In this age of electronic devices, where screens rule our lives, the charm of tangible printed items hasn't gone away. If it's to aid in education in creative or artistic projects, or simply adding an individual touch to your area, Which States Do Not Tax Ira Distributions have become a valuable resource. Here, we'll take a dive to the depths of "Which States Do Not Tax Ira Distributions," exploring what they are, how to find them, and what they can do to improve different aspects of your life.

Get Latest Which States Do Not Tax Ira Distributions Below

Which States Do Not Tax Ira Distributions

Which States Do Not Tax Ira Distributions - Which States Do Not Tax Ira Distributions, Which States Do Not Tax Roth Ira Distributions, What States Do Not Tax Your Ira Distributions, What States Have No Tax On Ira Distributions, Does Any State Not Tax Ira Distributions, Do All States Tax Ira Distributions, Which States Do Not Tax Retirement Distributions

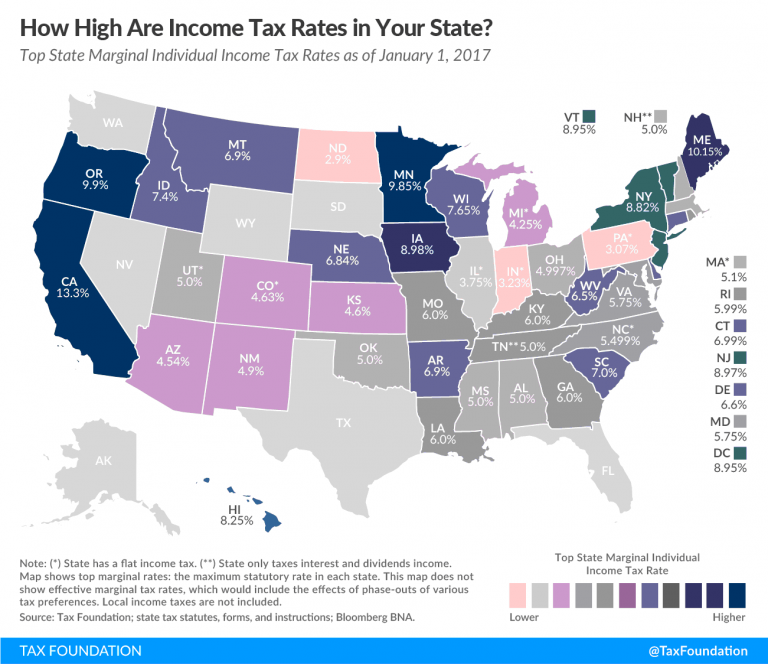

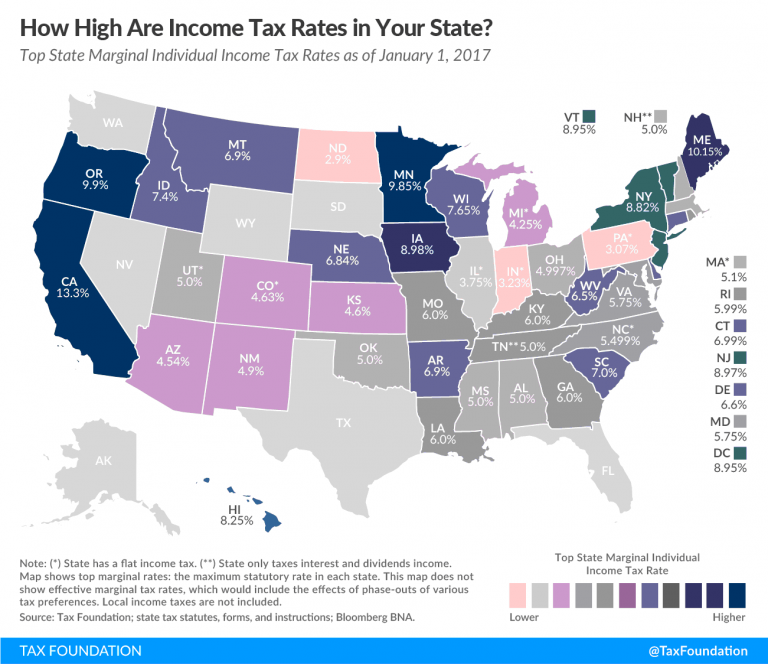

These include Alaska Florida Nevada South Dakota Tennessee Texas and Wyoming Washington has income tax but it only applies to capital gains income of high earners according to the Tax

Those eight Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming don t tax wages salaries dividends interest or any sort of income No state income tax means these states also don t tax Social Security retirement benefits pension payments and distributions from retirement accounts

Printables for free cover a broad range of printable, free content that can be downloaded from the internet at no cost. These resources come in many forms, including worksheets, templates, coloring pages, and much more. The value of Which States Do Not Tax Ira Distributions is in their versatility and accessibility.

More of Which States Do Not Tax Ira Distributions

IRA Distributions

IRA Distributions

Nevada New Hampshire does tax interest and dividends South Dakota Tennessee Texas Washington Wyoming No income tax on retirement income In addition four states with income tax

These include Alaska Florida Nevada South Dakota Tennessee Texas and Wyoming Washington has income tax but it only applies to capital gains income of high earners according to the Tax Foundation Similarly New Hampshire taxes only interest and dividend income States With No Taxation on Retirement Income

Which States Do Not Tax Ira Distributions have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: This allows you to modify the templates to meet your individual needs in designing invitations as well as organizing your calendar, or even decorating your home.

-

Education Value Printables for education that are free are designed to appeal to students from all ages, making them an essential resource for educators and parents.

-

The convenience of Fast access many designs and templates is time-saving and saves effort.

Where to Find more Which States Do Not Tax Ira Distributions

Top 3 Which States Do Not Collect Sales Tax In 2022 G u y

Top 3 Which States Do Not Collect Sales Tax In 2022 G u y

Companies Cryptocurrencies Technology Personal Finance More Earnings Financial Advisors Personal Finance Retiring These States Won t Tax Your Distributions November 28 2022 09 00

There are 12 states that don t tax your retirement income distributions While I would never recommend someone move in retirement to save money on taxes I would be remiss if I didn t point

After we've peaked your interest in Which States Do Not Tax Ira Distributions, let's explore where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with Which States Do Not Tax Ira Distributions for all uses.

- Explore categories such as decoration for your home, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets along with flashcards, as well as other learning materials.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a broad selection of subjects, including DIY projects to planning a party.

Maximizing Which States Do Not Tax Ira Distributions

Here are some creative ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to aid in learning at your home (or in the learning environment).

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Which States Do Not Tax Ira Distributions are an abundance of fun and practical tools that cater to various needs and pursuits. Their accessibility and flexibility make them a great addition to the professional and personal lives of both. Explore the plethora that is Which States Do Not Tax Ira Distributions today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes, they are! You can download and print these tools for free.

-

Can I download free printables to make commercial products?

- It depends on the specific usage guidelines. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables could have limitations regarding usage. You should read these terms and conditions as set out by the author.

-

How do I print Which States Do Not Tax Ira Distributions?

- Print them at home using either a printer or go to the local print shops for superior prints.

-

What software will I need to access Which States Do Not Tax Ira Distributions?

- Most printables come in the format of PDF, which can be opened using free software like Adobe Reader.

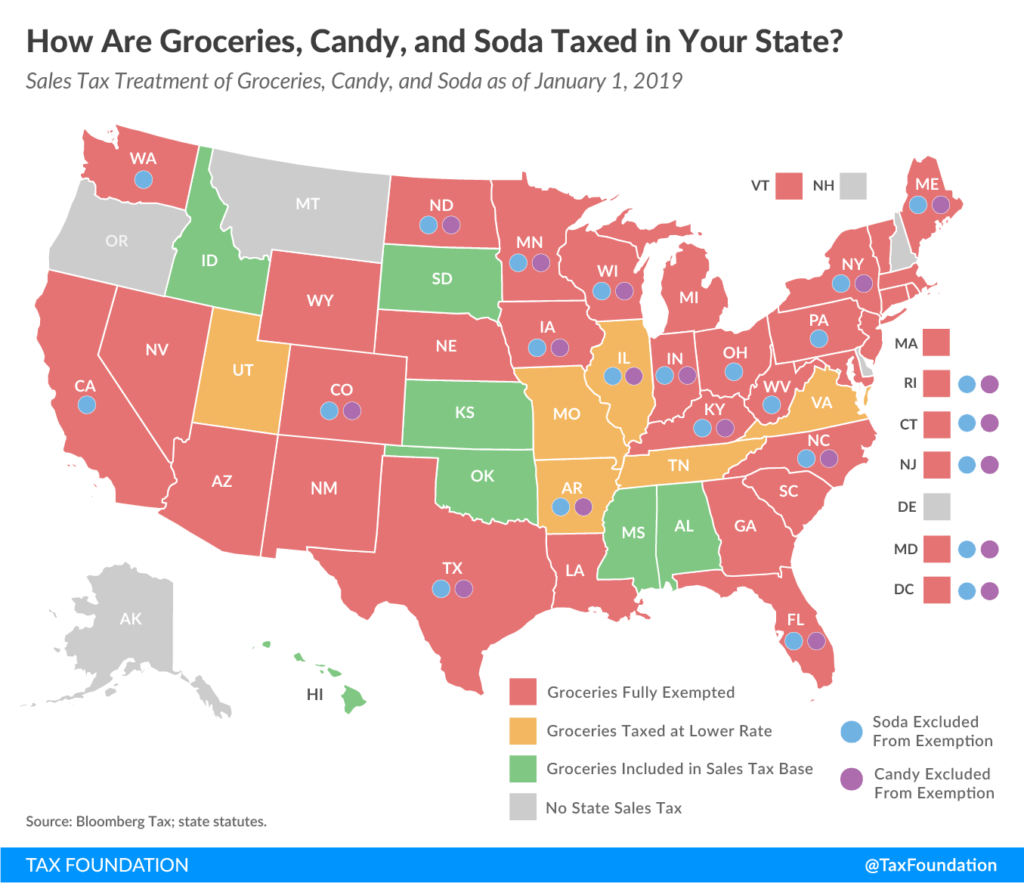

Sales Tax On Grocery Items By State Chart TopForeignStocks

Meet The 38 States That Do Not Tax Social Security Do You Live In One

Check more sample of Which States Do Not Tax Ira Distributions below

IRA Distributions Can I Avoid The Tax Pyke Associates PC

Taxation And Investing Of Inherited IRA Distributions NJMoneyHelp

Tax IRA And Roth IRA Accounts YouTube

States That Won t Tax Your Retirement Distributions In 2021

Understanding Pennsylvania s Tax Laws On IRA Distributions Linesville

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

https://smartasset.com/retirement/states-that-do...

Those eight Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming don t tax wages salaries dividends interest or any sort of income No state income tax means these states also don t tax Social Security retirement benefits pension payments and distributions from retirement accounts

https://walletgenius.com/taxes/states-that-wont...

Home 12 States That Won t Tax Your Retirement Distributions Published on Jul 20 2022 6 minute read By John Warbuck Choosing to live in a state that doesn t tax retirement income can help you preserve your savings for longer when you re aging Taxes aren t the sole factor you should consider

Those eight Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming don t tax wages salaries dividends interest or any sort of income No state income tax means these states also don t tax Social Security retirement benefits pension payments and distributions from retirement accounts

Home 12 States That Won t Tax Your Retirement Distributions Published on Jul 20 2022 6 minute read By John Warbuck Choosing to live in a state that doesn t tax retirement income can help you preserve your savings for longer when you re aging Taxes aren t the sole factor you should consider

States That Won t Tax Your Retirement Distributions In 2021

Taxation And Investing Of Inherited IRA Distributions NJMoneyHelp

Understanding Pennsylvania s Tax Laws On IRA Distributions Linesville

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Tax free IRA Distributions Make Sound Financial Sense For Many Donors

7 States That Do Not Tax Retirement Income

7 States That Do Not Tax Retirement Income

What States Do Not Tax Social Security Sapling