In this age of electronic devices, where screens rule our lives, the charm of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons and creative work, or just adding an individual touch to your home, printables for free have become a valuable resource. The following article is a take a dive in the world of "House Loan Interest Rebate In Income Tax," exploring what they are, where to locate them, and ways they can help you improve many aspects of your lives.

Get Latest House Loan Interest Rebate In Income Tax Below

House Loan Interest Rebate In Income Tax

House Loan Interest Rebate In Income Tax - Housing Loan Interest Rebate In Income Tax New Regime, Housing Loan Interest Rebate In Income Tax, Housing Loan Interest Rebate In Income Tax 2020-21, Home Loan Interest Rebate In Income Tax Fy 2022-23, Home Loan Interest Rebate In Income Tax Section, Home Loan Interest Deduction In Income Tax, Home Loan Interest Rebate In Income Tax 2022-23, Home Loan Interest Rebate In Income Tax Fy 2021-22, Home Loan Interest Rebate In Income Tax India, Housing Loan Interest Claim In Income Tax

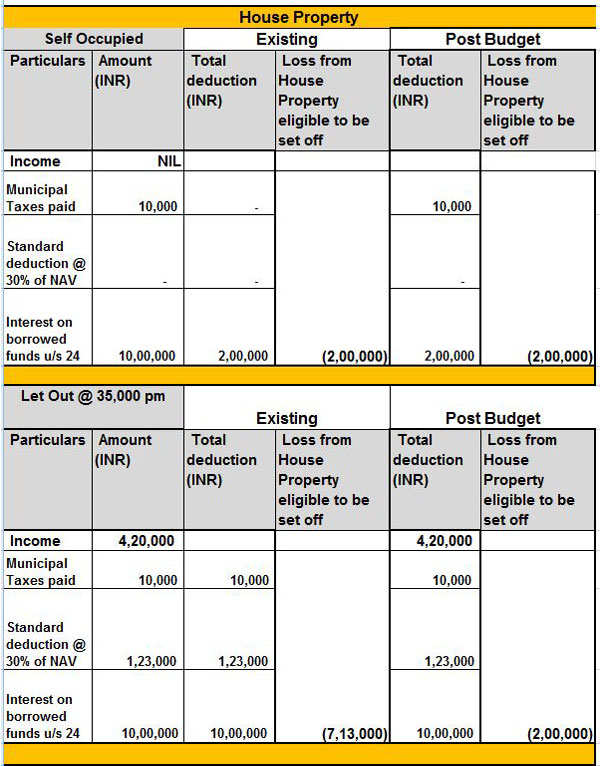

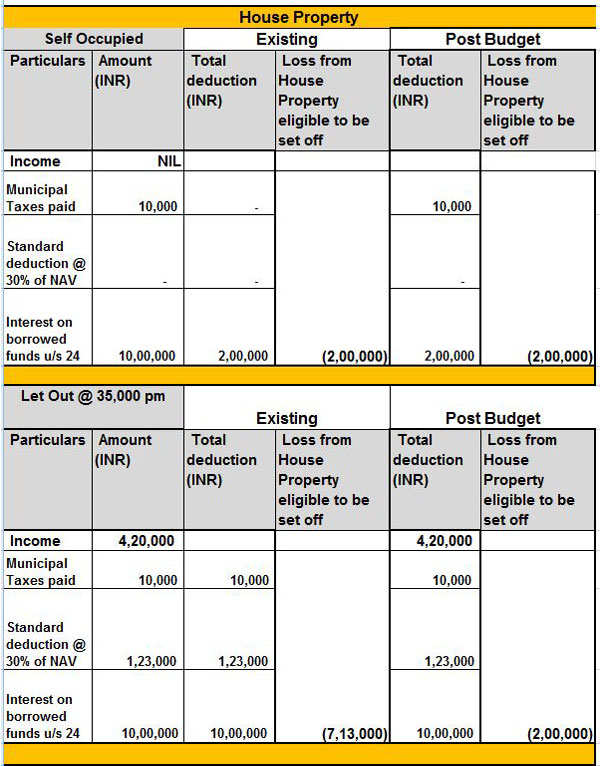

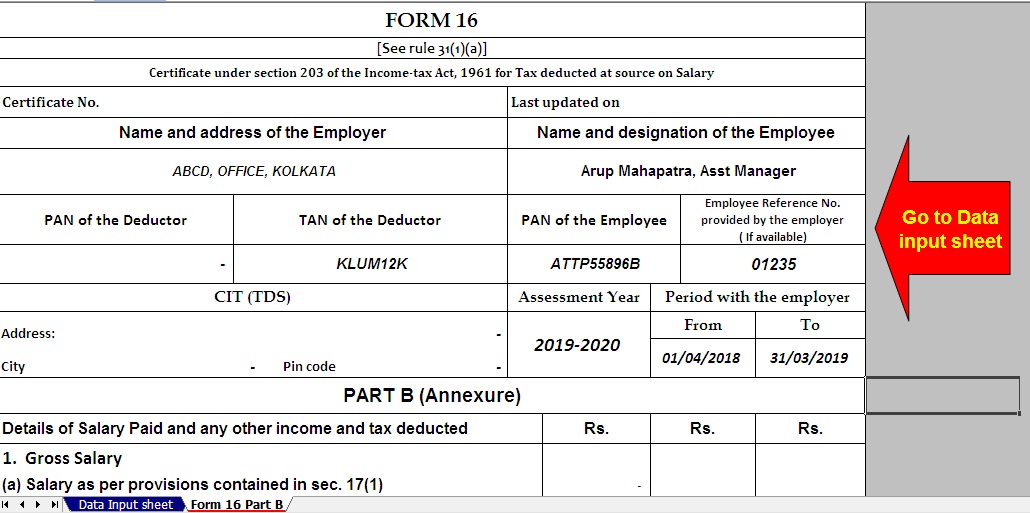

Web 24 ao 251 t 2023 nbsp 0183 32 Sections of Income Tax Act Tax Deduction Section 80C Up to Rs 1 5 lakh on principal repayment including stamp duty and registration fee Section 24 b Up to

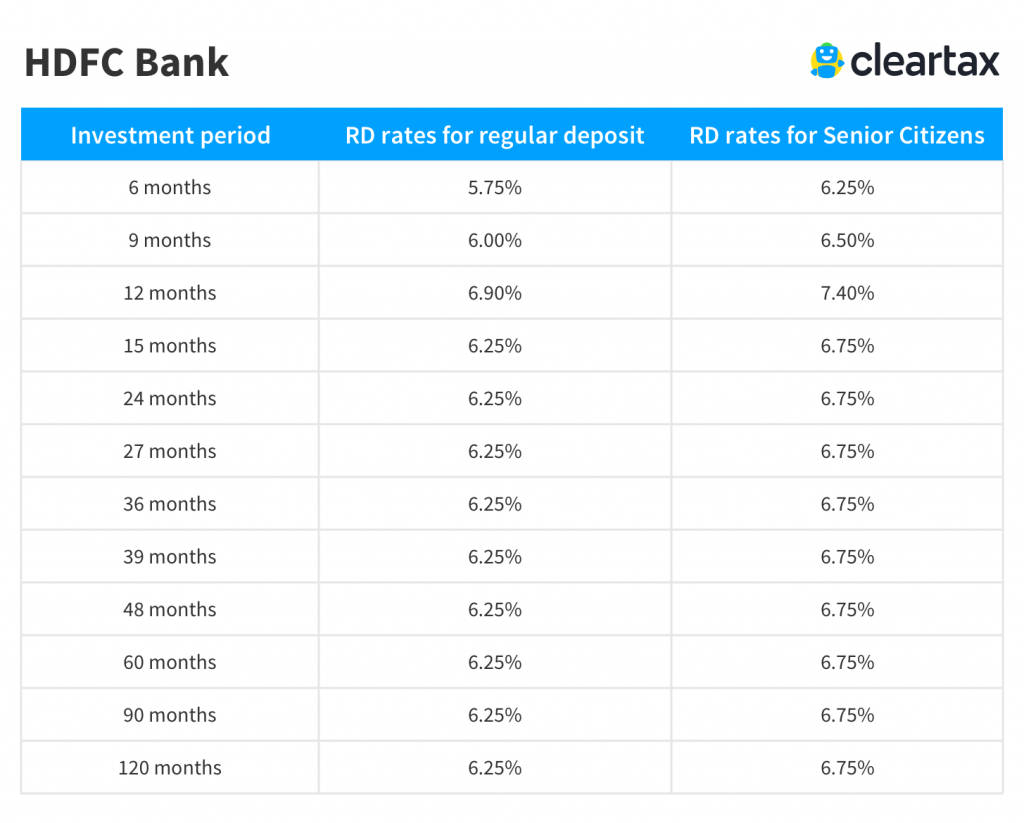

Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law

House Loan Interest Rebate In Income Tax cover a large assortment of printable resources available online for download at no cost. They are available in numerous styles, from worksheets to templates, coloring pages and more. The appealingness of House Loan Interest Rebate In Income Tax is their versatility and accessibility.

More of House Loan Interest Rebate In Income Tax

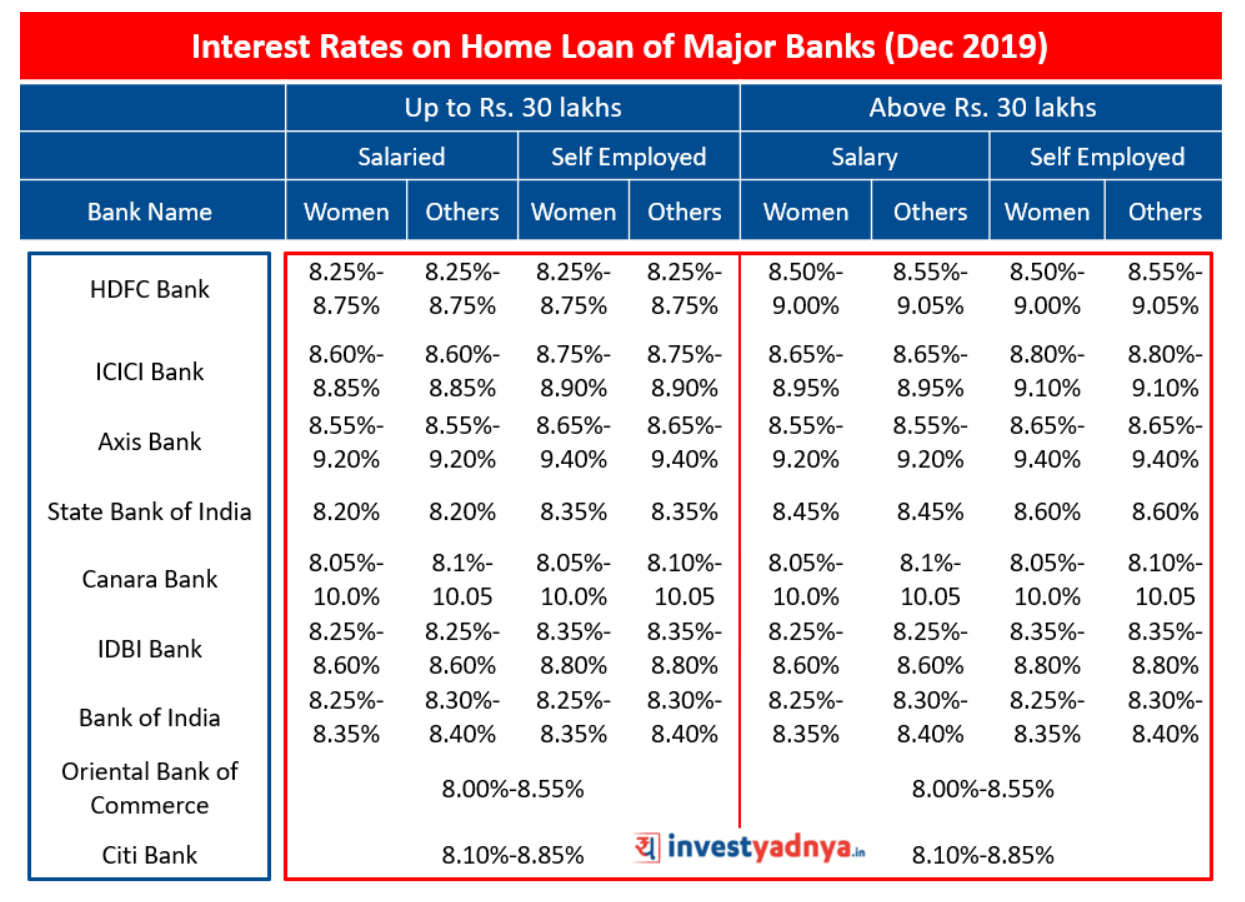

Oct 2016 Best Home Loan Interest Rates In 2016

Oct 2016 Best Home Loan Interest Rates In 2016

Web You will only receive a tax reduction if the deductible financing interest and fees exceed the amount added to your income for the imputed rental value of your home If your taxable

Web The maximum deduction on interest paid for self occupied houses is Rs 2 lakh This rule has been in effect from 2018 19 onwards However if your property is a let out then

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: Your HTML0 customization options allow you to customize the templates to meet your individual needs in designing invitations making your schedule, or decorating your home.

-

Educational Use: These House Loan Interest Rebate In Income Tax provide for students from all ages, making them an invaluable device for teachers and parents.

-

Easy to use: Instant access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more House Loan Interest Rebate In Income Tax

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Web 7 janv 2023 nbsp 0183 32 There is an express need for more tax sops for home buyers as well as investors The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum

Web 17 mai 2019 nbsp 0183 32 Taxpayers who avail of a top up home loan for repairs or renovation of a house can claim a deduction for interest paid on such loans Under the Act the

Now that we've piqued your interest in printables for free Let's find out where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and House Loan Interest Rebate In Income Tax for a variety reasons.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide variety of topics, from DIY projects to planning a party.

Maximizing House Loan Interest Rebate In Income Tax

Here are some creative ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

House Loan Interest Rebate In Income Tax are a treasure trove of practical and innovative resources that satisfy a wide range of requirements and desires. Their access and versatility makes them a valuable addition to both professional and personal life. Explore the endless world of House Loan Interest Rebate In Income Tax now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are House Loan Interest Rebate In Income Tax truly gratis?

- Yes, they are! You can download and print these resources at no cost.

-

Can I use the free printables for commercial purposes?

- It's dependent on the particular usage guidelines. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright issues with House Loan Interest Rebate In Income Tax?

- Certain printables could be restricted on usage. Check the terms and regulations provided by the author.

-

How do I print House Loan Interest Rebate In Income Tax?

- You can print them at home using an printer, or go to a local print shop for superior prints.

-

What program do I require to open printables free of charge?

- Most printables come in the format of PDF, which can be opened using free software such as Adobe Reader.

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

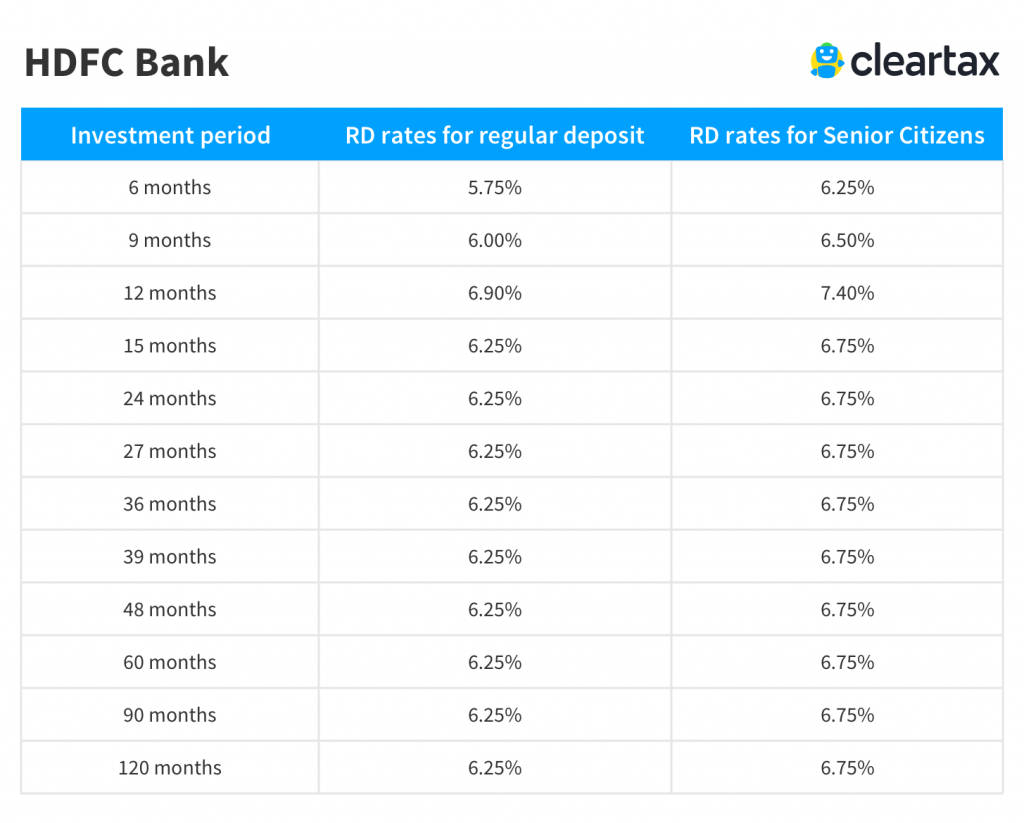

Home Loan Tax Benefit Calculator FrankiSoumya

Check more sample of House Loan Interest Rebate In Income Tax below

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Home Loan Interest Rebate On Home Loan Interest In Income Tax

Home Loan Interest Exemption In Income Tax Home Sweet Home

Don t Just Consider The Interest Rates When Taking A Home Loan Mint

House Loan Interest Rates

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Don t Just Consider The Interest Rates When Taking A Home Loan Mint

Home Loan Interest Rebate On Home Loan Interest In Income Tax

House Loan Interest Rates

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Best Home Loan Interest Rates In India For Nri Home Sweet Home

Best Home Loan Interest Rates In India For Nri Home Sweet Home

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel