment Of Deferred State Pension Lump Sum designed for a variety needs.

- Explore categories such as home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- The blogs are a vast selection of subjects, everything from DIY projects to planning a party.

Maximizing Tax Treatment Of Deferred State Pension Lump Sum

Here are some unique ways of making the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Treatment Of Deferred State Pension Lump Sum are a treasure trove of practical and innovative resources designed to meet a range of needs and desires. Their access and versatility makes they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast collection of Tax Treatment Of Deferred State Pension Lump Sum now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Treatment Of Deferred State Pension Lump Sum really for free?

- Yes they are! You can download and print these tools for free.

-

Can I make use of free printables to make commercial products?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns with Tax Treatment Of Deferred State Pension Lump Sum?

- Some printables may come with restrictions on use. Be sure to check the terms and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in any local print store for high-quality prints.

-

What program is required to open printables free of charge?

- Many printables are offered in PDF format. These can be opened with free software like Adobe Reader.

Trial Balance To Income Statement Examples Of Temporary Differences

DB Tax Free Lump Sum T mobile

Check more sample of Tax Treatment Of Deferred State Pension Lump Sum below

How To Claim Deferred State Pension Uk Retire Gen Z

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Deferred Tax Assets Meaning JWord

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)

Lump Sum DCF Payments DCF Annuities

State Pension MbarakDaeney

Is New York State Deferred Compensation Taxable The Right Answer

https://www.citizensadvice.org.uk/Global/Migrated...

Taking a one off taxable lump sum payment if you put off claiming your State Pension for at least 12 months and then getting your normal weekly State Pension for life For

https://www.gov.uk/deferring-state-pension/what-you-get

You can get a one off lump sum payment if you defer claiming your State Pension for at least 12 months in a row This will include interest of 2 above the Bank

Taking a one off taxable lump sum payment if you put off claiming your State Pension for at least 12 months and then getting your normal weekly State Pension for life For

You can get a one off lump sum payment if you defer claiming your State Pension for at least 12 months in a row This will include interest of 2 above the Bank

Lump Sum DCF Payments DCF Annuities

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

State Pension MbarakDaeney

Is New York State Deferred Compensation Taxable The Right Answer

USA Residents With A UK Pension The 3 Most Common Questions

How To Claim Deferred State Pension 2023 Updated

How To Claim Deferred State Pension 2023 Updated

Defer State Pension MoneySavingExpert Forum