In this age of technology, where screens have become the dominant feature of our lives The appeal of tangible printed objects hasn't waned. If it's to aid in education as well as creative projects or simply adding the personal touch to your space, Do You Pay Federal Income Tax On Social Security Retirement Benefits have proven to be a valuable resource. Here, we'll dive through the vast world of "Do You Pay Federal Income Tax On Social Security Retirement Benefits," exploring the benefits of them, where you can find them, and how they can improve various aspects of your life.

Get Latest Do You Pay Federal Income Tax On Social Security Retirement Benefits Below

Do You Pay Federal Income Tax On Social Security Retirement Benefits

Do You Pay Federal Income Tax On Social Security Retirement Benefits - Do You Pay Federal Income Tax On Social Security Retirement Benefits

Income and income alone dictates whether you owe federal taxes on your benefits To make that determination the IRS adds up your adjusted gross income AGI your tax exempt interest income and half of

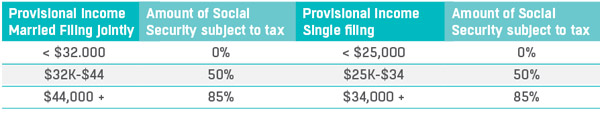

If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits

Do You Pay Federal Income Tax On Social Security Retirement Benefits offer a wide selection of printable and downloadable materials available online at no cost. These resources come in many formats, such as worksheets, coloring pages, templates and many more. The great thing about Do You Pay Federal Income Tax On Social Security Retirement Benefits is their versatility and accessibility.

More of Do You Pay Federal Income Tax On Social Security Retirement Benefits

Tax Withholding Estimator 2022 ConaireRainn

Tax Withholding Estimator 2022 ConaireRainn

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay

If your total income is more than 25 000 for an individual or 32 000 for a married couple filing jointly you must pay federal income taxes on your Social Security benefits Below those thresholds your benefits are not taxed

Do You Pay Federal Income Tax On Social Security Retirement Benefits have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Customization: This allows you to modify printing templates to your own specific requirements whether you're designing invitations and schedules, or even decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free cater to learners of all ages, which makes the perfect resource for educators and parents.

-

Easy to use: Instant access to various designs and templates reduces time and effort.

Where to Find more Do You Pay Federal Income Tax On Social Security Retirement Benefits

What Income Is Subject To The 3 8 Medicare Tax

What Income Is Subject To The 3 8 Medicare Tax

When you start receiving Social Security benefits they may be taxed depending on your combined income It is possible to be taxed at up to either 50 or 85 of your benefits

The federal government taxes up to 85 of Social Security payments for retirees who earn above a certain threshold To know if you owe taxes on Social Security consider the following

If we've already piqued your curiosity about Do You Pay Federal Income Tax On Social Security Retirement Benefits, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Do You Pay Federal Income Tax On Social Security Retirement Benefits to suit a variety of reasons.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a broad range of interests, from DIY projects to party planning.

Maximizing Do You Pay Federal Income Tax On Social Security Retirement Benefits

Here are some ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Do You Pay Federal Income Tax On Social Security Retirement Benefits are an abundance filled with creative and practical information that satisfy a wide range of requirements and hobbies. Their access and versatility makes them a fantastic addition to each day life. Explore the vast world of Do You Pay Federal Income Tax On Social Security Retirement Benefits and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I utilize free printables in commercial projects?

- It's based on the usage guidelines. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may have restrictions concerning their use. Make sure you read these terms and conditions as set out by the author.

-

How do I print Do You Pay Federal Income Tax On Social Security Retirement Benefits?

- You can print them at home with either a printer at home or in the local print shop for the highest quality prints.

-

What software do I need to run printables at no cost?

- Most printables come in the PDF format, and can be opened with free programs like Adobe Reader.

Top 1 Pay Nearly Half Of Federal Income Taxes

56 Of Social Security Households Pay Tax On Their Benefits Will You

Check more sample of Do You Pay Federal Income Tax On Social Security Retirement Benefits below

Is Social Security Taxable Income 2021 Savvy Senior Is Social

Are My Social Security Benefits Taxable Calculator

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

2021 Nc Standard Deduction Standard Deduction 2021

Social Security Wage Base 2021 Updated For 2023 UZIO Inc

States That Tax Social Security Benefits Tax Foundation

https://smartasset.com/retirement/is-social-security-income-taxable

If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits

https://faq.ssa.gov/en-US/Topic/article/KA-02471

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000

If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000

2021 Nc Standard Deduction Standard Deduction 2021

Are My Social Security Benefits Taxable Calculator

Social Security Wage Base 2021 Updated For 2023 UZIO Inc

States That Tax Social Security Benefits Tax Foundation

Will I Pay Tax On Social Security Windgate Wealth Management

When To File For Social Security Retirement Benefits Early

When To File For Social Security Retirement Benefits Early

How Federal Income Tax Rates Work Full Report Tax Policy Center