In this age of electronic devices, in which screens are the norm but the value of tangible printed items hasn't gone away. If it's to aid in education project ideas, artistic or just adding an individual touch to the home, printables for free have become an invaluable resource. We'll take a dive through the vast world of "Is Company Pension Contribution Taxable," exploring what they are, how to find them, and how they can add value to various aspects of your life.

Get Latest Is Company Pension Contribution Taxable Below

Is Company Pension Contribution Taxable

Is Company Pension Contribution Taxable - Is Company Pension Contribution Taxable, Is Employer Pension Contribution Taxable, Is Employer Pension Contribution Taxable Uk, Are Employer Pension Contributions Taxable Ireland, Are Employer Pension Contributions Taxable Income, Are Employer Pension Contributions Taxable Canada, Are Employer Pension Contributions Taxable Benefits, Are Company Pension Contributions Tax Free, Are Company Pension Contributions Taxed, Are Employer Retirement Contributions Taxable

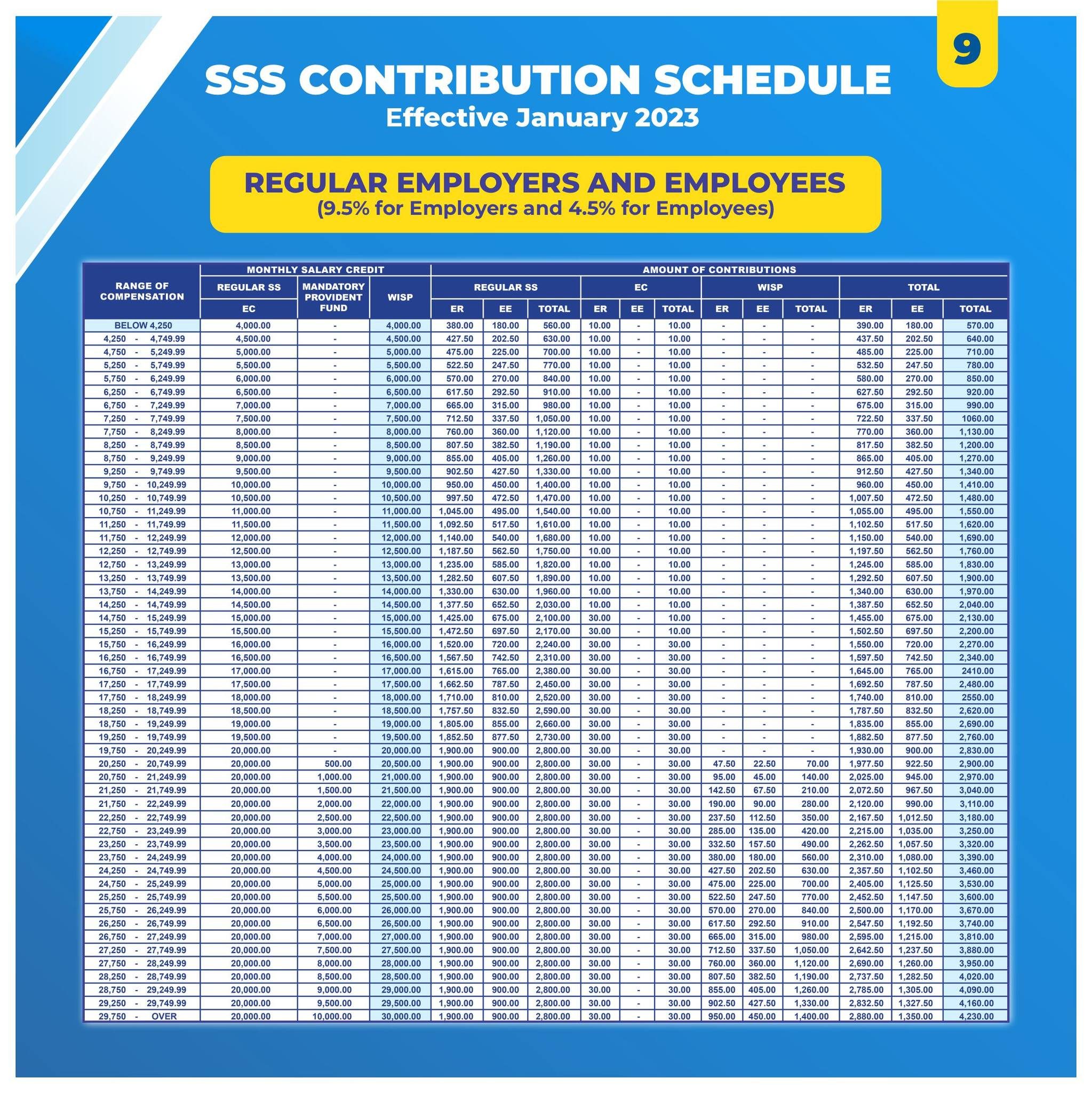

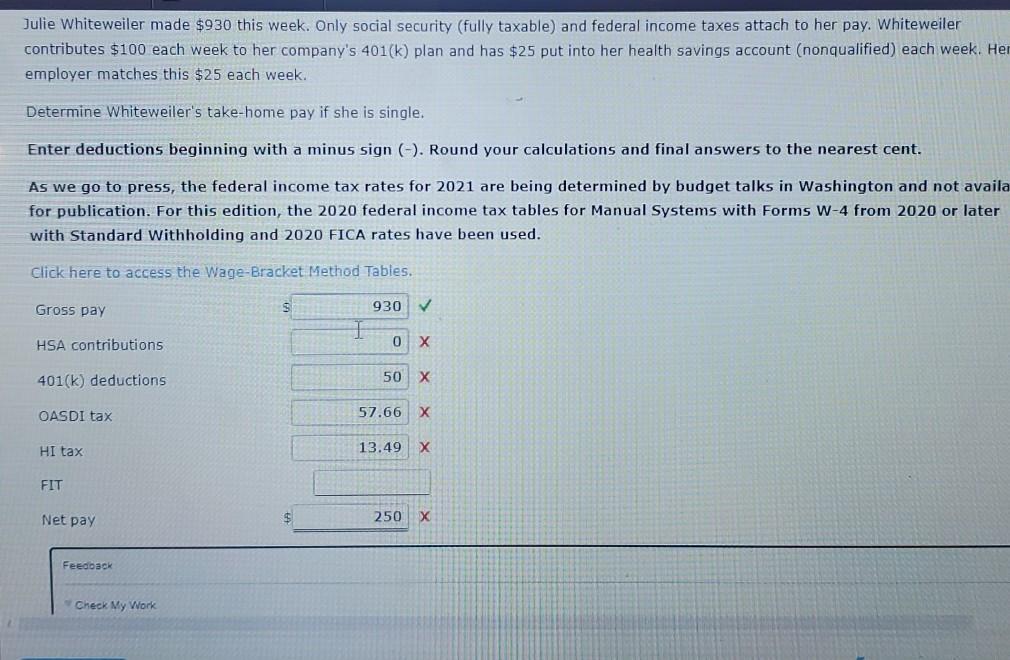

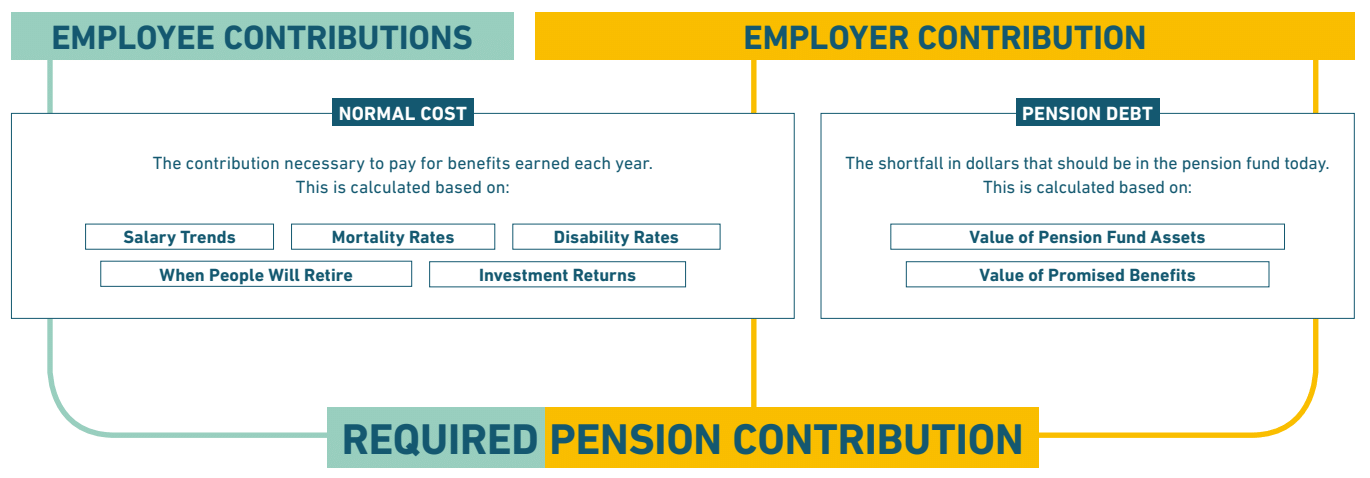

The contributions you make into your pension pot aren t necessarily taxable as long as you stick within the allowances It s a pretty generous allowance so it shouldn t

Your limited company can contribute pre taxed company income to your pension Because an employer contribution counts as an allowable company pension

Is Company Pension Contribution Taxable offer a wide array of printable content that can be downloaded from the internet at no cost. These resources come in many forms, including worksheets, templates, coloring pages, and much more. The beauty of Is Company Pension Contribution Taxable lies in their versatility and accessibility.

More of Is Company Pension Contribution Taxable

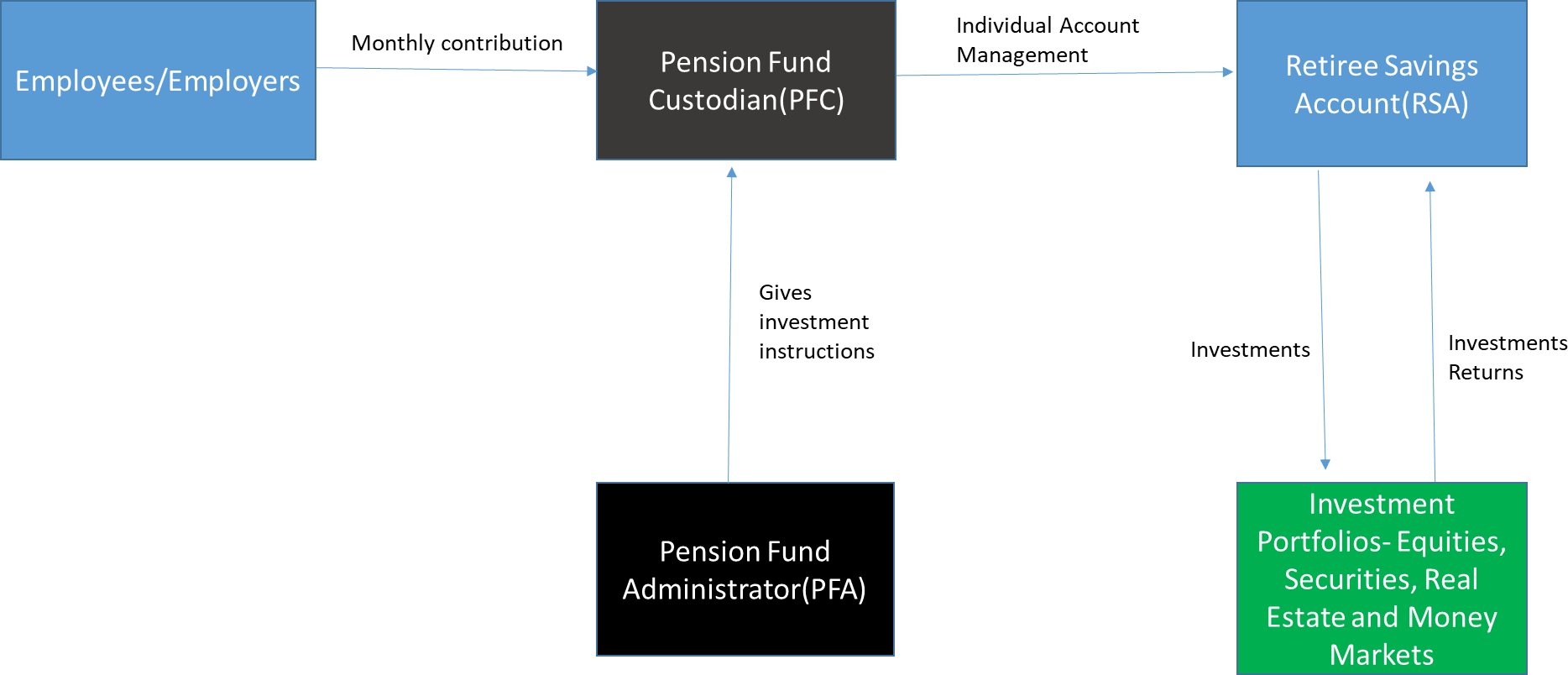

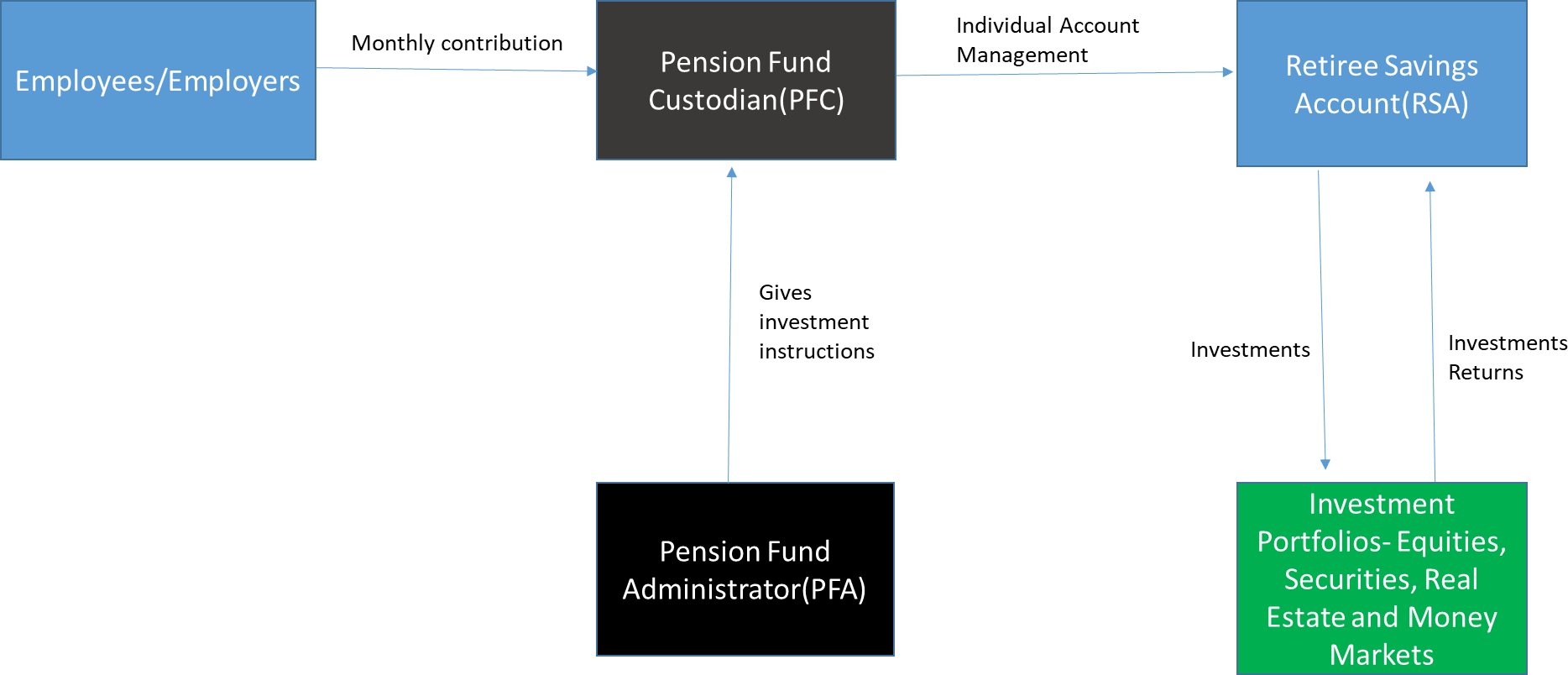

How Pension Contributions Work

How Pension Contributions Work

In theory an employer or company can pay any amount of pension contribution to a registered pension scheme in respect of one of their employees or an

The pension or annuity payments that you receive are fully taxable if you have no investment in the contract sometimes referred to as cost or basis due to any of the

The Is Company Pension Contribution Taxable have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

The ability to customize: It is possible to tailor the templates to meet your individual needs whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Use: Downloads of educational content for free cater to learners from all ages, making these printables a powerful device for teachers and parents.

-

The convenience of Access to many designs and templates will save you time and effort.

Where to Find more Is Company Pension Contribution Taxable

Company Pension Overview National Pension Helpline

Company Pension Overview National Pension Helpline

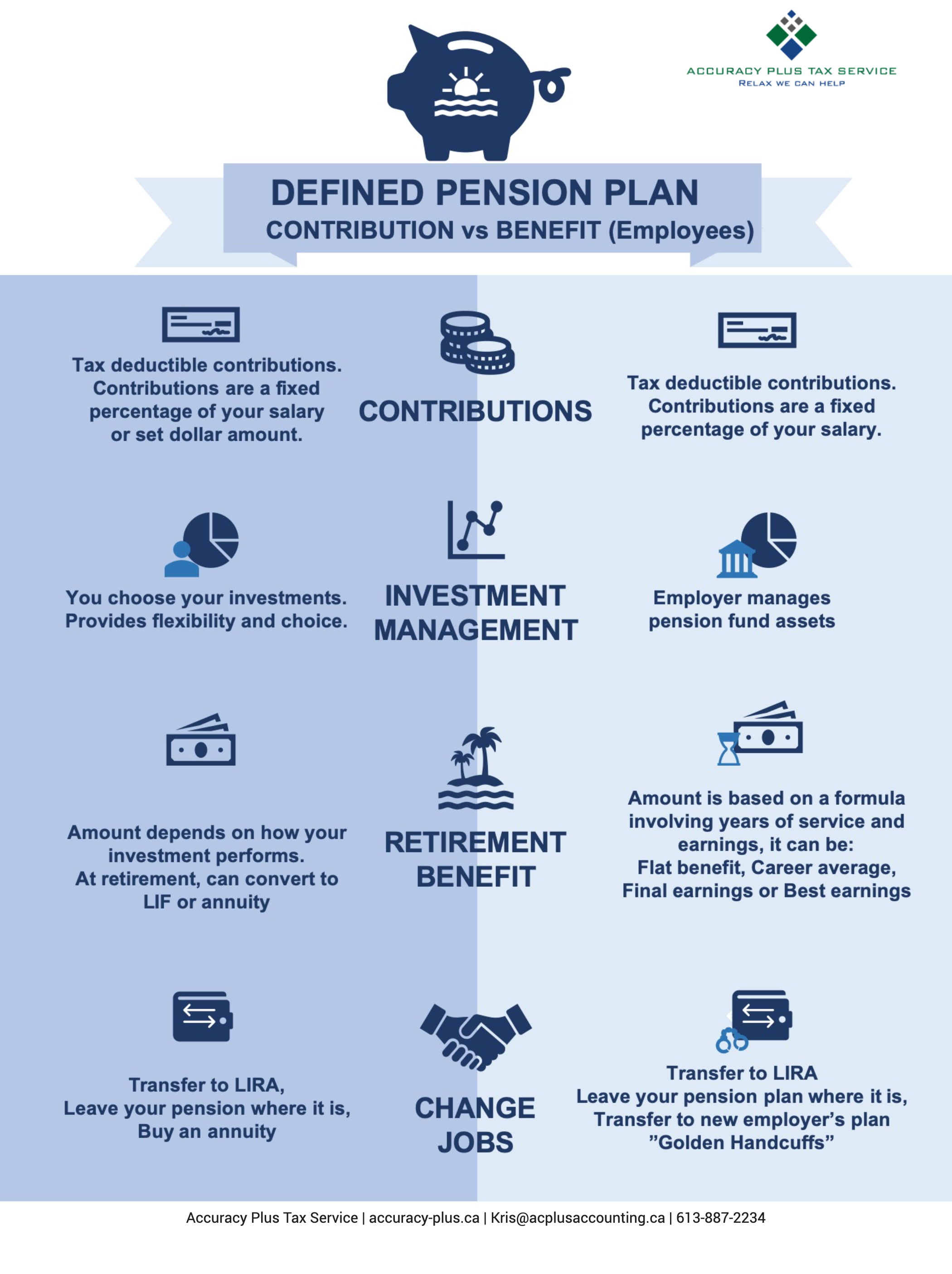

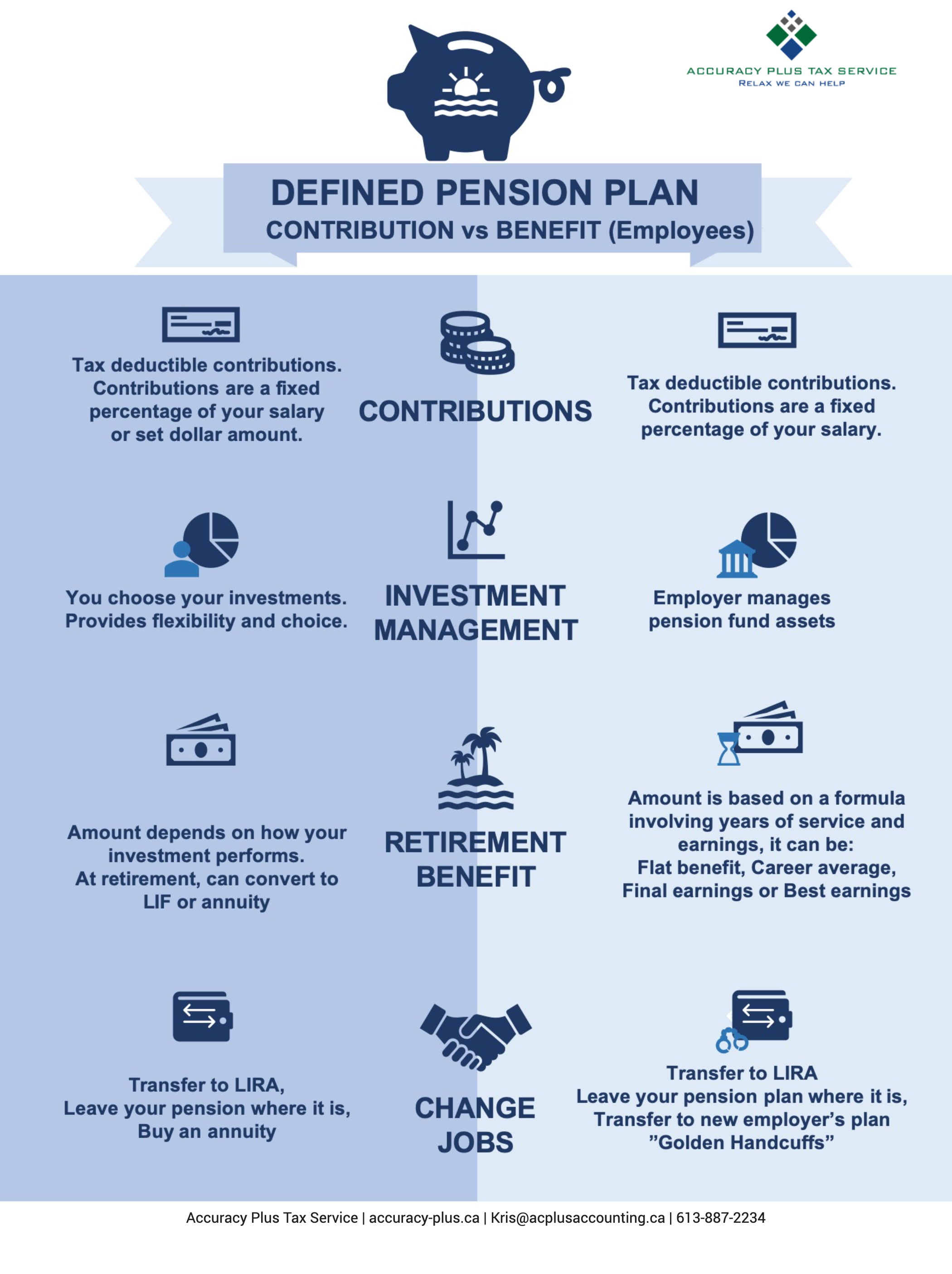

Defined contribution pension plans In a defined contribution pension plan you know how much you ll pay into the plan However you don t how much you ll get when you

If you re paying into a pension through your employer your employer will take 80 of your pension contribution from your salary technically known as net of

Now that we've piqued your interest in Is Company Pension Contribution Taxable Let's find out where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Is Company Pension Contribution Taxable to suit a variety of purposes.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a broad variety of topics, all the way from DIY projects to planning a party.

Maximizing Is Company Pension Contribution Taxable

Here are some new ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to enhance learning at home or in the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Is Company Pension Contribution Taxable are a treasure trove of innovative and useful resources designed to meet a range of needs and passions. Their accessibility and flexibility make them an invaluable addition to your professional and personal life. Explore the vast collection of Is Company Pension Contribution Taxable to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes you can! You can download and print these files for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's based on specific rules of usage. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may contain restrictions regarding usage. Be sure to check the conditions and terms of use provided by the creator.

-

How do I print Is Company Pension Contribution Taxable?

- Print them at home using an printer, or go to a print shop in your area for superior prints.

-

What program must I use to open printables that are free?

- A majority of printed materials are in the format of PDF, which can be opened with free software, such as Adobe Reader.

A Closer Look At The Retirement Savings Account RSAs Nairametrics

Law Web Supreme Court Court Can Not Attach Pension And Gratuity

Check more sample of Is Company Pension Contribution Taxable below

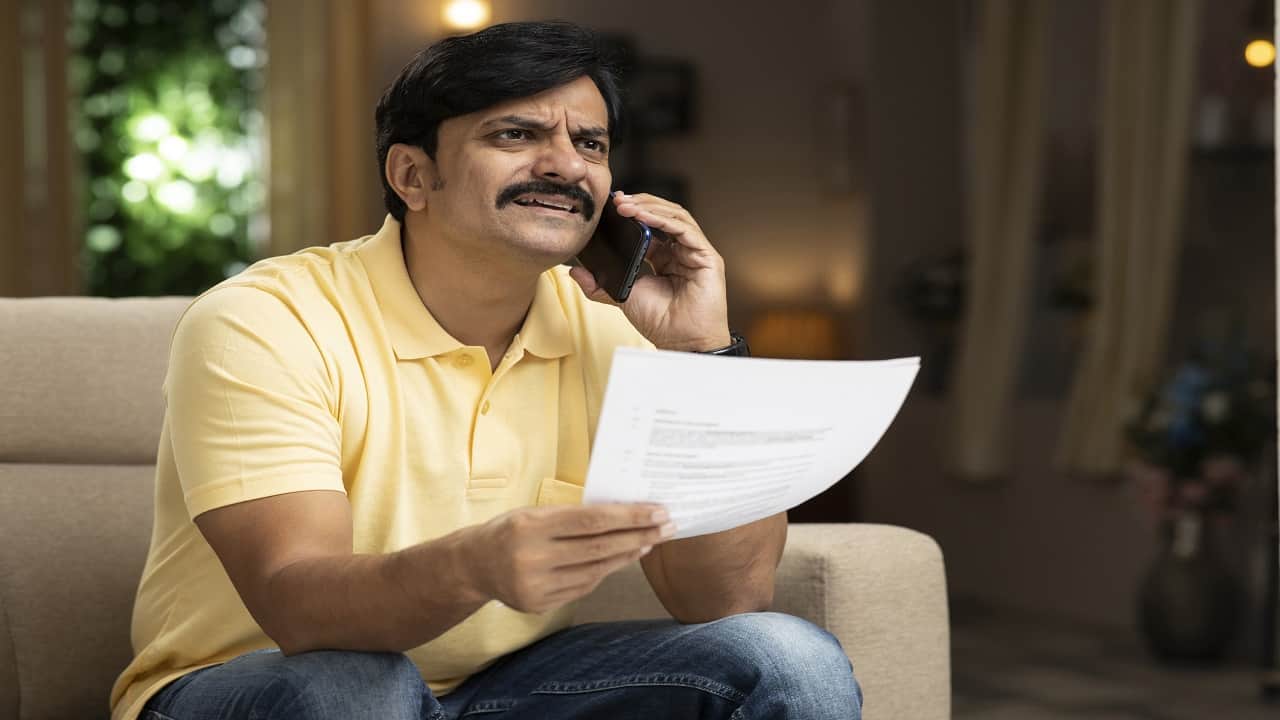

Is EPF Employer Contribution Taxable In The Revised New Tax Regime

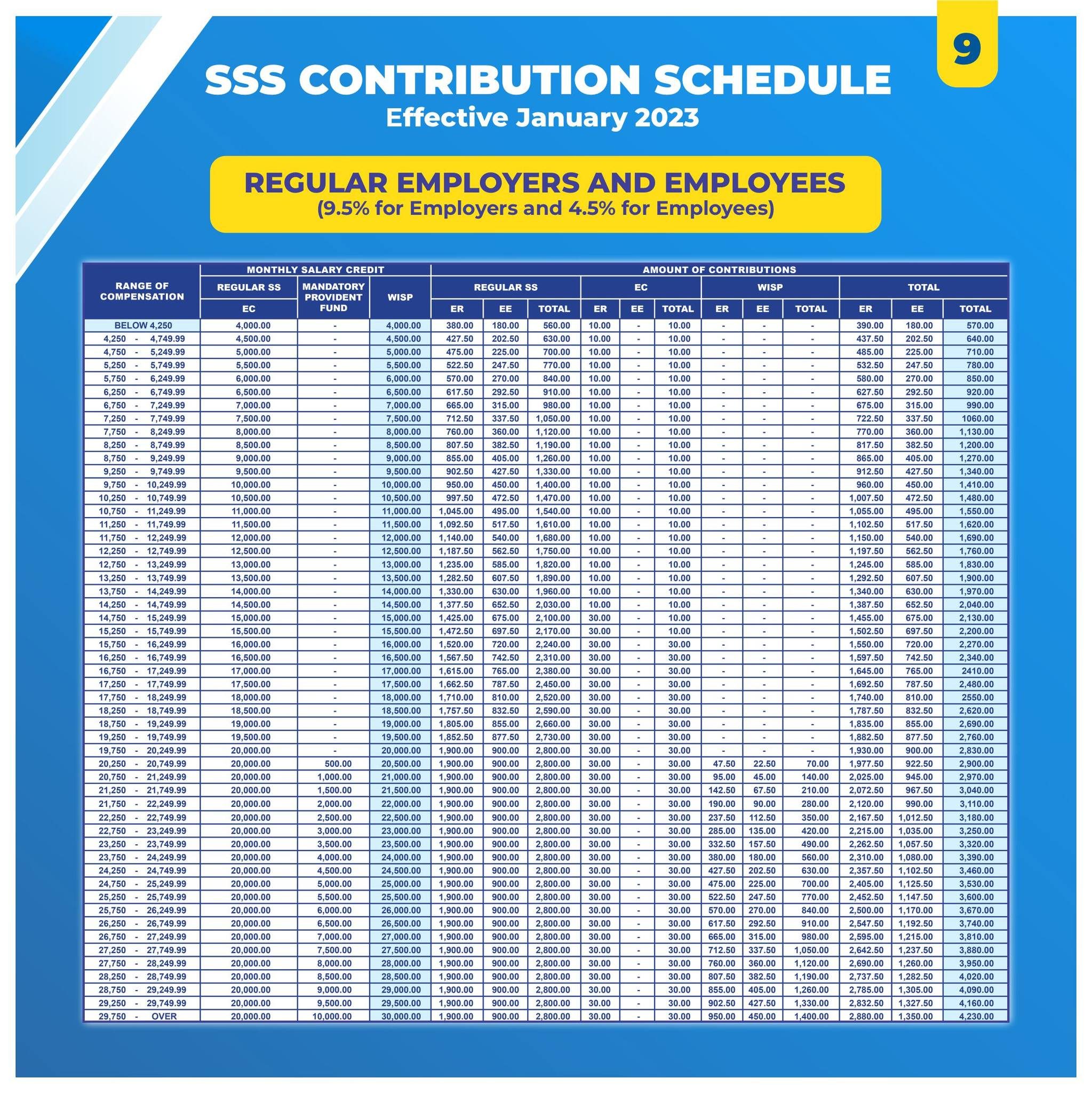

FAST FACTS What Are SSS GSIS PhilHealth Pag IBIG Salary Deductions

Changes In NHS Pension Contributions Are You A Winner Or Loser

How To Write A Letter Requesting Pension Benefits

Update Pension Contribution Percentages For Employees Onfolk Support

Financial Management Fundamentals Alternative Career Options After

https://www.pensionbee.com/pensions-explained/self...

Your limited company can contribute pre taxed company income to your pension Because an employer contribution counts as an allowable company pension

https://www.investopedia.com/terms/p/pens…

Updated December 15 2023 Reviewed by Andy Smith Fact checked by Pete Rathburn What Is a Pension Plan A pension plan is an employee benefit that commits the employer to make regular

Your limited company can contribute pre taxed company income to your pension Because an employer contribution counts as an allowable company pension

Updated December 15 2023 Reviewed by Andy Smith Fact checked by Pete Rathburn What Is a Pension Plan A pension plan is an employee benefit that commits the employer to make regular

How To Write A Letter Requesting Pension Benefits

FAST FACTS What Are SSS GSIS PhilHealth Pag IBIG Salary Deductions

Update Pension Contribution Percentages For Employees Onfolk Support

Financial Management Fundamentals Alternative Career Options After

Mind The Pensions Gap BTU

Defined Contribution Vs Benefit Pension Plan For Employees Accuracy

Defined Contribution Vs Benefit Pension Plan For Employees Accuracy

How Is The Pension Contribution Adjusted By Employ Fishbowl