In this age of technology, with screens dominating our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. If it's to aid in education for creative projects, simply adding personal touches to your space, How Much Is A Lump Sum Pension Payment Taxed In Canada are a great resource. With this guide, you'll take a dive deeper into "How Much Is A Lump Sum Pension Payment Taxed In Canada," exploring the benefits of them, where to get them, as well as ways they can help you improve many aspects of your daily life.

Get Latest How Much Is A Lump Sum Pension Payment Taxed In Canada Below

How Much Is A Lump Sum Pension Payment Taxed In Canada

How Much Is A Lump Sum Pension Payment Taxed In Canada -

When foreign pension income is regarded as taxable income it should be reported in Canadian dollars on line 11500 of the person s T1 return The pensioner can sometimes choose to receive the payments either in a

You have to deduct income tax from lump sum payments that are from a registered retirement savings plan RRSP or a plan referred to in subsection 146 12 of the

Printables for free cover a broad range of printable, free items that are available online at no cost. They come in many types, like worksheets, coloring pages, templates and many more. One of the advantages of How Much Is A Lump Sum Pension Payment Taxed In Canada is in their versatility and accessibility.

More of How Much Is A Lump Sum Pension Payment Taxed In Canada

Pension Versus Lump Sum Blue Rock Financial Group

Pension Versus Lump Sum Blue Rock Financial Group

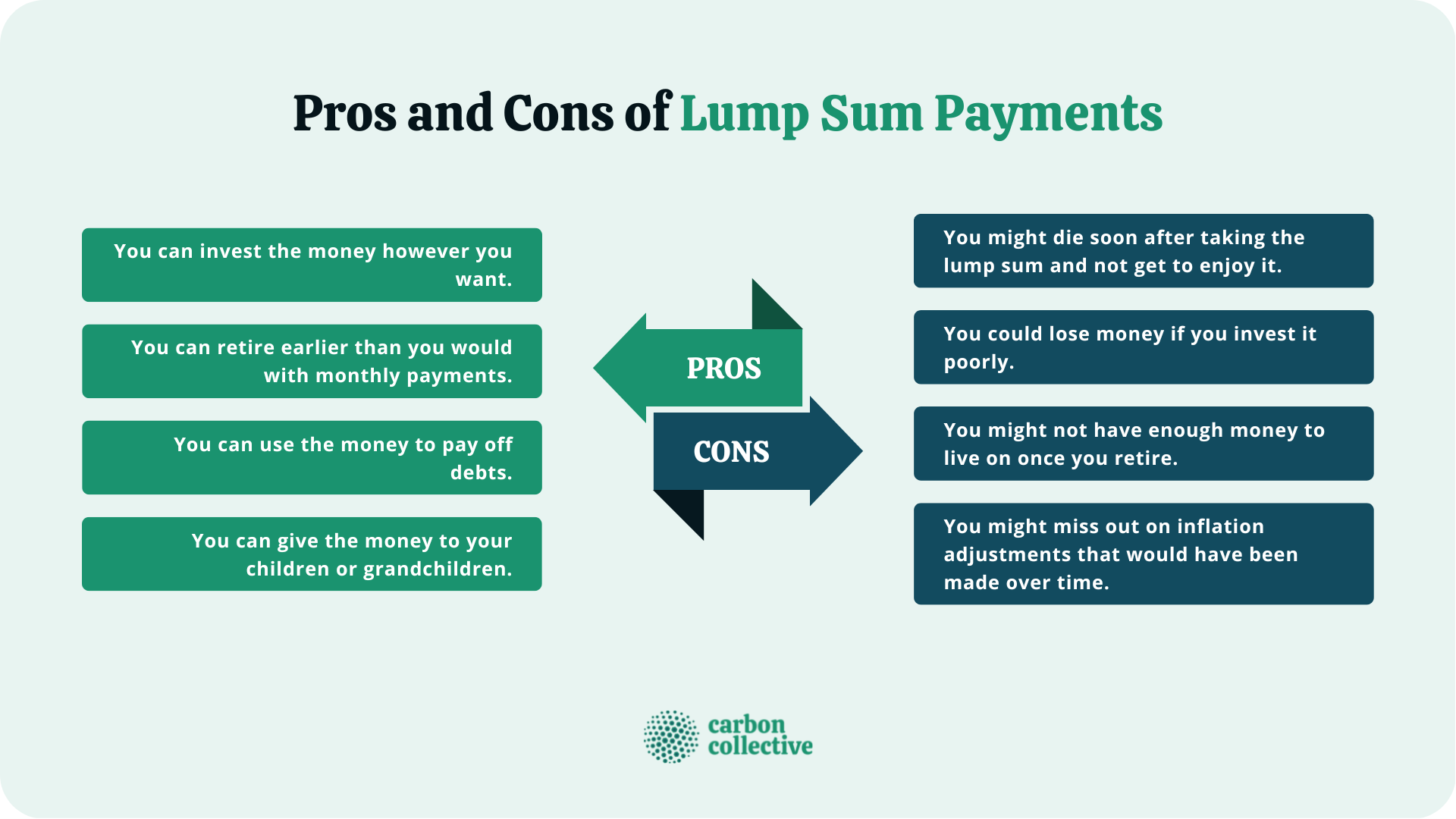

How Much Tax Do You Pay on a Lump Sum Pension Payout If you choose a lump sum distribution you can transfer it to the following accounts without incurring any tax

For payments up to and including 5 000 the withholding rate is 10 percent For payments between 5 000 and 15 000 the rate is 20 percent For amounts over 15 000 it is 30

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Personalization There is the possibility of tailoring printables to your specific needs when it comes to designing invitations or arranging your schedule or even decorating your house.

-

Educational Value Printing educational materials for no cost can be used by students of all ages, which makes them a valuable source for educators and parents.

-

An easy way to access HTML0: You have instant access an array of designs and templates, which saves time as well as effort.

Where to Find more How Much Is A Lump Sum Pension Payment Taxed In Canada

Should You Retire Early To Get A Larger Lump Sum On Your Pension WSJ

Should You Retire Early To Get A Larger Lump Sum On Your Pension WSJ

There are tax implications to receiving a pension lump sum payment in cash as it s usually considered taxable income The tax rate applied to your lump sum payment will depend

Registered Pension Plan withdrawals are all taxable income at your current marginal tax rate Defined Benefit Pension Plan paid in regular installments Defined Contribution

Now that we've piqued your curiosity about How Much Is A Lump Sum Pension Payment Taxed In Canada we'll explore the places you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of How Much Is A Lump Sum Pension Payment Taxed In Canada for various uses.

- Explore categories such as decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching materials.

- The perfect resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing How Much Is A Lump Sum Pension Payment Taxed In Canada

Here are some fresh ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet for teaching at-home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

How Much Is A Lump Sum Pension Payment Taxed In Canada are an abundance of useful and creative resources designed to meet a range of needs and interest. Their accessibility and versatility make them an invaluable addition to both personal and professional life. Explore the vast collection of How Much Is A Lump Sum Pension Payment Taxed In Canada right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Much Is A Lump Sum Pension Payment Taxed In Canada really completely free?

- Yes you can! You can print and download these files for free.

-

Does it allow me to use free printables for commercial uses?

- It's determined by the specific rules of usage. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns with How Much Is A Lump Sum Pension Payment Taxed In Canada?

- Some printables may come with restrictions concerning their use. Check these terms and conditions as set out by the designer.

-

How can I print printables for free?

- Print them at home with either a printer at home or in any local print store for better quality prints.

-

What software do I need to run printables free of charge?

- Most printables come in PDF format. They can be opened using free software like Adobe Reader.

Lump Sum Payment Meaning Examples Calculation Taxes

Lump Sum Payment What It Is How It Works Pros Cons

Check more sample of How Much Is A Lump Sum Pension Payment Taxed In Canada below

Lump Sum Payment Definition Example Tax Implications

How Do I Calculate My Federal Pension Government Deal Funding

Smart Tax Strategies For Lottery Winners Tax Insider

How Top Up Your Pension With A Lump Sum Payment

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

What Is A Lump Sum Payment SSA 1099 Support

https://www.canada.ca/.../special-payments/lump-payments.html

You have to deduct income tax from lump sum payments that are from a registered retirement savings plan RRSP or a plan referred to in subsection 146 12 of the

https://www.canada.ca/en/revenue-agency/services/...

12 rowsFor example SPP payments may only be considered pension income if you are 65 or over Retroactive lump sum payments Line 13000 Other income You may

You have to deduct income tax from lump sum payments that are from a registered retirement savings plan RRSP or a plan referred to in subsection 146 12 of the

12 rowsFor example SPP payments may only be considered pension income if you are 65 or over Retroactive lump sum payments Line 13000 Other income You may

How Top Up Your Pension With A Lump Sum Payment

How Do I Calculate My Federal Pension Government Deal Funding

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

What Is A Lump Sum Payment SSA 1099 Support

Lump Sum Pension Distribution Or Defined Benefit Plans Posts By

Lump Sum Tax What Is It Formula Calculation Example

Lump Sum Tax What Is It Formula Calculation Example

Should You Sell Your Pension For A Lump Sum YouTube