In this age of technology, where screens rule our lives and the appeal of physical, printed materials hasn't diminished. For educational purposes or creative projects, or simply to add an individual touch to your area, Home Loan Interest Rebate In Income Tax Section have become an invaluable resource. We'll dive through the vast world of "Home Loan Interest Rebate In Income Tax Section," exploring what they are, where to get them, as well as how they can add value to various aspects of your life.

Get Latest Home Loan Interest Rebate In Income Tax Section Below

Home Loan Interest Rebate In Income Tax Section

Home Loan Interest Rebate In Income Tax Section - Home Loan Interest Rebate In Income Tax Section, Home Loan Interest Deduction In Income Tax Section, Income Tax Rebate On Second Housing Loan Interest, What Is Interest Rebate On Housing Loan, Maximum Rebate On Home Loan Interest, Section For Housing Loan Interest Deduction, Is Home Loan Interest Tax Deductible

Web income tax Sections that provide tax rebate when you take a home loan you make the home loan repayment to the lender in equated monthly installments EMIs the home

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Home Loan Interest Rebate In Income Tax Section encompass a wide array of printable material that is available online at no cost. They are available in a variety of styles, from worksheets to coloring pages, templates and many more. The appealingness of Home Loan Interest Rebate In Income Tax Section is their versatility and accessibility.

More of Home Loan Interest Rebate In Income Tax Section

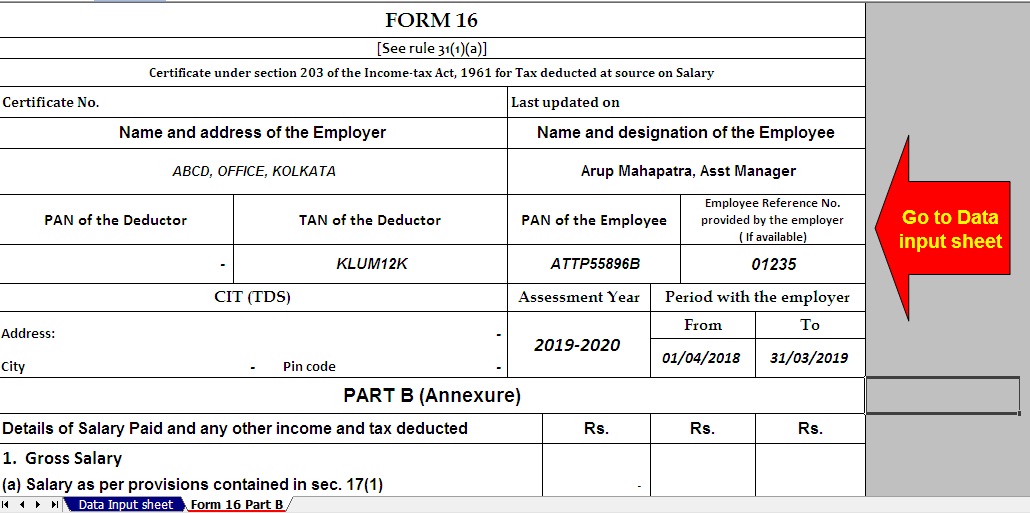

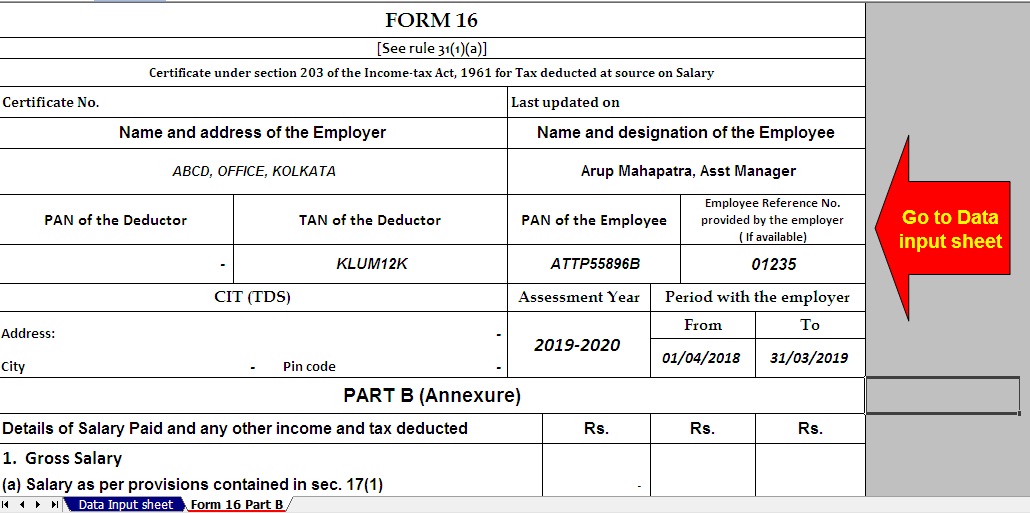

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web 9 f 233 vr 2018 nbsp 0183 32 The repayment of your Home Loan principal amount and the repayment of the interest on your Home Loan each fall under separate

Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

customization You can tailor printed materials to meet your requirements for invitations, whether that's creating them planning your schedule or decorating your home.

-

Education Value Downloads of educational content for free are designed to appeal to students from all ages, making them a valuable tool for teachers and parents.

-

Simple: Quick access to a plethora of designs and templates saves time and effort.

Where to Find more Home Loan Interest Rebate In Income Tax Section

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Web You can claim a deduction under your interest category of up to Rs 2 lakh under Section 24 The maximum deduction on interest paid for self occupied houses is Rs 2 lakh This

Web 24 ao 251 t 2023 nbsp 0183 32 Sections of Income Tax Act Tax Deduction Section 80C Up to Rs 1 5 lakh on principal repayment including stamp duty and registration fee Section 24 b Up

Now that we've ignited your interest in printables for free and other printables, let's discover where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Home Loan Interest Rebate In Income Tax Section for various needs.

- Explore categories such as decoration for your home, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free, flashcards, and learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a wide selection of subjects, that includes DIY projects to planning a party.

Maximizing Home Loan Interest Rebate In Income Tax Section

Here are some inventive ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Home Loan Interest Rebate In Income Tax Section are an abundance of practical and imaginative resources catering to different needs and interests. Their access and versatility makes them an essential part of both professional and personal life. Explore the endless world of Home Loan Interest Rebate In Income Tax Section and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes, they are! You can print and download these documents for free.

-

Do I have the right to use free printables for commercial purposes?

- It depends on the specific terms of use. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may contain restrictions regarding usage. Be sure to read these terms and conditions as set out by the designer.

-

How can I print printables for free?

- You can print them at home using your printer or visit an area print shop for top quality prints.

-

What program do I need in order to open printables that are free?

- Most printables come in PDF format. These can be opened with free software, such as Adobe Reader.

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Check more sample of Home Loan Interest Rebate In Income Tax Section below

Home Loan Interest Exemption In Income Tax Home Sweet Home

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Lic Home Loan Interest Rate 2020 Calculator Online Offer Save 61

Essential Design Smartphone Apps

DEDUCTION UNDER SECTION 80C TO 80U PDF

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Essential Design Smartphone Apps

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

DEDUCTION UNDER SECTION 80C TO 80U PDF

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

All You Need To Know About Tax Rebate Under Section 87A By Enterslice