In the age of digital, where screens have become the dominant feature of our lives and the appeal of physical printed materials isn't diminishing. Whether it's for educational purposes such as creative projects or just adding personal touches to your area, Does State Of California Tax Ira Distributions are a great source. The following article is a dive deeper into "Does State Of California Tax Ira Distributions," exploring the benefits of them, where to find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Does State Of California Tax Ira Distributions Below

Does State Of California Tax Ira Distributions

Does State Of California Tax Ira Distributions - Does State Of California Tax Ira Distributions, Does California Tax Ira Distributions, Which States Do Not Tax Ira Distributions, Are Ira Distributions State Taxable, Does Any State Not Tax Ira Distributions

Withholding from an IRA distribution for California income taxes is not mandatory However most financial firms will automatically withhold 10 percent of the amount withheld for federal income taxes if federal taxes

The federal government considers distributions from pensions 401 k s and traditional individual retirement accounts IRAs as income the same as it does the income you get from work Eight

Printables for free cover a broad array of printable content that can be downloaded from the internet at no cost. They are available in numerous forms, including worksheets, templates, coloring pages, and much more. The beauty of Does State Of California Tax Ira Distributions is in their variety and accessibility.

More of Does State Of California Tax Ira Distributions

California Tax Rules On IRA Distributions Sapling

California Tax Rules On IRA Distributions Sapling

You may be able to claim a deduction on your income tax return for the amount you contributed to your IRA We generally follow the IRS when it comes to deduction limits

1 Best answer dmertz Level 15 The taxable amount of an IRA distribution is ordinary income so there is no California calculation involved that is specific to the IRA

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Customization: There is the possibility of tailoring designs to suit your personal needs whether you're designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value Education-related printables at no charge cater to learners from all ages, making them a great instrument for parents and teachers.

-

Convenience: Instant access to a myriad of designs as well as templates reduces time and effort.

Where to Find more Does State Of California Tax Ira Distributions

Roth IRA Withdrawal Rules Oblivious Investor

Roth IRA Withdrawal Rules Oblivious Investor

Income that California handles differently IRA and Pension Distributions IRA Distribution Adjustments Pension Adjustments I don t understand how to do this

What is a 401 k in California A 401 k is a tax qualified plan that allows employees to withhold a portion of their pay on a pre tax basis With these funds

After we've peaked your interest in printables for free Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Does State Of California Tax Ira Distributions suitable for many objectives.

- Explore categories such as design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- These blogs cover a broad spectrum of interests, from DIY projects to planning a party.

Maximizing Does State Of California Tax Ira Distributions

Here are some innovative ways how you could make the most use of Does State Of California Tax Ira Distributions:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Does State Of California Tax Ira Distributions are a treasure trove of creative and practical resources designed to meet a range of needs and desires. Their accessibility and versatility make these printables a useful addition to both personal and professional life. Explore the vast collection of Does State Of California Tax Ira Distributions now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes, they are! You can print and download these materials for free.

-

Can I use the free templates for commercial use?

- It's based on specific conditions of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright rights issues with Does State Of California Tax Ira Distributions?

- Certain printables could be restricted regarding their use. Check the terms and regulations provided by the creator.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit an area print shop for the highest quality prints.

-

What program do I require to open Does State Of California Tax Ira Distributions?

- Most printables come in PDF format. They can be opened using free software such as Adobe Reader.

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA

Check more sample of Does State Of California Tax Ira Distributions below

IRA Distributions Can I Avoid The Tax Pyke Associates PC

Understanding Pennsylvania s Tax Laws On IRA Distributions Linesville

States That Won t Tax Your Retirement Distributions In 2021

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Prem Pariyar MSW On Twitter The State Of California Must Protect The

https://www.aarp.org/money/taxes/info-2023/…

The federal government considers distributions from pensions 401 k s and traditional individual retirement accounts IRAs as income the same as it does the income you get from work Eight

https://www.ftb.ca.gov/forms/2021/2021-1005-publication.pdf

Immediately before retirement begins California does not impose tax on retirement income received by a nonresident after December 31 1995 This includes military pensions

The federal government considers distributions from pensions 401 k s and traditional individual retirement accounts IRAs as income the same as it does the income you get from work Eight

Immediately before retirement begins California does not impose tax on retirement income received by a nonresident after December 31 1995 This includes military pensions

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Understanding Pennsylvania s Tax Laws On IRA Distributions Linesville

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Prem Pariyar MSW On Twitter The State Of California Must Protect The

+1000px.jpg)

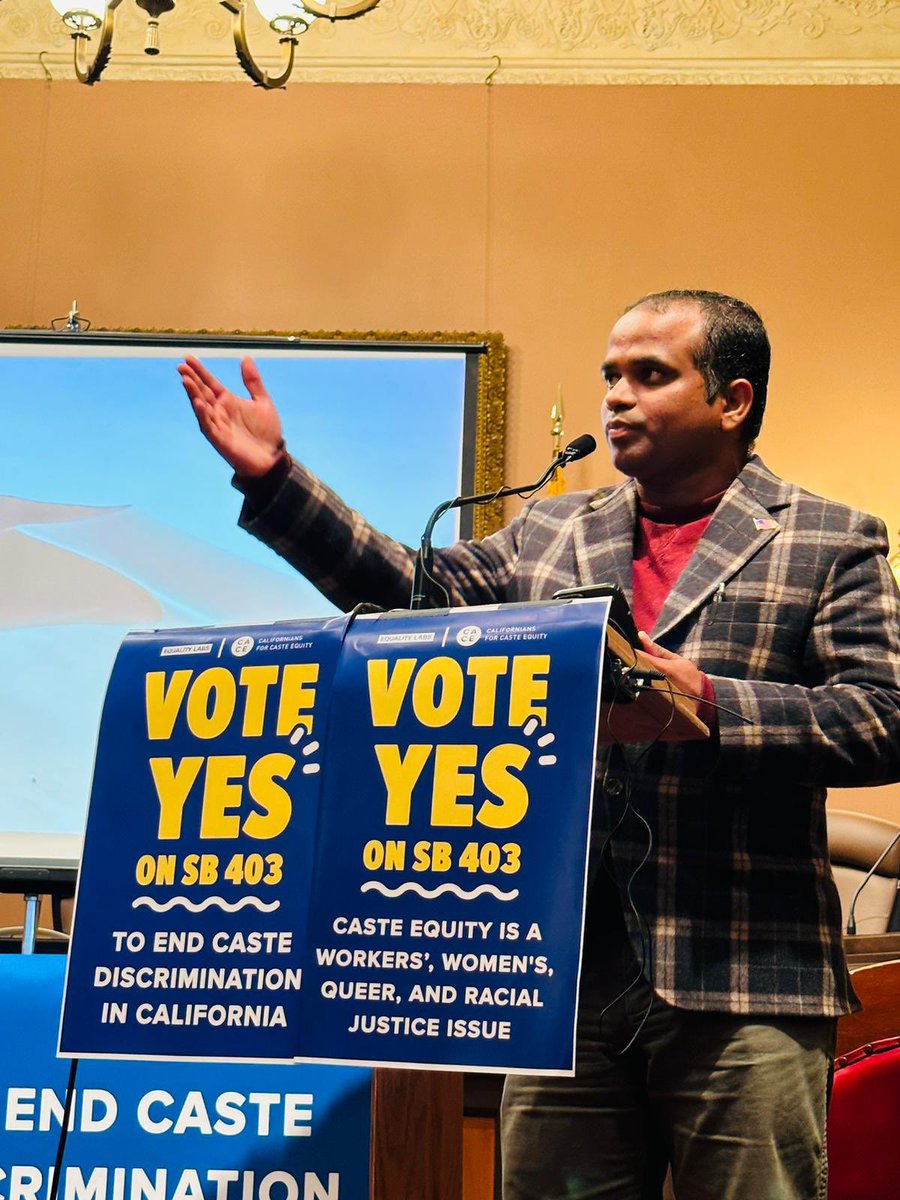

IRA Beneficiary Options For Deaths Before January 1 2020 Ascensus

State Of California On LinkedIn Https lnkd in g5Adc9tZ

State Of California On LinkedIn Https lnkd in g5Adc9tZ

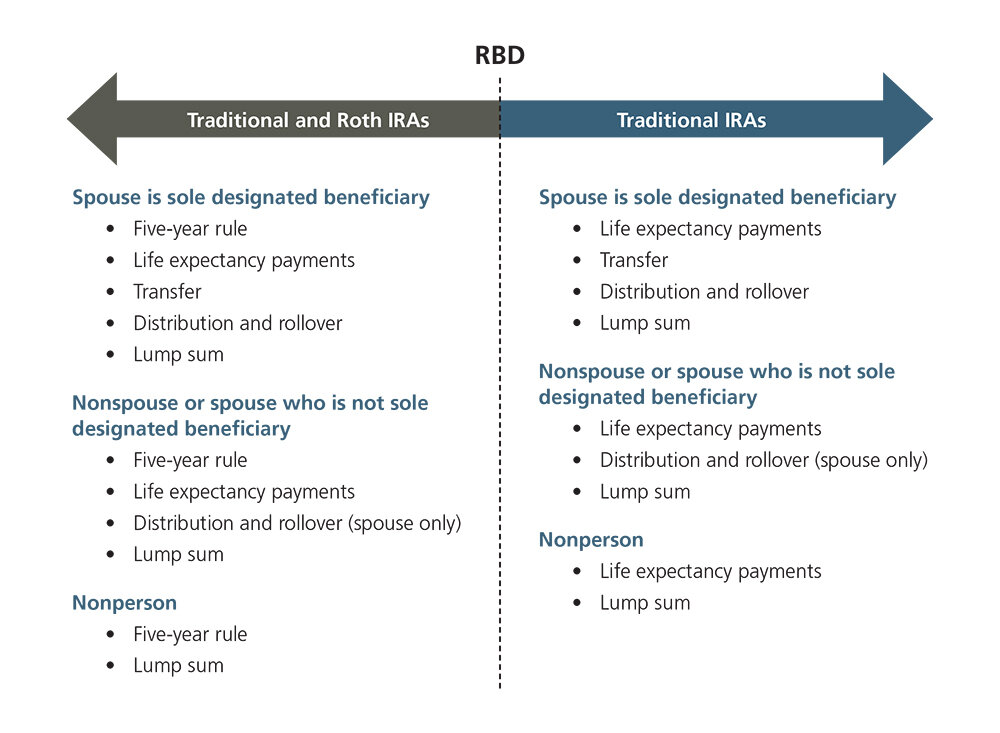

California Tax Exempt Form 2020 Fill And Sign Printable Template