In this age of technology, where screens have become the dominant feature of our lives and the appeal of physical printed products hasn't decreased. Whether it's for educational purposes project ideas, artistic or simply adding a personal touch to your space, Is A Lump Sum Pension Payment Taxable can be an excellent source. Through this post, we'll take a dive deep into the realm of "Is A Lump Sum Pension Payment Taxable," exploring the benefits of them, where to find them, and what they can do to improve different aspects of your lives.

Get Latest Is A Lump Sum Pension Payment Taxable Below

Is A Lump Sum Pension Payment Taxable

Is A Lump Sum Pension Payment Taxable - Is A Lump Sum Pension Payment Taxable, Is A Lump Sum Pension Payout Taxable, Is A Lump Sum Retirement Payment Taxable, How Is A Lump Sum Pension Payment Taxed, How Much Is A Lump Sum Pension Payment Taxed In Canada, Is A Lump Sum Pension Taxable, How Is Lump Sum Pension Payment Taxed On Death Canada, Are Lump Sum State Pension Payments Taxable, Is Lump Sum Pension Taxable In Canada, Is Lump Sum Pension Considered Income

If you took your pension on or after 6 April 2023 you ll pay Income Tax on some or all of the lump sum if it is more than 25 of the standard lifetime allowance If you hold

Lump sums from your pension You can usually take up to 25 of the amount built up in any pension as a tax free lump sum This is limited to a maximum of 25 of your

Printables for free cover a broad assortment of printable, downloadable materials available online at no cost. These resources come in many types, like worksheets, coloring pages, templates and more. The appealingness of Is A Lump Sum Pension Payment Taxable is their flexibility and accessibility.

More of Is A Lump Sum Pension Payment Taxable

Pension Versus Lump Sum Blue Rock Financial Group

Pension Versus Lump Sum Blue Rock Financial Group

What s a lump sum distribution A lump sum distribution is the distribution or payment within a single tax year of a plan participant s entire balance from all of the employer s

The rules for taking your pension as a number of lump sums mean three quarters 75 of each lump sum taken counts as taxable income This is added to the rest of your

Is A Lump Sum Pension Payment Taxable have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Customization: This allows you to modify designs to suit your personal needs whether you're designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Use: Free educational printables offer a wide range of educational content for learners of all ages, which makes them an invaluable tool for parents and educators.

-

Accessibility: Access to an array of designs and templates cuts down on time and efforts.

Where to Find more Is A Lump Sum Pension Payment Taxable

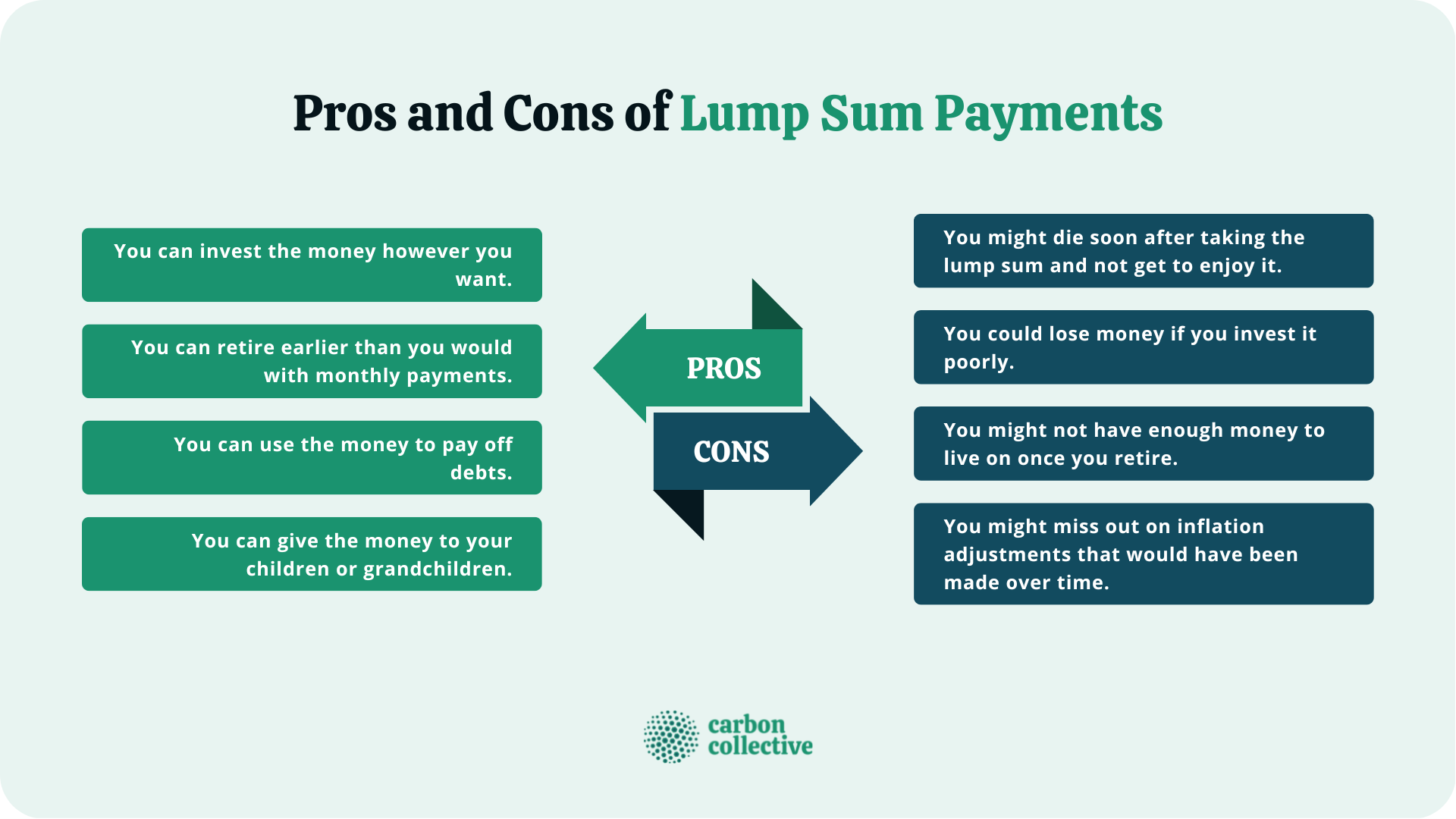

Lump Sum Payment What It Is How It Works Pros Cons

Lump Sum Payment What It Is How It Works Pros Cons

Income from pensions is taxable However if you roll over that lump sum into your IRA you will have much more control over it when you remove the funds and pay the income tax on them

So if Bill takes a state pension lump sum in 2023 24 and his other taxable income is more than 12 570 tax will be due on the state pension lump sum The tax

We hope we've stimulated your interest in printables for free Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Is A Lump Sum Pension Payment Taxable suitable for many objectives.

- Explore categories like home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets, flashcards, and learning materials.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a wide spectrum of interests, from DIY projects to party planning.

Maximizing Is A Lump Sum Pension Payment Taxable

Here are some creative ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Is A Lump Sum Pension Payment Taxable are an abundance of practical and innovative resources for a variety of needs and interest. Their availability and versatility make them a wonderful addition to each day life. Explore the wide world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes you can! You can print and download these items for free.

-

Can I use free printables to make commercial products?

- It's based on the usage guidelines. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright issues with Is A Lump Sum Pension Payment Taxable?

- Certain printables might have limitations regarding their use. Always read these terms and conditions as set out by the designer.

-

How can I print Is A Lump Sum Pension Payment Taxable?

- You can print them at home with an printer, or go to a print shop in your area for more high-quality prints.

-

What software will I need to access printables that are free?

- The majority of PDF documents are provided in the format PDF. This can be opened with free software, such as Adobe Reader.

Lump Sum Payment Definition Example Tax Implications

Lump Sum Vs Payments Providence Financial 2019

Check more sample of Is A Lump Sum Pension Payment Taxable below

Lump Sum Pension Distribution Or Defined Benefit Plans Posts By

Lump Sum Tax What Is It Formula Calculation Example

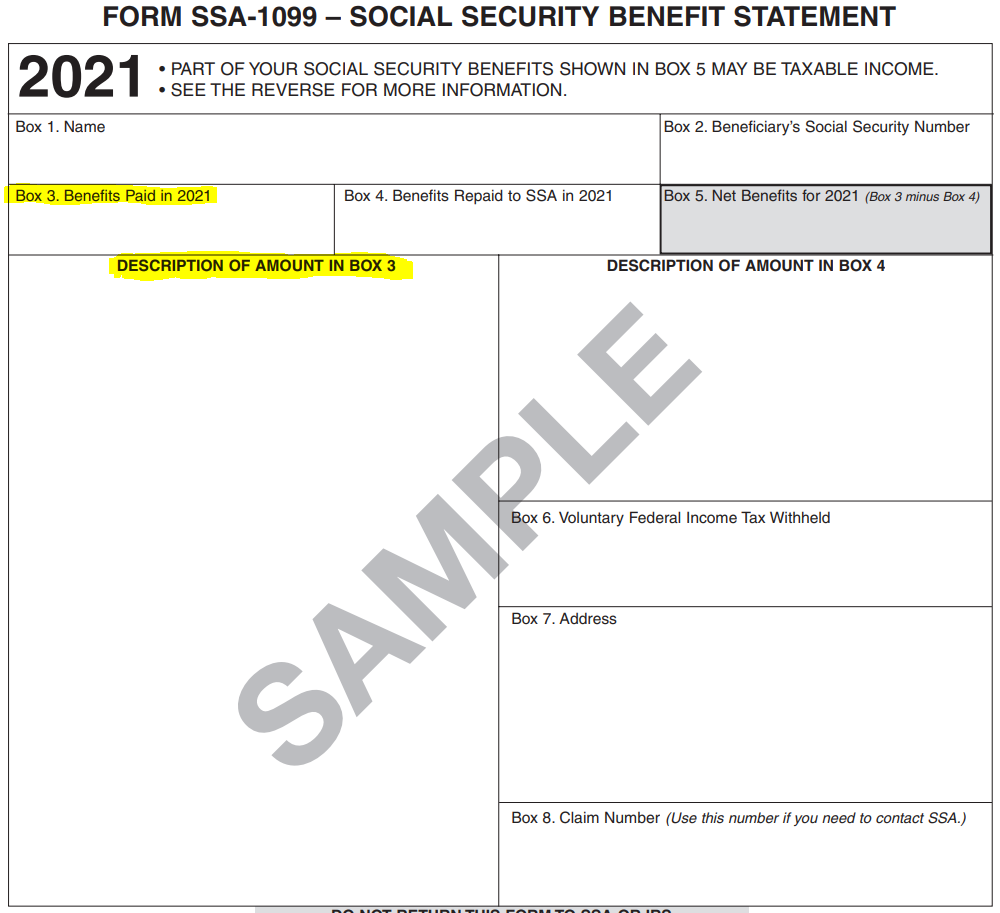

What Is A Lump Sum Payment SSA 1099 Support

How Do I Calculate My Federal Pension Government Deal Funding

Is A Lump Sum Pension Taxable Knowing Your Tax Obligations

Should You Take A Lump Sum Or Monthly Pension When You Retire

https://www.gov.uk/tax-on-pension/tax-free

Lump sums from your pension You can usually take up to 25 of the amount built up in any pension as a tax free lump sum This is limited to a maximum of 25 of your

https://www.which.co.uk/money/pensions-and...

Is the deferred state pension lump sum taxable The state pension lump sum is taxable at the rate you are currently paying So if you re a basic rate 20 taxpayer at the time you come to withdraw the state pension

Lump sums from your pension You can usually take up to 25 of the amount built up in any pension as a tax free lump sum This is limited to a maximum of 25 of your

Is the deferred state pension lump sum taxable The state pension lump sum is taxable at the rate you are currently paying So if you re a basic rate 20 taxpayer at the time you come to withdraw the state pension

How Do I Calculate My Federal Pension Government Deal Funding

Lump Sum Tax What Is It Formula Calculation Example

Is A Lump Sum Pension Taxable Knowing Your Tax Obligations

Should You Take A Lump Sum Or Monthly Pension When You Retire

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Can I End Alimony With A Lump Sum NJMoneyHelp

Can I End Alimony With A Lump Sum NJMoneyHelp

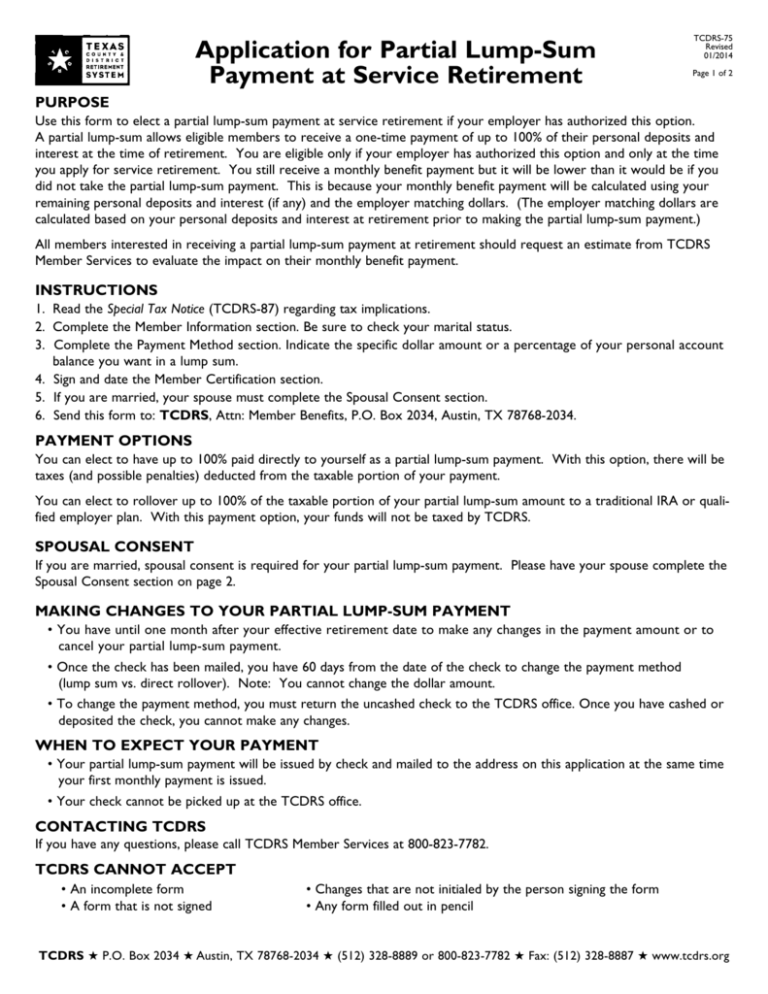

Application For Partial Lump Sum Payment At Service