In this day and age where screens dominate our lives but the value of tangible printed material hasn't diminished. Whether it's for educational purposes or creative projects, or just adding some personal flair to your area, Income Tax Rebate For Higher Education have proven to be a valuable resource. We'll take a dive into the sphere of "Income Tax Rebate For Higher Education," exploring what they are, how to find them, and how they can enrich various aspects of your life.

Get Latest Income Tax Rebate For Higher Education Below

Income Tax Rebate For Higher Education

Income Tax Rebate For Higher Education - Income Tax Deduction For Higher Education, Income Tax Exemption For Higher Education, Income Tax Rebate On Higher Education Fees, Income Tax Exemption On Higher Education Fees, Tuition Fee Tax Rebate Section

Web Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961 Even if an individual has

Web Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity

Income Tax Rebate For Higher Education cover a large variety of printable, downloadable materials that are accessible online for free cost. They are available in a variety of types, such as worksheets templates, coloring pages, and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Income Tax Rebate For Higher Education

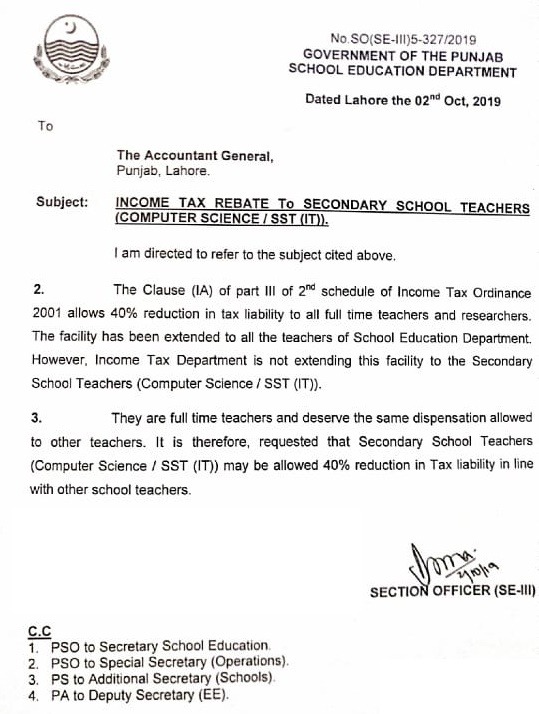

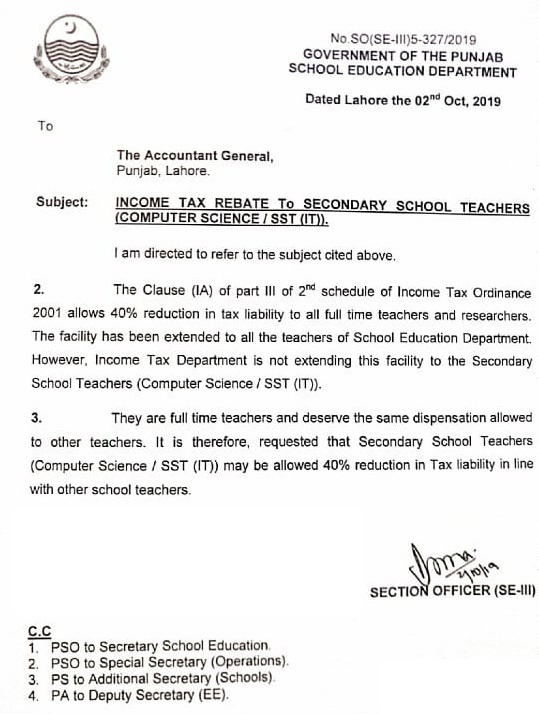

Income Tax Rebate 40 To All Teachers Of School Education Department

Income Tax Rebate 40 To All Teachers Of School Education Department

Web An individual who has taken an education loan for higher education can avail the tax deduction under Section 80E of the Income Tax Act 1961 The best part about this

Web 27 juin 2023 nbsp 0183 32 Updated on Dec 28th 2022 3 27 43 AM 5 min read CONTENTS Show An education loan helps you not only finance your foreign studies but it can save you a lot of tax as well

Income Tax Rebate For Higher Education have garnered immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

customization It is possible to tailor printing templates to your own specific requirements, whether it's designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value: Free educational printables offer a wide range of educational content for learners of all ages. This makes them a valuable device for teachers and parents.

-

Accessibility: Instant access to a variety of designs and templates saves time and effort.

Where to Find more Income Tax Rebate For Higher Education

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Web 14 sept 2019 nbsp 0183 32 The Income Tax Act allows tax benefits for a loan taker for higher education when certain conditions are met Tax benefits have been laid down under

Web 25 f 233 vr 2021 nbsp 0183 32 Not only investments but also expenditures like tuition fees are allowed a deduction under the Income Tax Act The following article provides detailed information regarding education tax works for higher

We've now piqued your interest in printables for free Let's take a look at where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Income Tax Rebate For Higher Education to suit a variety of goals.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning materials.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs are a vast array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Income Tax Rebate For Higher Education

Here are some innovative ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to aid in learning at your home for the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Rebate For Higher Education are an abundance of innovative and useful resources for a variety of needs and needs and. Their accessibility and flexibility make these printables a useful addition to both professional and personal lives. Explore the many options of Income Tax Rebate For Higher Education now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate For Higher Education really completely free?

- Yes they are! You can download and print the resources for free.

-

Do I have the right to use free printables for commercial uses?

- It's contingent upon the specific rules of usage. Always read the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright issues in Income Tax Rebate For Higher Education?

- Certain printables may be subject to restrictions on usage. Check the terms and conditions offered by the author.

-

How can I print Income Tax Rebate For Higher Education?

- Print them at home with printing equipment or visit any local print store for the highest quality prints.

-

What program do I need to open printables free of charge?

- The majority of PDF documents are provided with PDF formats, which can be opened with free programs like Adobe Reader.

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Education Property Tax Rebate Continues In 2022 City Of Portage La

Check more sample of Income Tax Rebate For Higher Education below

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Individual Income Tax Rebate

What To Know About Montana s New Income And Property Tax Rebates

Section 87A Tax Rebate Under Section 87A

https://www.irs.gov/publications/p970

Web Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity

https://www.financialexpress.com/money/income-tax/income-tax-benefits...

Web 10 sept 2018 nbsp 0183 32 For many of us education costs be it for secondary or higher education constitute a significant outlay from the disposable income available This makes us think

Web Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity

Web 10 sept 2018 nbsp 0183 32 For many of us education costs be it for secondary or higher education constitute a significant outlay from the disposable income available This makes us think

Individual Income Tax Rebate

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

What To Know About Montana s New Income And Property Tax Rebates

Section 87A Tax Rebate Under Section 87A

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Pin On Tigri

Pin On Tigri

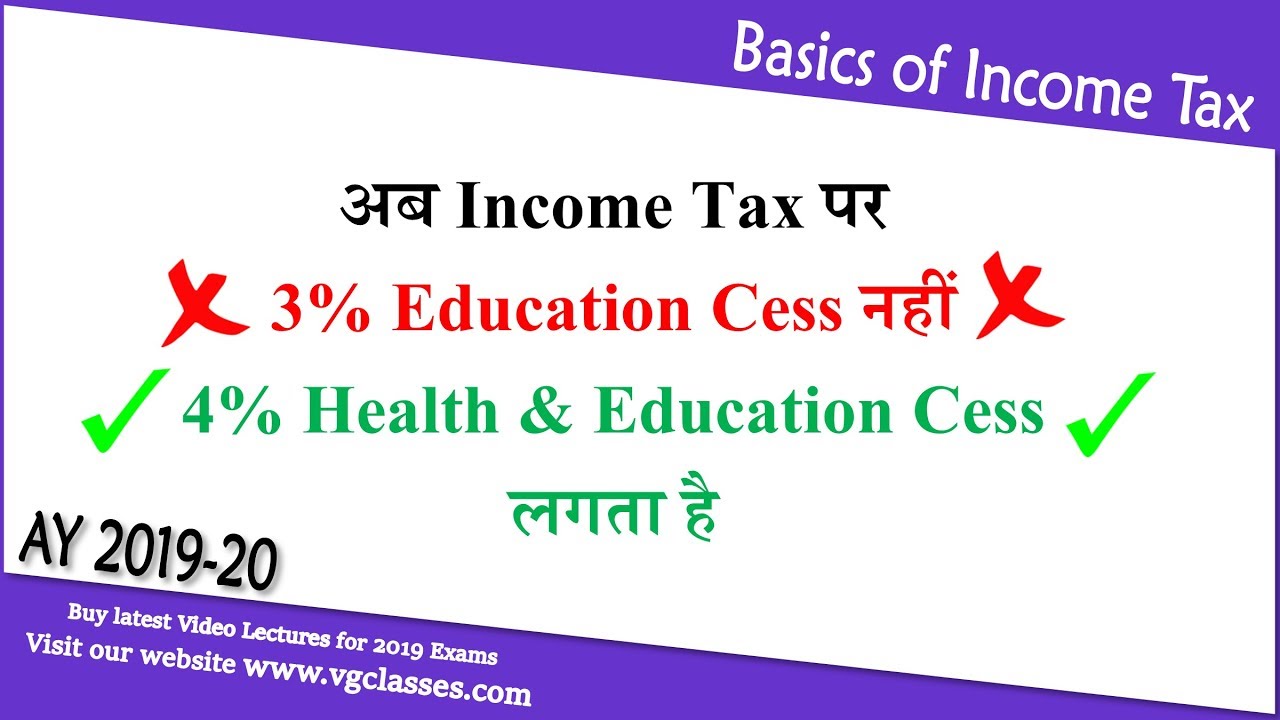

Health Education Cess Rebate U s 87A Marginal Relief Income Tax