In the digital age, in which screens are the norm and the appeal of physical printed material hasn't diminished. No matter whether it's for educational uses, creative projects, or just adding an individual touch to the space, Housing Loan Interest Rebate In Income Tax New Regime have become a valuable resource. We'll take a dive into the world "Housing Loan Interest Rebate In Income Tax New Regime," exploring the different types of printables, where they are available, and how they can enhance various aspects of your life.

Get Latest Housing Loan Interest Rebate In Income Tax New Regime Below

Housing Loan Interest Rebate In Income Tax New Regime

Housing Loan Interest Rebate In Income Tax New Regime -

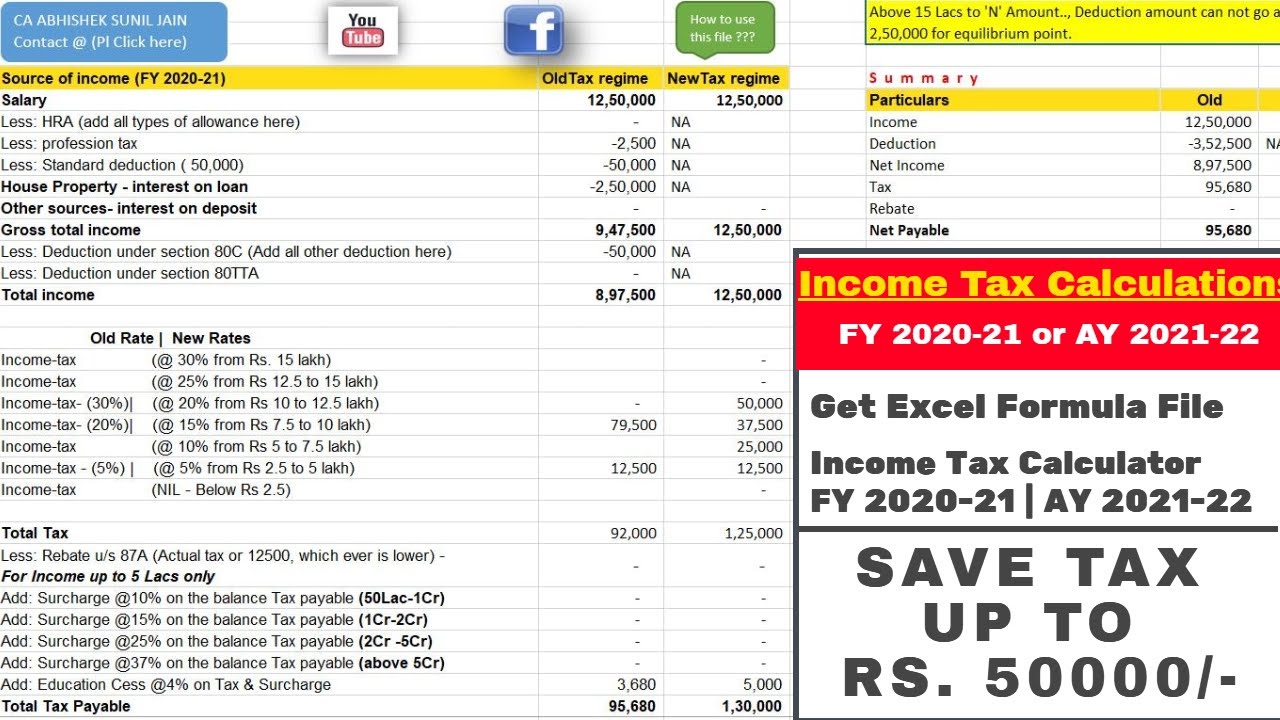

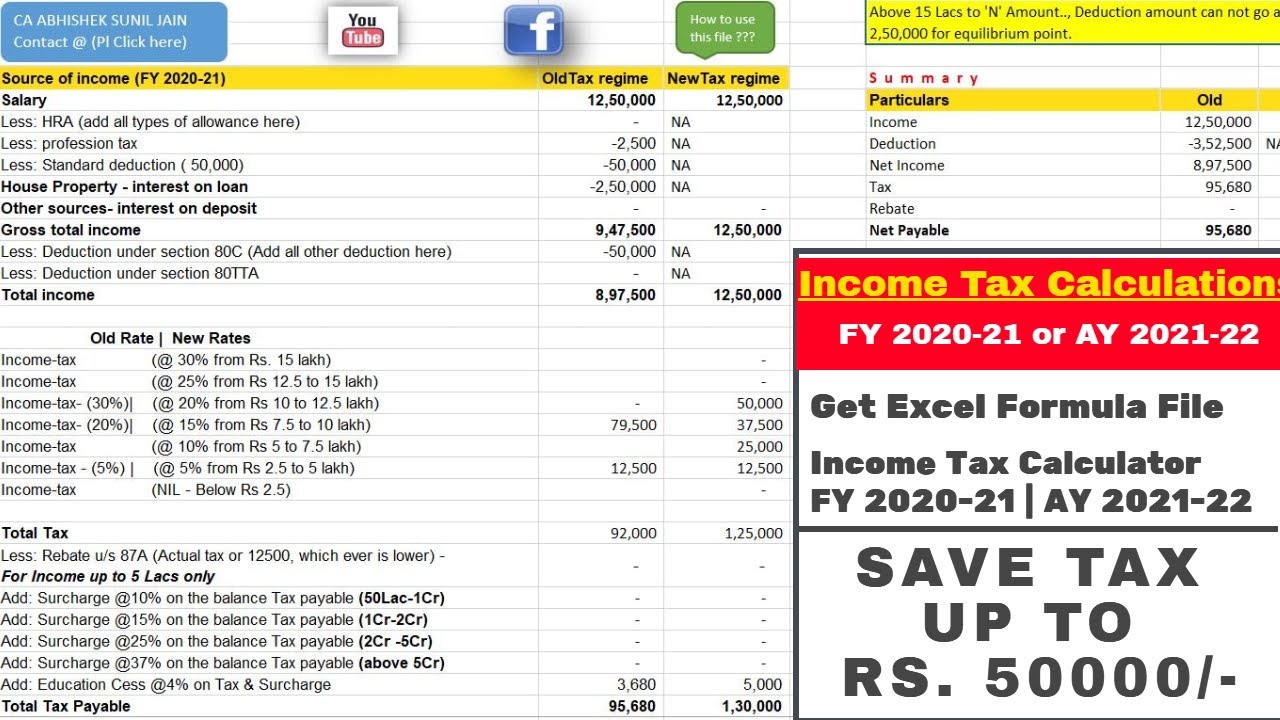

Interest paid on housing loan taken for a rented out property can be claimed as deduction under section 24 b even in the new proposed tax regime Budget 2020 has proposed a new tax regime with lower tax slab rates along with removal of almost all deductions exemptions

The new tax regime has limited these benefits Here are 3 questions What are the maximum deductions for home loan interest payments How can joint home loan holders claim deductions What are the impacts of

Housing Loan Interest Rebate In Income Tax New Regime include a broad collection of printable resources available online for download at no cost. These resources come in various forms, including worksheets, templates, coloring pages and more. The appealingness of Housing Loan Interest Rebate In Income Tax New Regime is in their versatility and accessibility.

More of Housing Loan Interest Rebate In Income Tax New Regime

Income Tax Return How To Claim Home Loan Tax Rebate In This Husband

Income Tax Return How To Claim Home Loan Tax Rebate In This Husband

While it offers lower tax rates it also affects the way you can claim deductions for your home loan Here s how the new regime impacts home loan tax benefits Reduced Benefits Section 24 b Deduction Interest on Self Occupied Property This common deduction for interest paid on self occupied properties is not available under

Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional deduction of 50 000

The Housing Loan Interest Rebate In Income Tax New Regime have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Individualization They can make designs to suit your personal needs, whether it's designing invitations to organize your schedule or decorating your home.

-

Education Value Education-related printables at no charge cater to learners from all ages, making them a great resource for educators and parents.

-

Simple: Instant access to a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Housing Loan Interest Rebate In Income Tax New Regime

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Rebate U s 87A For The Financial Year 2022 23

1 min read 26 Oct 2021 05 40 PM IST Shipra Singh The tax rules still allows deduction on interest paid towards loan on a rented property under section 24 b The new tax structure

However for homebuyers income tax deduction of up to 1 50 lakhs on the repayment of housing loans principal interest under Sec 80C is available under the old tax regime and switching

We hope we've stimulated your curiosity about Housing Loan Interest Rebate In Income Tax New Regime and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of purposes.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs covered cover a wide spectrum of interests, everything from DIY projects to party planning.

Maximizing Housing Loan Interest Rebate In Income Tax New Regime

Here are some ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Housing Loan Interest Rebate In Income Tax New Regime are a treasure trove of fun and practical tools that satisfy a wide range of requirements and hobbies. Their accessibility and versatility make them an invaluable addition to any professional or personal life. Explore the vast world of Housing Loan Interest Rebate In Income Tax New Regime to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes they are! You can download and print these resources at no cost.

-

Can I download free printouts for commercial usage?

- It is contingent on the specific rules of usage. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with Housing Loan Interest Rebate In Income Tax New Regime?

- Some printables may come with restrictions in their usage. Always read these terms and conditions as set out by the designer.

-

How can I print Housing Loan Interest Rebate In Income Tax New Regime?

- Print them at home with your printer or visit a local print shop to purchase high-quality prints.

-

What software do I need to open Housing Loan Interest Rebate In Income Tax New Regime?

- Most printables come as PDF files, which can be opened using free software, such as Adobe Reader.

Income Tax New Regime Rebate Slabs 2023 Explained Should You Choose

Joint Home Loan Declaration Form For Income Tax Savings And Non

Check more sample of Housing Loan Interest Rebate In Income Tax New Regime below

Income Tax New Regime Vs Old Regime shorts budget2023 income

Income Tax New Regime Vs Old Regime YouTube

Why The New Income Tax Regime Has Few Takers

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

How Is Housing Loan Interest Calculated In Singapore

Breathtaking Income Tax Calculation Statement Two Types Of Financial

https://cleartax.in/s/home-loan-tax-benefits

The new tax regime has limited these benefits Here are 3 questions What are the maximum deductions for home loan interest payments How can joint home loan holders claim deductions What are the impacts of

https://www.godrejcapital.com/media-blog/knowledge...

Income Tax Benefits on Home Loans in the New Income Tax Regime In the updated income tax return policy exemptions on the interest paid for a self occupied property are no longer available under section 24 Furthermore since deductions under section 80C are not allowed in the new tax regime you cannot claim an exemption on the principal

The new tax regime has limited these benefits Here are 3 questions What are the maximum deductions for home loan interest payments How can joint home loan holders claim deductions What are the impacts of

Income Tax Benefits on Home Loans in the New Income Tax Regime In the updated income tax return policy exemptions on the interest paid for a self occupied property are no longer available under section 24 Furthermore since deductions under section 80C are not allowed in the new tax regime you cannot claim an exemption on the principal

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

Income Tax New Regime Vs Old Regime YouTube

How Is Housing Loan Interest Calculated In Singapore

Breathtaking Income Tax Calculation Statement Two Types Of Financial

New Income Tax Slabs Budget 2023 Highlights Big Rebate On Income Tax

New Tax Regime Vs Old Tax Regime Which Is Better Yadnya Investment Vrogue

New Tax Regime Vs Old Tax Regime Which Is Better Yadnya Investment Vrogue

How To Deal With An Income Tax Notice Wealthzi