Today, in which screens are the norm yet the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses or creative projects, or simply adding a personal touch to your area, Do You Pay Taxes On Social Security Retirement Payments are now an essential source. With this guide, you'll dive deep into the realm of "Do You Pay Taxes On Social Security Retirement Payments," exploring what they are, how they are available, and the ways that they can benefit different aspects of your daily life.

Get Latest Do You Pay Taxes On Social Security Retirement Payments Below

Do You Pay Taxes On Social Security Retirement Payments

Do You Pay Taxes On Social Security Retirement Payments - Do You Pay Taxes On Social Security Retirement Payments, Do You Pay Federal Income Tax On Social Security Retirement Benefits, Do You Get Taxed On Social Security Retirement Benefits, What Taxes Do You Pay On Social Security Payments, Do You Pay Social Security Taxes On Social Security Payments, What Social Security Payments Are Taxable

Nobody pays taxes on more than 85 percent of their Social Security benefits no matter their income The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits

Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a separate tax return you probably will pay taxes on your benefits Your adjusted gross income Nontaxable interest

Do You Pay Taxes On Social Security Retirement Payments encompass a wide range of printable, free documents that can be downloaded online at no cost. They are available in a variety of types, such as worksheets templates, coloring pages and many more. The benefit of Do You Pay Taxes On Social Security Retirement Payments is in their versatility and accessibility.

More of Do You Pay Taxes On Social Security Retirement Payments

Will You Pay Taxes On Your Social Security Benefits The Motley Fool

Will You Pay Taxes On Your Social Security Benefits The Motley Fool

If you decide to strike out on your own in retirement you ll probably need to pay income taxes on your earnings plus Social Security and Medicare taxes 12 4 on the first

The percentage of your Social Security retirement benefit that s taxable isn t equal to the percentage you pay in taxes For example if your annual Social Security benefit is 20 000

Do You Pay Taxes On Social Security Retirement Payments have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: There is the possibility of tailoring printables to your specific needs in designing invitations and schedules, or even decorating your house.

-

Educational Use: These Do You Pay Taxes On Social Security Retirement Payments provide for students of all ages, making them an invaluable resource for educators and parents.

-

Convenience: Instant access to a variety of designs and templates is time-saving and saves effort.

Where to Find more Do You Pay Taxes On Social Security Retirement Payments

Paying Taxes The Pros And Cons Of Doing It With A Credit Card

Paying Taxes The Pros And Cons Of Doing It With A Credit Card

You won t be taxed on all your benefits Under an overhaul of Social Security s financing passed by Congress and signed by President Ronald Reagan in 1983 up to 50 percent of benefit income could be taxed if the recipient s combined income exceeded the limits noted above

50 of your Social Security benefit 11 436 31 436 of combined income Based on the Social Security income thresholds up to 50 of your benefit would be considered taxable income That s

In the event that we've stirred your curiosity about Do You Pay Taxes On Social Security Retirement Payments we'll explore the places you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Do You Pay Taxes On Social Security Retirement Payments suitable for many objectives.

- Explore categories like furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- The blogs are a vast variety of topics, starting from DIY projects to party planning.

Maximizing Do You Pay Taxes On Social Security Retirement Payments

Here are some inventive ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Do You Pay Taxes On Social Security Retirement Payments are an abundance of useful and creative resources catering to different needs and passions. Their accessibility and flexibility make them a great addition to every aspect of your life, both professional and personal. Explore the world of Do You Pay Taxes On Social Security Retirement Payments and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes you can! You can print and download these files for free.

-

Does it allow me to use free printables for commercial use?

- It's based on the conditions of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with Do You Pay Taxes On Social Security Retirement Payments?

- Some printables may come with restrictions on their use. Make sure to read these terms and conditions as set out by the designer.

-

How can I print Do You Pay Taxes On Social Security Retirement Payments?

- You can print them at home with a printer or visit a print shop in your area for the highest quality prints.

-

What software do I need in order to open printables free of charge?

- Many printables are offered with PDF formats, which is open with no cost software such as Adobe Reader.

Avoid Paying Taxes On Social Security Paying Taxes Social Security

Will I Pay Tax On Social Security Windgate Wealth Management

Check more sample of Do You Pay Taxes On Social Security Retirement Payments below

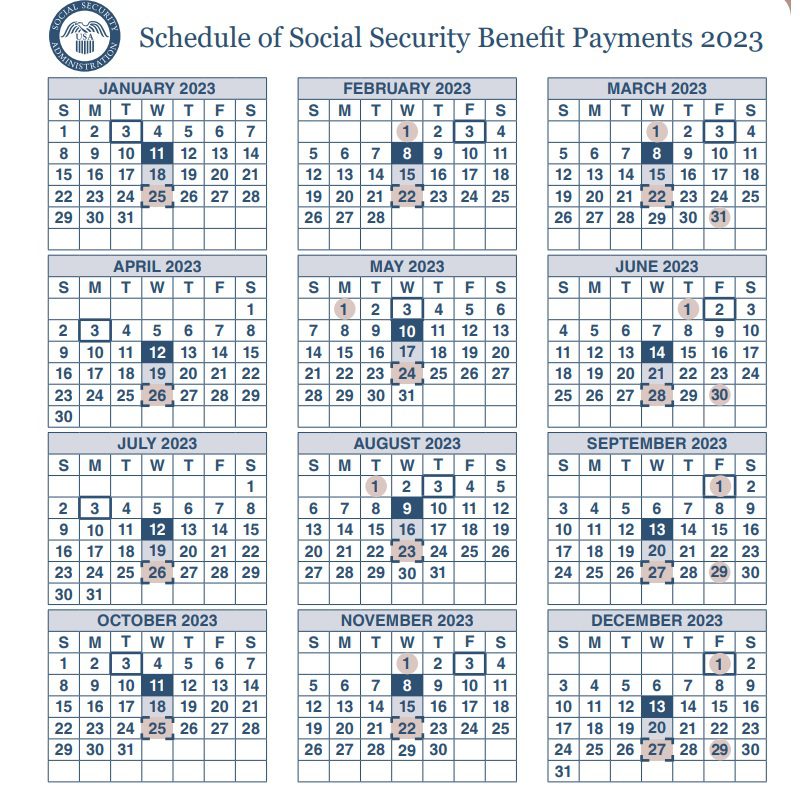

Social Security Payment Schedule December 2021 Social Security Genius

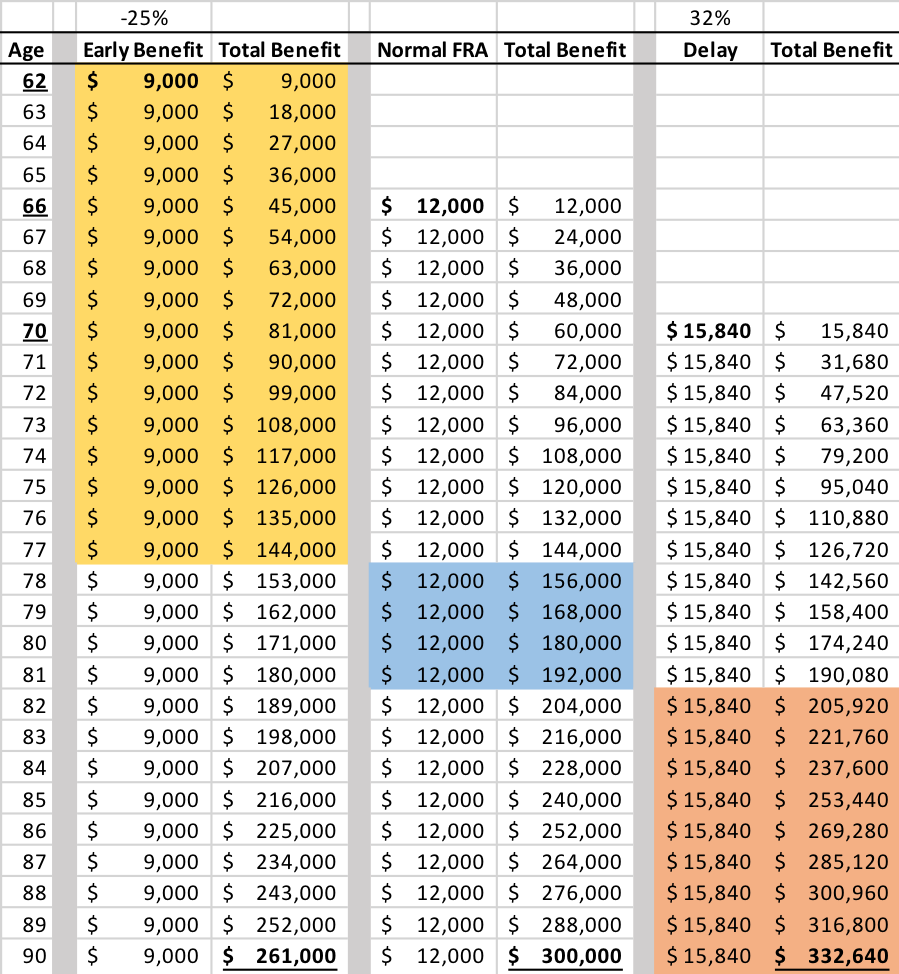

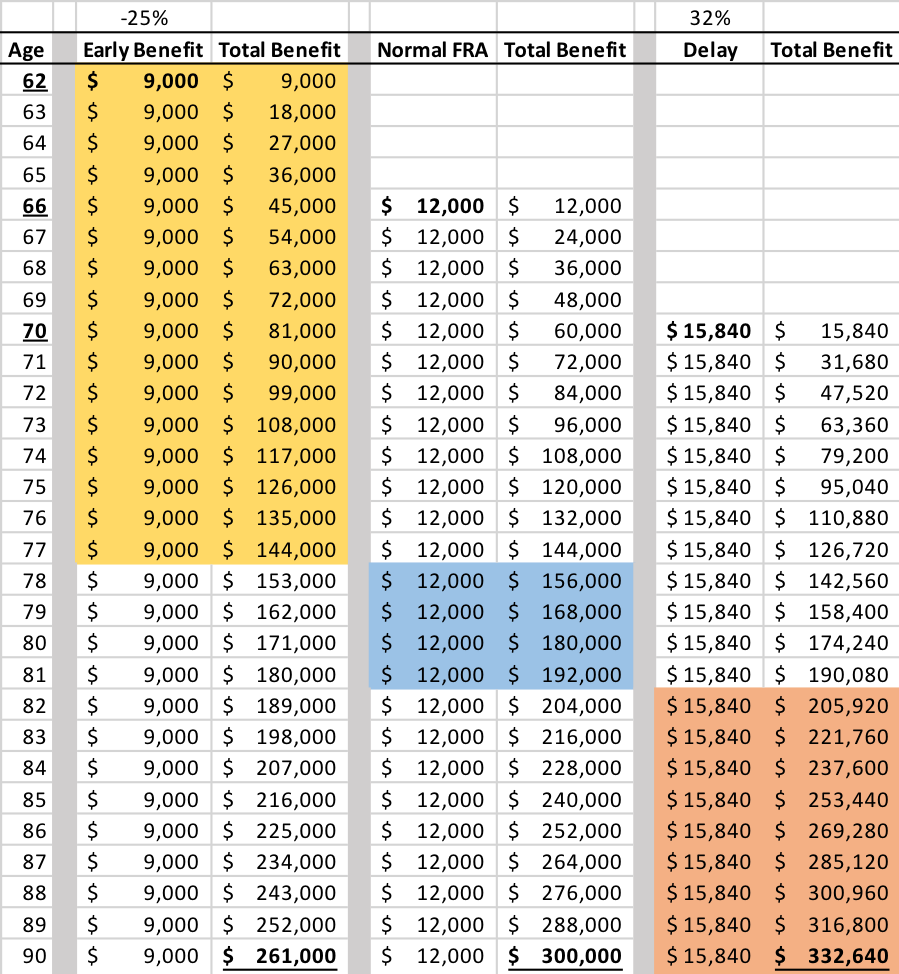

The Best Age To Begin Collecting Social Security Retirement Benefits

SSA Payment Schedule 2023 Schedule Of Social Security Benefit

What Happens If You Don t Pay Your Taxes A Complete Guide All

Are Americans Getting Their Money s Worth From Social Security The

56 Of Social Security Households Pay Tax On Their Benefits Will You

https://www.ssa.gov/benefits/retirement/planner/taxes.html

Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a separate tax return you probably will pay taxes on your benefits Your adjusted gross income Nontaxable interest

https://faq.ssa.gov/en-US/Topic/article/KA-02471

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000 If you are married and file a separate return you probably will have to pay taxes on your benefits

Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a separate tax return you probably will pay taxes on your benefits Your adjusted gross income Nontaxable interest

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000 If you are married and file a separate return you probably will have to pay taxes on your benefits

What Happens If You Don t Pay Your Taxes A Complete Guide All

The Best Age To Begin Collecting Social Security Retirement Benefits

Are Americans Getting Their Money s Worth From Social Security The

56 Of Social Security Households Pay Tax On Their Benefits Will You

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

Social Security Administration Update January 2023 Payments Schedule

Social Security Administration Update January 2023 Payments Schedule

What Are Payroll Taxes An Employer s Guide Wrapbook