Today, when screens dominate our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. For educational purposes as well as creative projects or simply adding an extra personal touch to your area, Are Employer Pension Contributions Taxable Income are now an essential source. The following article is a dive into the sphere of "Are Employer Pension Contributions Taxable Income," exploring the benefits of them, where they are available, and how they can add value to various aspects of your life.

Get Latest Are Employer Pension Contributions Taxable Income Below

Are Employer Pension Contributions Taxable Income

Are Employer Pension Contributions Taxable Income - Are Employer Pension Contributions Taxable Income, Do Employer Pension Contributions Count As Income, Are Employer Pension Contributions Taxable, Do Employer Pension Contributions Count As Taxable Income, Are Employer Paid Pension Contributions Taxable

16 February 2024 5 min read This article looks at pension contributions who can pay them tax relief and if there are any restrictions Key facts Contributions made by an

3 00 Minimum Deposit 1 Term 9 Months Learn More From Our Partner Whether the money you receive from a pension is taxed depends on how it was first contributed to the account Most

Are Employer Pension Contributions Taxable Income offer a wide range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in a variety of types, like worksheets, coloring pages, templates and many more. The value of Are Employer Pension Contributions Taxable Income is their flexibility and accessibility.

More of Are Employer Pension Contributions Taxable Income

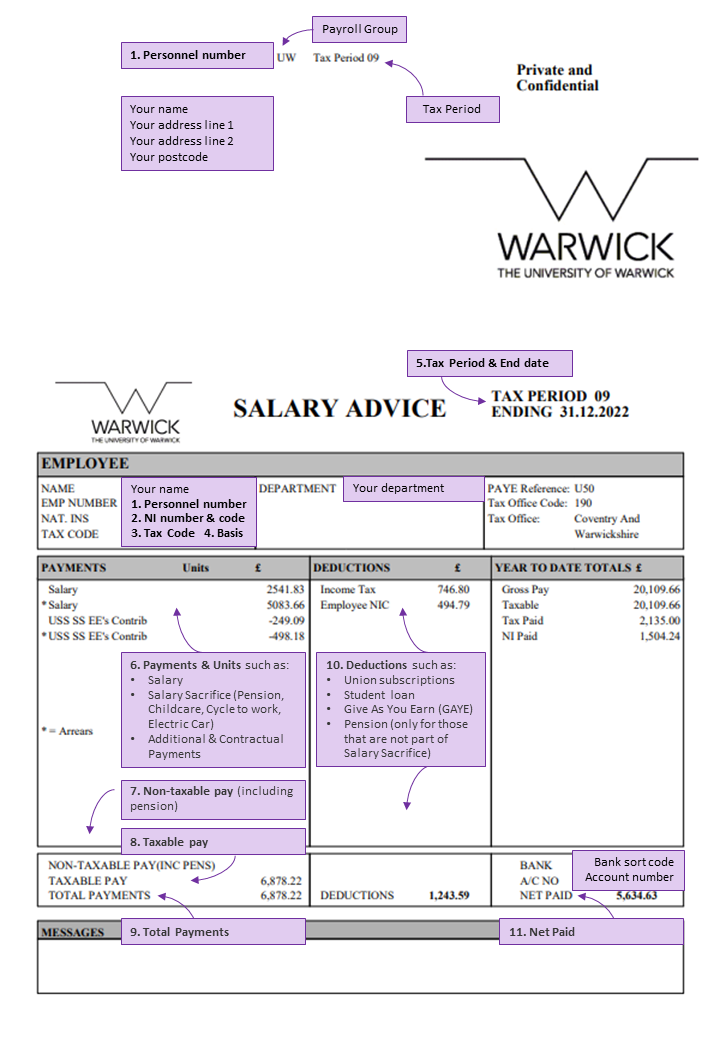

OS Payroll Your P60 Document Explained

OS Payroll Your P60 Document Explained

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject

If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan all or some portion of the amounts you receive may

Are Employer Pension Contributions Taxable Income have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

The ability to customize: You can tailor the templates to meet your individual needs for invitations, whether that's creating them for your guests, organizing your schedule or decorating your home.

-

Education Value Educational printables that can be downloaded for free are designed to appeal to students of all ages, making them a vital source for educators and parents.

-

Convenience: immediate access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Are Employer Pension Contributions Taxable Income

How Much Are Employer Pension Contributions Unbiased co uk

How Much Are Employer Pension Contributions Unbiased co uk

Designated Roth contributions are a type of elective contribution that unlike pre tax elective contributions are currently includible in gross income but tax

Pensions are a source of retirement income that are employer sponsored Upon retirement you can generally start receiving payouts from your pension The amount of your pension depends on your age salary

After we've peaked your curiosity about Are Employer Pension Contributions Taxable Income and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection in Are Employer Pension Contributions Taxable Income for different uses.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Are Employer Pension Contributions Taxable Income

Here are some innovative ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets for teaching at-home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Are Employer Pension Contributions Taxable Income are an abundance of practical and innovative resources that meet a variety of needs and desires. Their accessibility and versatility make them a great addition to both professional and personal lives. Explore the endless world of Are Employer Pension Contributions Taxable Income now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes you can! You can print and download these documents for free.

-

Can I use free printables for commercial uses?

- It's based on specific conditions of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may come with restrictions on use. Check the terms and condition of use as provided by the author.

-

How do I print Are Employer Pension Contributions Taxable Income?

- You can print them at home with either a printer at home or in a local print shop for the highest quality prints.

-

What software do I require to open printables at no cost?

- The majority of printables are in PDF format. They can be opened using free software like Adobe Reader.

Corporate Payroll Services Payroll Outsourcing MI Simplycounted

Understanding Your Payslip

Check more sample of Are Employer Pension Contributions Taxable Income below

Employer Contribution May Be Tax Free Under National Pension Scheme

Employer Pension Contributions Calculator Factorial

Do RRSP Contributions Reduce Taxable Income

Individual Retirement Account Bank Northwest

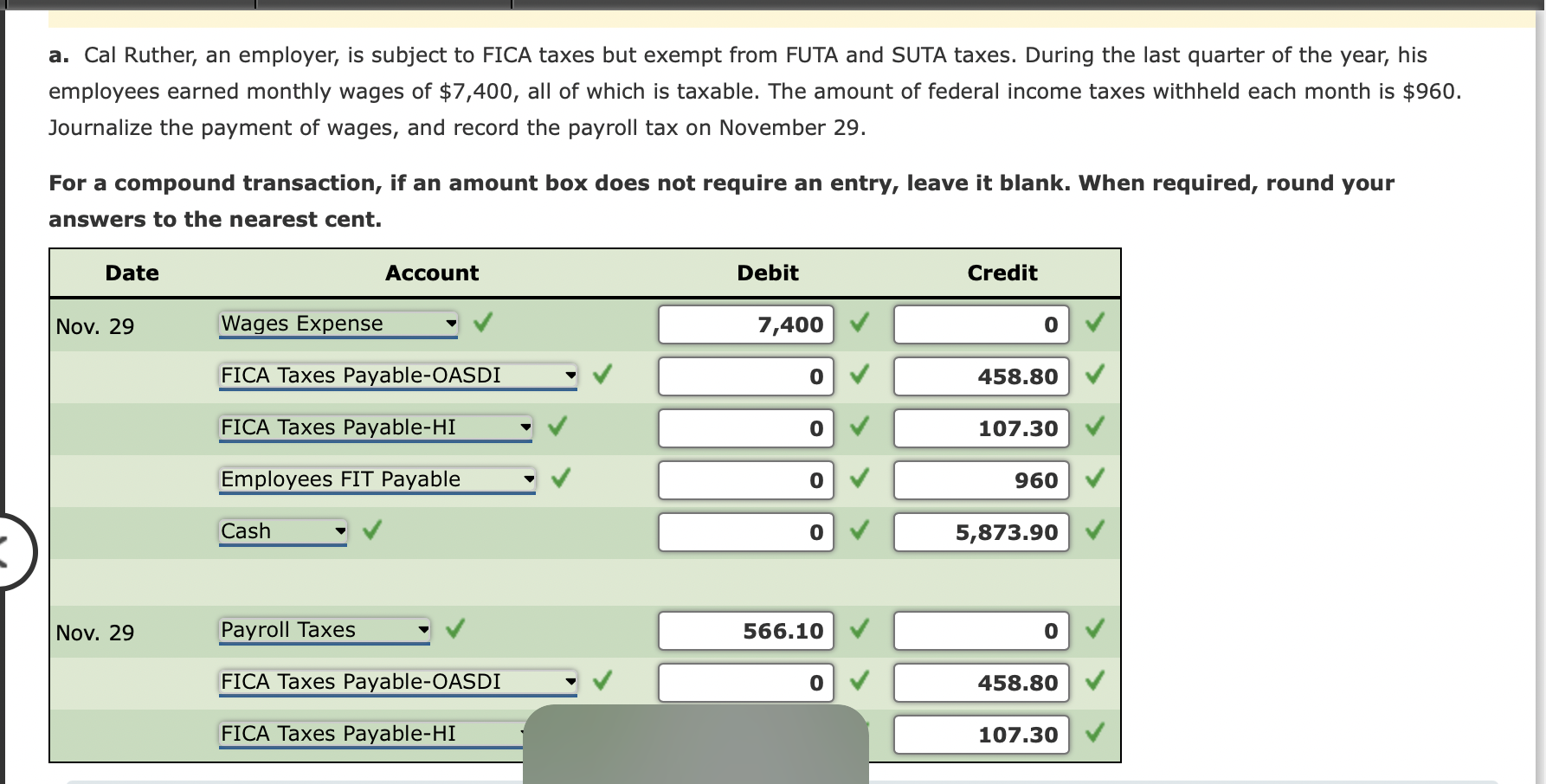

Solved Example 6 5 The Journal Entry To Record The Payroll Chegg

EMPLOYER PENSION CONTRIBUTIONS IN IRELAND

https://money.usnews.com/money/retiremen…

3 00 Minimum Deposit 1 Term 9 Months Learn More From Our Partner Whether the money you receive from a pension is taxed depends on how it was first contributed to the account Most

https://www.investopedia.com/terms/p/pens…

Updated May 02 2024 Reviewed by Andy Smith Fact checked by Pete Rathburn What Is a Pension Plan A pension plan is an employee benefit that commits the employer to making regular

3 00 Minimum Deposit 1 Term 9 Months Learn More From Our Partner Whether the money you receive from a pension is taxed depends on how it was first contributed to the account Most

Updated May 02 2024 Reviewed by Andy Smith Fact checked by Pete Rathburn What Is a Pension Plan A pension plan is an employee benefit that commits the employer to making regular

Individual Retirement Account Bank Northwest

Employer Pension Contributions Calculator Factorial

Solved Example 6 5 The Journal Entry To Record The Payroll Chegg

EMPLOYER PENSION CONTRIBUTIONS IN IRELAND

Minimum Contributions Are Going Up The People s Pension

What Is A Pension Plan And How Does It Work GOBankingRates

What Is A Pension Plan And How Does It Work GOBankingRates

Understanding Your Forms W 2 Wage Tax Statement Tax Tax Refund