In this digital age, where screens have become the dominant feature of our lives The appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons as well as creative projects or simply adding the personal touch to your area, Maximum Tuition Fee Rebate In Income Tax have become a valuable resource. We'll dive deep into the realm of "Maximum Tuition Fee Rebate In Income Tax," exploring what they are, how they are available, and how they can add value to various aspects of your life.

Get Latest Maximum Tuition Fee Rebate In Income Tax Below

Maximum Tuition Fee Rebate In Income Tax

Maximum Tuition Fee Rebate In Income Tax - Maximum Tuition Fee Rebate In Income Tax, Tuition Fees Exemption Limit In Income Tax 2021-22, What Is The Maximum Limit Of Tuition Fees 80c, Tuition Fee Tax Rebate Section, How Much Tuition Fee Is Exempted From Income Tax, What Is The Maximum Tuition And Fees Deduction

Web 13 mai 2022 nbsp 0183 32 The maximum amount you could claim for the tuition and fees adjustment to income was 4 000 per year The deduction was further limited by income ranges

Web 5 janv 2023 nbsp 0183 32 What Is the Maximum Deduction for Tuition and Fees The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees

Maximum Tuition Fee Rebate In Income Tax provide a diverse selection of printable and downloadable resources available online for download at no cost. They come in many types, such as worksheets templates, coloring pages, and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Maximum Tuition Fee Rebate In Income Tax

Maximum Tuition Schechter Manhattan

Maximum Tuition Schechter Manhattan

Web 1 d 233 c 2022 nbsp 0183 32 The deduction is 0 2 000 or 4 000 depending on your Modified Adjusted Gross Income MAGI 4 000 deduction for MAGI of 65 000 or less 130 000 or less

Web 22 juil 2021 nbsp 0183 32 Worth a maximum benefit of up to 2 500 per eligible student Only for the first four years at an eligible college or vocational school For students pursuing a degree

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization Your HTML0 customization options allow you to customize print-ready templates to your specific requirements whether it's making invitations making your schedule, or even decorating your home.

-

Educational Worth: Education-related printables at no charge cater to learners of all ages. This makes them a useful resource for educators and parents.

-

The convenience of The instant accessibility to the vast array of design and templates can save you time and energy.

Where to Find more Maximum Tuition Fee Rebate In Income Tax

Fact Check BJP Leaders Claim That AAP Govt Is Reimbursing Fees Of

Fact Check BJP Leaders Claim That AAP Govt Is Reimbursing Fees Of

Web Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children

Web 10 sept 2018 nbsp 0183 32 Rs 80 000 under Section 80C of the ITA sums paid towards PPF LIP Balance Rs 70 000 for tuition fees 150 000 80 000 or vice versa In other words the

We've now piqued your interest in Maximum Tuition Fee Rebate In Income Tax we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Maximum Tuition Fee Rebate In Income Tax suitable for many uses.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets, flashcards, and learning materials.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs covered cover a wide array of topics, ranging including DIY projects to party planning.

Maximizing Maximum Tuition Fee Rebate In Income Tax

Here are some ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to reinforce learning at home and in class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Maximum Tuition Fee Rebate In Income Tax are an abundance of creative and practical resources for a variety of needs and preferences. Their access and versatility makes they a beneficial addition to every aspect of your life, both professional and personal. Explore the many options of Maximum Tuition Fee Rebate In Income Tax today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I download free printouts for commercial usage?

- It's dependent on the particular rules of usage. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions regarding usage. You should read the conditions and terms of use provided by the designer.

-

How can I print Maximum Tuition Fee Rebate In Income Tax?

- You can print them at home with a printer or visit a local print shop to purchase premium prints.

-

What program do I require to view printables that are free?

- A majority of printed materials are in the format PDF. This can be opened using free software such as Adobe Reader.

Income Tax Deductions For Consultants In India

Request Letter For Bonafide Certificate For Income Tax How To Write

Check more sample of Maximum Tuition Fee Rebate In Income Tax below

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

Australian Universities Offer Tuition Fee Rebates To Offshore

UK Students Ask For 30 Tuition Fee Rebate

Employee Salary Tax Calculator RhionnaLetty

Income Tax Deduction Exemption FY 2021 22 WealthTech Speaks

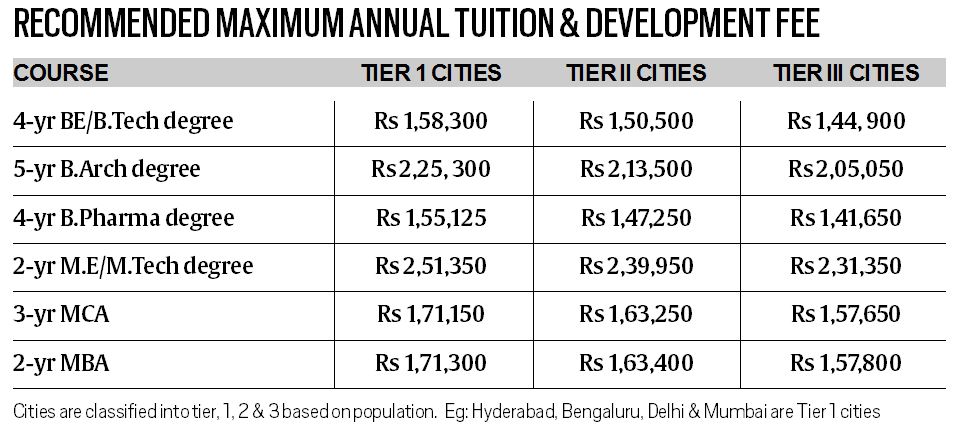

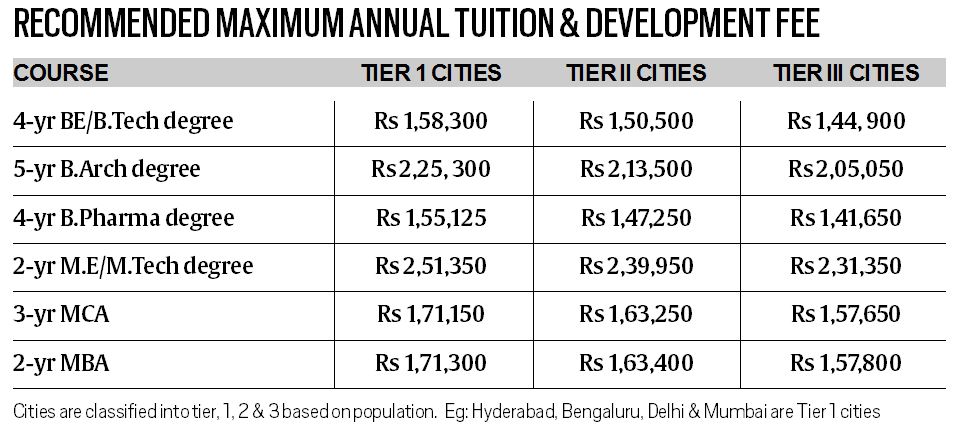

Govt Panel Suggests Cap On Fee For MBA Engineering Courses In Private

https://instafiling.com/tuition-fees-exemption-in-income-tax-2022-23

Web 5 janv 2023 nbsp 0183 32 What Is the Maximum Deduction for Tuition and Fees The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Web 14 avr 2017 nbsp 0183 32 Tax deduction on tuition fees Exemption for Childrens education and Hostel Expenditure The following exemption is provided to a salaried taxpayer in India

Web 5 janv 2023 nbsp 0183 32 What Is the Maximum Deduction for Tuition and Fees The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees

Web 14 avr 2017 nbsp 0183 32 Tax deduction on tuition fees Exemption for Childrens education and Hostel Expenditure The following exemption is provided to a salaried taxpayer in India

Employee Salary Tax Calculator RhionnaLetty

Australian Universities Offer Tuition Fee Rebates To Offshore

Income Tax Deduction Exemption FY 2021 22 WealthTech Speaks

Govt Panel Suggests Cap On Fee For MBA Engineering Courses In Private

Top Notch Income Tax Calculation Statement How To Prepare A Cash Flow

5 Rebate Income Tax YouTube

5 Rebate Income Tax YouTube

CWTS Tuition