In the digital age, where screens have become the dominant feature of our lives and the appeal of physical, printed materials hasn't diminished. In the case of educational materials, creative projects, or simply to add the personal touch to your area, Income Tax Deduction For Higher Education are now a useful resource. For this piece, we'll take a dive to the depths of "Income Tax Deduction For Higher Education," exploring their purpose, where to locate them, and how they can enhance various aspects of your daily life.

Get Latest Income Tax Deduction For Higher Education Below

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Income Tax Deduction For Higher Education

Income Tax Deduction For Higher Education -

Updated on May 25 2022 Reviewed by David Kindness Fact checked by Emily Ernsberger In This Article What Expenses Qualify Examples of Tax Breaks for Education Expenses Online Resources for Eligibility

If the credit reduces tax to less than zero the taxpayer could even receive a refund Taxpayers who pay for higher education in 2021 can see these tax savings

Printables for free cover a broad array of printable materials available online at no cost. These resources come in various kinds, including worksheets coloring pages, templates and more. One of the advantages of Income Tax Deduction For Higher Education lies in their versatility as well as accessibility.

More of Income Tax Deduction For Higher Education

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

Terry Vine Getty Images If you or your child is in college you may be eligible to claim tax credits and deductions for higher education During tax season you may want to file your tax return as

Published January 4 2022 Last Updated October 24 2023 Education Tax Credits and Deductions Did you know there can be tax benefits for pursuing higher education

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization It is possible to tailor printing templates to your own specific requirements whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Impact: Free educational printables cater to learners of all ages, which makes these printables a powerful tool for parents and educators.

-

Accessibility: You have instant access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Income Tax Deduction For Higher Education

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

Up to 2 500 of interest can be deducted per year but the deduction is phased out for taxpayers with modified adjusted gross income over certain threshold amounts

Tax filers can deduct up to 4 000 of tuition and fees paid for higher education in the tax year It is an above the line deduction meaning filers can claim

Now that we've piqued your interest in Income Tax Deduction For Higher Education Let's see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Income Tax Deduction For Higher Education designed for a variety purposes.

- Explore categories such as furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets, flashcards, and learning tools.

- It is ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a broad variety of topics, that includes DIY projects to party planning.

Maximizing Income Tax Deduction For Higher Education

Here are some innovative ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home or in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Income Tax Deduction For Higher Education are a treasure trove of practical and innovative resources that meet a variety of needs and interest. Their availability and versatility make these printables a useful addition to your professional and personal life. Explore the many options of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes they are! You can print and download the resources for free.

-

Do I have the right to use free printables for commercial uses?

- It is contingent on the specific rules of usage. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables could have limitations concerning their use. Be sure to review the terms and conditions provided by the designer.

-

How can I print Income Tax Deduction For Higher Education?

- You can print them at home using an printer, or go to the local print shop for premium prints.

-

What software will I need to access Income Tax Deduction For Higher Education?

- Many printables are offered in PDF format. These can be opened using free software like Adobe Reader.

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

Income Tax Deduction

Check more sample of Income Tax Deduction For Higher Education below

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

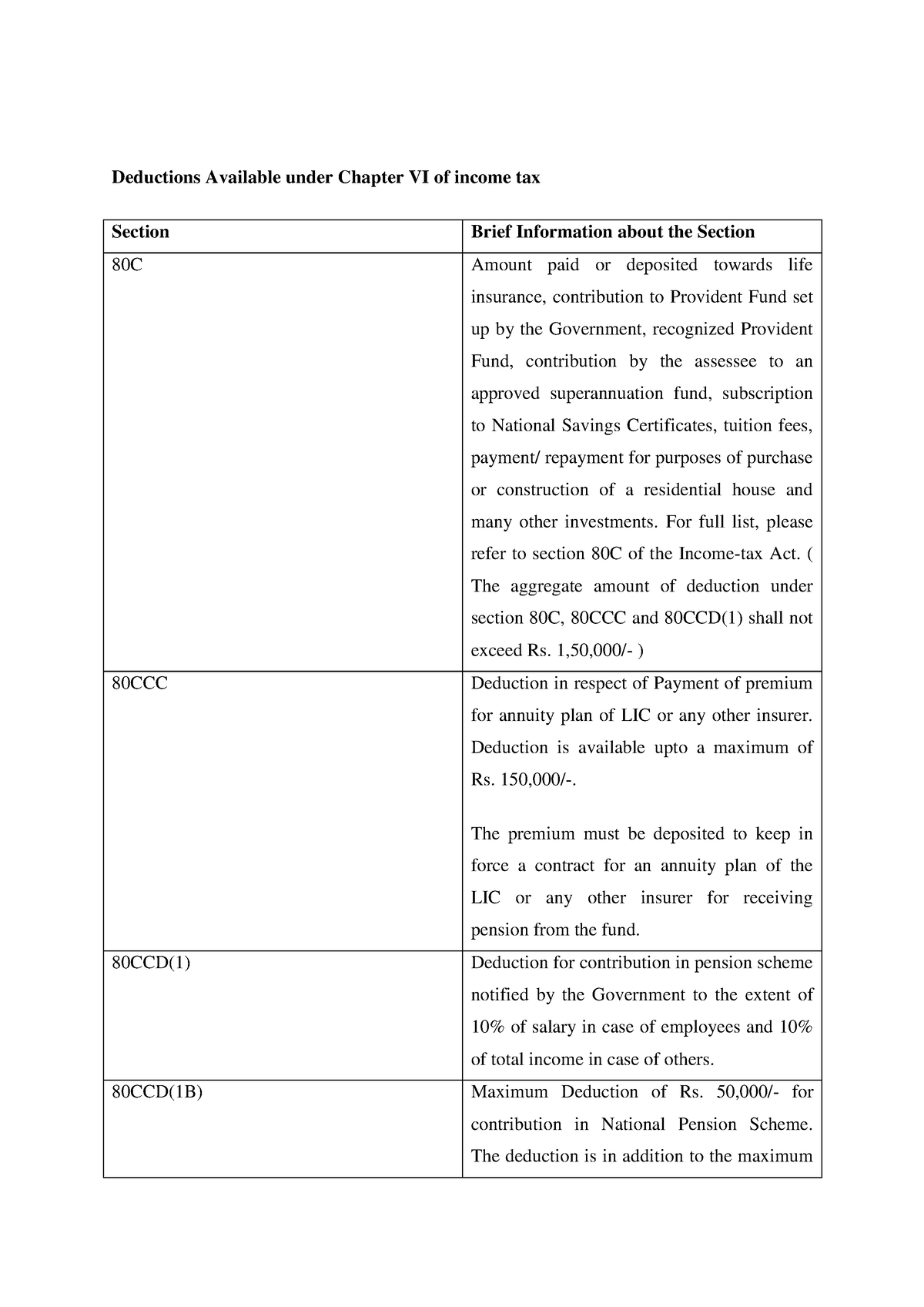

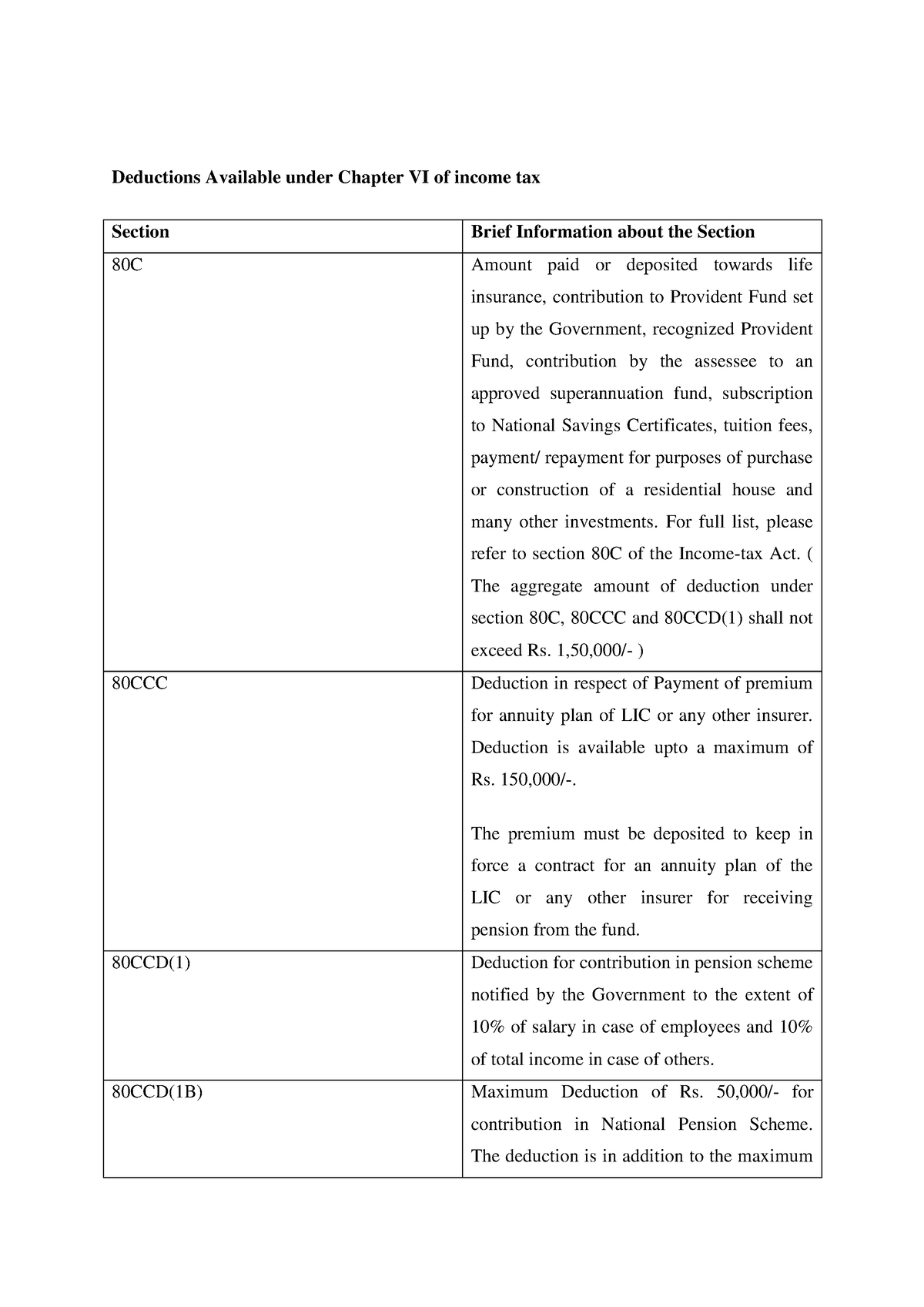

Deductions Available Under Chapter VI Of Income Tax Taxation KSLU

Which States Have The Highest And Lowest Income Tax USAFacts

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://www.irs.gov/newsroom/heres-what-taxpayers...

If the credit reduces tax to less than zero the taxpayer could even receive a refund Taxpayers who pay for higher education in 2021 can see these tax savings

https://www.irs.gov/credits-deductions/individuals/...

How much is the AOTC worth A3 It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the

If the credit reduces tax to less than zero the taxpayer could even receive a refund Taxpayers who pay for higher education in 2021 can see these tax savings

How much is the AOTC worth A3 It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Deductions Available Under Chapter VI Of Income Tax Taxation KSLU

Which States Have The Highest And Lowest Income Tax USAFacts

2020 Standard Deduction Over 65 Standard Deduction 2021

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms