Today, where screens have become the dominant feature of our lives and the appeal of physical printed objects hasn't waned. In the case of educational materials such as creative projects or simply to add an element of personalization to your home, printables for free are now a useful resource. With this guide, you'll take a dive in the world of "Tuition Fee Tax Rebate Section," exploring their purpose, where they are available, and how they can enhance various aspects of your daily life.

Get Latest Tuition Fee Tax Rebate Section Below

Tuition Fee Tax Rebate Section

Tuition Fee Tax Rebate Section -

This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act 1961 The amount of tax benefit is within the overall limit of the section of Rs 1 5 lakh a year For tax

Section 80C of the Income Tax Act in India provides tax deduction benefits for tuition fees paid by parents for their children s education The maximum limit for income tax

Tuition Fee Tax Rebate Section cover a large variety of printable, downloadable items that are available online at no cost. These resources come in many forms, including worksheets, templates, coloring pages and more. The benefit of Tuition Fee Tax Rebate Section lies in their versatility as well as accessibility.

More of Tuition Fee Tax Rebate Section

Smart Things To Know Deduction Under Section 80C For Tuition Fee

Smart Things To Know Deduction Under Section 80C For Tuition Fee

The relief is claimed by completing the tuition fees section on your Form 11 annual tax return at the end of the year If you receive any grant scholarship or payment

The maximum amount you can claim is 7 000 per course per person per academic year Each claim is subject to a single disregard amount of 3 000 or 1 500

The Tuition Fee Tax Rebate Section have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Customization: Your HTML0 customization options allow you to customize printables to your specific needs for invitations, whether that's creating them planning your schedule or decorating your home.

-

Educational value: Printing educational materials for no cost cater to learners of all ages. This makes them a valuable tool for parents and educators.

-

Affordability: Quick access to an array of designs and templates reduces time and effort.

Where to Find more Tuition Fee Tax Rebate Section

Printable Free Professional Fee Receipt Templates At

Printable Free Professional Fee Receipt Templates At

Section 80C to 80U Property Tax MCD Property Tax Tax Deduction for Self Education Expenses in India Tuition and education fees are eligible for tax benefits in India

How to save income tax with tuition fee and hostel fee Lenvica HRMS Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee

If we've already piqued your interest in printables for free Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Tuition Fee Tax Rebate Section for different motives.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a wide selection of subjects, ranging from DIY projects to planning a party.

Maximizing Tuition Fee Tax Rebate Section

Here are some creative ways to make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Tuition Fee Tax Rebate Section are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and pursuits. Their accessibility and flexibility make them a fantastic addition to both personal and professional life. Explore the endless world that is Tuition Fee Tax Rebate Section today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can download and print these items for free.

-

Does it allow me to use free printables to make commercial products?

- It's determined by the specific terms of use. Always review the terms of use for the creator before using their printables for commercial projects.

-

Are there any copyright concerns with Tuition Fee Tax Rebate Section?

- Certain printables could be restricted in their usage. Make sure you read the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit a local print shop for higher quality prints.

-

What software will I need to access printables that are free?

- Most PDF-based printables are available in PDF format. These is open with no cost software such as Adobe Reader.

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Tuition Fee Income Tax Rebate YouTube

Check more sample of Tuition Fee Tax Rebate Section below

Donate Now SARZA

Tuition Fee Tax Credit QualiVests

Attention IDM Students 60 Tuition Reduction Sisler High School s

Tuition Fee Tax Rebates Cancelled For Manitoba Graduates The Projector

Income Tax Deduction For Children Tuition School Education Fee Under

Tuition Fee Tax Rebates Cancelled For Manitoba Graduates The Projector

https://www.policybazaar.com/income-tax/income-tax...

Section 80C of the Income Tax Act in India provides tax deduction benefits for tuition fees paid by parents for their children s education The maximum limit for income tax

https://tax2win.in/guide/tution-fees-deduction-under-section-80c

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax

Section 80C of the Income Tax Act in India provides tax deduction benefits for tuition fees paid by parents for their children s education The maximum limit for income tax

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax

Tuition Fee Tax Rebates Cancelled For Manitoba Graduates The Projector

Tuition Fee Tax Credit QualiVests

Income Tax Deduction For Children Tuition School Education Fee Under

Tuition Fee Tax Rebates Cancelled For Manitoba Graduates The Projector

Tax Rebate Under Section 87A All You Need To Know YouTube

How To Claim Tuition Fee Deduction Under Section 80C YouTube

How To Claim Tuition Fee Deduction Under Section 80C YouTube

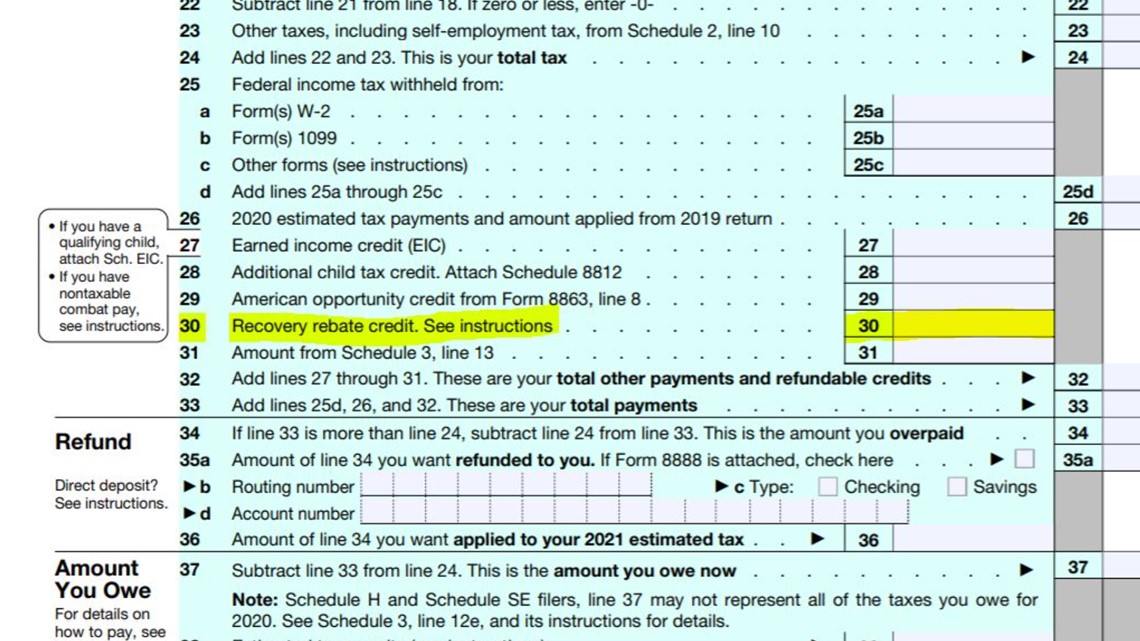

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit Wcnc